Germany takes rapid steps for its own and Europe's security

Link

Read Sebastian Sebastian PARIS HORVITZ's market analysis for February 26, 2025.

Summary

►The meeting between President Macron and President Trump underlined the differences between the views of the American authorities on the war in Ukraine. Nevertheless, E. Macron seemed to show some optimism about the support the United States could provide if European military forces were deployed in Ukraine for peacekeeping purposes in the event of an agreement between Russia and Ukraine on a peace plan or truce.

►Nevertheless, the American president does not seem to have given any real security guarantees. So, while President Trump says he is ready to meet V. Putin, the outlines of the peace or ceasefire plan he would like to negotiate with him are unclear. Meanwhile, President Zelensky says he is ready to sign an agreement with the United States so that the latter can exploit the country's mining reserves, particularly rare earths. But the security guarantees offered by the USA remain unclear. Against this backdrop of confusion, the markets, particularly in the US, seem to be holding back uncertainty about the economic outlook, which is affecting risk-taking and benefiting safe-haven stocks.

►Following the German elections, the comments made by F. Merz, leader of the CDU and surely the future Chancellor, on the country's leadership in Europe and the urgent need to reinforce the security of the country and Europe, have already been translated into action. Indeed, discussions seem to have begun with the SPD, with whom the CDU/CSU coalition is expected to form a future government, and the Greens to create a 200 billion euro fund to strengthen the country's military capabilities. This would apparently be in addition to the €100 billion fund already set up.

►In addition, the current discussions would have opened the door to the possibility of relaxing the German government's highly restrictive debt criteria. The idea would be to adopt these measures before the new parliament is in place, since in the current configuration, the conservatives, social democrats and Greens have the required majority to make such a change. The next few weeks will provide further clarity. If these changes take place, it would be a positive thing for Europe and should support the region's assets.

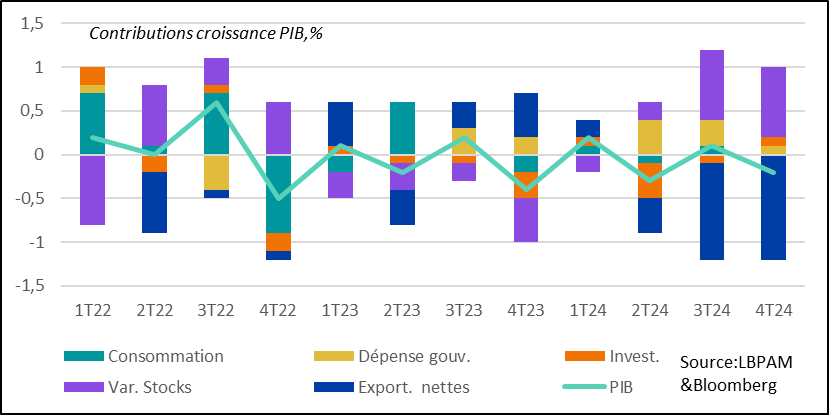

►While adapting to a new geopolitical reality, with the United States moving away from Europe, the German authorities know they have to boost growth. This is one of the causes of the malaise in the eastern part of the country, which voted heavily for the Afd. In this sense, the details of contributions to GDP growth in 4Q24, showed the weakness of private demand while the external engine is stalled. 2024 marked the second consecutive year of GDP contraction.

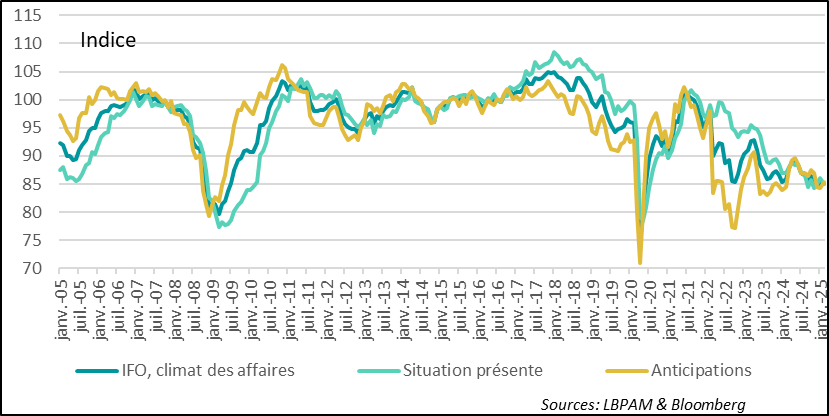

►The only relief for Germany from an economic point of view is the improvement in the outlook according to companies in the February IFO survey. In fact, the index has reversed the decline seen over the last two months. Nevertheless, the index remains well below its historical average.

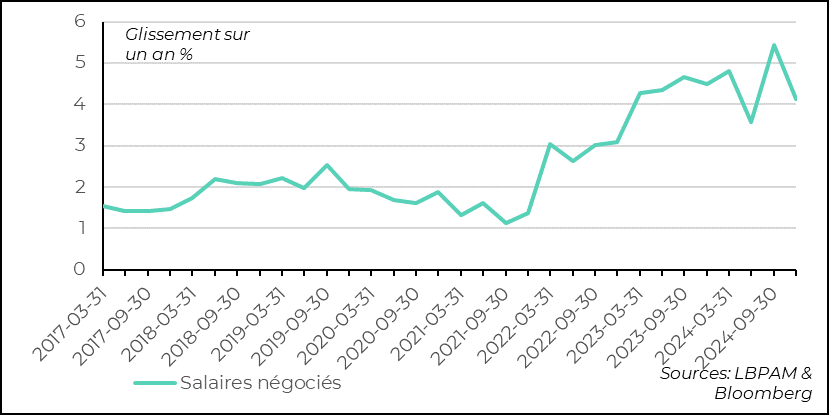

►For Germany, as for the eurozone as a whole, further easing of monetary policy will be an important element in stimulating growth in the year ahead. In this sense, the words of I. Schnabel, member of the Governing Council, questioning whether ECB policy is still restrictive, could suggest that rate cuts are nearing an end. We don't think so. Nevertheless, like Mrs. Schnabel, we believe that the real equilibrium rate is higher than in the past. This is why we expect the ECB to stop cutting rates to 2% before the summer. In this continuing downward trend, the clear deceleration in negotiated wage growth in 4Q24, to 4.1% year-on-year, is a step in the right direction.

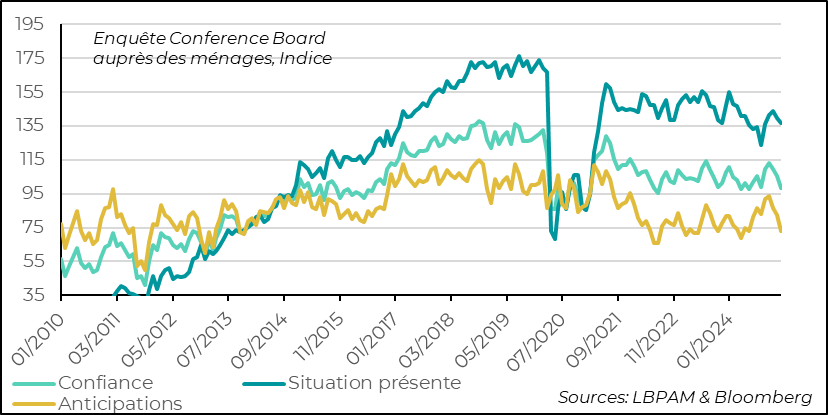

►In the United States, the series of bad economic statistics continues. The Conference Board's Household Confidence Survey showed that the optimism generated by the election of D. Trump is now waning. Indeed, the uncertainty caused by some of the new administration's announcements, sometimes exacerbating already existing concerns about inflation, caused the confidence index to fall sharply, particularly the outlook index, which lost more than 9 points, its biggest drop since the summer of 2021.

►Late last night, the House of Representatives in an almost totally partisan vote (217 for and 215 against) passed a budget plan that aims for $4,500 billion in tax cuts and $2,000 billion in budget cuts over the next 10 years. The tax cuts are largely due to extensions of cuts made by D. Trump during his first term. The text does not specify where the spending cuts will be, but it will be impossible to achieve this goal without cutting social spending, notably Medicaid. As it stands, the public deficit would increase by $2,000 to $3,000 billion (or nearly 9 points of GDP!). The Senate must now pass the bill. As it stands, we can expect tensions on long rates.

To go deeper

As Germany prepares to adopt an even more radical change in its military strategy to ensure its own and Europe's security, it also needs to focus on returning to growth. Indeed, the economy has contracted over the last two years (-0.3% in 2023 and -0.2% in 2024). Above all, the foreign trade engine has stalled, while domestic demand remains sluggish.

Details of the contributions to GDP growth made by the various demand items in 4Q24 clearly illustrate the difficulties facing the German economy.

In particular, household consumption remains sluggish, offering no impetus to the economy. This shows the degree of lack of confidence, and is certainly exacerbating tensions in the most disadvantaged regions, particularly those in the East. This explains, in part, the strong swing in these regions towards the far-right vote, against a backdrop of problems integrating foreign populations.

The industrial crisis, particularly affecting the automotive industry, is also one of the causes of this weak dynamism and loss of confidence. In fact, investment rebounded only slightly in the last quarter of the year, after two consecutive quarters of contraction. Only the build-up of inventories, for the second consecutive quarter, really supported growth.

But the biggest impact is the continuing negative contribution of foreign trade to growth. Difficulties in finding outlets in China, in particular, are weighing heavily on industry. The introduction of tariffs by the United States could further exacerbate the situation.

Germany: Private demand almost stagnated in 4Q24 apart from rising inventories, while foreign trade makes a negative contribution to growth

Will the new government that is due to take over the reins of the country, notably by freeing itself from budgetary constraints, try to stimulate growth? This is surely one of the major challenges for the country, but also for the eurozone.

In this respect, the IFO's business survey for February brought a little good news, with an upturn in positive opinions on the outlook. Nevertheless, the survey's indices all remain well below historical averages, demonstrating the scale of the task ahead in restoring confidence.

Germany: IFO survey for February shows slight upturn in positive outlook, but index levels remain historically low

As we all know, part of the impetus for activity in the eurozone will also come from the ECB's continued monetary easing. We continue to believe that the ECB will pursue its rate cuts over the coming months, landing at 2% for its key rate by early summer. Of course, many uncertainties remain, including the possible impact of US trade policy on Europe.

One of the factors that remains important in reassuring the ECB that it is ready to lower its key rates is wage growth, which in turn should contribute to a more marked slowdown in price rises in the services sector.

In this respect, the ECB's statistics on the evolution of negotiated wages for 4Q24 brought some good news, with a marked year-on-year decline, with wages rising by 4.1% compared with 5.4% the previous quarter.

Eurozone: Wage deceleration appears to have begun in 4Q24, which is good news for the ECB, but a steeper decline is expected at the start of the year.

ECB economists project that indexation effects will continue to drive a sharp deceleration in wage growth over the coming quarters. In fact, their projection for the end of this year is 1.4% year-on-year wage growth.

Nevertheless, given the uncertainties, the ECB should maintain a cautious tone, in our view. Above all, many members of the Governing Council remain concerned about inflation trends.

Remarks by I. Schnabel, a member of the Governing Council, on the need to proceed cautiously go in this direction, even if in her latest speech she adopted a much more circumspect tone on the scale of possible rate cuts to come. Indeed, she questioned whether the ECB's current monetary policy stance was indeed restrictive. Her main argument was that the equilibrium real interest rate may have risen much more than previously thought. In part, she pointed to the sharp rise in public debt as a factor pushing equilibrium rates higher.

We continue to believe that the equilibrium rate relative to the pre-Covid period is well above what was considered prior to this shock. Nevertheless, based in particular on Europe's potential growth, and taking into account the demands posed by budget spending requirements (energy transition and military needs), we estimate the real rate to be close to zero, although well above the -1% to -1.5% often considered previously. Our assumption of a 2% key rate reflects this view.

In the US, economic data continues to come in slightly worse than expected. Such is the case with the Conference Board's latest household confidence survey. It shows that the optimism generated by D. Trump's election is unravelling, with a fall in the general index, but above all a plunge in the outlook index, which saw its biggest monthly drop since August 2021.

The announcement of tax cuts could provide a boost to confidence, even if the tax cuts are merely an extension of past cuts, i.e. will have little impact on net incomes.

United States: Consumer confidence falls according to Conference Board survey, especially expectations

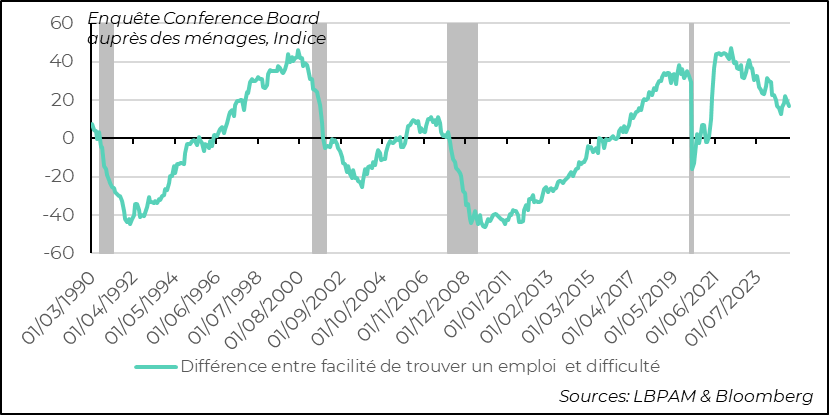

The survey also confirms that the job market is still buoyant, even if it has largely normalized. Indeed, the difference between those who think it's easy to find a job and those who think it isn't remains fairly high (which is positive), but well down on the situation of recent years.

United States: Job market remains buoyant according to survey, but has largely normalized

Sebastian PARIS HORVITZ

Head of Research