Global activity holds up, confidence fluctuates

Link

Find the market analysis for March 19, 2025, signed by Xavier Chapard.

Summary

► Markets remain cautious ahead of Donald Trump's announcements on reciprocal tariffs, scheduled for April 2. Fears have receded somewhat in recent days, following J. Powell's rather accommodating speech and rumors that the tariff hikes may be more targeted and limited than imagined. But this rebound is likely to remain fragile at least until next week, especially as the Fed is not yet ready to support the markets.

► Meanwhile, preliminary PMI indicators for March are mixed. Overall, they show a slight upturn in developed countries, pointing to a stabilization of global growth after the slowdown at the start of the year, at a level only slightly lower than at the end of last year.

► But the improvement comes from the rebound in services PMIs in the Anglo-Saxon world, in particular the US PMI, which recovers to 53.5pt. But manufacturing PMIs are back below 50pt, suggesting that the upturn in activity in anticipation of tariff hikes is already running out of steam. And services PMIs are scattered across the zones.

► For the eurozone, the composite PMI came in at 50.4pt after 50.2pt, consistent with just positive growth. And between long-term hopes, linked to German fiscal easing and increased defense spending, and short-term fears, linked to customs duties, eurozone companies are posting stable growth at a limited level.

► All in all, these data are compatible with our scenario of a still slow recovery in Europe over the coming months, held back by the negative impact of customs duties. We expect uncertainty to persist, while the rise in public investment will take time to materialize.

► US consumer confidence continues to fall sharply in March, according to the Conference Board survey, to a 4-year low. Rising inflationary and future income fears illustrate the impact of Trump's policies. Yet households report that their current situation and the job market remain solid for the time being. This data confirms the growing gap between the current state of the US economy, which is slowing in a limited way, and the falling confidence data, which suggest a growing risk of recession.

► As it stands, our scenario forecasts a significant slowdown in the US economy in the middle of the year, but without economic contraction. But the risk of recession increases with the duration of uncertainty and the scale of the policy shocks that will potentially be implemented.

To do deeper

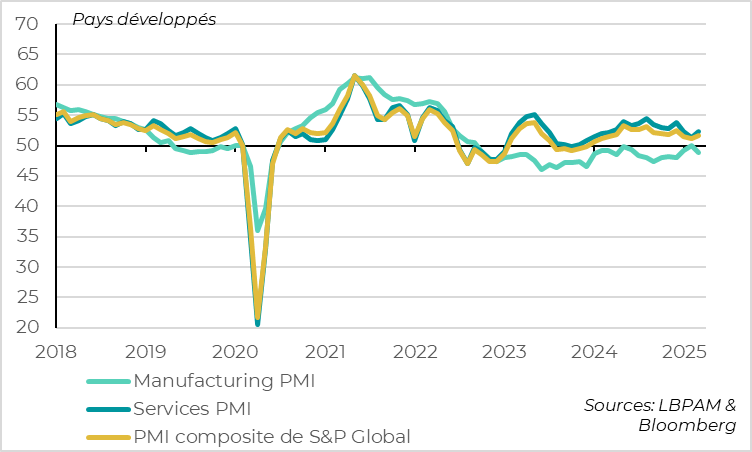

Developed countries: Global PMI stabilizes but manufacturing PMI falls again

Overall, the composite PMI for developed countries rose by around 0.5pt in March to 51.5, according to our calculations, which remains slightly below its average level of last year (but in positive territory).

While a slight rebound in the global PMI in March is reassuring, as it suggests that overall growth is not in doubt, the mix is a little less favorable this month. Indeed, the rebound mainly reflects a normalization of US services activity. But the manufacturing PMI, which is less volatile month-on-month, is back in contraction territory, whereas it had been on a recovery trajectory in recent months and had moved into expansion territory last month. This could indicate that industrial activity was temporarily buoyed at the start of the year by the anticipation of tariff hikes, but that this effect is already running out of steam. Meanwhile, activity in the services sector was more dispersed across geographical zones in March.

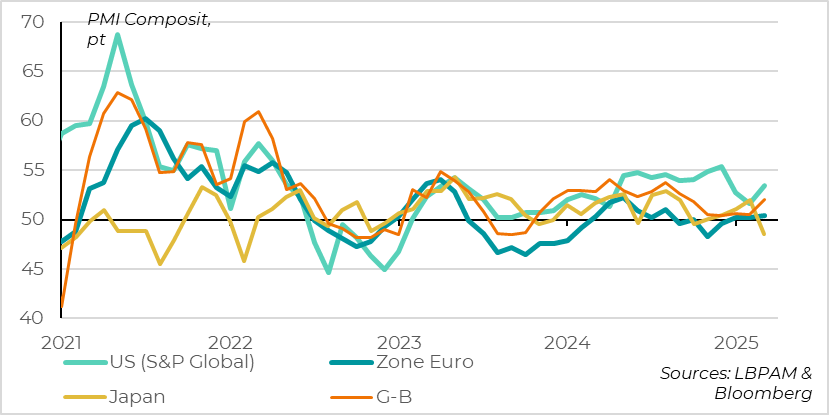

Developed countries: PMI rebounds in the Anglo-Saxon world but falls in Japan

S&P Global's US PMI rebounded in March, from 51.6 to 53.5pt, thanks to the normalization of activity in services, which had suffered from unfavorable weather conditions at the start of the year. However, the US manufacturing PMI relapsed into contraction after having rebounded strongly at the start of the year. Overall, the US composite PMI remains clearly in the growth zone, but below its H2 2024 level, which is compatible with a gradual slowdown in the economy.

The UK PMI also rose sharply in March to 52.0pt, after stagnating at around 50.5pt for the past 4 months. This rise, driven by the services PMI, suggests that domestic demand is picking up a little after its weakness at the turn of the year. However, the UK manufacturing PMI fell sharply to a year-and-a-half low of 44.6pt, illustrating the UK economy's sensitivity to global risks.

By contrast, the Japanese PMI fell sharply in March, from 52 to 48.5, its lowest level since mid-2021. This weakness, which affects both the industrial sector (PMI at 48.3) and the service sector (PMI at 49.5), comes as a surprise. But Japanese PMIs can be very volatile, so we don't think we should draw too many conclusions for the outlook from this publication.

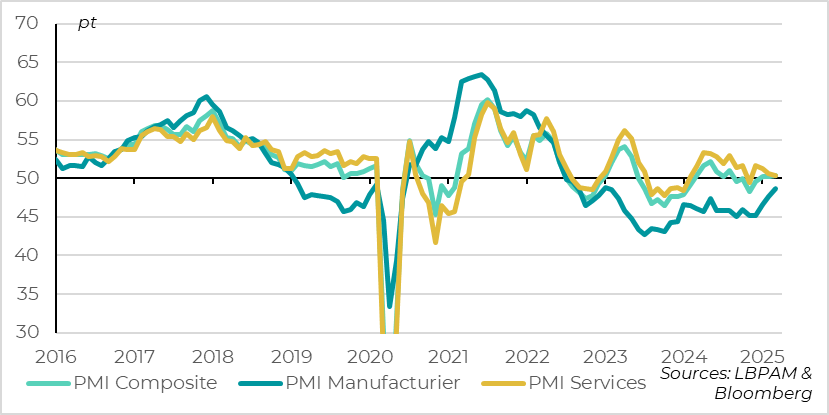

Euro zone: PMI remains just above the 50-point mark in March

For the Eurozone, the composite PMI came in at 50.4pt after 50.2pt, consistent with just positive growth. On the one hand, manufacturing activity continues to recover from a very depressed level. On the other, services activity is weakening.

Business sentiment for the months ahead is deteriorating slightly, especially in France. This marks a real difference with the sharp rise in financial analysts' confidence, indicated by the ZEW and Sentix surveys. This confirms our view that economic risks remain bearish in the short term, as the real economy will be rapidly impacted by tariff hikes, while public investment spending will take time to unfold. The good news comes from price-pressure indicators, which continue to moderate, and from the employment PMI, which returned to the expansion zone in March.

In terms of sectors, the Manufacturing PMI rose by 1.1pt to 48.7 in March. This third consecutive rise pushes the indicator to a 2-year high, even if it remains in contraction territory (but the production sub-component moves back into expansion territory for the first time since mid-2022). In contrast, the services PMI fell by 0.2pt to 50.4, its lowest level for a year if we exclude the month of the US election (November). This raises questions about the dynamism of consumption, which is supposed to be one of the main drivers of recovery in the eurozone, given the rise in household purchasing power.

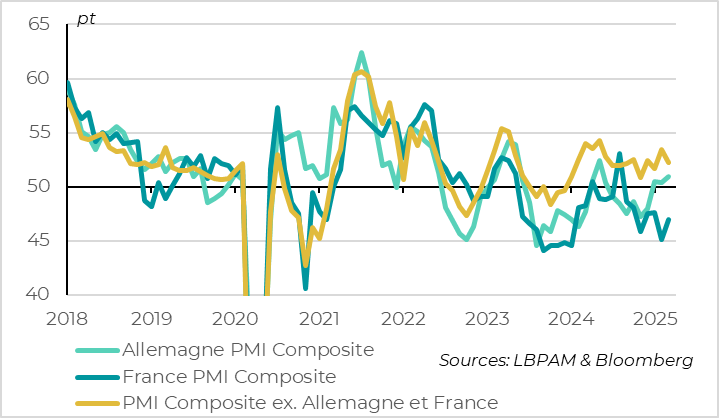

Euro zone: despite a rebound, French PMI still lags behind, in contraction zone

Within the Eurozone, Germany benefited from improved industrial activity, such that the composite PMI reached a one-year high of 50.9pt despite stagnating activity in services.

The French PMI rebounded by 1.4pt to 46.6pt, reversing part of its sharp decline in February, but remaining at a low level. This is reassuring, and more in line with the stability of the INSEE survey, which has picked up a little since the start of the year but remains below its long-term average and pre-dissolution level (at 97pt in March). Overall, these surveys indicate that growth in France is still virtually non-existent.

These data imply that in the rest of the eurozone, according to our calculations, the PMI fell by around 1 point in March, but remains in line with its S2 2024 level. This suggests that peripheral countries will continue to outperform core countries in early 2025.

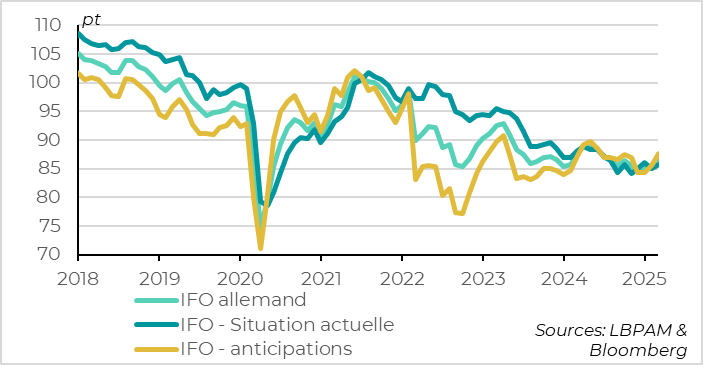

Germany: IFO survey shows a clearer rebound in business activity expectations

The IFO survey confirms the slight improvement in the German economy, returning in March to its level of last summer. The indicator of the current state of the economy remains weak at 85.7 pt. On the other hand, the expectations indicator has picked up more markedly over the past 2 months, which may reflect hopes linked to the CDU/CSU - SPD coalition, seen as more pro-business than the previous coalition.

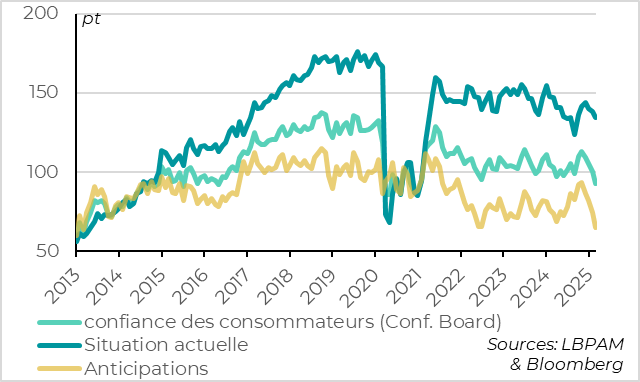

United States: Household confidence continues to deteriorate...

The Conference Board survey confirms that the decline in US household confidence remained marked in March, with the aggregate indicator falling sharply for the second consecutive month to a 4-year low (at 92.9pt).

This sharp deterioration stems from household confidence in the future, which fell to its lowest level since 2013. It comes from economic policy uncertainties, as evidenced by rising inflation expectations linked to tariff hikes and rising employment fears linked to federal job cuts.

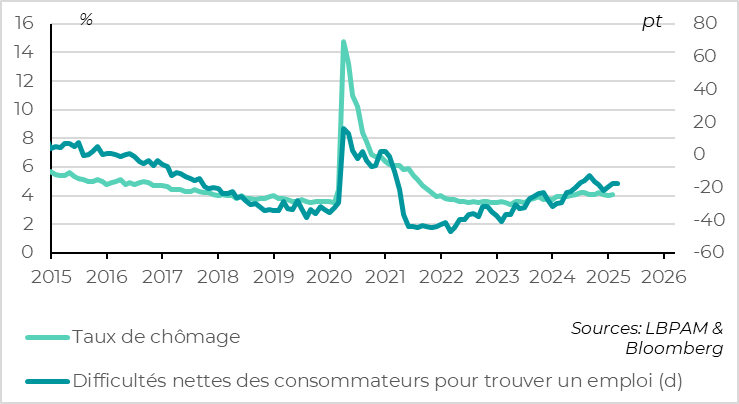

...But households still point to resilience in employment

Yet US households report that their current situation remains fairly good, with the current conditions indicator falling only slightly since the start of the year and remaining above its lows of last year, when consumption was very buoyant. Households in particular are benefiting from the resilience of the labor market. Thus, the job abundance indicator stabilized in March, remaining at a level consistent with low unemployment, only slightly above its February level (4.1%).

Under normal circumstances, the indicator of households' current situation is a more reliable gauge of the economic outlook than the indicator of future confidence, which is more volatile and regularly sends out false signals of a change in trend. Given the resilient activity figures for February and the rebound in the services PMI, this points to US growth being less strong than last year, but still positive in Q1.

But obviously, these are not “normal times”. And the drop in US household confidence has been accompanied by a sharp decline in the confidence of COEs, developers and investors over the past two months, in the face of uncertain economic policies. If confidence remains this low for several months and is ultimately justified by highly recessionary economic policies, the risk to the US cycle will become very significant.

As things stand, our scenario forecasts a marked slowdown in the US economy in the middle of the year, but without economic contraction, due to the policies implemented (higher tariffs, lower immigration, disorganization of the federal state). But the risk of recession increases with the duration of uncertainty and the scale of the policy shocks that will potentially be implemented.

Xavier Chapard

Strategist