Falling inflation supports monetary easing

02.09.2024

Link

Sebastian PARIS HORVITZ's in-depth analysis of the fall in inflation supported by monetary easing can be found in the August 26, 2024 Market Decrypt.

In summury

►Inflation continues to fall in most countries, which is good news. This justifies expectations of an easing of monetary rigor.

►The speed of monetary easing remains the major debate on the markets. In the United States, expectations are very aggressive, with 4 rate cuts (of 25 basis points) expected between now and the end of the year, including the first in September. In the Eurozone, just over 2 (or 3, including the one already carried out in June, for comparison with the Fed).

►We believe that in the United States, 3 cuts would both support the disinflation process and avoid restricting the economy too much, so as not to weigh too heavily on demand and therefore on the job market. For the Fed, we know that this is a crucial point. At this stage, the labor market is showing signs of easing, but not of collapse. Similarly, domestic demand remains solid. It seems to us that more aggressive easing would only be justified in the event of a marked acceleration in layoffs, for example. We must not forget that the US unemployment rate remains historically low. Also, given the unprecedented nature of this cycle, it seems inappropriate to make overly peremptory assumptions about the equilibrium level of the unemployment rate, or of key interest rates.

►In the eurozone, the picture is somewhat different. Although overall inflation is falling, there are notable pockets of resistance, particularly in services, despite weak demand (although there are marked differences between countries). The ECB's mandate is to bring inflation back down to 2%. Given that inflation in services is still close to 4%, it is difficult to ease monetary policy too quickly. Hence our projection of two rate cuts between now and the end of the year.

►Our projections on monetary policy, in particular, still lead us to be cautious on short-term sovereign bond yields. It seems to us that a larger-than-usual cash position would be wise to deploy it in healthier market conditions. In our view, the market's expectations regarding the monetary policies of the major central banks are too high.

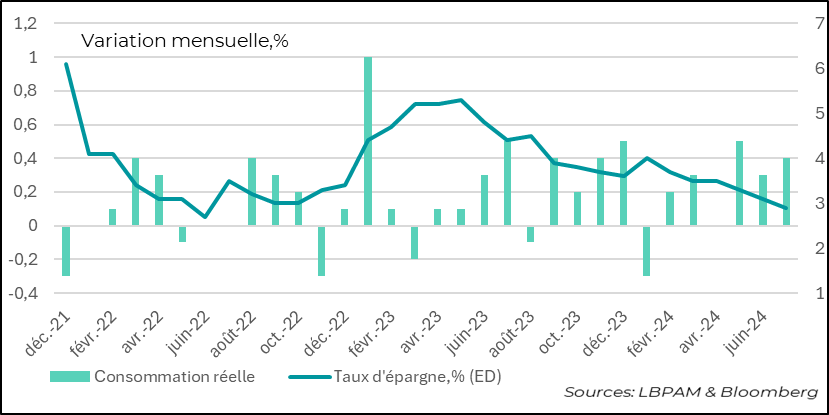

►The figures published last week support our view for the time being. In the United States, despite fears about demand, consumption held up well in July, with a significant rebound. Household confidence also picked up slightly, according to the U. of Michigan survey. Nevertheless, the further fall in the household savings rate leads us to believe that our projection of further moderation in consumption in the final quarter remains valid.

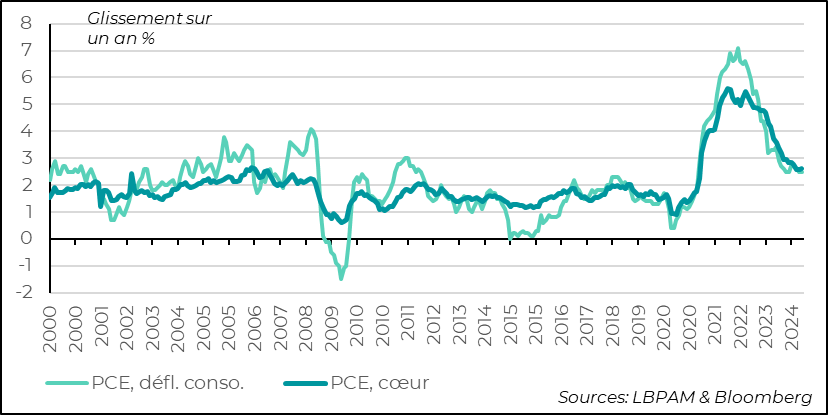

►On the inflation front, the consumer deflator, the Fed's preferred indicator, came out as expected for July. Inflation stagnated at 2.5% annualized. Core inflation also remained unchanged at 2.6%. Nevertheless, we can see that inflation has confirmed its downward trend. In view of these figures, it seems reasonable to expect a 25bp cut in key rates in September, but no more, unless there is a sharp surprise deterioration in the labor market.

►In the Eurozone, inflation fell sharply in August, as expected, to 2.2% year-on-year, compared with 2.6% the previous month. Most of this decline was due to base effects associated with energy prices. Core inflation fell very slightly to 2.8%. This is due to inflation in services, which is struggling to come down. It even climbed to 4.2% in August. Clearly, the ECB needs to see more marked signs of a slowdown in wages before it can be completely reassured that inflation is converging towards its 2% target.

►In Japan, as is well known, monetary policy is moving in the opposite direction to other countries. The trend is away from the extreme easing that has prevailed in recent years. Tokyo's inflation figures for August, which came in higher than expected at 2.6% year-on-year, point to a very slow continuation of monetary tightening. The BoJ's objective of keeping inflation around 2% seems well within reach. Nevertheless, the rise in inflation in August was largely driven by energy prices, while other prices were more subdued.

►In China, the publication of official PMI surveys showed that the economy seems to be growing at a slower pace. The manufacturing sector is stagnating (or growing very slowly, according to the independent PMI-CAXIN) and, above all, the services sector is not taking off at all. This is in line with our forecast of sluggish growth in the second half of the year.

►The two regional elections in Germany's Este region, in Thuringia (the smallest region) and Saxony, more than justified the fears expressed by the country's ruling coalition. Indeed, for the first time since the 2nd World War, a far-right party (Afd) came out on top in Thuringia with over 30% of the vote, beating the CDU. The CDU seems to have won in Saxony. Also, the far-left BSW party made a strong breakthrough, garnering around 12-16% of the vote. What is most striking is the rout of the ruling parties. The recent knife attack by a foreign national seems to have been the major factor behind these election results. Nevertheless, the Afd will find it difficult to govern in the Länder of Thuringia, lacking the allies needed to secure a majority. This rise in extreme populism could further weaken the ruling coalition and create a stir in European politics.

There is much debate in the market about the true robustness of the US economy. In this respect, consumer spending figures for July confirmed that the American consumer is still resilient. In fact, inflation-adjusted consumer spending rose by 0.4%, more than expected for the month, an acceleration on the previous month, which was revised upwards.

To go deeper

United States: Household consumption rebounds in July, but its strength could slow as savings rate reaches very low levels

The strength of consumer spending is reassuring for the US economy's short-term growth prospects. It is therefore reassuring that the Fed may be slowing markedly, and thus acting more swiftly to implement its monetary easing policy.

Of course, we will have to continue monitoring the situation on the labour market to be completely reassured about growth. At this stage, we are not seeing any noticeable acceleration in layoffs, especially as companies are still maintaining very high margins. But this is indeed a point of vigilance.

At the same time, we expect the strength of consumer spending to wane somewhat in the months ahead, as the savings rate continues to fall. It is now at its lowest level since the end of 2022. It seems to us that the less buoyant dynamics of the job market should gradually push up the savings rate and calm the appetite for consumption.

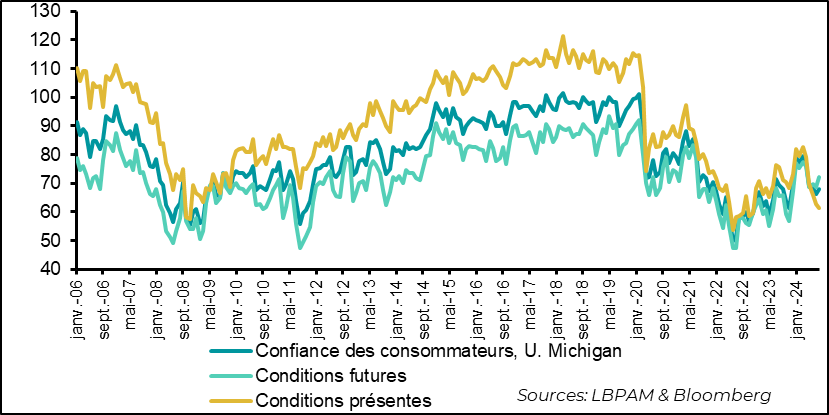

Equally reassuring, consumer confidence, according to the University of Michigan survey, picked up in August, thanks in particular to a rise in sentiment about the outlook. Nevertheless, partly due to the elections, overall confidence remains low by historical standards, not least because of a rather poor perception of current conditions.

United States: Consumer confidence recovers in August, but remains relatively low by historical standards

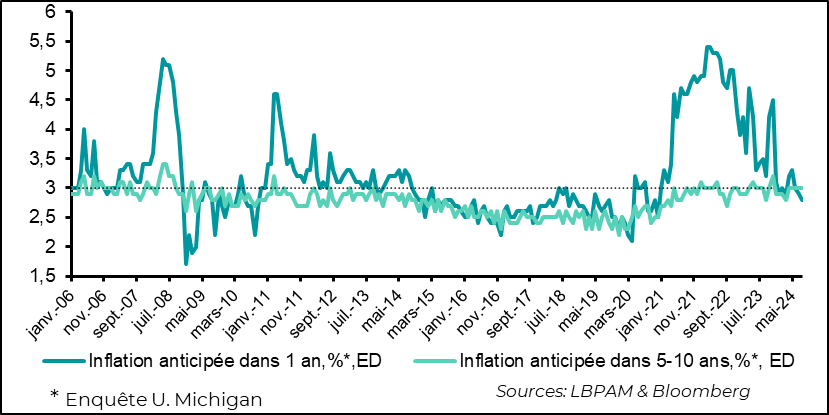

Another factor that has surely contributed to the upturn in confidence, particularly for the future, is the slight drop in short-term inflation expectations. In our view, this partly reflects the significant drop in gasoline prices over the month. Medium-term inflation expectations remain stable at around 3%.

United States: short-term household inflation expectations fall in August, but remain stable over the medium term (5-10 years) at around 3%

In fact, the release of figures for the consumer price deflator (CPI), the Fed's preferred statistic for tracking inflation, came out stable, as expected, for the month of July, at 2.5% year-on-year. Core inflation was also stable, at 2.6%.

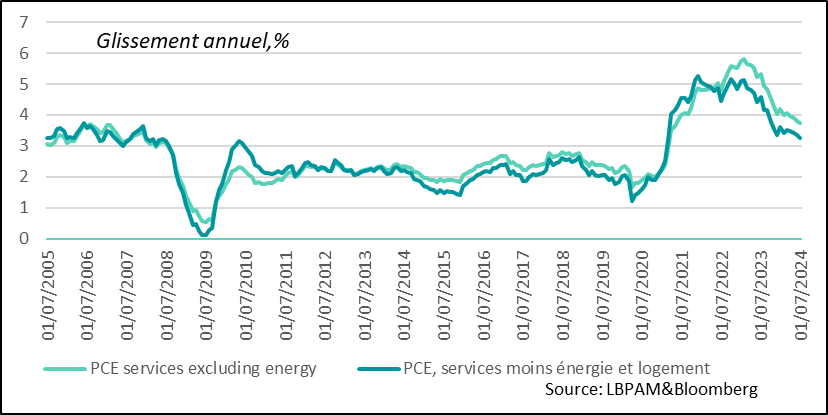

United States: the consumer price index (PCE) came in as expected, showing inflation stable at around 2.5%

Nevertheless, it's worth noting that there are no downside surprises that could have prompted the Fed to adjust its policy even more quickly. At the same time, the better news on inflation dynamics in recent months, which have corrected the bad surprises of the beginning of the year, show that the downward trend has nevertheless accelerated, if we take a window shorter than the year. In fact, over 6 months, inflation adjusted for extreme values has corrected the acceleration seen at the start of the year.

United States: price trends in recent months appear to have corrected the acceleration seen at the start of the year

Inflation in the services sector has also eased in recent months, allowing this segment to pick up the pace of deceleration. This seems to corroborate the trend towards wage deceleration that we have been observing for some months now.

United States: the deceleration in service prices, albeit slow, is contributing to this trend towards easing inflationary pressures

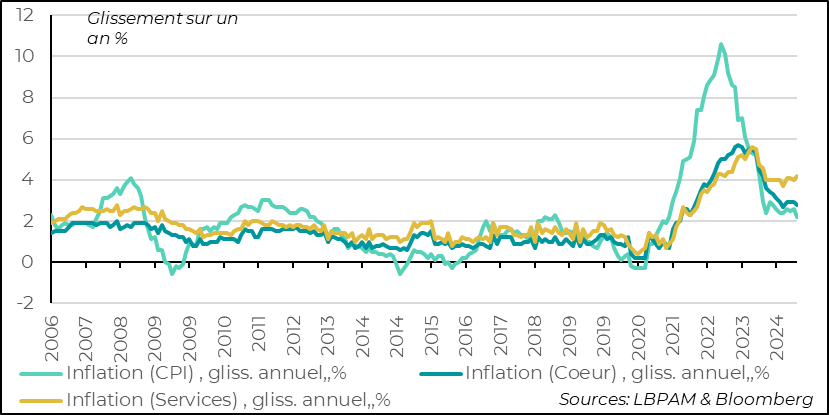

In the eurozone, preliminary inflation estimates for August showed that inflation was continuing to fall. However, this deceleration was mainly due to lower energy prices.

Nevertheless, total inflation reached its lowest level since the summer of 2022, at 2.2% year-on-year. However, this good result conceals the thorn in the ECB's side, namely the behavior of service prices. Indeed, prices in services actually accelerated over the month to 4.2% year-on-year. This is frustrating for the ECB, and the members of the Governing Council, especially the more orthodox ones, will want to see wages decelerating faster to be more reassured that inflation is converging towards the 2% target.

However, we still believe that this does not change the strategy of lowering key rates, which the European economy needs, but should make the ECB even more cautious in easing its policy, hence the maintenance of 2 rate cuts between now and the end of the year.

Eurozone: inflation recedes under the impact of energy prices, but service prices continue to resist

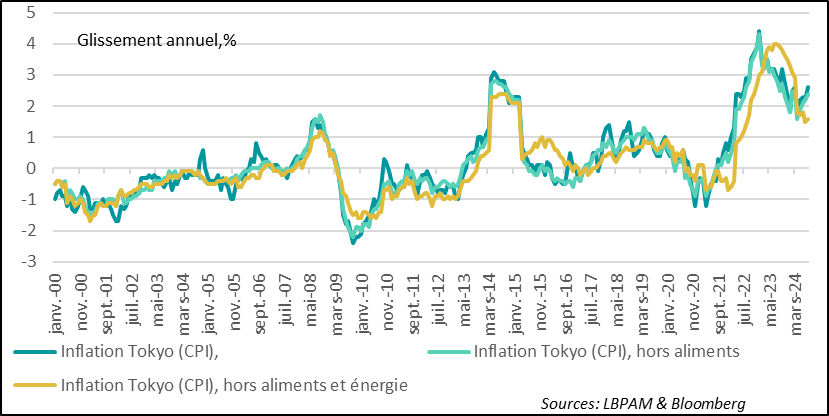

In Japan, the inflation figure for Tokyo, which is a very good leading indicator for the country's inflation, rose in August to 2.6% year-on-year, surprising economists. However, this acceleration was largely due to the base effects of energy prices.

Underlying prices, i.e. excluding energy and food, remained relatively stable, accelerating more slightly to 1.6%.

Nevertheless, the important message from these figures is that inflation appears to remain well anchored at around 2%. This is a reassuring message for the BoJ. As such, we believe this should open the door to a further rate hike by the end of the year. But we still believe that the normalization of monetary policy will be slow.

Japan: Tokyo inflation accelerates in August, driven in particular by energy prices

Sebastian PARIS HORVITZ

Head of Research