Faced with uncertainty, the Fed maintains its patience

Link

Market Update for May 12, 2025: Insights by PARIS HORVITZ

Key Takeaways

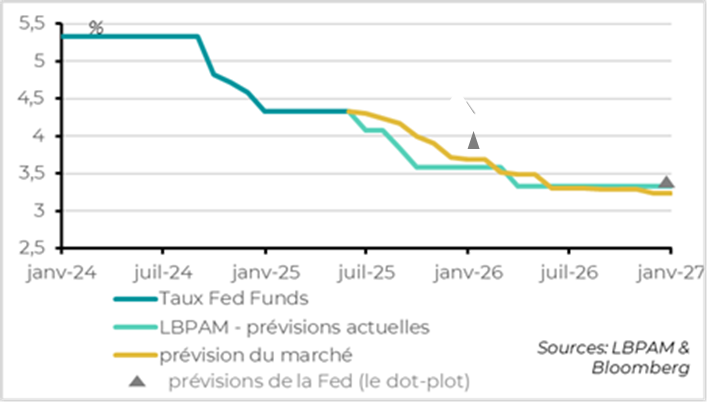

► Last week, as expected, the Fed kept its key rates unchanged. The monetary policy committee still considers that the economy remains solid (low unemployment) and that inflation, although still slightly above the 2% target, is moderating. Nevertheless, the committee sees uncertainty mounting, and therefore prefers to remain patient.

► Last week, as expected, the Fed kept its key rates unchanged. The monetary policy committee still considers that the economy remains solid (low unemployment) and that inflation, although still slightly above the 2% target, is moderating. Nevertheless, the committee sees uncertainty mounting, and therefore prefers to remain patient.

►Despite the uncertainty surrounding the level of future US tariffs and the impact of migration restrictions, our central scenario still calls for the US economy to slow sharply from this summer onwards. This explains our forecast of three rate cuts between now and the end of the year. Future economic weakness continues to motivate our cautious stance on US assets.

►Our caution is not necessarily shared by the market. Indeed, US indices have recovered the ground lost when the bilateral tariffs were announced at the beginning of April. In our view, this optimism about future trade relations is premature, especially as the potential impact of reduced migration on economic growth should not be overlooked.

► At this stage, bilateral trade talks are continuing, but it is difficult to determine with any clarity what the outcome will be. The agreement with the UK does not really change the situation. British imports will be taxed at 10%, although cars and steel should avoid the 25% rate.

►But the real issues are the agreements with the EU and China. S. Bessent, Secretary of the Treasury, declared that the negotiations with China, which took place this weekend in Switzerland, had been “productive” and that an agreement was in sight. Further details are expected on Monday. The Chinese authorities have made no statement.

►We'll see what's announced today. The level of tariffs is obviously an essential element for the global economy, but the uncertainty engendered by the unilateral measures taken by the United States is likely to weigh on the world's economic trajectory for some time to come.

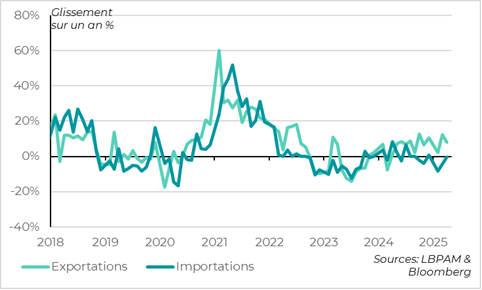

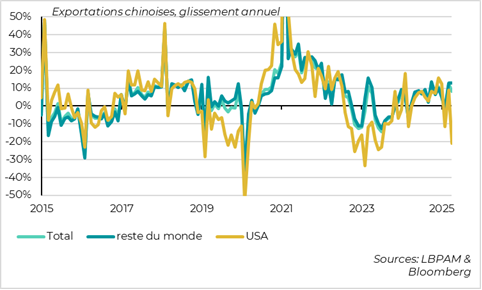

► Speaking of China's trade, exports decelerated in April to 8.1% year-on-year in dollar terms, compared with 12.4% the previous month. This deceleration was much less than expected. Exports to the United States were expected to fall sharply, following a sharp rise at the start of the year to stay ahead of tariffs. In fact, they fell by 22% year-on-year. However, exports to other Asian countries rose sharply. At the same time, imports are still in contact, though less than expected. This still points to a lack of dynamism in domestic demand.

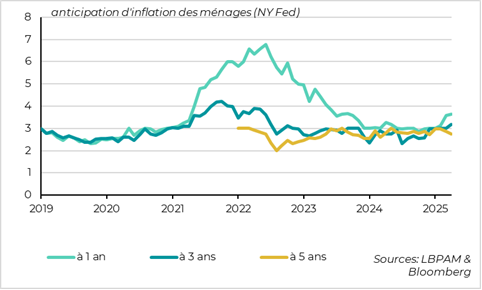

► As regards US inflation, the New York Fed's survey for April gave a less worrying diagnosis of household expectations than the U. of Michigan survey. Indeed, inflation expectations have continued to rise, but only slightly, to 3.6% over 1 year (the highest point since August 2023) and 3.2% over 3 years (the highest since July 2022). This should be reassuring for the Fed.

To Go Further

As expected, the Fed decided to keep its key rates unchanged. J. Powell emphasized two major reasons for this decision. Firstly, the US economy remains robust (unemployment remains low), and the decline in GDP in 1Q25 masks solid domestic demand growth, while inflation, although still slightly above target, has moderated sharply. Secondly, the level of uncertainty about the potential effects of the government's economic policy remains very high. On this point, the committee members consider that the upside risks to both inflation and the unemployment rate have increased.

Thus, the Fed feels that its policy, which remains relatively restrictive, seems appropriate in these circumstances.

According to the Fed, the coming months should enable it to adapt its policy, if necessary quickly, in view of the first signs of the impacts of the measures taken by President Trump's administration.

The Fed is expected to provide more details at its next meeting in mid-June, when it will revise its economic projections.

We continue to believe that the Fed should act as early as June, by continuing to cut its key rates, even though we are aware of the major uncertainties on the horizon. In particular, if the labor market continues to resist, the Fed could still wait and postpone the easing of monetary policy.

For the time being, the market is opting for a further, later cut in September. Nevertheless, market expectations are in line with a landing at the end of the year at 3.5%.

United States: the Fed remains patient...but should resume its cuts this summer

The labor market figures at the end of May will be decisive in giving us a better idea of the Fed's decision. In this sense, we'll be keeping a close eye on the jobless claims figures for signs of possible waves of layoffs. At this stage, signs of deterioration are not really visible, even if business surveys seem to indicate a more negative dynamic.

In May, we could also see the first effects of tariff hikes on prices. In particular, this will enable us to determine how companies behave in terms of margins when setting their prices in the wake of the tariff shock.

Negotiations with the United States' trading partners are continuing. At this stage, the only agreements apparently finalized are those with the United Kingdom. The UK's tariff rate would remain at 10%, but the rates on cars and steel would be reduced to 10%, compared with 25% today. On cars, the 10% rate would apply up to 100,000 imported vehicles, the level reached in 2024, and would rise to 25% beyond that. In the case of steel, the British government is likely to put its hand in its pocket to preserve activity, given the constraints imposed on the sector in the agreement.

At the same time, the UK is said to have lifted non-tariff barriers on agricultural products. The British authorities would also have given the USA privileged access in several areas.

According to the White House's statement, this agreement establishes a framework for further negotiations with its trading partners. It remains to be seen whether the European Union will be as easy to convince, particularly if the trade agreements do not correspond to the interests of the zone. The same applies to China.

The negotiations that opened this weekend between China and the United States were described as “productive” by Treasury Secretary S. Bessent. Trade Representative Jamison Greer was more emphatic, declaring that an agreement had already been reached to reduce the US trade deficit with China. However, no details were given, particularly on the level of tariffs.

Apparently, this Monday President Trump could announce the terms of a possible agreement. At this stage, however, the Chinese authorities have made no statement.

On the other hand, we did get the figures on the evolution of China's trade flows for April.

As expected, exports decelerated, but performed much better than anticipated. Year-on-year and in dollar terms, exports decelerated to 8.1% from 12.4% the previous month. Consensus economists were expecting growth of just 2%.

Imports, on the other hand, although slightly up on the previous month, were only stagnant year-on-year. This reflects the fact that domestic demand remains relatively sluggish. This could increase if the government continues to implement its stimulus policy to offset the deterioration in foreign demand caused by US protectionist policies.

China: exports hold up better than expected, while imports stagnate

The fact that exports held up better in April than expected is due in part to the rise in Chinese exports to other Asian countries. This may reflect China's desire to get around the current US tariffs, by re-exporting to the US from other countries.

In any case, as expected, exports to the USA fell sharply in April (-22% year-on-year). This reflects, on the one hand, the backlash from the sharp rise in previous months in anticipation of the tariffs, but also, on the other hand, certainly the impossibility of exporting given the extravagant level of current tariffs (145%!).

China: exports to the USA plummet after rebound in anticipation of tariff hikes, but exports to other Asian destinations rise

We'll have to wait and see what the US authorities announce this Monday about a substantial reduction in current tariffs.

Nevertheless, if we go to 80%, as D. Trump has suggested, the situation won't really change.

In the United States, on the inflation front, we had the results of the New York Fed's household survey.

Inflation expectations are still up at 1 year (3.6%) and 3 years (3.2%), but down at 5 years (2.7%). The trend is not good, but these figures should not worry the Fed too much.

United States: 1-year and 3-year inflation expectations rise according to NY Fed survey...

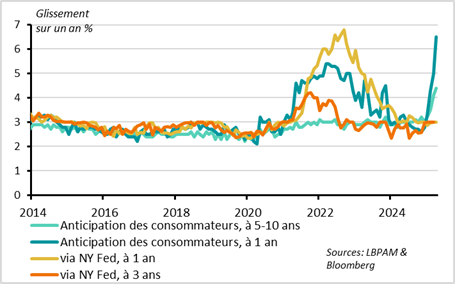

What is certain is that they are much more moderate than those published by the U. of Michigan, which suggested a very worrying drift.

The impact of the new tariffs on prices will become clearer in the months ahead. This will be important for the Fed, but also for D. Trump. Let's not forget that one of his key campaign promises was to reduce inflation.

United States: ...but the increase in expectations in the NY Fed survey are much more moderate than those in the U. of Michigan survey.

PARIS HORVITZ

Head of research