Financial conditions continue

to ease in the United States

Link

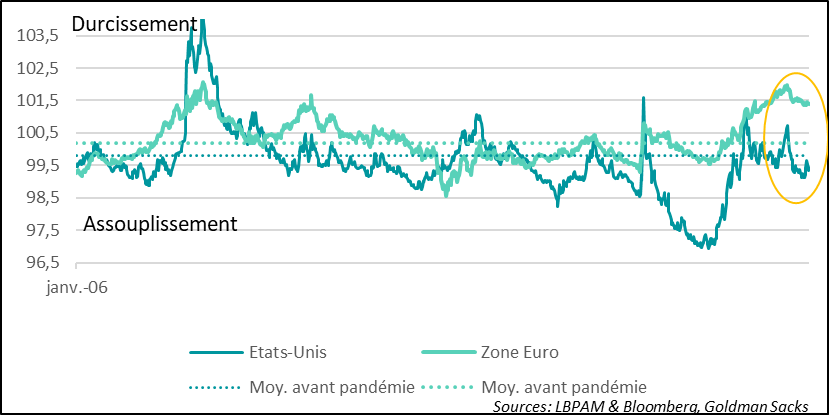

- J. Powell yesterday reiterated the need for patience before starting to ease monetary policy. This patience seems to be reflected in market expectations of key rate cuts in 2024. Nonetheless, long-term interest rates are continuing to fall, stimulating a further rise in equities, along with a fairly solid earnings season. This appreciation of liquid assets is helping to ease financial conditions further. For the Fed, this could help to keep key rates high for longer.

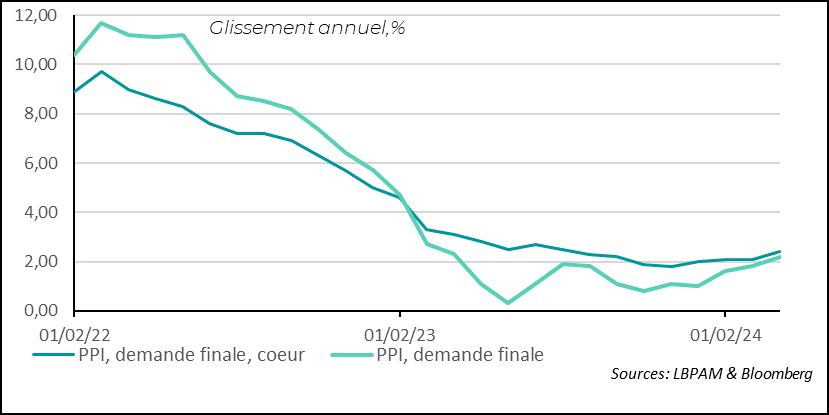

- More flexible financial conditions are likely to stimulate domestic demand further and thus maintain pressure on prices, particularly in services. Indeed, the Producer Price Index (PPI) came out stronger than expected, with core PPI rising by 0.5% in April. Nevertheless, price trends were revised sharply downwards (-0.1%) in March, and some prices in services, which had been rising rapidly, are now moderating. Nonetheless, inflation in the services sector remains too high.

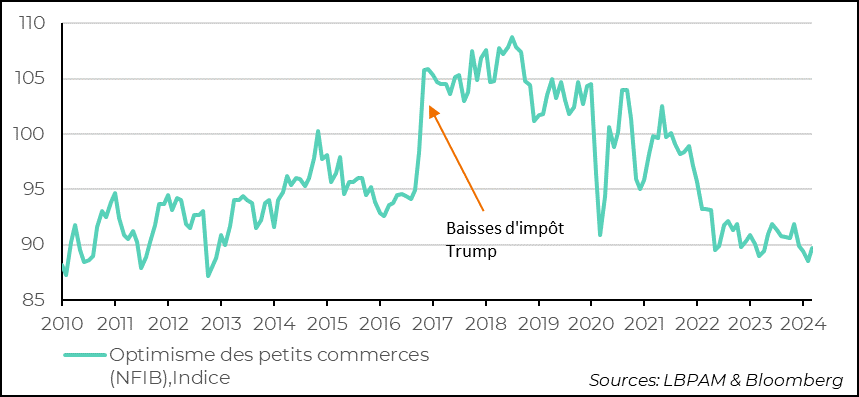

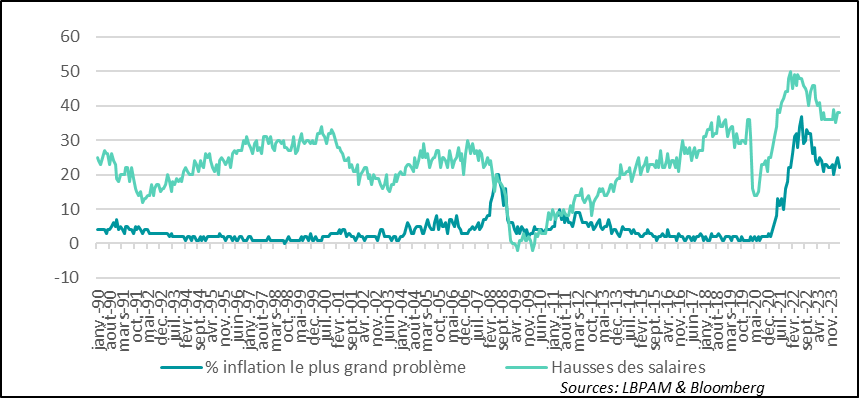

- On the business front, the NFIB survey of small businesses for April showed a slight upturn in confidence for the first time this year, although it remains historically low. On the price front, the results are mixed. On the one hand, price rises are easing among the retailers surveyed, but cost pressures are rising, notably because of wages. It is difficult to make a convincing diagnosis of the disinflation process.

- President Biden's decision to drastically increase tariffs on a number of products imported from China this year may complicate price trends. These include electric cars, solar panels, aluminium and steel. Tariffs on semi-conductors are set to double by 2025. Despite the 100% increase in tariffs on electric car imports, the direct impact on prices will be negligible, as only 2% of imports come from China. Nevertheless, these tariff increases could still affect price trends in the very short term, even if only marginally.

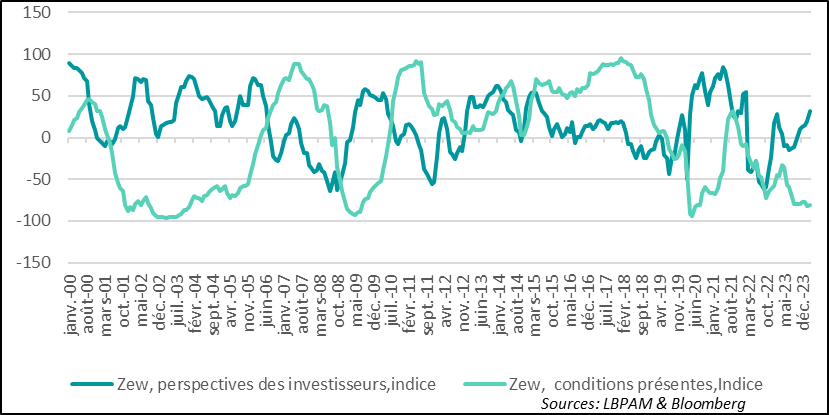

- In Europe, the best economic statistics of recent months, particularly in Germany, have unsurprisingly led to a further improvement in market operators' expectations of the economic outlook in the ZEW survey. It reached its highest level since February 2022. This can also be explained by expectations of rate cuts, with the ECB's key rates almost certain to be cut in June.

- In the UK, although wage growth in March was stronger than expected by the market, at 5.7%, it was nonetheless in line with the Bank of England's (BoE) expectations. Also, the rise in the unemployment rate to 4.3%, albeit very gradual, and the fall in job vacancies, nonetheless underline the fact that wage pressures could ease further in the future. A. Bailey, the BoE governor, reassured the markets by opening the door to rate cuts as early as June. This is our assumption. But we will need to see more progress on services inflation to be sure.

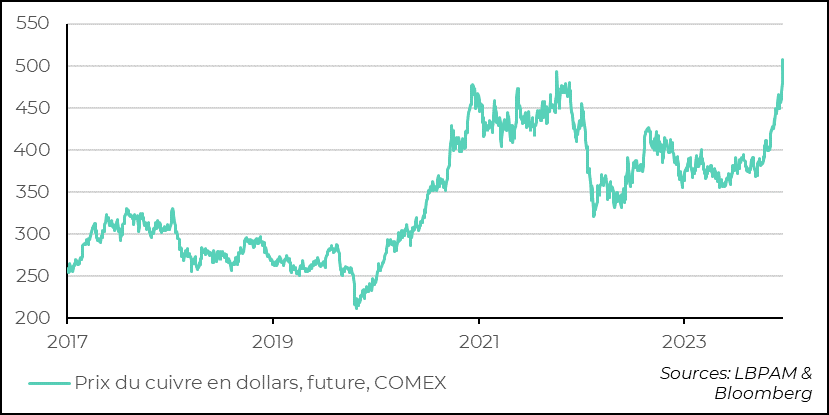

- Copper prices are soaring, reaching all-time highs, mainly because of a shortage of supply due to under-investment in new production units.

Financial conditions have continued to improve in recent weeks, particularly in the United States. Indeed, despite the significant reduction in expectations of Fed rate cuts, long-term bond yields have continued to fall. This reduction was due in particular to lower inflation expectations. Keeping key rates higher for longer is surely seen as a factor that should ensure a reduction in inflationary pressures over time. The recent fall in oil prices has also contributed to this decline.

Falling long-term interest rates have also helped to fuel the continued rise in the value of risky assets, particularly equities. Equities are also benefiting from solid corporate results for 1Q24, largely due to the major technology groups. Nonetheless, share price rises have far outstripped expectations for earnings growth over the next 12 months, resulting in higher valuations. The S&P500 has returned to a price-to-expected-earnings ratio (12 months) of more than 20 times.

The appreciation of the most liquid assets, plus corporate bonds, has largely helped to improve financial conditions across the Atlantic. This is obviously a stimulating factor for demand, and could help to fuel inflationary pressures in those segments of the economy where they are still strongest, notably in services.

In the eurozone, the fall in long-term interest rates has been the main factor in the improvement in financial conditions, but they remain largely in restrictive territory.

Fig.1 Financial conditions: more accommodating than at the start of the year

- United States

- Euro zone

- Average before pandemic

We continue to believe that maintaining key rates at higher levels for longer in the US should help to slow the economy. But, of course, there is a risk that the Fed's rhetoric will remain somewhat ambiguous. While insisting on the need to delay rate cuts, the direction given to the market is still to reassure about future rate cuts. It is this that the market seems to be focusing on, which is fuelling risk-taking.

Activity and inflation figures over the coming months should give us a clearer indication of the economic slowdown we expect and whether inflationary pressures will persist.

We are still expecting two rate cuts from the Fed in 2024, starting in September.

For the ECB, the rate cut in June is surely a foregone conclusion. We see two further rate cuts between now and the end of the year, reflecting the ECB's cautious stance on inflation dynamics, particularly in services. Nonetheless, these cuts are an important factor in maintaining the recovery momentum of the eurozone economy.

The persistence of inflationary pressures in the United States was reflected in producer prices for April. The core PPI in particular rose by 0.5% over the month, largely due to services. Admittedly, this sharp rise needs to be tempered by the sharp downward revision to price trends in the previous month, which are now estimated to have fallen by 0.1%.

Nevertheless, in terms of trend, if we look year-on-year, we see an acceleration rather than a deceleration in prices. This may reflect persistent cost pressures, due in particular to rising wage costs.

We can still take comfort from the fact that the prices of certain PPI components, which are used to calculate the consumption deflator, the Fed's preferred price index, have moderated over the past month. Nonetheless, for the Fed, the sharp rise in the PPI is not good news.

Fig.2 United States: producer prices rose more strongly than expected in April,

resuming their upward trend year-on-year

- PPI, final demand, core

- PPI, final demand

The market seems to have focused mainly on the relatively good news that some prices are moderating, rather than on the fact that prices in services are not really moderating overall.

The consumer price index to be published today will shed more light on inflation dynamics. The most important thing will be to monitor price trends in services.

On the business front, the survey of small businesses (NFIB) showed a slight upturn in confidence, even though it remains at historically very depressed levels. This renewed optimism is notable in that it is the first rise in the index since the start of the year, and reflects a little more optimism about sales.

Fig.3 United States: Confidence among small retailers picks up slightly in April,

even though it remains historically very lo

- Small Business Optimism (NFIB), Index

The bad news once again came from price pressures. While a smaller percentage of retailers expect to raise prices in the very short term, and inflation continues to be less of a problem (though still a major concern), wage rises continue. This suggests potential price rises in the future.

Fig.4 United States: wage rises continue according to small retailers and inflation

remains a major problem, even though it fell in April

- % inflation the biggest problem

- Salary increases

In the eurozone, economic data on activity has been more favourable since the start of the year, and the market is now confident that the ECB will cut its key rates in June. In particular, there has been an improvement, albeit gradual, in the two major economies, France and Germany. Unsurprisingly, German market participants continue to be more confident about the future. The outlook component of the ZEW survey rose again, reaching its highest level since February 2022.

On the other hand, the outlook for current conditions remains very depressed.

Certainly, the prospect of a loosening of the monetary straitjacket is seen as a favourable development for boosting credit in the Zone and thus stimulating growth.

Fig.5 Eurozone: ZEW survey shows growing optimism among market operators

about the outlook for the German economy

- Zew, investor outlook, Index

- Zew, current conditions, Index

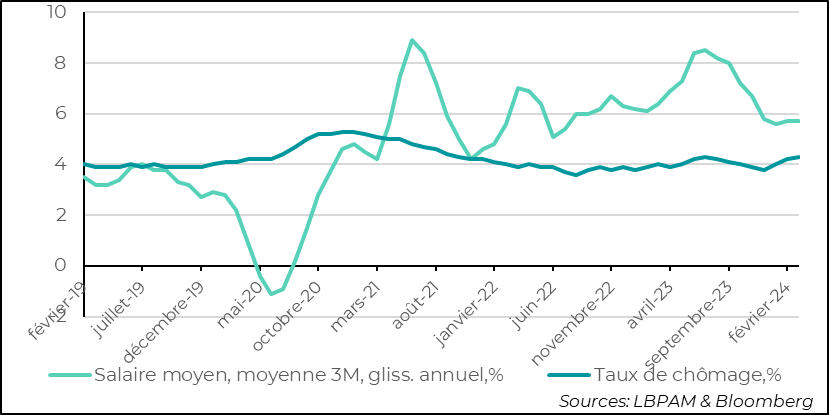

In the United Kingdom, data on developments in the labour market and wage pressures gave a mixed message. While the unemployment rate continued its upward trend in March, reaching 4.3%, wages rose faster than economists had forecast, although relatively in line with the BoE's expectations.

The rise in the unemployment rate, although still at a historically low level, is one indication that the labour market is indeed easing. As a result, we can expect wages to decelerate more rapidly in the months ahead. For the time being, by continuing to rise at around 6%, this trend is not compatible with inflation converging to 2% on a sustainable basis.

The BoE, given its forecasts and the statements by Governor A. Bailey, the Governor, seems confident of a favourable trend.

We believe that the possibility of a cut in key rates as early as June has become more likely, but future inflation figures will have to show a more marked easing of disinflation in service prices.

Fig.6 United Kingdom: Wages are still rising fairly rapidly, but a slowdown

could emerge as the labour market eases.

- Average salary, 3M average, year-on-year, %

- Unemployment rate, %

Copper prices are soaring, reaching all-time highs. This is due less to very strong demand at the moment than to a shortage of supply. Indeed, the recurring fear expressed by operators in the sector about the possibility of a chronic shortage of supply seems to be materialising. Indeed, the under-investment in new production units in recent years, coupled with rising extraction costs, is likely to result in severe pressure on prices, and this may be long-lasting, especially as the metal plays a key role in the energy transition.

This rise in prices is a new factor that could complicate the disinflation dynamic.

Fig.7 Copper: prices soar in the face of production shortfalls due to under-investment in recent years

- Copper price in dollars, future, COMEX