Fed to confirm need for patience

Link

- This week will be marked by the Fed's monetary policy meeting. In our opinion, the most likely outcome will be a confirmation of the views expressed by J. Powell. That is, the need to keep current policy in place for longer, so that it can have an impact on the economy. This would be in response to the more robust growth data that have dominated since the start of the year and the stronger-than-expected inflation figures. At this stage, we think it would be premature for it to adopt a more aggressive message.

- The market has already adopted the scenario of higher key rates for longer. Only half a rate cut is envisaged between now and the end of 2024. We still believe the Fed could cut rates twice. This is based on our view that the economy should decelerate from the summer onwards more sharply. A no-rate-cut scenario is conceivable in the event of a much stronger resilience in activity than we envisage.

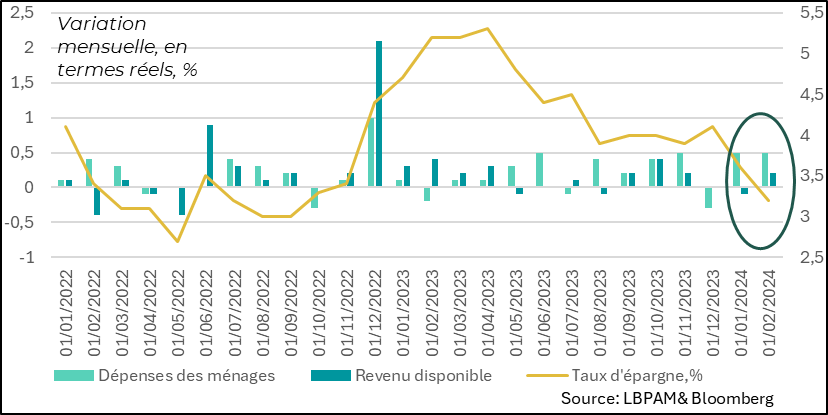

- Detailed data on trends in US household spending showed that consumption growth remained very robust. The monthly expansion was 0.5% in real terms, the same pace as the previous month. Consumption momentum thus remains robust. This must be a cause for concern for the Fed

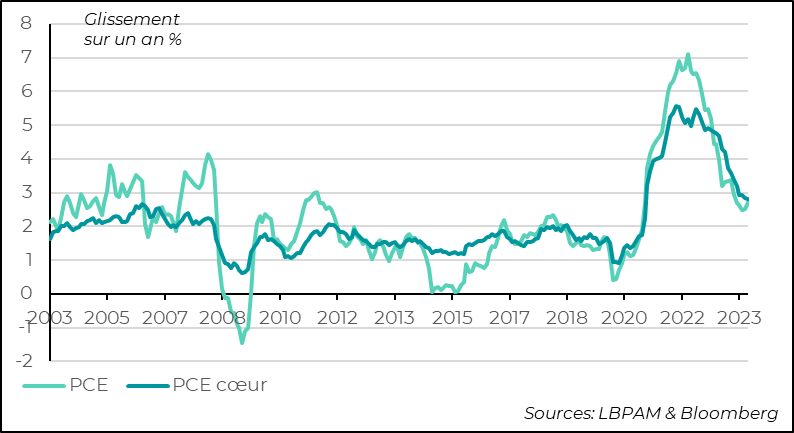

- The consumption deflator (PCE) was just as strong in March as in the previous month, at 0.3%. The core PCE rose by the same amount. Year-on-year, total inflation accelerated to 2.7%, while core inflation stagnated at 2.8%. This is another indication that the decline in inflation is slower than expected. This is the main reason for the Fed's cautious stance. But inflation expectations, which are still well anchored, do not require a more aggressive stance.

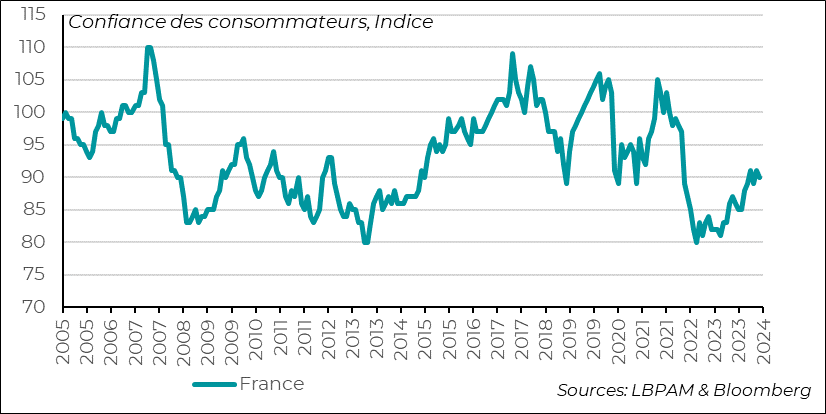

- In the Eurozone, while the economic situation is improving, it remains fragile. In France, the household confidence survey showed a deterioration in April. In particular, households are seeing a worsening outlook for their financial situation. This is reflected in a rise in sentiment about the need to save. We'll see if this really affects consumption. The rate cuts we envisage for the ECB should gradually help to support activity.

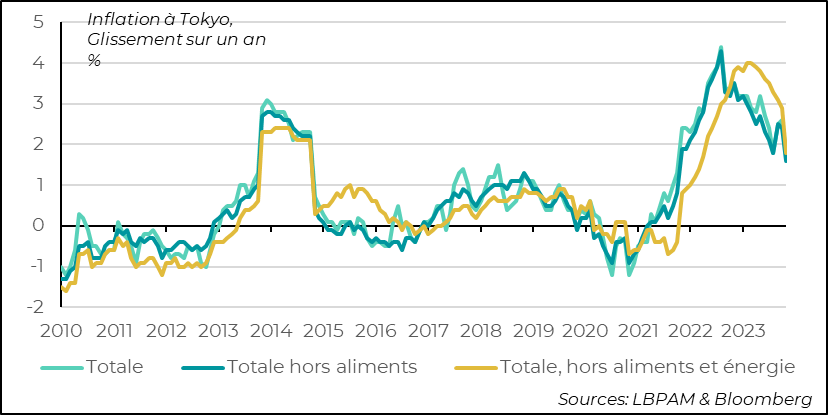

- In Japan, inflation in Tokyo came in lower than expected, at 1.8% vs. 2.5%. This led to renewed speculation that accommodative monetary policy would be maintained for much longer. However, inflation data were heavily impacted by the introduction of free tuition in Tokyo. This distortion will not affect domestic inflation. The yen nevertheless fell sharply to an all-time low of 160 to the dollar, but appears to be recovering.

- Tensions in the war between Israel and Hamas could ease if an agreement is reached for the release of a significant number of Israeli hostages held by Hamas in return for a 6-week ceasefire.

These figures confirm what we already knew after the publication of the CPI, i.e. that the disinflation process is much slower than anticipated.

This measure of inflation, which is the Fed's preferred indicator, underlines the continuation of the unpleasant surprises we've been seeing since the start of the year, i.e. higher-than-expected inflation rates month after month. Above all, it justifies the new cautious tone adopted by monetary authorities in recent weeks regarding the outlook for the path of monetary policy.

Fig.1 United States: PCE confirms slow deceleration in US inflation.

- PCE

- PCE heart

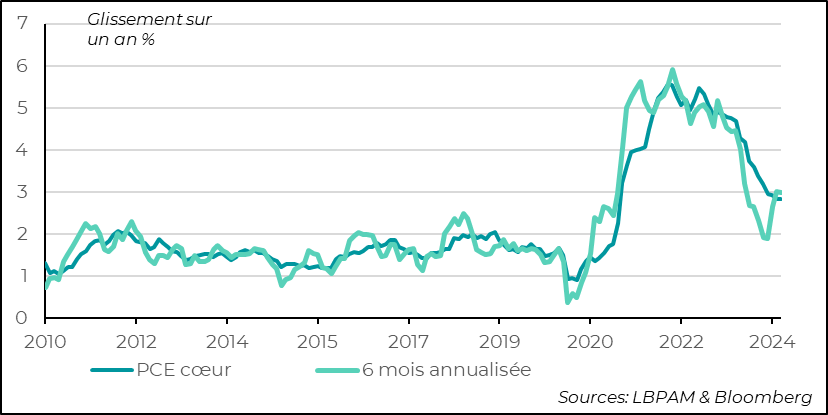

Obviously, one of the Fed's concerns is that the trend towards price deceleration should be broken, and that inflation should start to rebound. What is certain is that the shorter-term trend since the start of the year, looking at the 6-month slide, shows that inflation has indeed started to rise again, particularly when core inflation is taken into account, in order to remove the volatility of energy and food prices.

However, at this stage, we do not believe that this is a new trend. We already considered that the disinflation process would be slow, all the more so in a context where demand remains robust. So, seeing short-term trends fluctuate seems normal to us.

Fig.2 United States: Core inflation decelerates slowly as trend change in shorter-term measures indicates

- PCE heart

- 6 months annualized

So, while there are always specific factors that can disrupt inflation trends, it remains important to monitor measures that remove the most extreme movements. This is what the Dallas Fed is doing. It's clear that the trend is still towards a deceleration in prices, even if short-term indicators show that this is not happening as quickly as some, notably the Fed, had anticipated.

Fig.3 United States: The evolution of the PCE adjusted for extreme variations in the prices of certain goods shows that disinflation is indeed taking place, but at a slow pace.

- PCE corrected for extreme values

- Gliss. 6 months, annualized, %

In our view, the key factor behind the resilience of inflation is the persistence of strong growth in US domestic demand. As preliminary GDP figures have shown, domestic demand grew just as strongly in 1Q24 as in the previous quarter, at an annualized rate of over 3%.

In particular, consumption remains a strong driver of growth on the other side of the Atlantic. This has been demonstrated by the particularly robust consumer spending figures of the last two months.

At the same time, we can see that the rise in consumption, while still supported by the robustness of the job market, is underpinned by the rapid decline in the savings rate. This is unsustainable if, as we expect, the job market begins to show signs of slowing.

At the same time, we can see that the rise in consumption, while still supported by the robustness of the job market, relies on the rapid decline in the savings rate. This is unsustainable if, as we expect, the job market begins to show signs of slowing.

One of the "surprises" at the end of 2023 was that the savings accumulated by households over the Covid period had not been fully utilized. Updated calculations from the San Francisco Fed show that this is now the case. This lends further weight to the idea that the current decline in the savings rate is unsustainable. This should calm consumption.

The fact remains that the improvement in financial conditions during 1Q24, partly triggered by J. Powell's overly premature announcement that rate cuts were imminent, has surely stimulated consumption via a wealth effect. Recent clarifications from the Fed, and the very cautious statement we expect this week from the Monetary Policy Committee, should go some way to correcting this effect.

Fig.4 United States: Consumption has been particularly robust over the past two months, showing the continuing strength of domestic demand

- Household expenditure

- Disposable income

- Savings rate, %

The latest economic indicators for the Eurozone were rather favorable, indicating that activity was picking up, particularly in services, including in the major countries. Nevertheless, the situation remains fragile. We were reminded of this by the INSEE indicator of French consumer confidence. Indeed, it deteriorated in April.

One explanatory factor, which does not bode well in the short term, is the deterioration in households' perception of their future financial situation. Indeed, the latter fell quite sharply over the month. The first consequence of this is an increase in the need to save. This could lead to more sluggish consumption in the months ahead. Obviously, the relationship between confidence and consumption is not always exact, but this statistic underlines the fact that the current recovery remains fragile, despite a job market that remains historically solid.

Fig.5 France: Household confidence deteriorated slightly in April and remains below its long-term average (100).

- France

We believe that this fragility of the recovery in the Eurozone should play a part in the ECB's decision in June, when we, like the rest of the market, are still expecting a cut in key rates. Indeed, still-weak demand should continue to consolidate the deceleration in prices. Nevertheless, the viscosity of service prices should, in our view, fuel a certain caution on the part of the ECB in the pace of monetary easing.

In Japan, inflation in Tokyo surprised on the downside in April. Total inflation came out at 1.8% year-on-year, against expectations of 2.5%. For core inflation, i.e. excluding food or food and energy, there were similar surprises.

In fact, the surprise came mainly from the introduction of free tuition by the authorities in the Tokyo region. High school tuition fees for all households were abolished, and grants were introduced for private college fees. This obviously had a considerable impact on the Tokyo area price index.

Fig.6 Eurozone: Services drive recovery, while manufacturing lags behind.

- Total

- Total excluding food

- Total, excluding food and energy

However, this is not a national policy and should therefore have a more marginal impact on the national index. Moreover, this is a non-recurring factor which will dissipate over time.

The important thing is to know whether or not the inflation trend has changed. It's not yet clear. The good news on wages and activity should keep inflation on track towards the central bank's target. Nevertheless, we must remain cautious.

This is the strategy adopted by the central bank (BoJ) to date. Although it has moved away from negative key rates, it is still pursuing a very accommodating policy. Indeed, in the wake of Tokyo's inflation figures, the possibility of this accommodating policy continuing for even longer than expected was quickly translated into a plunge in the yen to an all-time low of 160 to the dollar. Since then, the exchange rate has recovered, although it is not yet known whether the Japanese authorities have intervened to halt the currency's slide.