Les finances publiques françaises déçoivent fortement

Link

-

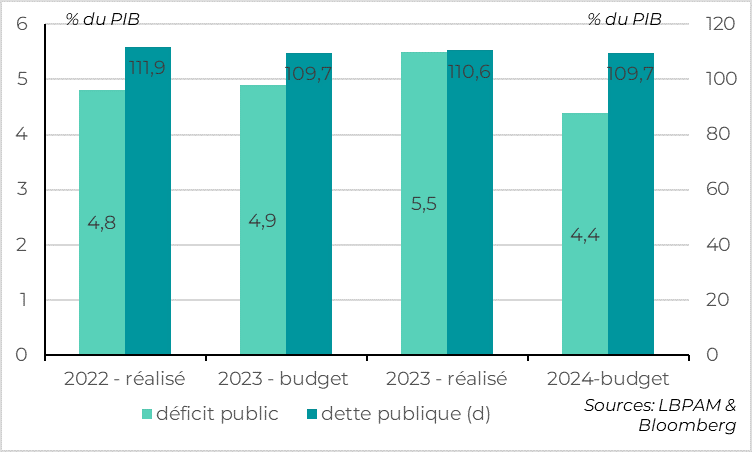

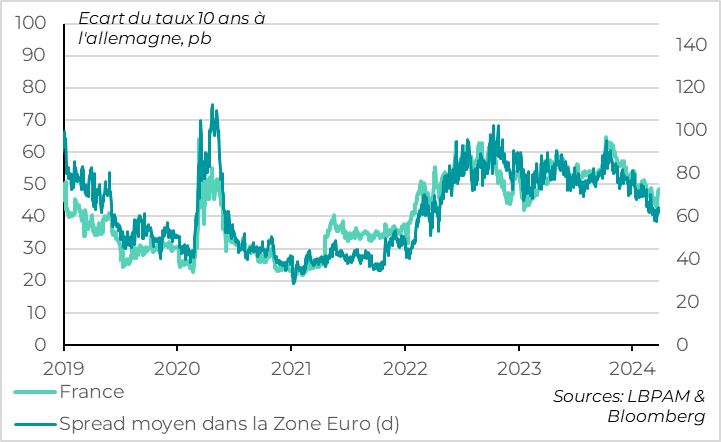

Insee confirmed yesterday that the French public deficit had widened much more than expected in 2023, coming in at 5.5% of GDP compared with 4.8% in 2022 and 4.9% announced in the budget. Although the impact on the markets has been limited, French debt is underperforming that of other European countries, and the yield differential on 10-year debt against Germany is approaching 50bp.

-

The government had already announced additional savings of 10 billion to achieve the 4.4% deficit it had announced, despite weaker-than-expected growth (1% compared with 1.4%). If it wants to maintain this target (which is unlikely), it will need almost 20 billion in additional savings. Despite the greater savings, which will limit growth, the government should review its plans and envisage an even slower return to the 3% deficit.

-

With the application of the new European budgetary rules from this year, the Commission will probably trigger an excessive deficit procedure against France from the summer onwards. This is neither a catastrophe nor a surprise, but it will constrain France's budgetary policy and weaken its voice in European negotiations (notably on defence funding).

-

This reinforces our more defensive stance on French debt than on other European countries, particularly Spain, even though we believe that the risk of a sharp rise in France's credit premium remains limited. The market will be watching closely to see whether the rating agencies revise France's rating in the next two months.

-

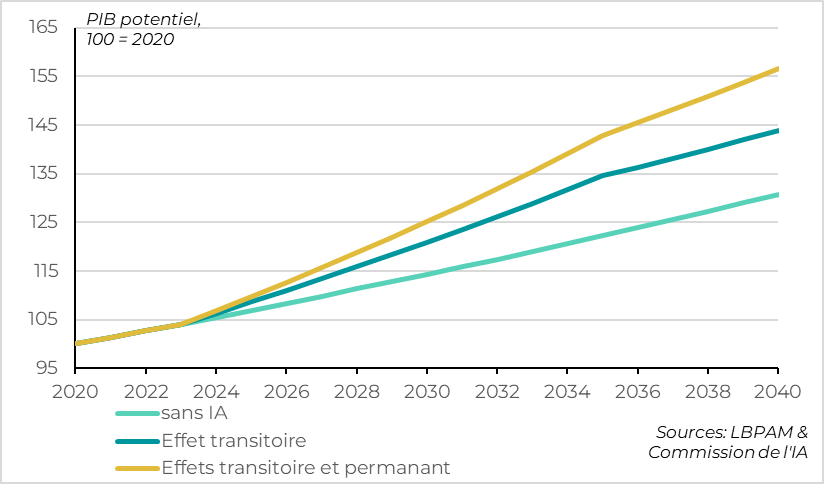

If we are to believe the report from the Artificial Intelligence Commission submitted to the President a fortnight ago, AI could enable France to grow twice as fast over the next 10 years. In that case, there would be no budgetary adjustment problem. But these estimates seem far too optimistic, and in our view it is unlikely that the impact of AI on the economy as a whole will be sufficiently strong and rapid to avoid having to adjust our public finances.

-

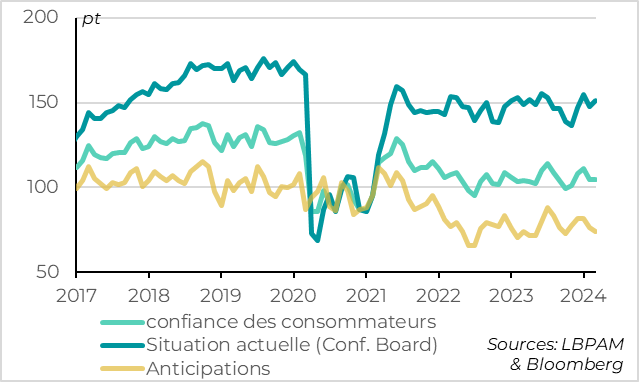

In terms of economic data, US consumer confidence remained stable in March at a satisfactory level, which is reassuring after the slowdown in consumption at the start of the year. Above all, US households indicate that the job market remains solid, suggesting that the risk of an abrupt slowdown remains limited.

Fig.1 France: A massive budgetary slippage in 2023

France's public deficit has widened to 5.5% of GDP in 2023 from 4.8% in 2022. This represents a significant slippage compared with the 4.9% announced by the government in the budget. According to INSEE, this slippage is due to lower revenues than expected at the end of 2023, which is consistent with weaker-than-expected growth (0.7% in 2023 compared with 1.0% forecast in the budget), as well as a larger social security deficit.

Fig.2 France: Debt slightly underperforms that of other eurozone countries

French debt has underperformed slightly over the past week, although the impact of yesterday's deficit announcement on the markets was limited, as the government had prepared the markets for this slippage in recent weeks.

Overall, the yield spread between French and German 10-year bonds, a measure of France's credit risk, has risen by 5bp over the past week and is approaching 50bp. This is in line with the average risk premium on French debt over the past 3 years and is still well below the premiums on Italian (130bp) or Spanish (83bp) debt. But the trend is negative. The French premium is above its pre-Covid level, unlike in Spain and Italy. The cost of financing French debt is rising, with a current market rate of 2.9% compared with a rate of 1.8% on the stock of existing debt.

What are the consequences?

-

A more restrictive fiscal policy in 2024-2025 and a slower return to a deficit below 3%. The government had already announced additional savings of 10 billion to achieve the 4.4% deficit announced, despite weaker-than-expected growth (1% compared with 1.4%). If it wants to maintain this target (which is unlikely), it will need almost 20 billion in additional savings (or tax rises, but the government is still refusing to do this). It is unlikely that the government will be able to achieve 1pt of additional GDP savings this year, when the budget already forecast a 0.5pt budgetary tightening. So the deficit is likely to be higher than expected. Especially as the 1% growth forecast remains optimistic (the consensus is for 0.7%).

- Tensions with our European partners? The new European budgetary rules are being applied from this year onwards, following their suspension in connection with Covid and the energy crisis. Unsurprisingly, France is not in line. The deficit is above 3% and the debt is not on a sufficiently downward trajectory (-1% of GDP per year), which are criteria that should lead the Commission to trigger an excessive deficit procedure and ask France to speed up its budgetary tightening. This is neither a catastrophe nor a surprise, and the Commission should wait until after the European elections in June to announce the bad news. But it will force France to revise its budget, which is complicated in the current domestic political situation, and it will certainly weaken France's voice in European discussions (particularly on defence funding).

- The markets will be waiting with some suspicion for the rating agencies to revise their ratings. Moody's (Aa2/Stable) and Fitch (AA-/Stable) are due to review their ratings on 21 and 28 April. Above all, S&P (AA/Negative) will review its rating on 2 June, and the risk of a downgrade is significant given the already negative outlook for this rating. Sovereign ratings should not be over-interpreted (if the agencies knew more than others, we wouldn't know), and the market impact of a downgrade on France is unlikely to be very significant. But the signal would still be negative, especially just a few days before the European elections.

All in all, we think that French debt is less attractive than the debt of other European countries, particularly Spain, even though we believe that the risk of a sharp rise in France's credit premium remains limited.

Can AI save us? Yes, if we are to believe the report by the Commission on Artificial Intelligence submitted to the President a fortnight ago. But this seems to us to be far too optimistic.

Fig.3 France: AI should support growth, but not as much as expected

In fact, the report indicates that French growth could be twice as high as expected over the next 10 years thanks to AI, because the adoption of AI would boost productivity on a transitory basis (+0.5% per year over 10 years) and innovation on a permanent basis (+0.5% per year). And all this at a cost in terms of public investment of "only" 1% of GDP over 10 years.

If this is the case, this higher growth would improve budget revenues and increase GDP, leading to a significant improvement in public finances. If taken at face value, these growth projections would allow the deficit to fall back below 3% of GDP within two years without any additional effort.

It is quite possible that the transition to AI will help French growth and public finances a little over the next few years, as was the case with information technology in the United States in the late 1990s and early 2000s. But in our view, it is highly unlikely that the impact of AI will be anywhere near the level presented in this report for the French economy as a whole. It is therefore more of a hope than a forecast on which to build a budget.

Fig.4 United States : Households remain confident thanks to their current good situation

US consumer confidence remained stable in March at a fairly positive level. And the details show that households remain in a favourable situation, which is encouraging for the economic cycle.

According to the Conference Board survey, household confidence was stable in March at 104.7pt, slightly above its level at the end of 2023 and before Covid, but above its historical average. The detail is rather favourable, as households indicate that their current situation remains solid (151pt), which is consistent with the solidity of the employment market, the increase in their purchasing power and the favourable wealth effects. But this is reassuring because it suggests that the signs of weakness among the least well-off households (including the rise in defaults on consumer credit) are not spreading to households as a whole. On the contrary, households remain wary of the outlook. But this component is volatile and historically not a very good leading indicator of consumption.

Fig.5 United States : Households indicate that the labour market is still positive

Households also indicate that the US labour market remains solid, which is reassuring after February's mixed employment data.

Indeed, the number of households seeing jobs as hard to find vs. plentiful reverses its February rise in January and remains at a level consistent with an unemployment rate still below 4%.

On the business side, the regional Fed surveys for March are consistent with the overall S&P PMI and point to stable economic momentum, slightly below its normal level.

Overall, these US confidence indicators remain compatible with our scenario of US growth slowing relative to the end of 2023 but remaining positive. This is slightly below the expectations of the Fed and the consensus, which see growth still above 2% in Q1, but confirms that the risk of recession remains reduced at the start of 2024.