Fears over Fed rate cuts continue to intensify

Link

-

US interest rates are rising again this week due to growing doubts about the Fed's rate cuts and the slight rise in oil prices, which is having a dampening effect on the equity markets. The market is now anticipating only one rate cut between now and the end of the year, and 10-year yields are back above 4.5% for the first time since the start of the month after Neel Kashkari said he was not totally ruling out further rate hikes, even if they were unlikely. As we have written before, we believe that the markets can absorb later and limited rate cuts, especially as the economic data is fairly positive. But they would probably react very negatively to a reversal in the Fed's rhetoric that ruled out the prospect of rate cuts. That said, we believe that this risk is very limited at present, hence our reasonably constructive stance.

-

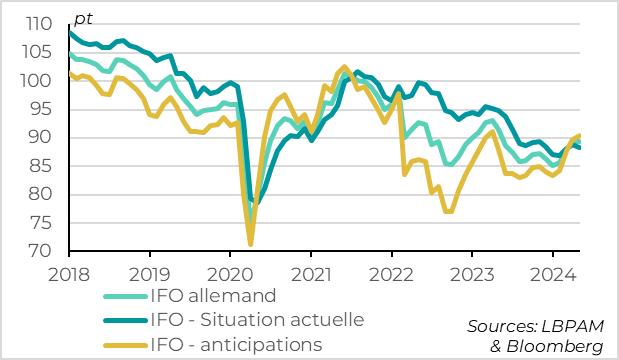

In Europe, national surveys are a little less favourable than the PMI, even if their trend remains positive. The German IFO, for example, stagnated in May due to still limited activity, even though the outlook continues to improve. This is in line with our scenario, which predicts that growth in the eurozone will pick up again in 2024 after almost two years of stagnation, but only gradually.

-

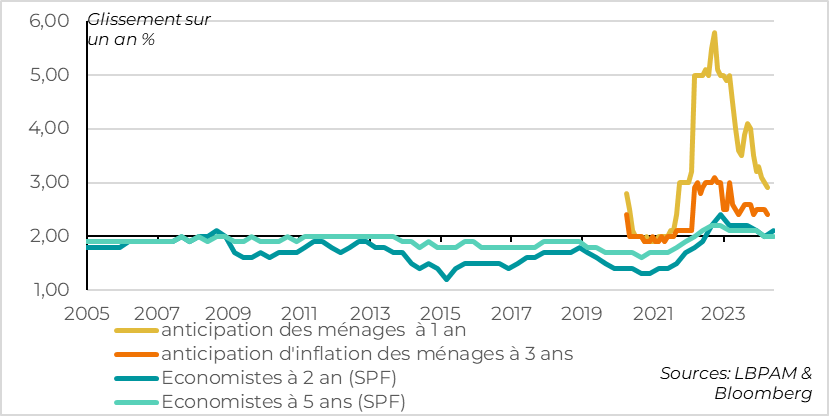

The good news for the ECB is that household inflation expectations are continuing to normalise. Long-term expectations remain anchored and one-year expectations have fallen back below 3% for the first time since the start of the inflationary shock in mid-2021. This allows the ECB to cut rates next week, although it will probably wait for more signs that services and wage inflation are slowing before committing to further rate cuts. Attention now turns to the inflation figures for May, which are published at the end of the week and should indicate that inflation in services is still holding up.

-

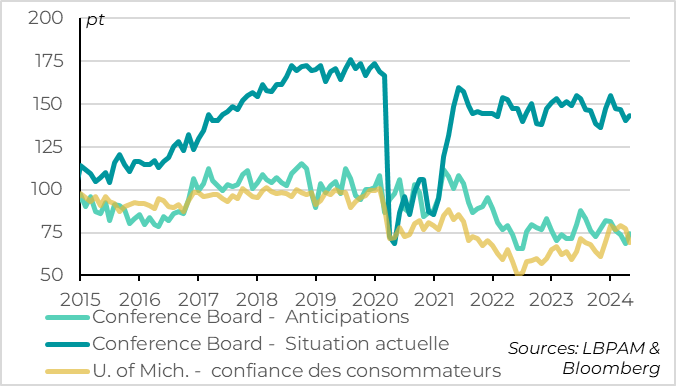

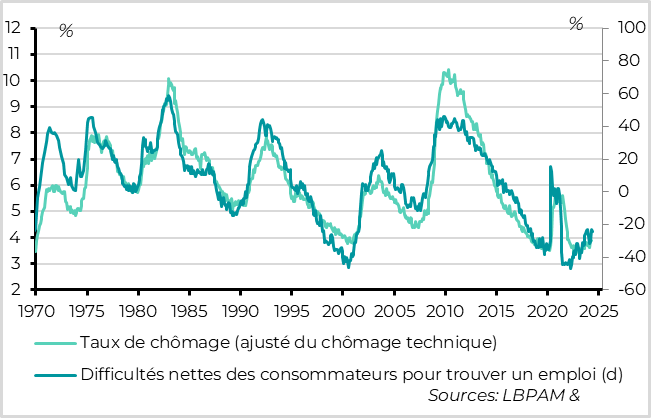

The latest surveys from the United States for the month of May are somewhat reassuring after the weakness of the data for April. Following the rebound in S&P's PMI survey, and in contrast to the University of Michigan's survey, the Conference Board's less volatile consumer confidence survey indicates that the situation of US households remains solid. Above all, they indicate that the labour market remains favourable, which limits the risks of an abrupt slowdown in the economy. All in all, this is reflected in the economic surprises, which are stabilising after having fallen into negative territory since the start of the month.

-

Oil is rebounding after hitting a three-month low at the end of last week due to tensions in the Middle East (the Israeli army entered Rafah) and ahead of the OPEC+ meeting this weekend. That said, the price of oil remains broadly stable at between $80 and $85 a barrel, a level which is neutral for the outlook for growth and inflation.

Fig.1 Allemagne : l’IFO stagne en mai mais les perspectives restent positives

- IFO German

- IFO - Current situation

- IFO - Expectations

The IFO stagnated in May after two months of clear rebound, remaining at a limited level of 89.3pt, but the trend remains favourable.

The stagnation of the IFO in May is explained by a slight fall in the current situation component, concentrated in services. This suggests that the recovery remains sluggish in the first part of the year. This is consistent with the breakdown of German GDP for Q1, which shows that the 0.2% growth came from temporary factors (exports, construction investment), while consumption and business investment continued to contract.

But the expectations component, which is the most important for assessing the outlook, continues to rebound, after having fallen back above the current component the previous month. This is a strong sign that the recovery dynamic is well underway. Also, the IFO excluding services, which is less volatile, continues to recover gradually in May.

All in all, the data are in line with our scenario, which forecasts a recovery in growth in the eurozone during 2024 after almost two years of stagnation, albeit a gradual one. We expect the eurozone to return to potential growth this year, thanks to a gradual recovery in the core countries, while growth stabilises in the peripheral countries.

Fig.2 Zone euro : les anticipations d’inflation des ménages continuent de refluer

- 1-year household expectations

- 3-year household inflation expectations

- Economists 2 years (SPF)

- 5-year economists (SPF)

Household inflation expectations continued to normalise in April, according to the ECB survey. One year ahead, households expect inflation to be below 3% for the first time since the start of the inflationary shock in mid-2021. More importantly, medium-term household expectations remain well anchored at 2.4%, close to their pre-Covid level. The levels of household expectations are difficult to judge, as this survey is fairly recent and only covers the post-Covid period. But the trend is reassuring. And the inflation expectations of the markets and economists, for which we have a track record of over 20 years, are anchored close to the 2% target in both the short and long term.

This is reassuring for the ECB, unlike wages, which remain too buoyant. In fact, inflation expectations, along with wages, are the drivers of inflation in the medium term. And anchored expectations mean that we can anticipate that wages will eventually normalise if the tensions on the labour market ease. This allows the ECB to cut rates next week, although it will probably wait for more signs that inflation in services and wages is slowing before committing to further rate cuts. If the Governor of the Banque de France wants to keep open the option of a second rate cut as early as July, we continue to think that the ECB will wait until September and the Q2 wage figures before cutting rates further.

Fig.3 United States: household confidence

- Conference Board - Expectations

- Conference Board - Current situation

- U. of Mich. - consumer confidence

US consumer confidence held up better than expected in May. In contrast to the University of Michigan survey, the Conference Board survey remained at a solid level in May. According to this survey, consumer confidence is back above 100pt at 102. This reflects the solidity of the current situation, which households have judged to be solid since the end of the Covid. This is important, because the current situation indicator is historically less volatile and more reliable for judging economic risks than the expectations indicator or the University of Michigan survey indicator.

- Unemployment rate (adjusted for technical unemployment)

- Consumers' net difficulty in finding a job (d)

In particular, US households are still facing a solid labour market, even if it is easing slightly. The proportion of Americans believing that jobs are plentiful rather than hard to find stabilised in May at a still high level (+24%). This is not as high as in 2022-2023 and slightly below the pre-Covid level, but it remains consistent with a stable unemployment rate of around 4%.

All in all, the US surveys for the month of May continue to reassure us about the trend of the US economy after the rather disappointing activity figures for April. They suggest that while the US economy is slowing a little, this is still very gradual.