Financial markets on hold

Link

-

While the macroeconomic calendar is fairly light this week, the markets are awaiting the elections in France this weekend. The polls are stable and the main parties have presented their programmes. However, the outlook remains unclear as to the direction the country will take after the parliamentary elections, with no majority or with an unprecedented RN majority in parliament. The market's questions about budget balances and future economic measures continue to put pressure on French assets. The yield spread between French and German sovereign bonds narrowed slightly this week, but remains high at around 75 basis points.

-

At this stage, the markets are far from anticipating a worst-case scenario (in terms of fiscal slippage and tensions with the European authorities). The ECB's systemic financial stress indicator remains at a fairly low level. This is positive, as it implies that the impact of political stress on the region's growth prospects, although negative, should remain ongoing. We remain cautious about Europe and France ahead of the elections, but without giving in to any panic.

-

Meanwhile, the European Union lives on. The press reports that the three centrist groups, which still have a large majority in the European Parliament, have reached an agreement for the main European posts. In particular, to reappoint Ursula von der Layen as head of the Commission. This agreement must be confirmed by the Heads of State at the end of the week and then ratified by a vote in the Parliament. Also on Tuesday, the European Union officially launched negotiations aimed at eventually allowing Ukraine (and Moldova) to join the EU.

-

Following the fall in eurozone PMIs for June, Germany's IFO confirms that the recovery lost momentum at the end of the 2nd quarter. That said, the IFO's decline is concentrated in industry and trade, while services continue to improve and construction is beginning to stabilise. This suggests that the recovery in the eurozone is limited due to the weakness of the overall industrial cycle (and probably to the uncertainty created by the rise in tariffs with China). But domestic demand continues to improve slightly and the impact of past monetary tightening is beginning to fade. This is why we expect the recovery in Europe to continue, albeit at a sluggish pace.

-

In the United States, consumer confidence remained stable in June according to the Conference Board survey. It is at its lowest level since Covid, but still in line with its historical average. This suggests that the slowdown in consumption remains very gradual.

-

Above all, US households indicate that the job market remained fairly resilient in June. This is reassuring, as the reading of employment in the US is made difficult by the discrepancies between the official employment data. All in all, the surveys of US households and businesses in June suggest that the US economy remains resilient, with upside risks to our scenario of a slowdown in mid-2024.

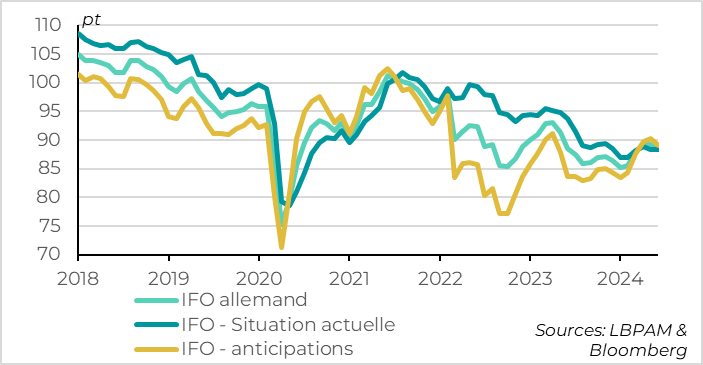

Fig 1 Germany: IFO confirms loss of momentum in the recovery at the end of Q2

- German IFO

- IFO - Current situation

- IFO - expectations

The unexpected fall in European PMIs in June was disappointing. As it stands, it does not call into question the recovery seen in the eurozone since the start of the year. But it does suggest that this recovery is limited and less diversified than we might have hoped in terms of countries and sectors. And it implies that the risks are tilted to the downside rather than the upside.

These disappointing figures are confirmed for Germany by the IFO survey, which also fell at the end of the second quarter. In fact, the IFO fell from 89.3 to 88.6 points in June after stagnating in May, so that it remains at a limited level. Above all, the June fall reflects a deterioration in expectations, which had been improving markedly since the start of the year. The German recovery therefore seems limited, given that IFO expectations are the best leading indicator of the German economy.

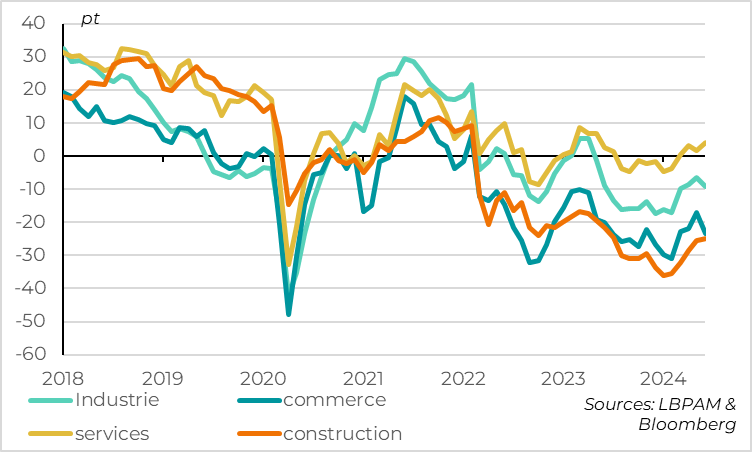

Fig.2 Germany: industry and trade no longer part of the recovery in June

- Industry

- services

- trade

- construction

In terms of sectors, the details of the IFO survey are a little more reassuring. The drop in June is due to the deterioration in the outlook for industry and trade in June. In contrast, the services sector continues to improve and construction is beginning to stabilise. Domestic demand is therefore continuing to recover, while the uncertainties associated with the introduction of customs barriers against China and the possibility of retaliation are certainly affecting sentiment among industrial companies across the Rhine.

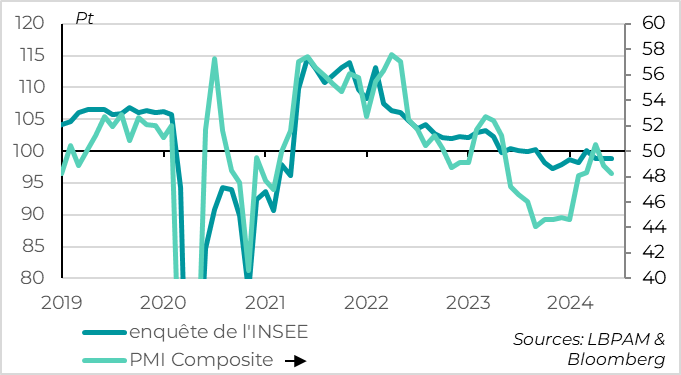

Fig.3 France: Economic activity slightly weaker in the 2nd quarter but remains positive

- INSEE survey

- PMI Composite

In France, the INSEE indicator remained stable in June, just below its long-term average, which is a little more reassuring than the PMI published last week. That said, unlike the PMI, the INSEE survey was conducted mainly before the announcement of the dissolution, and therefore does not take into account the impact of political uncertainty.

As they stand, however, the two surveys are consistent with slightly positive growth in Q2, of around +0.1%. This would be slightly weaker growth than at the start of the year, but still slightly positive. One bad sign is that the employment component of the INSEE survey slowed markedly in June, falling back below 100pt for the first time since the start of the year. We need to keep an eye on this because employment picked up in Q1 and because our expectation of a gradual recovery is based on consumption. In addition to the rise in real wages, employment must not deteriorate too much.

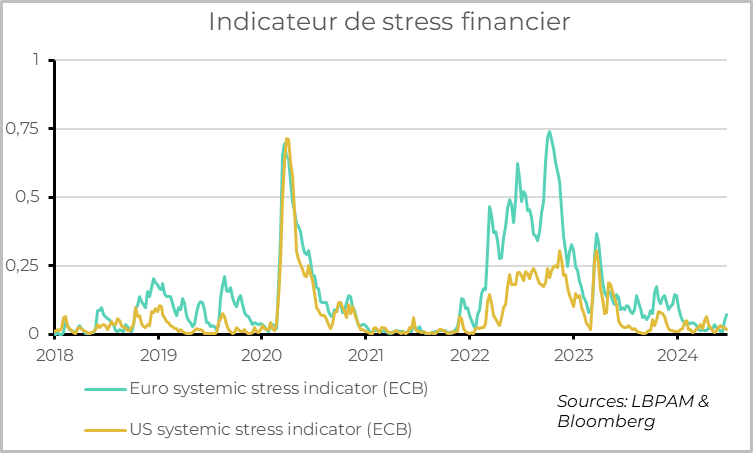

Fig.4 one euro: the spread of French political stress via the markets is very limited

- Euro systemic stress indicator (ECB)

- US systemic stress indicator (ECB)

The good news for the eurozone is that political uncertainty in France is not leading to a tightening of financial conditions, let alone systemic stress (on banks, companies' access to financing, etc.).

French assets, particularly those most closely linked to the government (public debt, banks, utilities), have taken on board the higher political risk. But the spread to other assets and other countries in the zone has been limited. Overall, the ECB's financial stress indicator has risen slightly since the elections were announced, but it remains low, below its level at the start of the year.

Of course, political uncertainty calls for caution in the short term, and greater stress is always possible. But as things stand, without uncertainty being transmitted via the financial sector, the impact on the economic outlook for the eurozone should be limited. Growth in the zone is likely to suffer a little because of greater caution on the part of business leaders and households in the short term. But for the time being, we believe that the prospects for a gradual recovery in the eurozone over the next few quarters are not in doubt.

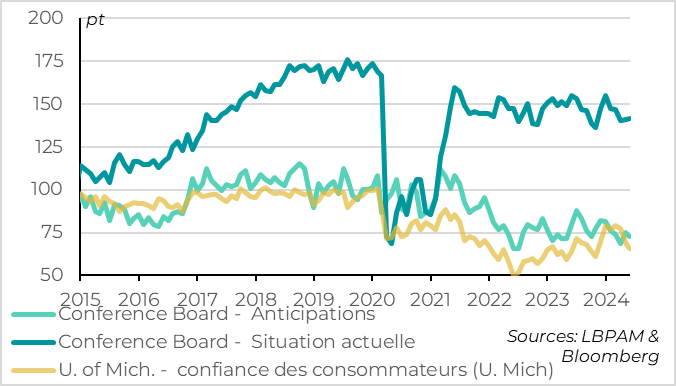

Fig.5 États-Unis : le ménage américain résiste encore

- Conference Board - Expectations

- Conference Board - Current situation

- U. of Mich. - Consumer confidence (U. Mich)

US household confidence remained stable at an average level in June, according to the Conference Board survey, which limits the risks of an abrupt slowdown in the economy. The survey shows that confidence is slightly lower than in previous quarters, but it stabilised in May and June at its historical average. This is reassuring because the University of Michigan survey, which is more volatile, fell sharply in May and June. Above all, the component on the current situation of households remains at a high level. As this is historically a better indicator of the cycle than household expectations, it suggests that the slowdown in consumption is very limited in Q2.

Fig.6 United States: job market shows resilience in June

-Unemployment rate

- Net consumer difficulty in finding a job (d)

Household confidence is benefiting from a job market that remains fairly solid, even if its trend is slowing. The number of households indicating that it is easy rather than difficult to find a job, which had hit a post-Covid low in May, rose slightly in June. It remains at a level compatible with an unemployment rate of around 4%, the level it reached in May. Given the uncertainty surrounding official employment data in the US at the moment, it is reassuring that households are indicating only a gradual slowdown in the job market.