Following the series of macroeconomic shocks, the focus could shift towards microeconomic outlook

Link

*BPS per week

*BPS per week

*% per week

*US 10-year yields

*German 10-year yields

*Equities (MSCI World)

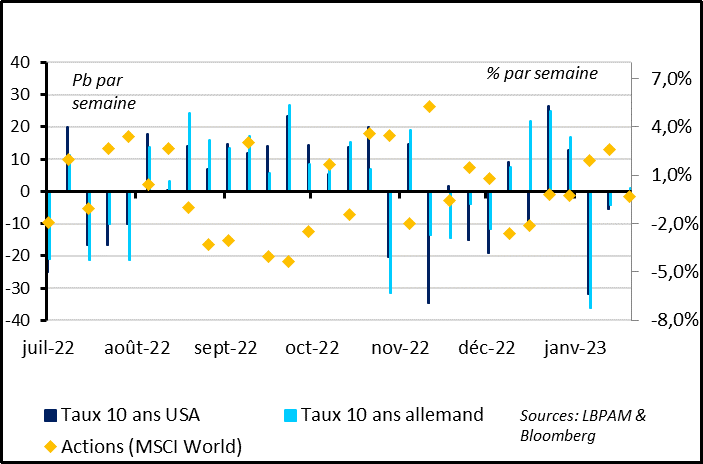

After staging an historic rally at the start of the year, the markets took a breather last week. Despite rallying sharply on Friday, equities ended the week down 0.3% after gaining 4.5% over the first two weeks of 2023. Long-term interest rates remained stable after having eased by 40bps. The fall in interest rates since the beginning of the year chiefly reflects lower forward guidance from central banks for the second half of 2023 and for 2024, combined with declining risk premiums. The downturn stems from an anticipated rapid fall in inflation, with the markets now expecting the inflation rate to drop back to 2% in the US, within a year, and to below 2.5% in the eurozone. These assumptions are not completely unfounded, particularly if energy prices remain at least as low as they were at the beginning of the year, with goods prices normalising rapidly and tensions in the jobs market starting to ease. We believe that this view is optimistic however and that base rates are unlikely to ease as sharply as the markets are anticipating, unless there is a rapid slowdown in wages growth and inflation in the services industries.

*Over-optimistic markets

*Over-optimistic markets

*Over-pessimistic markets

*Short-term risk appetite indicator

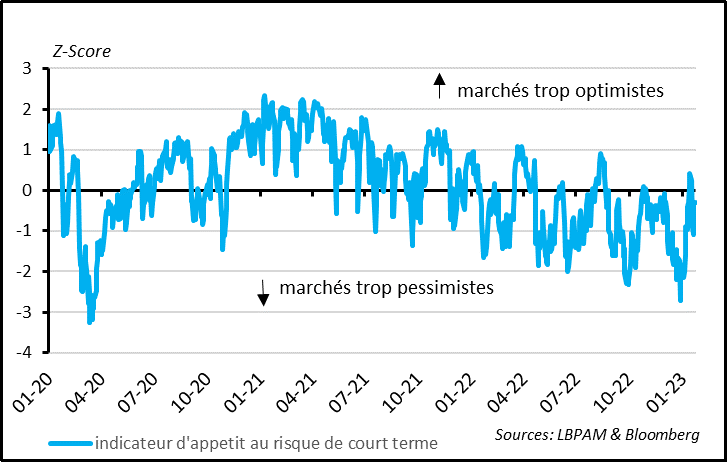

The market has rallied since the start of the year from the extreme risk aversion levels observed at the end of 2022. Our short-term investor risk appetite indicator has effectively bounced since the end of last year, when it was situated at 2 standard deviations below the mean, although it is still slightly negative. Risk appetite is still far from exuberant however, which limits the risk of a further sharp downturn. In addition, the market has rallied since the beginning of 2023 on relatively thin trading volumes, implying that investor positioning remains highly reasonable. Given the recent reassuring newsflow in terms of economic outlook, we believe that the risk of a sharp correction is limited.

*Returns on risk (equities, forex, credit, EM)

*Returns on risk (equities, forex, credit, EM)

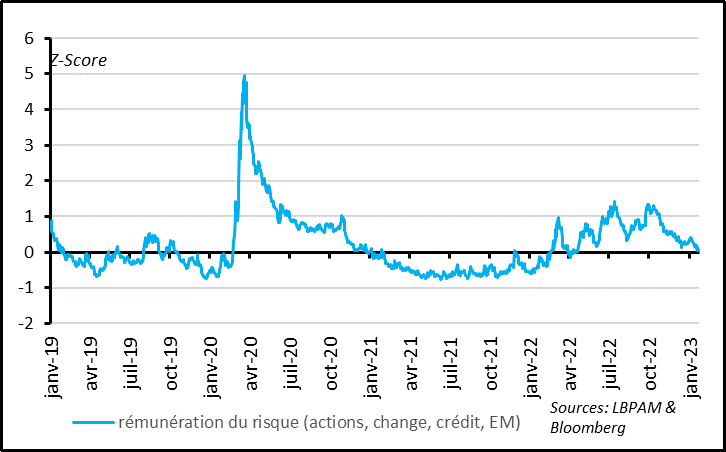

However, the markets have priced-in a relatively favourable, perhaps even over-optimistic scenario, assuming a rapid fall in inflation, which would enable the central banks to adopt less restrictive policies without the economy slowing too sharply. This view has driven valuations higher. As a result, returns on risk among equities, forex and credit markets and emerging assets are at their lowest level since Q1 2022 and only just in-line with historic averages, according to our estimates.

*US risk premium

*US risk premium

*Earnings yield

*Real risk-free 10-year interest rates

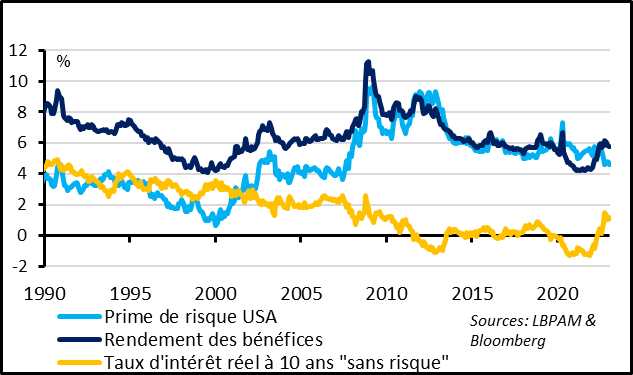

Among equities for example, price-to-earnings multiples in the US and in Europe have rallied by 15 and 25% respectively form their 2022 lows and have returned to their 20-year averages of 17.5 in the US and 12.5 in Europe. However, given that real interest rates remain significantly higher than the levels observed since the financial crises of the 2000s, the equity risk premium over risk-free assets is at its lowest level since 2007. Meanwhile, term spreads among risk-free assets and sovereign bonds have tipped back into negative territory. Although this situation was justified prior to the Covid crisis, when the inflation rate remained constantly below expectations, it now seems excessive given the persistent uncertainty from inflationary pressure.

On balance, we believe that although risk premiums are not extremely low, they do not sufficiently reflect risks and uncertainties in a context of further monetary tightening and major structural changes, including energy issues and also in terms of inflation and public policies.

After a series of macroeconomic shocks in 2022, the markets may at last refocus partly on microeconomic corporate fundamentals over the next few weeks, particularly as the Q4 2022 reporting season will be gathering pace in the US and beginning in Europe this week. Beyond the publication of 2022 earnings, companies will also be issuing guidance for the forthcoming quarters.

Fig.5 Markets: analysts have downgraded 2023 earnings forecasts for companies listed in the US but not yet in Europe * 12-month earnings downgrades over the past 3 months (%)

* 12-month earnings downgrades over the past 3 months (%)

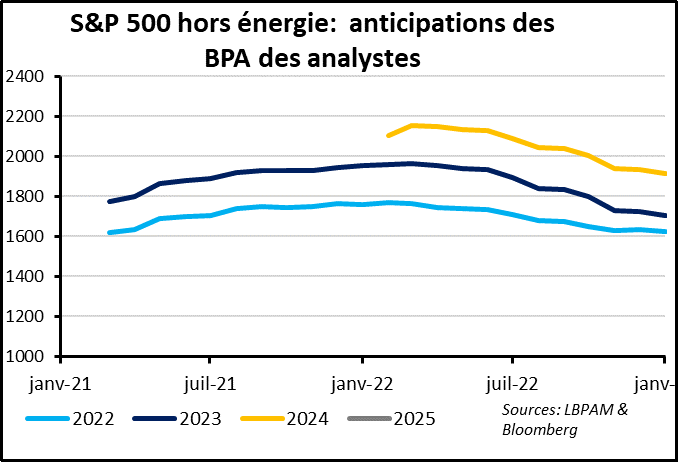

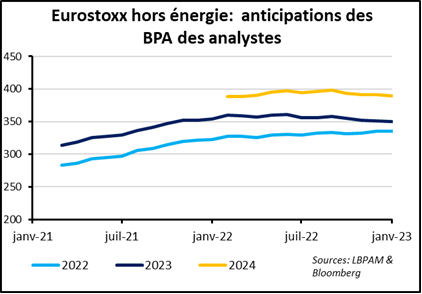

Equity analysts have already significantly downgraded 2023 earnings forecasts for American companies, by 10% since mid-way through last year. Earnings consensus was extremely high however and therefore still remains optimistic, banking on a 3% increase this year. In the eurozone, analysts have just begun revising profits lower. This is partly due to the fact that 2022 earnings growth forecasts in Europe were more reasonable and European companies also benefitted from a weaker euro in 2022. Forecasts for 2023 also appear optimistic however, predicting a 1.4% increase for Eurostoxx index companies and +5% excluding the energy sector.

*S&P 500 excluding energy: consensus EPS forecasts

*Eurostoxx excluding energy: consensus EPS forecasts

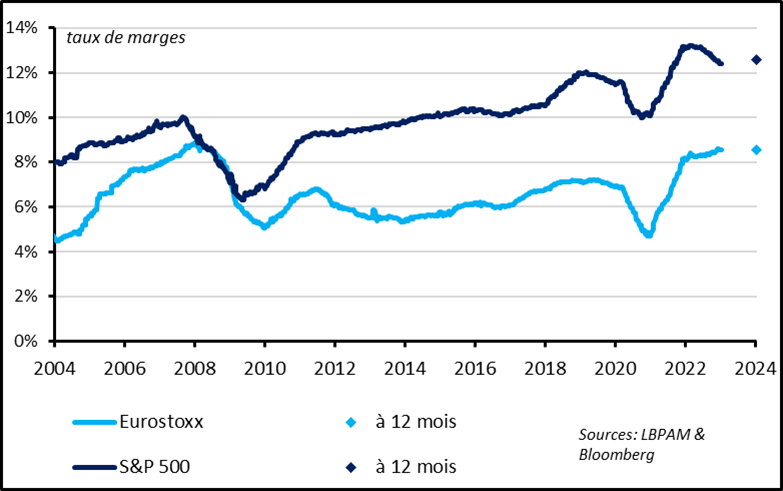

Consensus Q4 2022 corporate earnings forecasts appear reasonable, particularly in the US where outlook has already been revised sharply lower. We believe however that there will be fewer positive surprises than since the economies began reopening and that markets may be disappointed by company guidance. This is particularly the case as analysts are expecting corporate margins to remain stable at very high levels. This view would appear to be over-optimistic in a context of falling sales, due to a slowdown in growth and inflation, particularly as wages, energy costs and financial charges are still rising rapidly in Europe.

*Margin rates

*Margin rates

We believe that margin erosion and a slowdown in revenues will drive corporate earnings slightly lower in 2023 on both sides of the Atlantic, which will weigh on equity performances. Guidance issued by companies at the beginning of 2023 could force the markets to take this factor into account.