Germany: the whatever it takes is about to become a reality

Link

Find the market analysis for March 17, 2025, signed by Sebastian PARIS HORVITZ

What to remember

►In Germany, negotiations with the Green Party finally came to a successful conclusion. As a result, a historic project for military and infrastructure spending should be approved, along with reforms to budget spending limits. As part of the negotiations, the Greens were able to secure sanctuary for aid to Ukraine. In fact, F. Merz, the likely future Chancellor, has declared that as soon as the reforms are adopted by parliament, 3 billion euros will be deployed to help Ukraine militarily. The Greens have also managed to ensure that 100 billion euros of the 500 billion euros in infrastructure spending will be allocated to the climate and economic transformation fund.

►The radical change in Germany's public spending trajectory has already been largely reflected in the sharp rise in German long-term interest rates. Indeed, since F. Merz's “whatever it takes” announcement to invest and sharply increase military spending, German 10-year yields have gained nearly 40 basis points. In our view, this rise is not inconsistent. However, much of this spending will be very gradual, which leads us to believe that long-term interest rate expectations could ease in the months ahead, especially if the United States were to curb European growth with protectionist measures.

►In the U.S., Treasury Secretary S. Bessent downplayed the year-to-date decline in U.S. stock market indices as a salutary correction. He said he remained confident that Trump's economic policies would benefit the market. Despite the rebound in indices on Friday, it is clear that the market seems to be much less reassured about the stimulative nature of the policies being implemented. Above all, at this stage, it is difficult to identify a single measure aimed at creating confidence among households and businesses alike.

►On the consumer front, the University of Michigan's March preliminary survey struck a far less optimistic tone than the Secretary of State's words. Indeed, not only did confidence drop again, but some components came out historically negative. On unemployment, the outlook is very pessimistic for the future. On inflation, 5-year inflation expectations reached their highest level since 1991, at 3.9%, compared with 3.5% the previous month. This figure may be volatile, but this kind of increase is rare and should worry the Fed. Also, the divergence between respondents close to the Republican party and those close to the Democratic party is at historically high levels.

►This week, we'll see if these concerns are reflected in consumer spending, with the publication of retail sales for February. Above all, we'll see how the Fed interprets these figures at its monetary policy meeting. We believe, as many do, that the Fed will maintain its cautious tone.

►In China, a media outlet has announced that the State Council, the body headed by the Prime Minister that defines public policy, is expected to announce measures this Monday to support domestic demand and thus ensure “reasonable” economic growth. Markets are awaiting the implementation of more stimulating policies to counter American protectionist policies.

►At the same time, data on retail sales and investment for February (cumulating data since the start of the year) showed a slight improvement, suggesting that the measures taken so far by the Chinese authorities are supporting domestic demand somewhat, even if the construction sector remains very weak. Industrial production remains solid, supported by foreign demand. However, this could be weakened by US protectionist measures.

To go further

President Trump and the members of his cabinet continue to be very confident in the policies pursued so far to strengthen US growth at the expense of the rest of the world with strong protectionist measures. History has shown that such measures are generally bad for the economy and generate a great deal of uncertainty, which is detrimental to growth.

However, the impact of these measures is not yet really visible in economic statistics. It is, however, present in sentiment surveys of economic agents and in the reaction of financial markets. In this respect, we shall see whether Friday's rebound on the US stock market holds up. Our view is that, in the absence of policies more favorable to economic expansion, the market will remain very fragile. Hence our great caution.

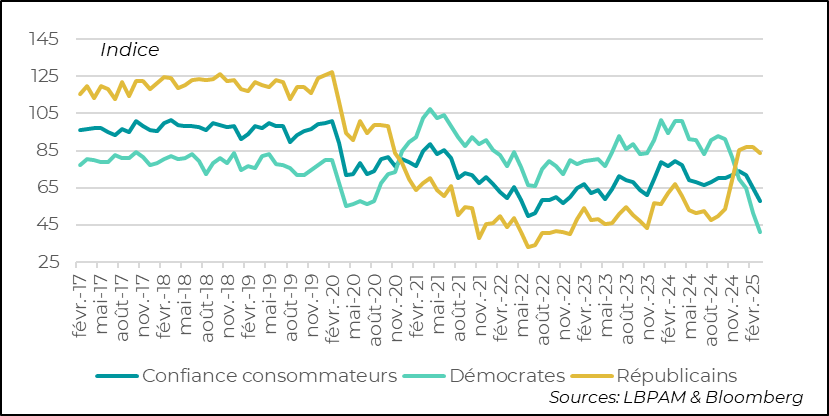

On the US household front, the University of Michigan's preliminary survey for March once again gave a very negative signal on the impact of the Trump administration's economic measures. Indeed, household confidence has once again fallen quite sharply after the previous month's sharp drop.

Nevertheless, it's almost fascinating to note the huge difference between the opinions of those with Republican and Democratic sensibilities. This divide is truly historic, and consistent with the political tensions observed between the two camps across the Atlantic.

United States: Household confidence index for March falls again, with a huge split between Democrats and Republicans

In detail, the messages given by the survey are quite worrying, even if we must always be cautious about linking them directly to actual household behavior, particularly in terms of consumption.

Nevertheless, the concern expressed about important variables is quite remarkable.

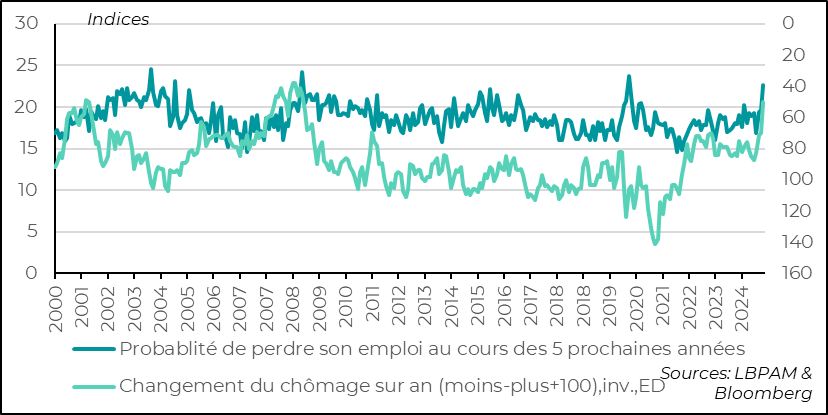

In terms of employment, the survey reveals considerable concern about how the job market will evolve in the coming years. Fears of rising unemployment in the coming year are now approaching the levels reached during the 2008-2009 financial crisis. Also, the possibility of losing one's job in the next 5 years has reached its highest level since the peak of Covid's arrival.

These fears, if they persist, could have a major impact on consumer behavior in the months ahead. We'll be keeping a close eye on consumer spending today, with retail sales figures for February. Even so, a rebound is expected after January's sharp fall.

United States: Fears about employment have become very high

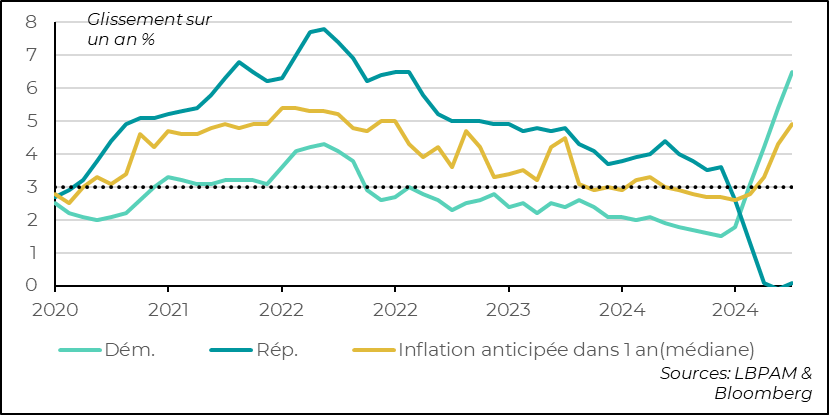

Another fear factor for consumers, which was one of the criteria that weighed against the Democrats in the last election, is inflation. Here again, households see inflation rising fairly sharply in the year ahead. However, this sentiment may be exacerbated by recent rises in certain foodstuffs such as eggs, due to an epidemic that has decimated poultry across the Atlantic.

The differences between the perception of Democratic and Republican voters is striking here, and obviously sends a message of caution on these statistics.

Nevertheless, the super-optimistic inflation forecasts of Republican voters seem unreasonable, unless you think a recession is just around the corner.

United States: Short-term inflation expectations (1 year) have risen sharply...

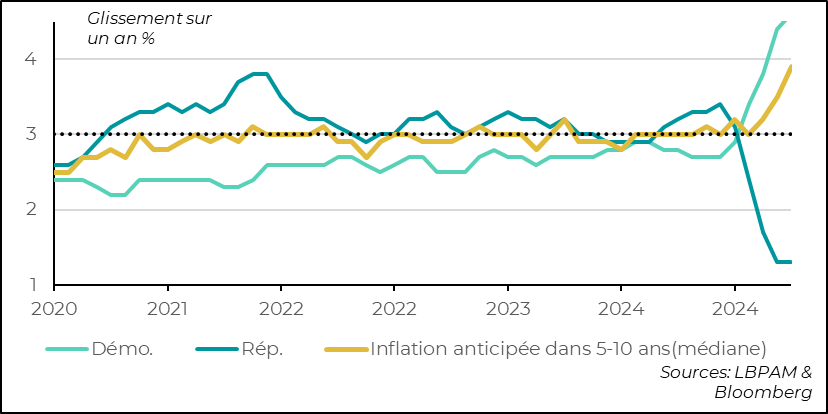

More worrying is the historically sharp rise in medium-term inflation expectations. Indeed, 5-10 year expectations of 3.9%, compared with 3.5% the previous month (already reflecting a sharp rise), have not been seen since 1991!

These statistics are sometimes quite volatile, and once again they reflect an impressive divide depending on the political color of the respondents.

For the Fed, this statistic is definitely not good news. Anchoring inflation expectations close to the central bank's 2% target is a major element of monetary policy. This statistic, without giving it too exaggerated an importance, should nevertheless contribute to the message of caution from US central bankers after their monetary policy meeting which starts tomorrow. The Fed is likely to keep its policy unchanged.

United States: ...but what is most worrying is that medium-term expectations have reached levels not seen since 1991

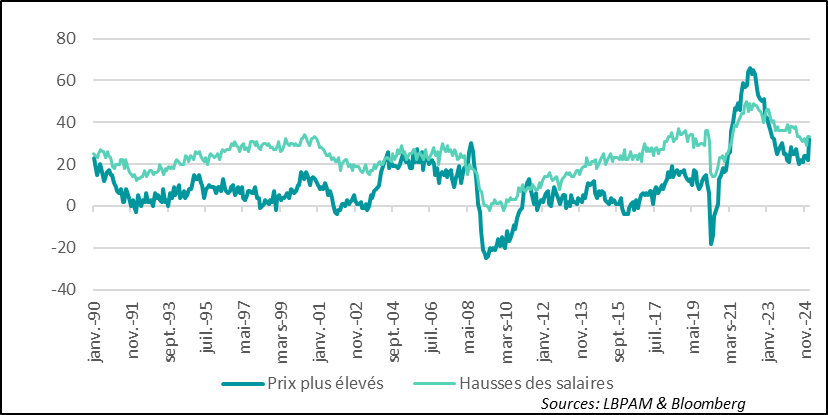

At the same time, which is not good news, we see that price increases by this category of businesses are rising again. Obviously, this could be corrected very quickly, especially since wage increases are diminishing, so the pressure on costs should reduce. Nevertheless, concerns about inflation that would be difficult to lower would be a problem for the Fed

United States: Among small businesses, price increases seem to have resumed an upward trend

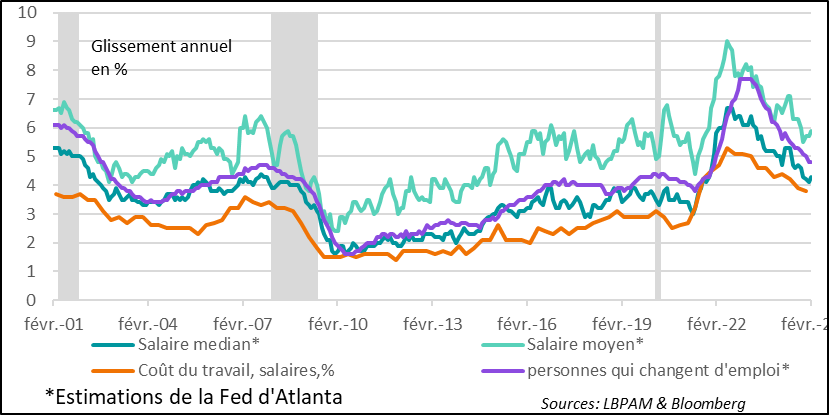

Also, at their meeting this week, Fed members will be able to analyze the behavior of the labor market and, more specifically, wage trends. In this respect, the Atlanta Fed's statistics gave a mixed message.

Year-on-year, wages rose in February, breaking the downward trend observed at the end of 2024. The median wage rose to 4.3% year-on-year, and the average to 5.9%. This is obviously not a positive message.

Nevertheless, a sign that tensions on the labor market are easing is reflected in the fact that the wages of people who voluntarily leave their jobs continue to decline gradually.

United States: Wages are no longer falling, although there are signs that the labor market is less tight

All in all, the Fed, faced with conflicting signals, a high degree of uncertainty as to the consequences of the Trump administration's measures, and economic statistics that have been rather solid to date, should remain very cautious on its monetary policy and continue to show patience.

In China, the authorities are said to be on the verge of making new announcements to support domestic demand. This is partly due to the anticipated effects of US protectionist measures, which could weaken the external engine of the Chinese economy.

At the same time, domestic demand statistics released at the start of the year came out slightly better than expected, partly reflecting the fact that the support measures taken so far have paid off. Also, the authorities' more conciliatory tone towards the tech giants in the recent period may have been another factor supporting confidence.

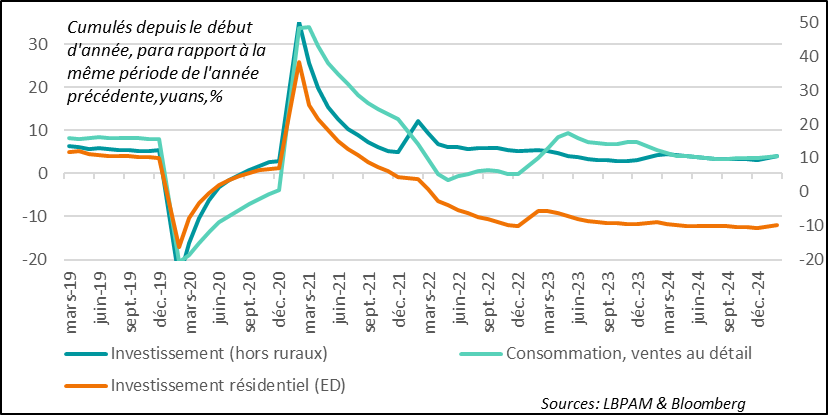

All in all, household consumption at the start of this year, up to February, was rather solid compared with last year. In fact, measured by retail sales, it grew by 4% in nominal terms, against an expected 3.8%.

Similarly, investment, excluding agriculture, rose by 4.1%, against an expected 3.2%. This is good news.

At the same time, the construction sector remains weighed down, despite a slight improvement, and is still making a very negative contribution to economic activity.

We continue to believe that the authorities should do all they can to get closer to their 5% annual growth target, but there is always the risk that the US-led trade war could be a major brake on the country's expansion.

China: Stronger statistics for consumption and investment at the start of the year, but the construction sector remains sluggish

Sebastian PARIS HORVITZ

Head of research