Eurozone inflation surprises sharply higher in May

Link

-

Eurozone inflation surprises sharply higher in May due to services, which should prompt the ECB to remain cautious after this week's pre-announced rate cut. The ECB is expected to raise its inflation forecasts slightly on Thursday, and to remain vague on the timing and extent of subsequent rate cuts. We continue to expect three ECB rate cuts this year, but the risk of even more gradual cuts is increasing. And this is not primarily because of the Fed, but because of persistent pressure on domestic service prices and wages.

-

Core inflation rebounded from 2.7% to 2.9% in May, its first rise since last summer, due to the acceleration in services inflation to a 7-month high of 4.1%. While some of this increase surely reflects temporary effects (public transport prices in Germany, travel, etc.), it is too widespread not to indicate that domestic pressures remain persistent.

-

In the US, the household consumption report for April is somewhat reassuring for the Fed, confirming that underlying inflation is not accelerating, while household spending and income are slowing more markedly at the start of the second quarter. As a result, consumption in volume terms fell by 0.1% in April due to the slowdown in incomes, while the savings rate was already very low. On the inflation front, the Fed's preferred measure rose by 0.25% over the month, its smallest increase this year, but still well above what would be required for inflation to return to its target.

-

OPEC+ oil-producing countries agreed this weekend to extend production cuts for longer than anticipated (until the end of 2025), but also to start reducing them earlier than expected (as early as October). All in all, this shows that OPEC+ countries and especially Saudi Arabia will continue to control the market, which limits the chances of oil prices falling much further. But sluggish demand and excess capacity limit the risk of a sharp rise, in our view. The price of oil is falling towards $80 a barrel this morning, and should remain in a band of $80-85 a barrel for the next few months, according to our scenario.

-

The S&P rating agency has downgraded France's sovereign rating from AA with a negative outlook to AA- with a stable outlook. This is unlikely to have a significant impact on French short-term interest rates, given that the downgrade was largely expected (S&P has long had a negative outlook), that it aligns France's rating with that of Fitch (Moody's remains one notch higher), and that France's rating remains high. But this confirms the downward trend in France's public finances and the need for a major budgetary adjustment. With the probable defeat of the government in the European elections and the announcement of an excessive deficit procedure against France expected this summer, we remain cautious on French debt in the medium term, preferring the debts of southern countries.

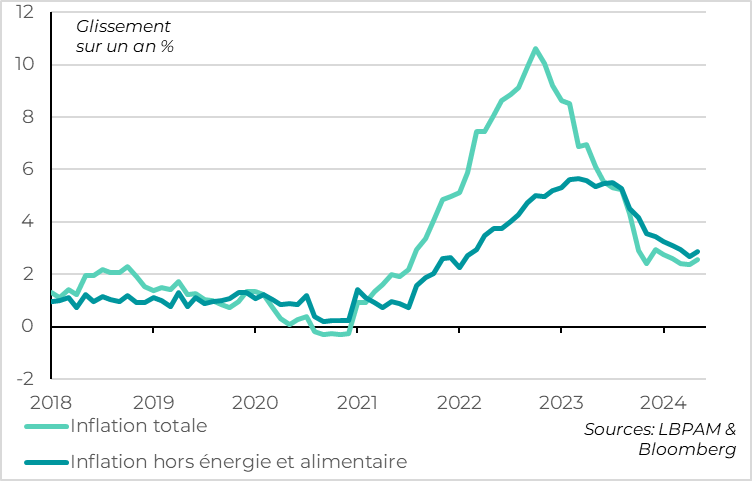

Fig.1 Eurozone: Inflation accelerates in May, even core inflation

- Total inflation

-Inflation excluding energy and food

Eurozone headline inflation accelerated from 2.4% to 2.6% in May, according to Eurostat's preliminary estimate. A slight rise to 2.5% was expected due to less favorable base effects on energy. Indeed, year-on-year energy inflation returned to positive territory for the first time in a year (at 0.3%), despite a 1.2% fall in prices in May, as the decline was greater last year. But the stronger-than-expected rise in inflation in May came from an unexpected rise in core inflation.

Core inflation, excluding energy and food, rebounded from 2.7% to 2.9% in May, whereas it was expected to be stable, its first rise since last summer. It reversed April's year-on-year fall due to a reacceleration in the sequential rate. Core prices rose by 0.35% over the month after two months at 0.25%, returning to the rate of increase seen in the first two months of the year.

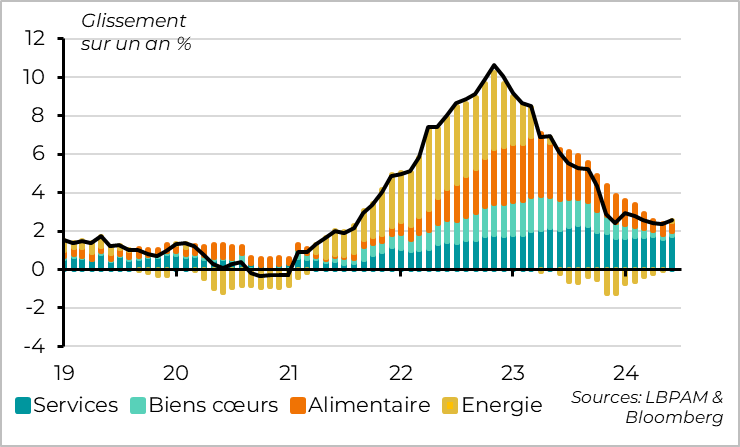

Fig.2 Eurozone: Service sector inflation rebounds

- Services

- Good hearts

- Food

- Energy

The persistence of inflationary pressures continues to come from services, the least volatile part of inflation.

Indeed, inflation in non-energy goods continues to slow, and is now at its lowest level since 2021. Industrial goods prices have stagnated for the past 4 months, rising by just 0.8% year-on-year. Food inflation also continues to normalize, at 2.6%.

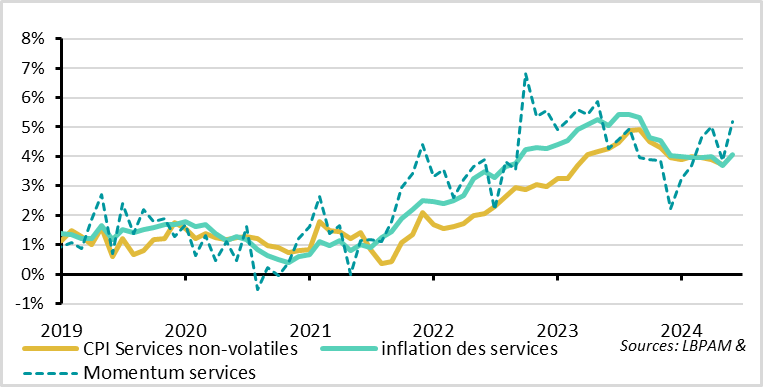

Fig.3 Eurozone: Inflation in services has not slowed down for 6 months and remains high

- CPI Non-volatile services

- Service inflation

- Services d'impulsion

By contrast, services inflation rebounded in May from 3.7% to 4.1% year-on-year, its highest level for 7 months. This was due to a 0.5% rise in prices in May, the biggest monthly increase in over a year.

This May rise is probably exaggerated by temporary effects (public transport and tourist travel in Germany, seasonal effects linked to Easter...). We'll have to wait for the publication of detailed data mid-month to get a clearer idea of the reasons for the acceleration in prices in May. But the scale of the price rise, and the fact that it came as a surprise in many Zone countries, suggests that it reflects in part a more fundamental persistence of pressure on service prices.

All in all, underlying inflation remains well above ECB forecasts for Q2 (at 2.8% vs. 2.5% anticipated by the ECB in March). This should not prevent the ECB from cutting rates this week (from 4% to 3.75% for the deposit rate), especially as this cut has been well-prepared. But, in addition to the upward surprises on wages in Q1, the persistence of inflationary pressures in services should prompt the ECB to exercise caution and remain very vague about the timing and scale of its subsequent rate cuts. Our scenario calls for two further rate cuts this year, in September and December, but the risk of an even more gradual rate cut is increasing.

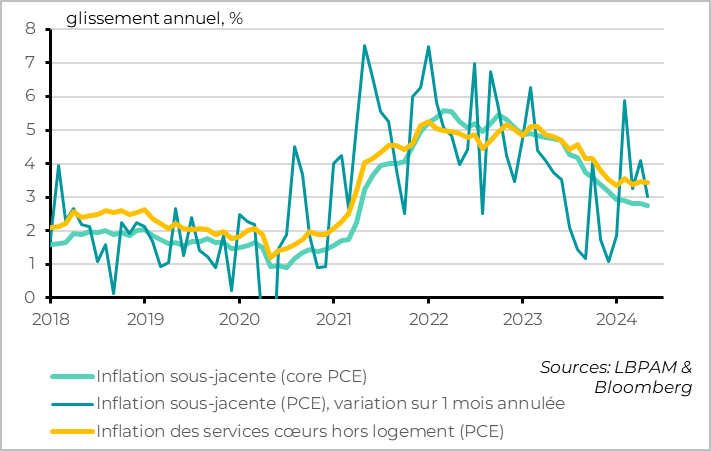

Fig.4 United States: Inflationary pressures are not accelerating but not slowing down

- Underlying inflation (core PCE)

- Underlying inflation (PCE), cancelled 1-month change

- Core services inflation excluding housing (PCE)

As expected, the Fed's preferred measure of inflation remained stable year-on-year in April, slowing slightly over the month compared with the first quarter. But it remains too high.

The core consumer price deflator, the Fed's target measure, remained stable in April at 2.8%. It even slowed slightly to 2.75% year-on-year, its lowest level since early 2021. But this is still a 30-year high if we exclude the post-Covid period. Over the month, price rises slowed to 0.25%. This is the smallest monthly rise this year, but still well above the increases needed to return to the 2% target forecast by the Fed in March.

Inflation in services excluding housing, which better reflects domestic demand pressures, has not slowed for 6 months and remains high at 3.4%. At least, it shows no sign of reaccelerating.

All in all, the Fed is likely to revise its inflation forecasts upwards next week and reinforce its talk of patience regarding future rate cuts, but continue to say that the risk of further rate hikes is low. All the more so as consumer spending is showing signs of slowing.

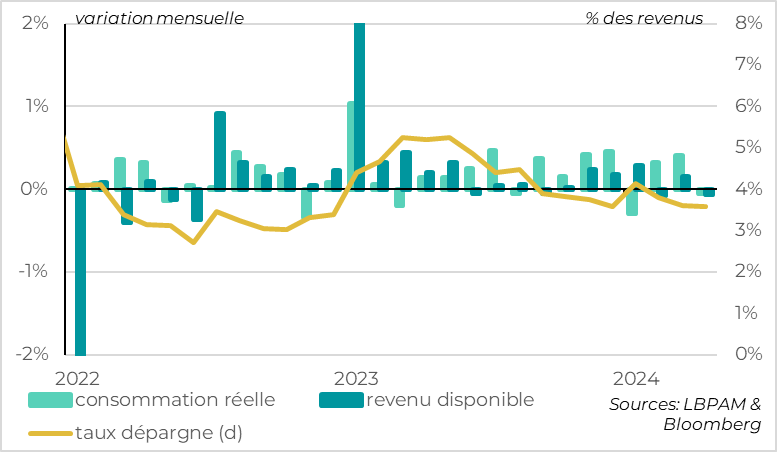

Fig.5 United States: Consumption continues to slow at the start of Q2

- Actual consumption

- Disposable income

- Savings rate (d)

Indeed, after being revised from 2.5% to 2.0% for Q1, consumer spending fell slightly in volume terms in April (-0.1%). This reduces the headline effect for Q2 to 1.3%, confirming that household consumption is easing in 2024 after growing by over 3% in the second half of 2023. This slowdown is explained by the gradual slowdown in household incomes, which goes hand in hand with the easing of the labor market, while the savings rate stabilizes at its lowest level since the post-Covid rebound at 3.6%.

This is in line with our scenario of a fairly sharp slowdown in the US economy over the course of 2024, albeit not an abrupt one. This could disappoint risky asset markets, but would allow the Fed to start cutting rates despite persistent inflationary pressures in the short term. This is why we are maintaining our scenario of two Fed rate cuts this year, starting in September.