Geopolitics steals the show from central banks

Link

Escalating tensions in the Middle East are pushing central banks into the background, rekindling fears about energy prices and economic stability.

Key Takeaways

► While the focus should have been on the many central bank meetings this week (Fed, BoE, BoJ...), geopolitical risk is back in the spotlight just as the main Western heads of state are meeting at the G7. If D. Trump's protectionism and its negative impact on the global economy were expected, we could have hoped for an easing of the conflicts in Ukraine and the Middle East. But that seems to be a long way off.

► The escalation of the conflict between Israel and Iran, with already three days of intense reciprocal bombing, is pushing energy prices sharply higher. Oil has jumped by $10 a barrel over the past week, and is now back above its pre-release level of almost $75 a barrel.

►This increase seems reasonable considering that Israel is attacking certain Iranian oil and gas assets, and that Iran has been exporting an average of 1.7 million barrels per day since the start of the year, or 1.5% of global oil demand. At the same time, the other OPEC+ countries still have substantial spare production capacity. The shock would be much more massive if maritime traffic via the Strait of Hormuz were at risk, given that 20% of the world's oil flows through this strait. As long as tensions continue to rise, this could justify a slightly higher short-term risk premium on oil and risky assets.

►The rise in oil (and gas) prices is negative for the European economy, but the increase remains limited, especially in euro terms, thanks to the euro's recent strong appreciation. Although the current situation is less favourable than the ECB forecast at the beginning of June, when energy prices were clearly falling, it does not call into question the return of inflation towards the 2% target, nor the sluggish recovery in growth that we anticipate.

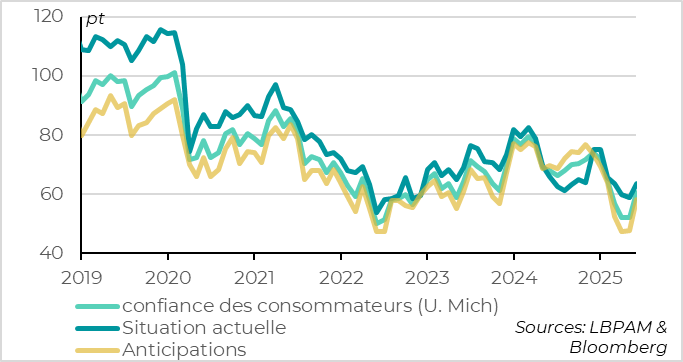

► On the other hand, the oil shock could once again weigh on consumer confidence and inflation expectations, particularly in the USA. The University of Michigan survey published at the beginning of June shows that consumer confidence is rebounding thanks to the easing of inflation expectations, especially in the short term. That said, household confidence remains at a limited level, and inflation expectations are still a little too high to fully reassure the Fed about the transitory nature of tariff-related inflation. Against this backdrop, the Fed is likely to remain cautious on Wednesday, indicating that it will keep rates unchanged this summer.

►Chinese activity data for May were mixed, with consumption more dynamic than expected thanks to support from the authorities, but a sharper slowdown in the industrial and investment sectors. This confirms that growth is holding up better than expected in the first half, but that more fiscal support will be needed to maintain growth in the second half of the year.

To Go Further

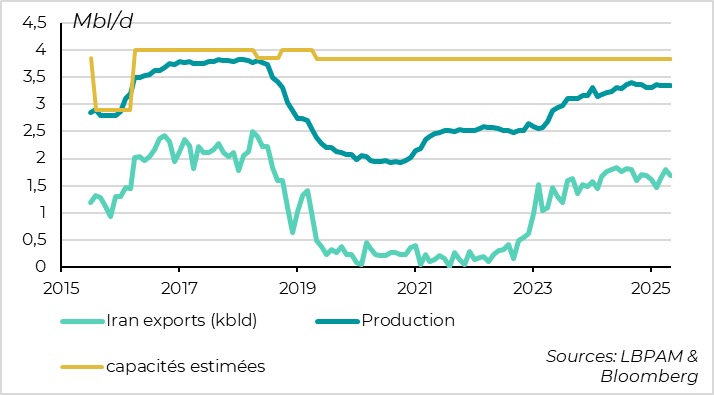

Oil: Iran exports 1.5% of global oil demand since 2023

Iran, which is exempt from OPEC+ quotas, is producing 3.35 million barrels per day (mbd) this year, almost at full capacity despite the sanctions. More importantly for the global market, Iran is exporting an average of 1.7 mbd this year, or 1.5% of world production.

A halt to Iranian exports could theoretically push prices back up towards $80 per barrel, if we consider oil's historical supply-price elasticity, which is high in the short term. Given that oil is stabilizing this morning just below $75 a barrel, this suggests that the oil market's reaction to the weekend's events is fairly reasonable. That said, this limited reaction can be explained by the still significant excess spare production capacity of the other OPEC+ countries, which gives the other countries the opportunity to increase their production more quickly if necessary (especially Saudi Arabia).

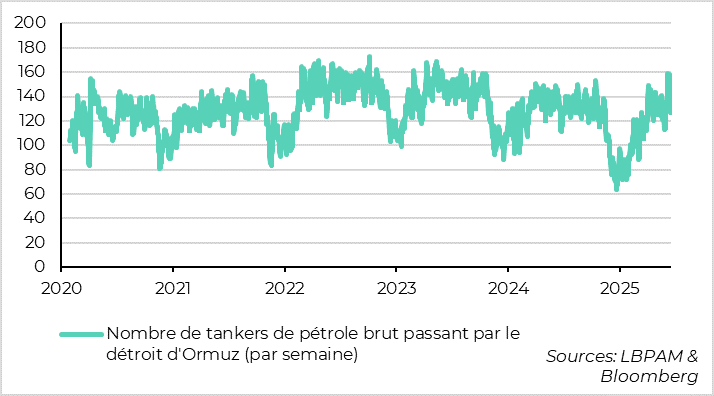

Oil: the main risk is that the conflict will impact the Strait of Hormuz

The shock would be much more massive if maritime traffic via the Strait of Hormuz were at risk, given that 20% of the world's oil and a significant proportion of its liquefied gas passes through this strait. In this case, the price of oil could well exceed $100. This scenario is still far from being the most likely, but its risk is increasing. This justifies a risk premium on energy prices as long as there is a risk of the conflict spreading.

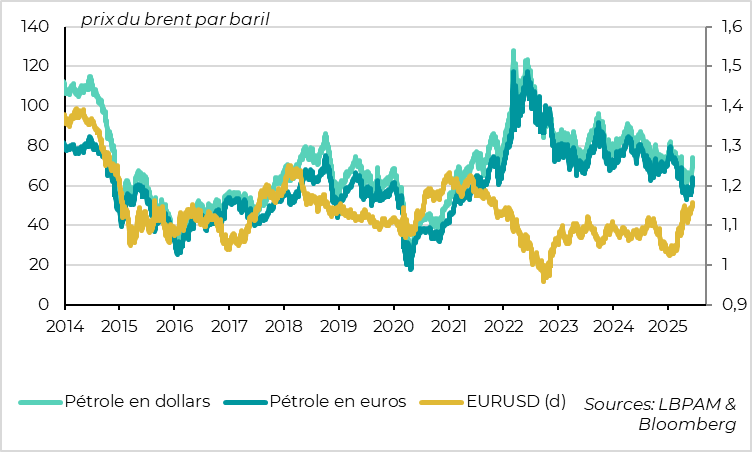

Oil: the price of oil in euros remains relatively contained

The price of oil has jumped by $10 per barrel since last week, and is $5 above its average level since the start of the year, although it remains slightly below its average of last year ($80). All else being equal, ECB models indicate that the rise in energy prices over the past week would increase European inflation by 0.5pt over one year and 0.25pt the following year, and reduce Eurozone growth by over a quarter of a point.

The good news is that the rise in oil prices in euro terms is more limited, thanks to the euro's strong rebound this year. Indeed, the price of oil in euros stands at 65 euros per barrel, having risen by 8 euros over the past week, which remains in line with its average level since the start of the year and almost 10 euros below its average price last year.

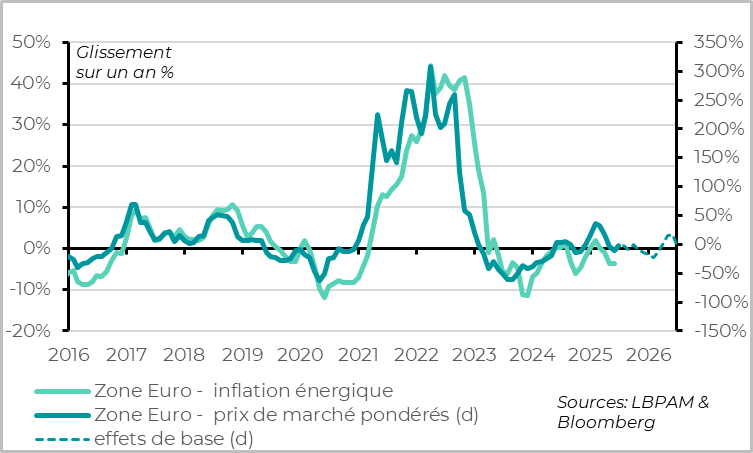

Euro zone: as things stand, energy inflation should be neutral this year

If oil prices and the euro remain at their current levels, energy inflation in the Eurozone would remain slightly negative this year and neutral next year. This is less favorable than the ECB estimated at the beginning of June, when energy prices were clearly falling, but it does not call into question the convergence of Eurozone inflation towards the 2% target.

United States: household expectations stabilize in early June...

US household confidence rebounds more strongly than expected at the beginning of June, according to the preliminary results of the University of Michigan survey, albeit at a limited level.

After stagnating at 52.2 in May, its lowest level since mid-2022, household confidence rebounded to 60.5 points in early June. Confidence remains well below last year's levels and its historical average, but is at its highest level since the start of the trade war four months ago.

The rebound, which affected all political sensitivities in June, came mainly from the normalization of household prospects, which converged on their current situation that had held up better in recent months. This reduces the risk of a massive retrenchment in household spending, even if households remain cautious overall.

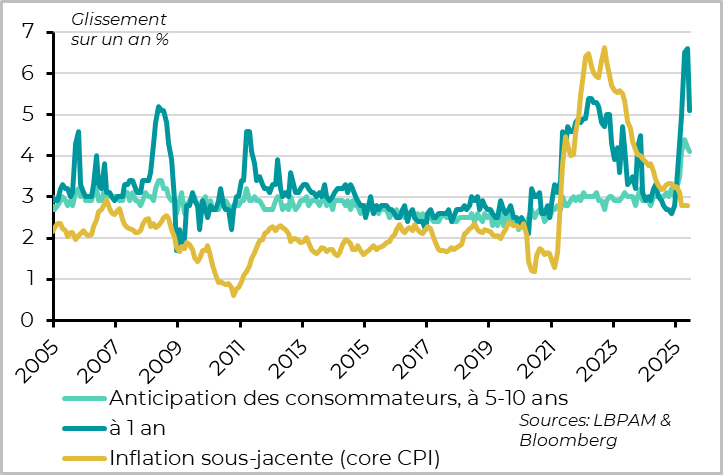

United States: ... thanks to a partial easing of inflation expectations

The improvement in household confidence stems from a decline in inflationary fears. Household inflation expectations for the year ahead fell for the first time since the start of the year, from 6.6% to 5.1%, and long-term expectations fell slightly for the second month running, from 4.2% to 4.1. This probably reflects the impact of the US administration's tariff rollbacks over the past two months, as well as the still limited level of tariff diffusion to goods prices, as demonstrated by the stability of core inflation in May.

That said, household inflation expectations are still at very high levels, and could suffer from the rise in oil prices and the delayed spread of tariffs to goods prices from the summer onwards.

The Fed should take some comfort from the fact that inflation expectations have stopped rising and are even starting to fall a little, but this easing is insufficient and still too uncertain for the Fed to conclude that the inflation shock expected in H2 will be only transitory. All in all, this gives the Fed time to remain in a wait-and-see stance this summer, which it should confirm at its meeting on Wednesday.

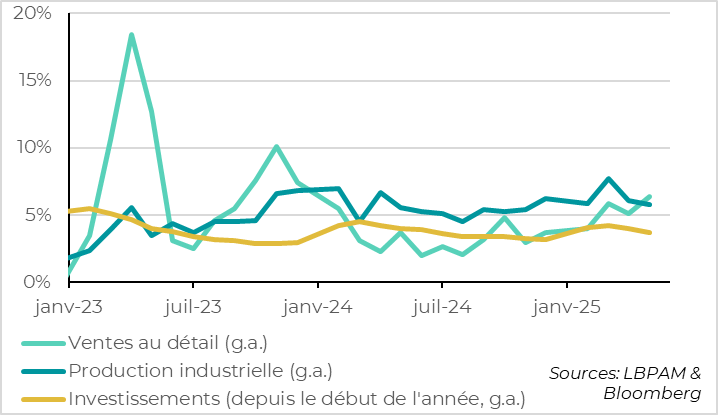

China: activity holds up in May thanks to consumption, but industrial sector slows down

In China, retail sales accelerated sharply from 5.1% to 6.4%, which is surprising given the high number of days off in May. While a rotation of growth drivers towards consumption is a good sign, it is questionable whether this is a sustainable development. Indeed, retail sales have benefited greatly from the authorities' temporary support measures, in particular programs to accelerate the replacement of household appliances and electronics. Fiscal support must therefore remain strong if consumption is to drive growth in H2.

At the same time, industrial production slowed slightly more than expected, from 6.1% to 5.8%, due to the slight slowdown in exports, but above all to the more marked slowdown in investment, which rose by just 3.7% over the first 5 months of the year, after 4% in April. This reflects the further deterioration in real estate, with property investment contracting more sharply than last year (-10.7%), as well as the sharp slowdown in industrial investment, probably due to the trade war. These slowdowns have not been offset by an acceleration in infrastructure investment, which will need further support from the authorities in the coming months.

Xavier Chapard

Strategist