Fed rate-cutting cycle clearly on pause

Link

Strong US employment reports for December and rising inflation expectations argue for a pause in Fed rate cuts, despite a slight deterioration in consumer confidence. To find out more, read Xavier Chapard's January 13, 2025 market decipherment.

Summary

► US employment reports for December were very strong. Over a quarter of a million jobs were created, the most in nine months, and the unemployment rate unexpectedly fell back below the Fed's estimated equilibrium level. Combined with rising inflation expectations, these figures argue for a pause in Federal Reserve interest rate cuts.

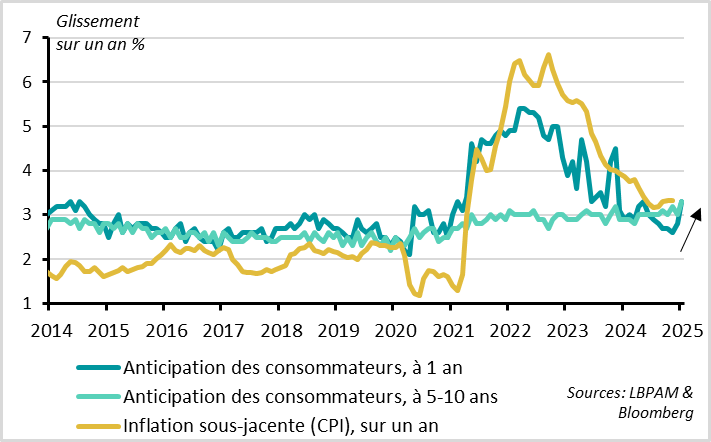

► Indeed, US consumer confidence deteriorated slightly in early January on fears of higher inflation ahead due to tariffs. Inflation expectations in both the short and medium term stand at 3.3%, a level a little too high for the Fed to be serene.

► The minutes of the latest Fed meeting and the latest speeches by Fed members indicate that the Fed is becoming more patient in its rate-cutting cycle, but still believes it can cut rates this year. The main reason for this is that the Fed considers that rates are still at 4.5%, in a zone of monetary restraint, while inflationary pressures are normalizing, albeit slowly. The risk of a further rate hike therefore still seems low, as long as wages do not accelerate and expectations remain anchored.

► But it will take softer inflation and employment figures, and perhaps a little more clarity on future economic policies, to enable the Fed to cut rates again. That's why we're anticipating a pause from the Fed in the coming months and “only” two rate cuts later in the year. If this is the case, it would mean that US key rates would remain close to 4% this year. The risk of even more limited rate cuts or no further cuts at all is real, especially if the most extreme inflationary policies presented during the presidential campaign are implemented, which is not our central scenario.

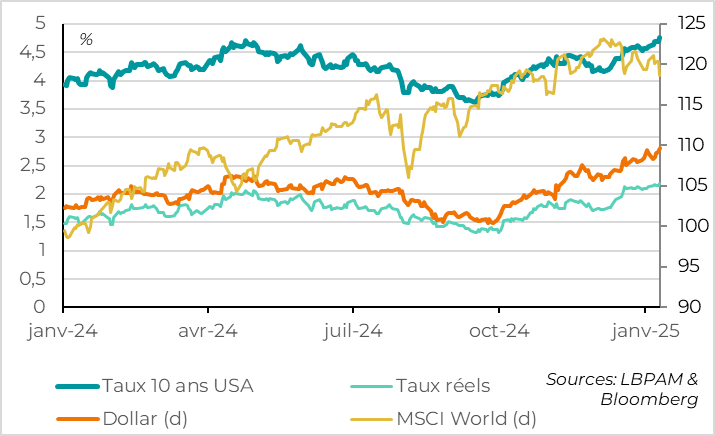

► Falling expectations of a Fed rate cut (the market now expects only one this year) and political uncertainties have pushed long yields even higher. The US 10-year yield is above 4.75% for the first time since the end of 2023, and German long yields are approaching 2.6%. While political uncertainty in the United States may still generate volatility on bonds in the run-up to the January 20 inauguration, it seems to us that the level of rates is now attractive. This is particularly true in Europe. Indeed, the latest data indicate that growth remains sluggish in Europe, and that inflation continues to decline in the eurozone. Against this backdrop, the ECB, unlike the Fed, is likely to continue cutting rates at upcoming meetings, as Chief Economist Lane reiterated over the weekend. The spread of the US rate hike to European rates therefore seems exaggerated to us. Especially as Trump's proposed tariffs are inflationary for the US but recessionary for Europe.

► Political uncertainty and tighter monetary conditions (rising long rates, the dollar...) are weighing a little on risky assets at the start of the year, despite resilient global activity. This could remain the case in the short term, as long as the new US administration has not been installed and data prevent the Fed from providing support. However, we remain constructive in the medium term, given the good corporate results. This should be evident in the Q4 earnings releases starting this week.

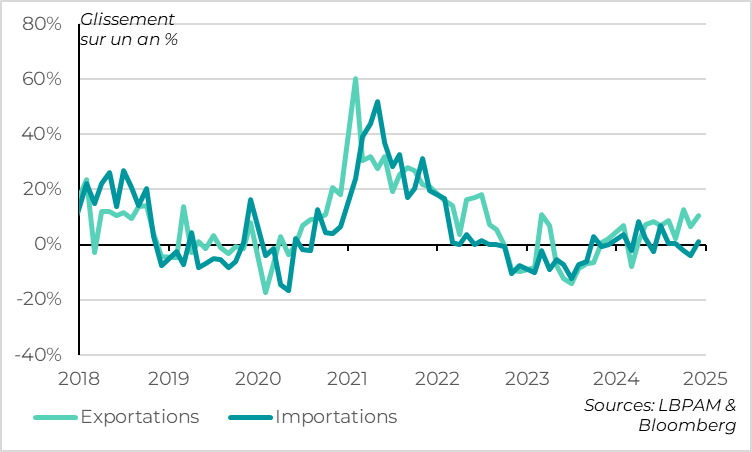

► Chinese exports accelerated strongly in December to 10.7%, perhaps in anticipation of tariff hikes. This is positive for Chinese growth in the short term, but could heighten tensions with the US, with China's trade surplus approaching 1,000 billion for the first time in 2024.

To go deeper

Markets: rising interest rates and the dollar weigh on risky assets in early 2025

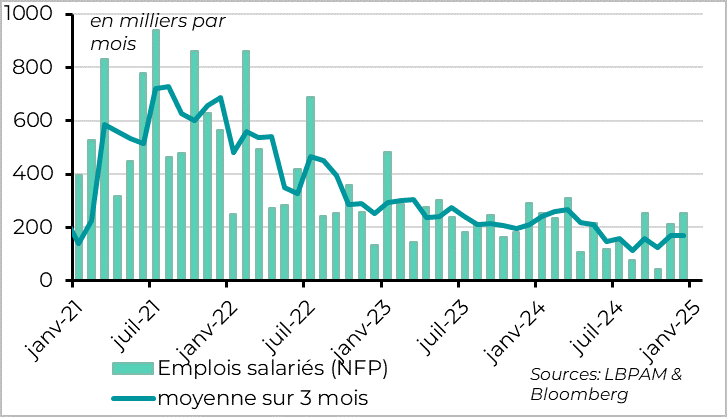

United States: job creation is very solid at the end of 2024

The US economy created 256,000 jobs in December according to the business survey, more than in November and well above expectations. This confirms that the weak job creation in October (43,000) was due to temporary factors (strikes, hurricanes) and that the job market remains solid. All the more so as job creation is fairly widespread in sector terms, with the exception of manufacturing, which is once again shedding jobs after a rebound linked to the end of the Boeing strike in November.

Beyond monthly volatility, job growth stabilized at around 170,000 on trend in the second half of 2024, after slowing sharply at the start of 2024. The job market therefore appears to have stabilized close to its equilibrium level according to this survey.

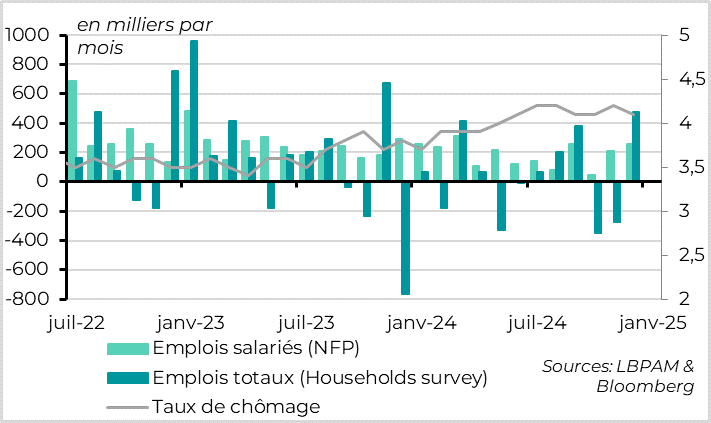

United States: unemployment rate stabilizes at a satisfactory level

The positive employment trend was confirmed in December by the household survey, which showed a drop in the unemployment rate to 4.1%. This is reassuring after two months in which the survey indicated that the job market was still deteriorating. Total employment rebounded by 478,000 in December, following a loss of over 600,000 jobs in the previous two months. This enabled the unemployment rate to fall from over 4.2% in November to under 4.1% in December. After revisions, the unemployment rate stabilized in H2 2024 at 4.1-4.2%, which is 0.5 pts above its pre- and post-Covid lows but at the bottom of the range the Fed considers to be the equilibrium of the job market (4.2% according to the December projections of Fed members).

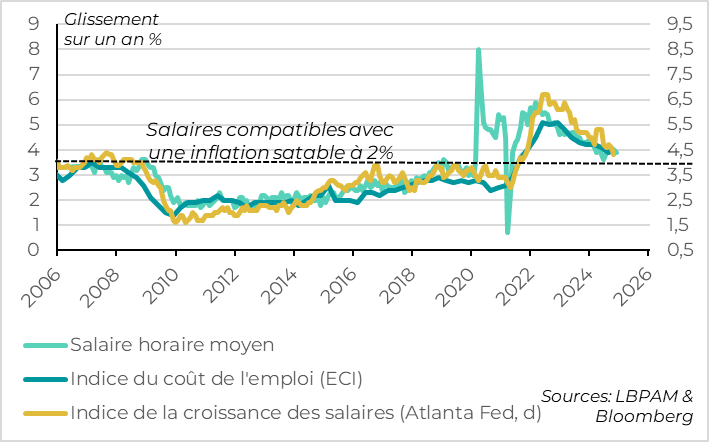

United States: wages remain dynamic but continue to normalize

The good news is the stabilization of the labor market, which does not prevent the gradual normalization of wage pressures from continuing until the end of 2024. This allows the Fed to remain confident about the trend of deflationary pressures over the medium term, at least as long as expectations remain well anchored.

Average hourly earnings slowed slightly in December, to 0.3% on the month after two months at 0.4%. This allows the year-on-year increase to slow down a little, from 4% to 3.9%, after accelerating slightly since last summer. This is positive, especially as less volatile measures of wages have continued to slow in trend over the autumn and are approaching normal levels. And this is consistent with measures of tightness in the labor market, such as the rate of resignations or job vacancies per unemployed person, which are back below their pre-Covid levels. All in all, while wage costs remain slightly above the Fed's comfort zone (around 3.5%), they continue to slow gradually at the end of 2024 and no longer generate high inflationary pressures, unlike in 2022-2023.

United States: US household confidence dips slightly in January...

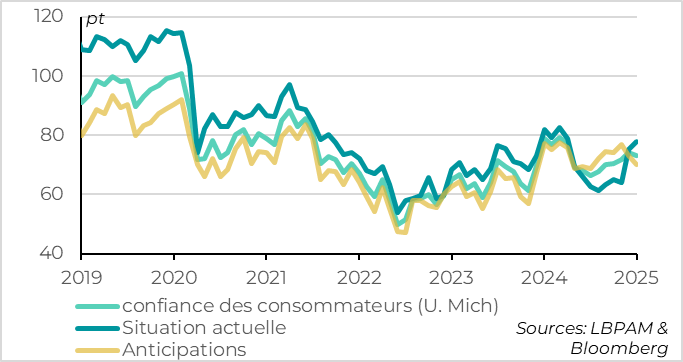

Consumer sentiment deteriorated slightly in early January on fears of higher inflation ahead. The strong current household situation and fears of higher prices could support consumption in the short term, by motivating some consumers to buy goods now to avoid possible price rises later. But declining household confidence and tighter financial conditions could weigh on growth in the second half of the year, especially if tariff hikes are significant. The University of Michigan's aggregate indicator fell for the first time in 6 months, from 74 to 73.2. This is due to a drop in the household outlook (-3 pts to 70.2), while the assessment of current conditions continues to improve (to 77.9). The drop in household outlook is explained by fears about the potential impact of tariffs on prices, which is spontaneously mentioned by a third of households. Also, fewer consumers now expect interest rates to fall.

United States: ... due to fears of tariff-related price rises

Above all, inflation expectations rose sharply at the start of the year, breaking out of their usual fluctuation band, which is not good news for the Fed. If this rise is confirmed in forthcoming surveys or spreads to market expectations (which is not the case at present), the Fed may fear that inflation expectations will become unanchored, necessitating a much tougher stance. But this is not yet the case. For the year ahead, expectations have jumped from 2.8% in December to 3.3%, the highest level since May and above the 2.3% to 3.0% range observed in the two years preceding the pandemic. And long-term inflation expectations, which are even more important to the Fed, also rose to 3.3% (from 3.0%), their highest level since 2008. Even at the peak of the 2021-2023 inflation shock, long-term inflation expectations remained within their normal fluctuation band (2.8-3.2%).

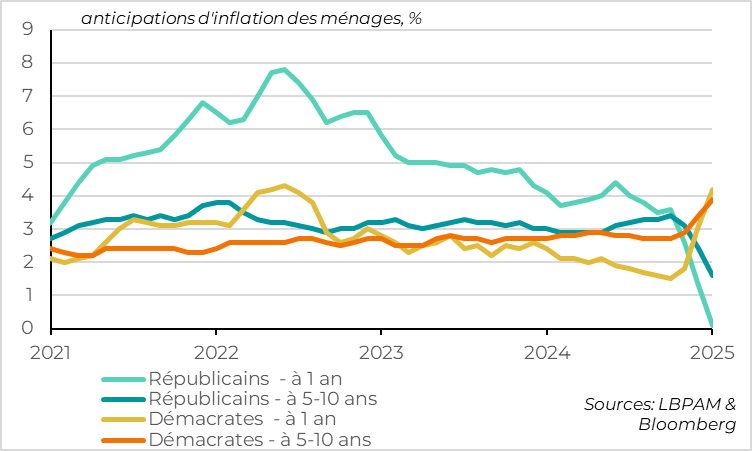

United States: partisan division becomes extreme in trust data

That said, the University of Michigan's household survey is increasingly difficult to read because of the partisan divide that has widened enormously since the November 5 presidential election, on all issues. Republicans are the most confident since Covid, expecting inflation to slow dramatically to 0% within a year. By contrast, Democrats have been the least confident since the end of Trump's first term, and expect inflation to rise sustainably towards 4%.

China: exports are very dynamic at the end of 2024, which could reinforce trade tensions

Xavier Chapard

Strategist