France in deadlock

Link

What should we take away from market news on October 7, 2025? Answers with the analysis of Sebastian Paris Horvitz.

Overview

► Sébastien Lecornu resigned from his position as Prime Minister, less than a month after taking office. Although the President asked Sébastien Lecornu to dedicate an additional 48 hours to see if a compromise could be found in the Assembly, the political deadlock appears total. This move by the President seems to indicate that he is still ruling out a new dissolution of the Assembly. The longer the political impasse lasts, the more negative the impact will be on the economy.

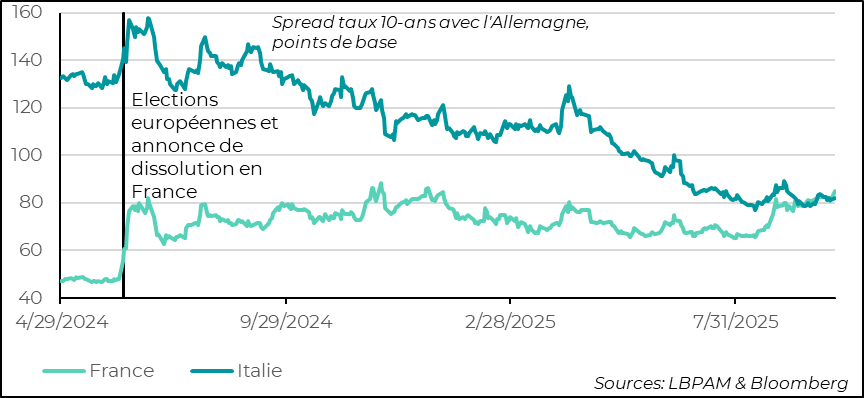

► French assets have been negatively affected by this new phase of uncertainty. Nevertheless, the bond market reacted moderately, with the spread between the French and German 10-year sovereign yields widening by less than 4 basis points, reaching 85 basis points. It is now above Italy’s spread. We remain very cautious about French government bonds.

► In Japan, the weekend’s election to lead the LDP ended with a relative surprise, with the appointment of Sanae Takaichi. She is the first woman to reach this position. A nationalist, she still aligns herself with the ideas promoted by S. Abe, the former reformist Prime Minister who advocated a very aggressive policy to lift the country out of its deflationary period. He supported a very accommodative monetary policy and an expansionary fiscal policy

► This is one of the reasons explaining the market’s reaction, which saw the Japanese stock market soar, long-term rates fall, and the yen depreciate. Obviously, the country’s economic situation has changed significantly compared to S. Abe’s era. Thus, we still expect the BoJ to raise its rates, no later than early 2026. Also, before being able to act, Ms. Takaichi will have to build alliances, as the LDP no longer holds a majority in both chambers. Therefore, the initial euphoria should at least subside while waiting to see which policies will actually be implemented.

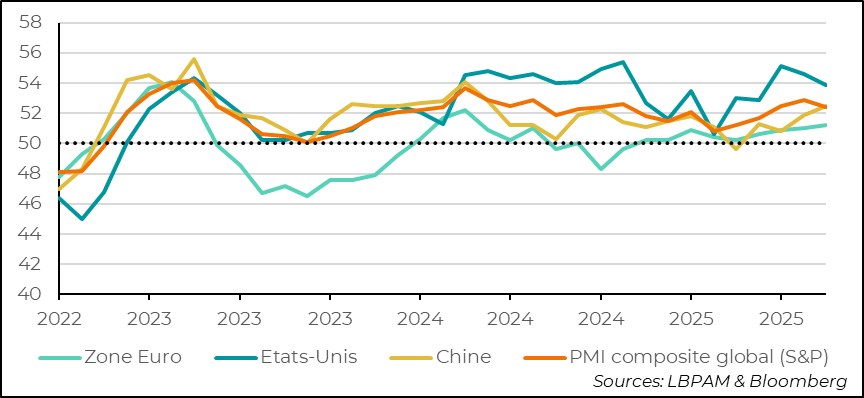

► Regarding global statistics, the composite PMI (manufacturing and services) for September published by JP Morgan based on S&P surveys conveyed a message of resilience in activity. Admittedly, according to this index, global activity is slowing slightly, but remains in expansion territory. The acceleration of industrial activity in China contributed to this, as did the slight improvement in services activity in the eurozone. Nevertheless, the S&P survey for the United States continues to portray a solid image of the American economy, which would remain the engine of global growth. This somewhat embellishes the message when compared to ISM statistics.

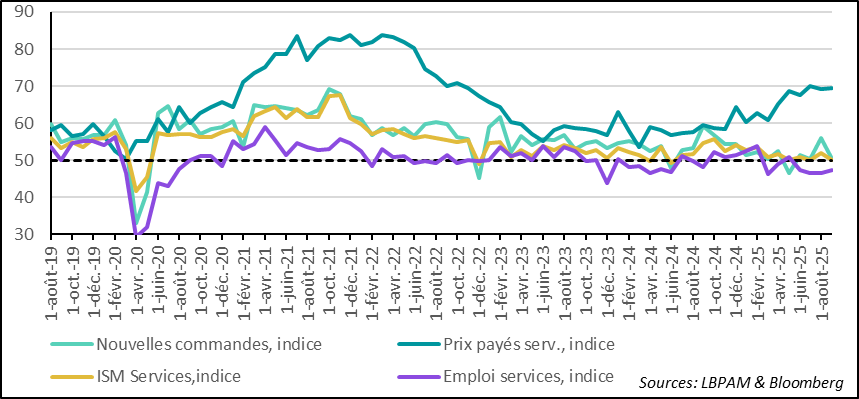

► Indeed, the ISM survey concerning services for the month of September proved very disappointing. The overall index dropped significantly, conveying a message of stagnation in activity. Above all, underlying statistics such as employment or new orders came out very depressed. On the other hand, the cost indicator remained high. According to survey responses, this mainly reflects the rise in customs tariffs. As we know, with the budget deadlock in the United States, public statistical services are shut down, which prevents tracking the American economic cycle with the usual data flow. What is certain is that until August, domestic demand remained very robust. The risk for the coming months is to see more fragility than we had anticipated.

Going Further

France: Political instability weighs on French assets

France’s spread rises above Italy’s

Sébastien Lecornu resigned from his position as Prime Minister, less than a month after taking office. His decision was reportedly driven by the difficulty in forming a government and the anticipated deadlock in the National Assembly, particularly regarding the adoption of a 2026 budget that would allow for an adjustment of public finances.

Nevertheless, the President asked Sébastien Lecornu to dedicate an additional 48 hours to see if a compromise could be found in the National Assembly to form a new government and take action. This request seems to reflect Emmanuel Macron’s desire to avoid a new dissolution. According to him, such a move would likely result in the same deadlock currently being experienced.

Without a new government and without a 2026 budget, French public finances will be governed by the same legislative framework as the previous budget. In this case, if the deadlock persists, tax brackets may not be adjusted, which would result in fiscal tightening. At the same time, exceptional taxes on large corporations will not be renewed. In this sense, the budget would be relatively neutral, meaning the public deficit could remain unchanged. Therefore, the minimum adjustment of 0.5 percentage points of GDP that France is expected to achieve in 2026 under its European commitments would not take place. From a cosmetic standpoint, stronger growth could help reduce the deficit more quickly, if France were to benefit more than expected from upcoming public spending policies in Europe, particularly in Germany.

What is certain is that the political deadlock weighs on the country’s economic outlook and partly weakens Europe at a time of major decisions for the future in a highly fragmented world, notably with unprecedented tensions with the United States.

Unsurprisingly, French assets have been “punished” by the current political instability, especially due to the lack of visibility regarding the trajectory of public finances.

The CAC 40 underperformed other European markets, losing nearly 1.4% over the course of yesterday. As is well known, political instability has been one of the factors contributing to the underperformance of French stocks since the beginning of the year.

On the French sovereign debt side, the spread between French and German 10-year bonds widened moderately by 4 basis points, reaching 85 basis points. This remains below the peak reached at the end of last November, which was 87 basis points. Nevertheless, France now has to borrow at a higher rate than Italy. The latter has seen the quality of its debt improve, resulting in a continuous narrowing of its spread with Germany’s rate.

Given the expected dynamics, we continue to favor exposure to Italy, while remaining very cautious on France.

Global activity: the global PMI shows resilience…

The composite PMI (manufacturing and services) declines slightly but remains in expansion territory

All PMI surveys for major countries for the month of September were published last Friday, including the state of activity in the services sector. According to the composite index (industry and services), compiled by JP Morgan based on S&P surveys, global activity remains resilient. The index has declined slightly but is still well within expansion territory.

The rebound in industrial activity in China and the gradual improvement in activity in the eurozone have partially offset the slowdown in the United States. However, according to the S&P survey, the growth momentum in the U.S. remains the strongest, with a composite index close to 54—well above the 50 threshold that separates contraction from expansion.

This resilience in the global economy continues to support markets, despite the risks of a slowdown that we still anticipate in the United States as a consequence of the policies implemented by the Trump administration. At the same time, spending related to the development of artificial intelligence (AI) remains significant, primarily in the U.S., which presents an image of a dual economy. The part of the economy most sensitive to distortions caused by protectionist policies would suffer, while sectors linked to AI would remain resilient.

…but the ISM services index shows stagnation in activity and rising costs

Indeed, the ISM survey for the services sector in September presented a much less flattering picture of activity than the S&P survey. The ISM index fell back to 50, indicating stagnation in activity during the month.

In detail, the survey shows that demand conditions deteriorated in September, with the new orders index falling just above the stagnation threshold. Similarly, hiring intentions remained in contraction territory, although they deteriorated less than in the previous month.

Companies continue to report significant cost pressures, with the prices paid index returning to its level from late 2022. According to them, these increases are largely due to rising tariffs. The question remains as to what extent these costs will be passed on to consumers. At this stage, we estimate that a significant portion of these increases will eventually be reflected in final prices, as companies seek to preserve their margins. However, this transmission could be gradual, especially if domestic demand were to slow more sharply.

Sebastian Paris HORVITZ

Head of Research