Europeans push for emergency measures to support Ukraine

Link

Read Sebastian PARIS HORVITZ's market analysis for March 03, 2025.

Summary

►Following the United States' abrupt end to negotiations with Ukraine, European leaders met this weekend in London, at the initiative of the British Prime Minister, to coordinate their military spending and offer Ukraine aid resources. A meeting of the enlarged Council of Europe is expected to allocate around 20 billion euros in additional military aid to Ukraine in the next few days.

►Despite these efforts, the Europeans will still have to try to maintain a dialogue with Washington to avoid further destruction of relations between the long-standing allies. This is important for world security, but also to preserve the essential asset of rules accepted and built by all to ensure fair trade relations within a well-defined legal framework. Nevertheless, we understand the difficulties faced by European leaders, particularly when faced with unilateral American initiatives that are far from cooperative.

►In fact, President Trump announced that tariffs of 25% would still be introduced on Mexican and Canadian exports on March 4. This despite efforts by these countries to meet US demands for secure borders. China could also be hit by an additional 10% import tax. The Eurozone should also be affected by early April.

►Against this backdrop, and in addition to the situation in Ukraine, it is clear that these measures are not conducive to appeasement. At this stage, the market seems to be taking a more reasonable view of tariffs. With the possible exception of the bond market, which seems to fear a negative impact on growth, given the sharp fall in long-term yields in recent weeks. For our part, unfortunately, we can only observe that the risks to growth associated with uncertainty are only increasing.

►For the Eurozone, monetary policy is likely to remain a “weapon” to support activity, even if it cannot fully compensate for strong trade constraints that could be imposed by the United States. In any case, we are still expecting a 25 basis point (bp) cut in key rates this Thursday. In our view, the February inflation figures for the Zone as a whole, while not marking a sharp drop in inflation, should be in line with an easing trend. We expect the decline to be more pronounced in the months ahead. Note that total French inflation for February fell below 1% for the first time since February 2021. In Germany, inflation is clearly easing less rapidly.

►In the United States, as expected, household consumption contracted sharply in January. The decline in real terms was 0.5% over the month, the sharpest since February 2021. This was partly due to bad weather. It is difficult to deduce a trend from this. Indeed, the job market is still holding up, which should help consumption. But we still expect a marked moderation in consumer appetite in 2025.

►Also on the other side of the Atlantic, the consumption deflator, the PCE, the measure tracked by the Fed, as expected, was more benign in February than the price index (CPI) would have suggested. The total index decelerated year-on-year to 2.5%, and core inflation to 2.6%, after 2.9% the previous month. The good news was the easing of prices in services. We continue to see very gradual easing ahead, which is likely to leave the Fed waiting for further rate cuts. This patience could be exacerbated by the sharp rise in tariffs. Nevertheless, if the current uncertainty instilled by the announced policies persists, there could be a far more negative impact on growth, which the Fed might be tempted to counter.

►In Japan, inflation in Tokyo came in slightly below expectations, but close to the Bank of Japan's estimates. Total inflation rose by 2.9% year-on-year, down from 3.4% the previous month. This was largely due to the effects of subsidies on energy prices. In fact, core inflation rose by 1.9% year-on-year, unchanged from the previous month. The market seemed to deduce that the Bank of Japan (BoJ) might be more cautious about raising its key rates, leading to a slight fall in the yen. We don't think so. We are still expecting at least 2 further rate hikes this year.

►In China, we had the official PMIs for February, which were relatively close to expectations. They rebounded slightly from the previous month, but point to very moderate growth in the economy. The good news came from the manufacturing index's return to expansionary territory. In fact, the private manufacturing PMI (CAXIN) also rose, but showing weak growth. Above all, we are awaiting the decisions that may emerge from the important meetings starting this week, notably that of the People's Committee (CNP) on economic matters in the face of the tariffs imposed on China by the United States.

To go deeper

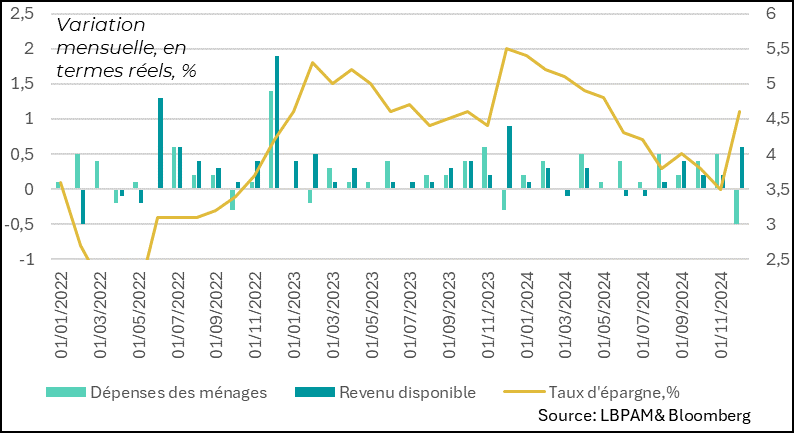

As expected, US household consumption fell sharply in January. In real terms, it contracted by 0.5%, the biggest drop since February 2021.

In part, this was due to poor weather conditions, which restricted purchases. However, it is also likely to be a corrective effect following the surge in consumption at the end of 2024.

This drop in consumption also led to a rebound in the savings rate, due to strong income growth. This breaks the downward trend in the savings rate. Nevertheless, the rise in incomes was mainly due to the indexation effects of social benefits for households, with earned income rising at the same rate as the previous month.

United States: Consumption falls sharply in January, mainly due to bad weather a correction to the sharp rise at the end of 2024

This sharp fall in consumption should be corrected in the months ahead, especially as the labor market remains buoyant in the private sector.

Nevertheless, we continue to expect a moderation in consumer appetite over the coming quarters. Indeed, we expect the labor market to adjust further. This adjustment could be somewhat amplified by the cuts that the new US administration is currently making to federal public services. Nevertheless, at this stage, these cuts in public employment are unlikely to have a significant, if negative, impact.

Nevertheless, there remains considerable uncertainty as to the impact that public policies could have on consumption. First of all, there are the consequences that tariff increases will have on prices, and therefore household purchasing power.

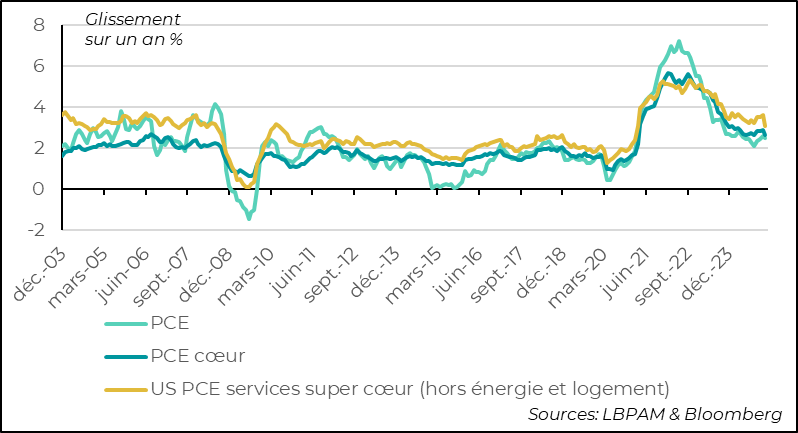

At this stage, particularly for the Fed, attention is focused on inflation, which is falling, albeit slowly.

In this respect, statistics on the consumer price deflator (CPI), the measure of inflation tracked by the Fed, for the month of January were rather reassuring. Indeed, the total index rose by 0.3% over the month, as expected, with the core index rising by the same amount.

Nevertheless, the year-on-year slowdown in inflation was fairly widespread, with a marked deceleration in service prices, even excluding rents. This broke the upward trend that had persisted since last autumn.

United States: PCE comes out as expected, with good news on the deceleration of inflation in services

The more favorable price dynamics in February can also be seen in the statistics, which correct for the extreme movements that can occur in certain goods and services over the course of each month. Adjusted for these movements, we can see that the year-on-year downward trend is still there. However, over a shorter time span, say 6 months, the upward trend of recent months is not completely corrected.

United States : The downward trend in prices seems to be affecting most consumer segments, adjusted for extreme values

These figures are obviously good news for the Fed. But, in our opinion, this is not enough to see it quickly change its patient attitude. It will wait to see whether this trend continues, along with a further easing of the labor market, before pursuing its monetary easing policy.

In addition, central bankers are likely to remain vigilant to the potential negative effects of higher tariffs on inflation, even if these are likely to be temporary and to have recessionary effects on the economy in the longer term.

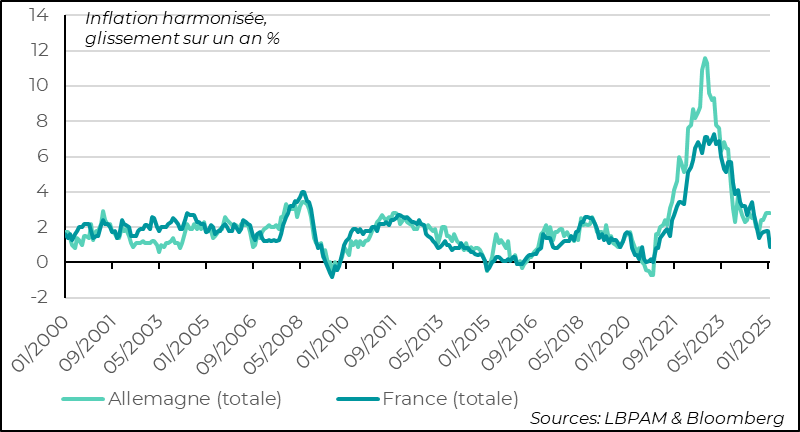

In the Eurozone, inflation figures for February will be released today. Core inflation is expected to fall to 2.5% year-on-year, from 2.7% the previous month. These figures come just ahead of the ECB's monetary policy meeting on Thursday.

The important thing here for the members of the Governing Council is that the downward trend continues. However, they know that the expected effects of the easing in wage growth will only be felt gradually over the 1st half of the year. Like the market, a 25bp cut in key rates is expected, but still marked by a cautious outlook for the future.

France's inflation figures for February went in the right direction to reassure the ECB, with a stronger-than-expected deceleration. Total inflation fell below 1% for the first time since February 2021.

In Germany, on the other hand, inflation came out a little stronger, showing greater difficulty in returning to a clear downward trend.

Eurozone: Inflation in France falls more sharply than expected, with total inflation at 0.9% annualized, while inflation in Germany is more resilient

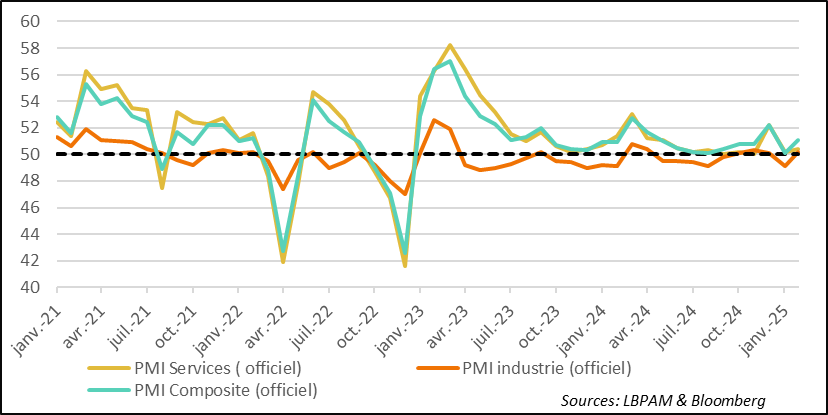

In China, February's PMI indicators correct somewhat the message of deceleration from the first month of the year. Official PMIs were up on the previous month. Above all, the index for the manufacturing sector moved back into expansion territory, albeit very slightly. This upturn in industry was confirmed by the private PMI (CAXIN), which also rose over the month.

Nevertheless, it is clear from the level of these indices that activity remains weak in the country.

China: PMIs rebound somewhat in February, but still suggest very moderate economic growth

With this in mind, all eyes are on the possible announcements that could be made at the important meetings starting this week, notably that of the National People's Committee (NPC).

Indeed, while D.Trump has announced that a further 10% increase in tariffs should be implemented on China as early as this week, we are awaiting the response of the Chinese authorities.

Foreign trade has so far been one of the factors contributing to the resilience of Chinese activity, so tariffs could harm economic growth. We'll see if the authorities, while attempting dialogue with Washington, decide to do more to stimulate domestic demand. The past month has already seen some symbolic gestures from President Xi, such as support for the private sector in the technology sector.

Sebastian PARIS HORVITZ

Head of Research