Everything is warming up… but not necessarily in a good way

Link

- Late last week, rumours of a possible agreement between Democrats and Republicans on raising the US debt ceiling triggered something of a surge in risky assets, boosting share prices even as the economic trajectory remains poor and highly uncertain. For the moment, nothing has been decided on the debt ceiling, and the latest comments from both sides call for caution. We still believe that that the worst will be averted. There won’t be a default. But the prevailing uncertainty gives pause and is keeping us from running after the market. More fundamentally, we continue to believe that economic momentum will be reined in by the ongoing tightening in monetary policies. True, tightening is coming to an end, but we expect monetary conditions to remain restrictive for some time to come. This view has gained ground recently, with a steep drop in Fed key rate downward expectations for 2023. In our view, only on rather bold assumptions can the economic and financial environment be expected to remain very favourable to equities. However, investors’ positioning and liquidity conditions may remain beneficial in the very short term. This is why we are slightly underweighting equities.

- The G7 summit in Japan shed some light on the challenging geopolitical landscape that we are currently moving through, although the markets do not seem to be pricing in any particular specific risk premium – with the possible exception of Chinese assets, which remain steeply undervalued, equities in particular. As a matter of fact, the G7 communiqué mentioned China by name for the first time, calling on it to show restraint in the Taiwan Strait, while stressing G7 countries’ desire to maintain constructive dialogue and to safeguard an economic partnership with Chinese leaders. Even so, a new day is dawning, according to G7 members: “We are not decoupling or turning inwards. At the same time, we recognise that economic resilience requires risking and diversifying. We will take steps, individually and collectively, to invest in our own economic vibrancy. We will reduce excessive dependencies in our critical supply chains.” Almost echoing this roadmap, the seven largest semiconductor makers announced at the same time plans for partnerships to manufacture in Japan. This has enhanced the attractiveness of the Japanese market, to which we recently increased our exposure.

- It is against this challenging political backdrop that the World Meteorological Organisation (WMO) announced last week that the probability was now the greatest ever (66%) that in at least one of the next five years, the average global temperature will, for the first time, exceed its pre-industrial level by more than 1.5 degrees. Obviously, that doesn’t mean that the temperature will remain this high on average, which is the Paris Agreement’s targeted ceiling. But it does, once again, show the need to prevent an even more rapid and harmful rise in temperatures. This is why the G7 once again devoted a large portion of its discussions to the energy transition.

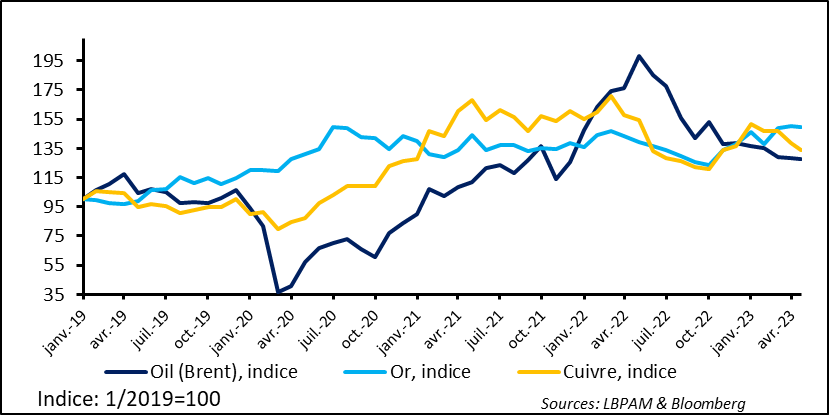

- On the economic front, we still see data point to a weakening in activity, albeit to various degrees. Globally, commodity prices, oil and copper, in particular, are being pulled down by anticipations of weaker demand in the developed world, and a tentative recovery in manufacturing in China. For example, in the United States, the Conference Board Leading Indicator, while not worsening further, continued to send out a message of weakness, which is consistent with past recessions. Meanwhile, the sector that is most vulnerable to higher interest rates – construction – has stabilised after its steep 2022 adjustment, and there was even a rebound in builder confidence, albeit from a very low base. On the job market, after a recent surge, jobless claims stabilised somewhat, especially after they were recently skewed by frauds that had inflated the statistics. We still expect the economy to continue worsening, but without an extremely severe adjustment.

The global economy remains weak, with the markets pricing in lacklustre global demand in the coming quarters. This is particularly apparent in leading indicators of the manufacturing cycle. Indeed, prices of commodities that are the most sensitive to global demand – oil and copper – continue to show some weakness. Both suggest that the consumption-driven Chinese recovery is taking some time to spread to the manufacturing sector and, hence, to demand for these essential inputs. This is why copper prices have moved steadily downward in recent months, after rising steeply early in the year on anticipations of heavy demand from China, given that global production capacities and inventories are rather limited.

Gold alone continues to glitter, thanks to its safe haven status in a period of uncertainty and continued strong inflation, on top of demand from emerging economies that are trying to diversity their international reserves.

Fig. 1 – Commodities: Lower oil and copper prices are still pointing towards continued depressed global demand

Oil (Brent), index Gold, index Copper, index Index: Jan. 2019 = 100

Jan. Apr. Jul. Oct. Jan.

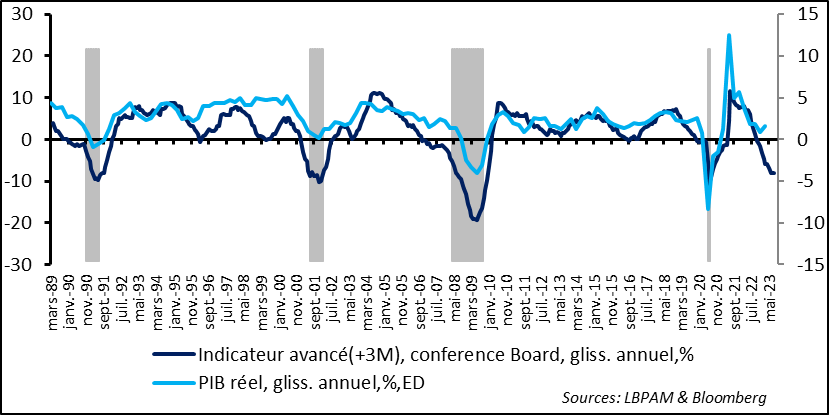

In the US, the Conference Board Leading Indicator for April was almost unchanged on a year-on-year basis but remained in recessionary territory. This indicator, which has always provided a rather reliable signal of momentum in the cycle, remains at levels that have been seen only during US economic recessions. Meanwhile, the reason the trend did not worsen further last month, was of signs of resilience of certain economic variables, consumption in particular.

Fig. 2 – US: The Conference Board Leading Indicator remains in recessionary territory, thus pointing to a weaker economy in the coming months.

Conference Board Leading Indicator, YoY % chg.

Real GDP, YoY % chg., right scale

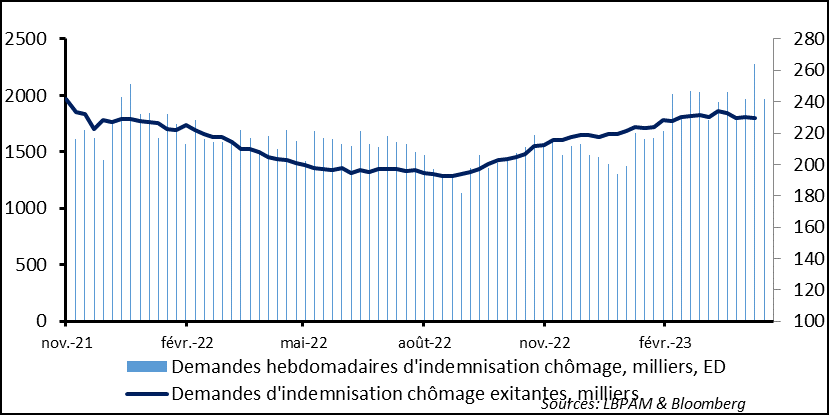

Consumption continues to be driven by a robust job market. This is showing up in jobless claims that recently levelled off after rising steadily since last summer. Granted, weekly claims are still higher than the historic lows that we saw in 2022. But they are not worsening appreciably. They did surge two weeks ago, but this seems to have been due to fraudulent claims, and the statistics have been adjusted to reflect that.

Fig. 3 – US: Jobless claims have levelled off

Weekly jobless claims, ‘000, right scale

Existing weekly jobless claims, ‘000

Nov. Feb. May, Aug. Nov. Feb.

More fundamentally, companies are holding up rather well, particularly their margins, and in spite of heavier costs. This is allowing them in many sectors to keep their headcount unchanged, while companies in some sectors, such as catering, are continuing to hire.

This momentum is helping to keep demand high, which, in our view, would be unable to help the supply-demand imbalance absorb itself and, thereby, ease inflationary pressures. This, in our view, is why at this point it is hard to see a rapid easing in Fed monetary policy coming.

Indeed, in recent days, in reaction to the language of several FOMC members, insisting that rates must not be cut in 2023, the market has priced out some of the many interest-rate cuts that it had been expecting. But the market continues to price in rate cuts, which is still not our opinion.

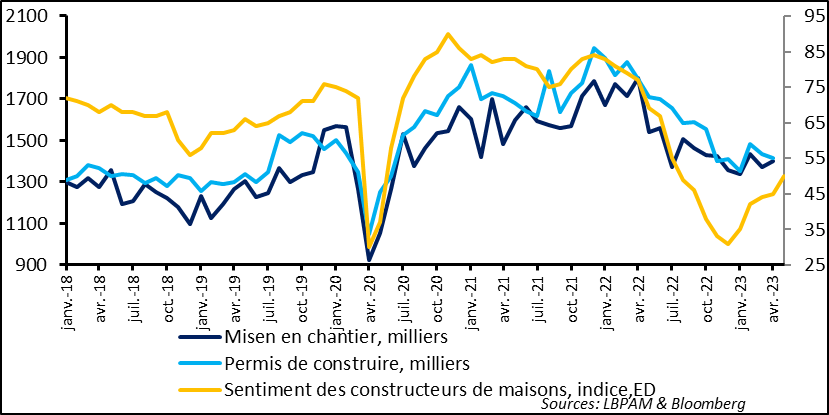

Resilience in the job market, as well as expectations of interest-rate cuts, are also surely the reason for the stabilisation in the construction sector, where figures are no longer worsening as significantly as they did in 2022. True, the inflating of economic activity during the Covid exit phase, driven by the very steep drop in interest rates, has now been completely corrected. Building permit applications have returned to their 2019 levels.

Fig. 4 – US: Construction activity has stabilised, for the moment

Building starts, ‘000

Building permits, ‘000

Homebuilder confidence, index, right scale

Even so, things could worsen further in the coming months, with the ongoing toughening of banks’ credit conditions and interest rates that are expected to remain relatively high, as well as, as we expect, a job market that begins to adjust.