Fed, the 25bp vs 50bp debate

16..09.2024

Link

Today, Sebastian PARIS HORVITZ provides an in-depth analysisfocused on the expected cut in the Fed’s key interest rates.

In summary

►As the Fed prepares to follow other major central banks, like the ECB, in easing its monetary policy with an initial cut in its key interest rates, the debate over the extent of this cut has intensified in recent days. The proportion of those expecting a 50 basis point (bp) cut has significantly increased. The main reason is a rapid slowdown in job creation, raising the risk of the economy quickly entering a recession. The Fed should act more strongly to counter this risk. Additionally, inflation risks have disappeared.

►It is true that some indicators, which have historically given early signals of recession risks, have been triggered. However, this is not the first time in this particular cycle. More importantly, many economic variables, such as the labor market, corporate health, or systemic financial risks (especially from banks), continue to point to the ongoing expansion of the U.S. economy, albeit at a slower pace.

►Thus, using one or two measures to diagnose the state of the U.S. economic cycle would be erroneous. Moreover, despite the favorable trend, inflation in the United States is still far from being under control.

►We continue to believe that a 25bp cut is the most probable and reasonable given the information we have. This is further justified by the fact that financial conditions in the United States have already become the most accommodative in 2 years. A more aggressive move could be seen as a much more negative diagnosis by the Fed on economic prospects, which could affect confidence. The most important thing will be to indicate to the market that the Fed is ready to act further if the economic situation deteriorates in the future.

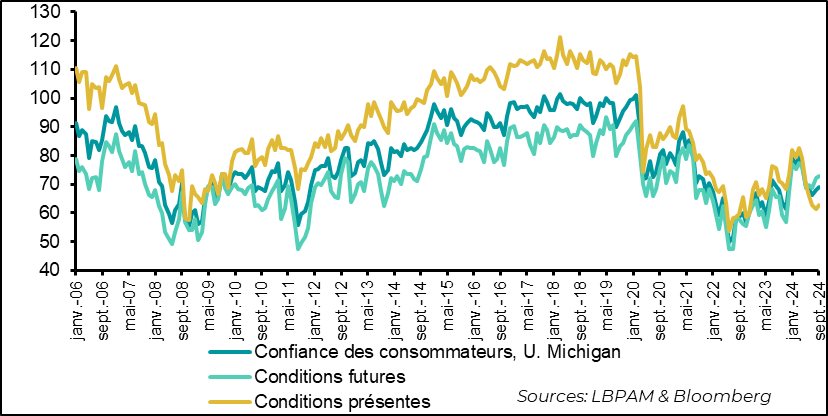

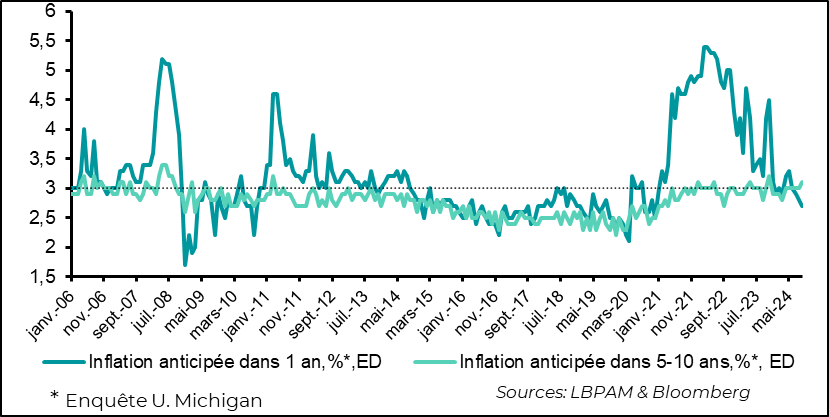

►In line with statistics describing a resilient economy, the University of Michigan’s consumer confidence survey showed a slight improvement in September. Unfortunately, on the inflation front, medium-term 5-10 year expectations have returned to their highest level at 3.1%. However, this level remains reasonable.

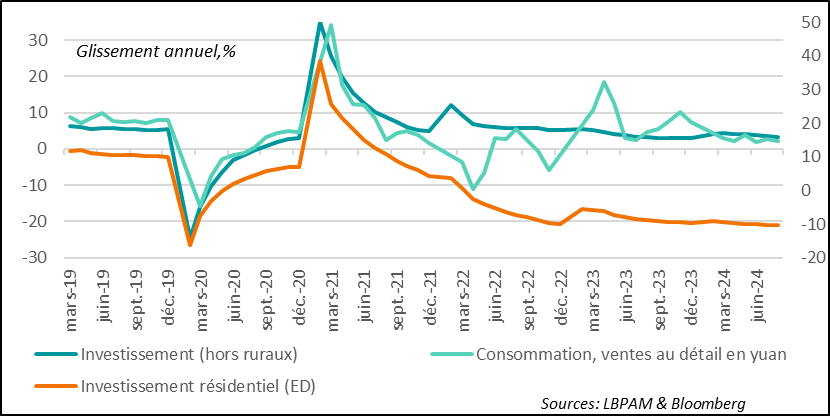

►In China, the latest activity statistics again disappointed in August. On the one hand, industrial production grew less than expected at 4.5% year-on-year, but more importantly, investment and consumption (via retail sales) were less robust than expected. Thus, the lack of confidence continues to weigh on consumption, and for investment, the ongoing contraction in real estate remains a significant drag.

Go deeper

Next Wednesday, the Fed is set to cut its key interest rates for the first time since the rate hike campaign began in March 2022. Obviously, this cut is widely anticipated. It corresponds to the need to start adjusting its monetary policy in a context where inflation has significantly decreased, although still far from the 2% target.

It will thus join most major central banks in easing monetary conditions. This later start corresponds to the specificity of the American cycle. Indeed, the United States has so far experienced much stronger economic growth than other countries, which raised concerns that inflationary pressures would persist longer.

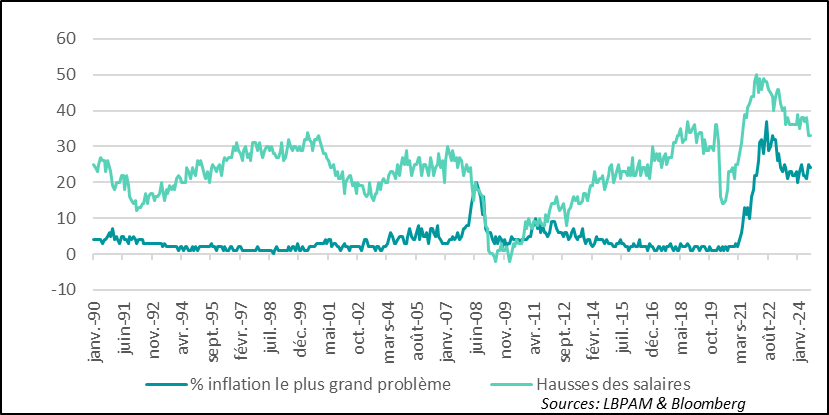

While inflation is indeed on a downward trend, the delayed effects of restrictive monetary policy are being felt more notably on the economy, particularly with a slowdown in job creation. The labor market finally seems to be normalizing.

However, this normalization of the labor market could prove more abrupt than anticipated. This concern has led the Fed to emphasize that within its dual mandate of ensuring price stability and full (non-inflationary) employment, it sees the latter objective as potentially at risk due to the rise in the unemployment rate.

It is true that the unemployment rate rose to 4.3% in July. This level is higher than the Fed anticipated. Even though it fell back to 4.2% in August, the fear of seeing unemployment rise sharply in the coming months has changed the Fed’s discourse, particularly that of its chairman, J. Powell. Indeed, the Fed’s goal seems to be to ensure a soft landing for the economy, which would result in minimal job losses. This would be an achievement.

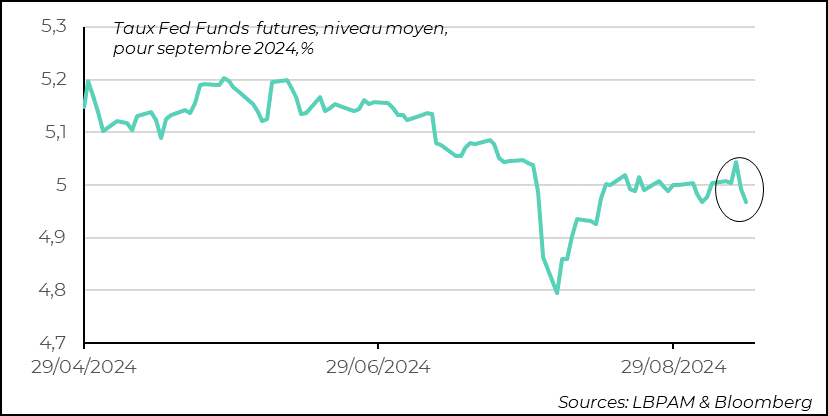

Based on this observation, the idea has gained traction that the Fed is behind in monetary easing and should act more swiftly. Thus, an even larger number of market operators, especially at the end of last week, now expect the Fed to proceed with an initial 50bp cut. This would indicate its willingness not to let the economy slip, or even enter a recession.

United States: The market increased its anticipation of a 50bp cut at the end of last week

This feverish rise has notably come from comments by some former Fed members, like B. Dudley, who have called for a strong cut. It is also based on J. Powell’s comments at the Jackson Hole conference in August, indicating that further deterioration in the labor market would not be welcome.

A 50bp cut would surely send a more urgent message to adjust monetary policy, especially since, as we know, it acts with a delay on the economy. This could lead some to fear that the risks to growth are much greater than anticipated. This could have negative consequences on the behavior of economic agents, who would become more cautious, ultimately affecting growth, which would be counterproductive.

Nevertheless, one could consider that the Fed indeed fears that its policy is too restrictive.

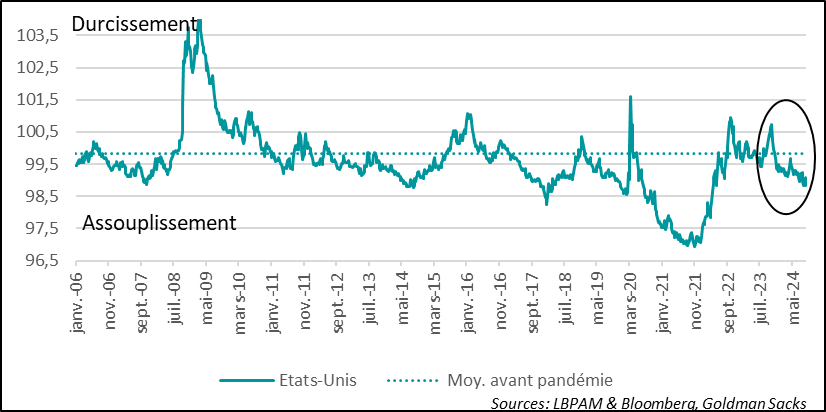

However, as far as we can judge, financial conditions in the United States are the most accommodative we have seen since the beginning of monetary tightening in early 2022.

United States: Financial conditions are the most accommodative since early 2022

Should we send the message that it is time to be more aggressive in moving towards even faster easing of financial conditions?

Obviously, it would be wrong to be dogmatic about the right diagnosis. Nevertheless, we have too many indicators that highlight that, despite some indicators warning of a possible near-term recession, the U.S. economy continues to show remarkable resilience.

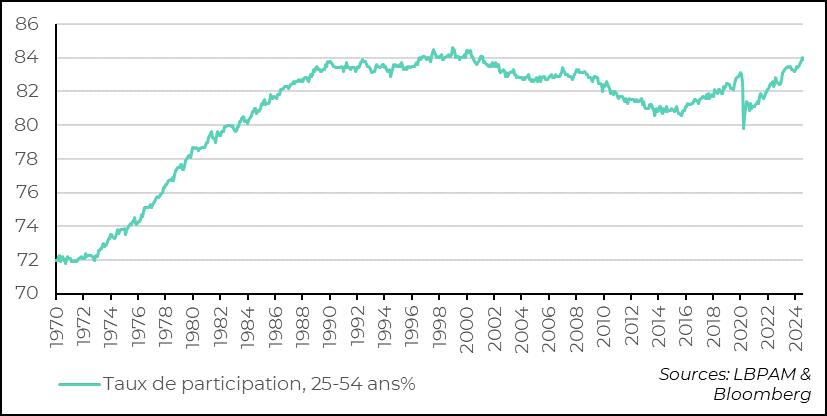

Regarding employment, while the unemployment rate has increased by nearly one percentage point from the historically low point of 3.4%, it remains at a historically low level. Moreover, we have reached a historically high participation rate when considering the largest category of the labor market, those aged 25-54. It is close to the peaks reached in the early 2000s. Furthermore, we still do not see any really palpable layoff dynamics in the economy.

United States: The labor market remains very close to full employment with a historically high participation rate in the largest category

Linked to employment, whose dynamics seem to have been strongly marked by the massive arrival of migrants, we also find companies that present a very solid financial situation. Thus, if the U.S. economy were at risk of entering a recession, it would be the first time this would happen: with companies maintaining historically high margins and showing no notable trend of deterioration.

United States: Corporate margins remain very high, reducing the risk to the labor market and an economic collapse

Moreover, the Fed continues to insist that systemic risks from the banking sector are very limited. Bank capitalization is therefore perceived as very solid, and notably capable of absorbing the deterioration, which seems normal at this stage of the cycle, of the situation of some households, the most fragile, who see their financial situation deteriorate (credit cards, auto loans).

Overall, it still seems more justified for the Fed to proceed cautiously with this first rate cut. Especially since in an election period, a more aggressive action would not leave presidential candidates indifferent. The Fed certainly would not want to become a topic of discussion. Also, on the fiscal side, nothing is being done to see any adjustment of public finances in the future.

We still expect a 25bp cut in the Fed’s key interest rates. However, the 50bp scenario has gained ground, although in our opinion, not really for very good reasons. In any case, the most important thing on Wednesday evening will be to know if the Fed gives an indication of the trajectory it will follow. We still expect 2 additional cuts by the end of the year, after Wednesday’s.

Regarding the trajectory of the U.S. economy, we had the University of Michigan’s consumer confidence survey for September, which indicated an improvement, particularly regarding prospects. Nevertheless, confidence remains at relatively low levels, partly explained by a very marked political polarization.

United States: Consumer confidence improves thanks to prospects in September according to the University of Michigan survey

However, the survey gave bad news regarding inflation expectations. Certainly, short-term expectations (1 year) are falling due to lower energy prices, but long-term (5-10 years) expectations are rising again. We are back to 3.1%, which is in the upper range of the last 15 years.

United States: Long-term (5-10 years) expectations rise slightly to a high for over 15 years

The Chinese economy continues to show signs of weakness. Indeed, industrial production in August was weaker than expected, at 4.5% year-on-year. Some base effects explain this deceleration compared to the previous month, but it also shows that there is no renewed dynamism.

Above all, on the domestic demand side, we see that there is really no strength in the recovery. On the household side, retail sales in August were significantly weaker than expected (2.1% year-on-year), showing that confidence is still not there. Also, on the investment side, even though infrastructure investment remains the engine used by the authorities, the real estate sector remains weighed down and affects activity.

We will see if these figures push the authorities to do more to stimulate activity. So far, we have seen that the probability of massive stimulus is not current. Nevertheless, we can expect financial conditions to continue to be eased.

China: Growth remains weak due to demand (consumption and investment) and calls for more measures to support activity

Sebastian PARIS HORVITZ

Head of Research