Global activity is holding up well, but so are inflationary pressures

Link

Purchasing Managers’ Indices (PMIs) rose again in February and suggest that global economic activity is expanding for the first time since last summer. This improvement is rather broad-based by sector and region, although it is being driven mainly by activity in services.

This is reassuring in the wake of the steep volatility in macroeconomic data in recent months, as it suggests that the global economic upturn of January has spilled over into February. But when the economy gets better, that always means that inflationary pressures are more persistent, something that the central banks cannot accept. Companies continue to report strong price increases – particularly evident in services, something we expected, but still just as strong in goods. However, the normalisation of commodity prices and easing tensions in production chains were supposed to result in a marked slowdown in goods prices. This lessens pressures on company margins but reinforces the risks that inflation will stay above-target longer. This could, in turn, cause central banks to raise their key rates even higher, barring a greater slowdown in the economy. Chinese PMIs hit a 10-year high in February, suggesting that the recovery there is more rapid and stronger than expected, driven by a rebound in domestic demand and the stabilisation of the real-estate sector. We still expect a 3% rebound in growth in 2022 to 5.5% in 2023. Meanwhile, the Chinese authorities this weekend announced conservative economic and fiscal objectives, including a 5% growth target. They want to balance economic development with financial stability and national security (the defence budget is up by 7.2%). This suggests that China’s knock-on effect on growth and global inflation will be rather limited, whereas tensions with the US will remain high. In the US, the ISM services stayed high in February after rebounding in January to 55.1 points. This suggests that the US economy has indeed improved in early 2023 and that growth should remain solid in the first quarter. In light of this, the Fed will probably have to take on a tougher line in March than in recent months.

The latest global PMI figures show that the economic activity outlook improved once again in February. Indeed, for the first time since last summer, the JP Morgan Global Composite PMI returned to the expansionary zone. Moreover, the improvement is rather broad-based by sector and by region. This suggests that the economy did indeed improve in January vs. a difficult yearend 2022 and that it was not due mainly to data volatility caused by the shift into the new year.

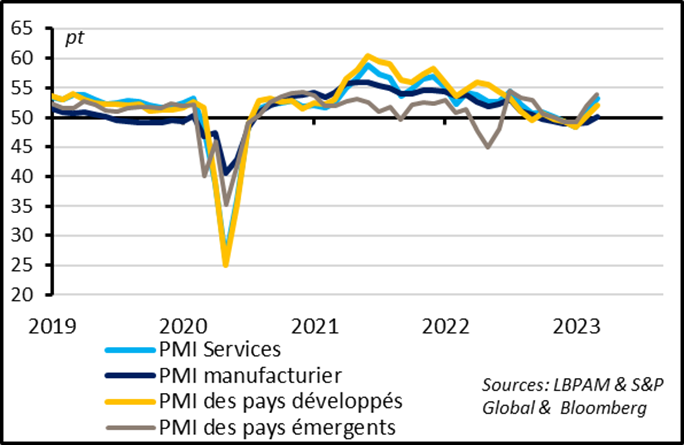

Fig. 1 – Global PMI : economic activity improved again in February across sectors and regions

The Global Composite PMI, which includes both manufacturing and services, moved back above 50 points in February for the first time since last July. At 52.1 points, it is at a one-year high and compatible with global growth that is just below trend.

The economic upturn is broad-based regionally. PMIs improved further in China in February, but also moved up sharply and above 50 points in the US and Europe.

By sector, PMIs have improved in both manufacturing and services but point to a mere stabilisation in manufacturing activity, whereas activity in services is expanding again. This suggests that growth is being driven by a recovery in demand, which is not good news for inflationary pressures.

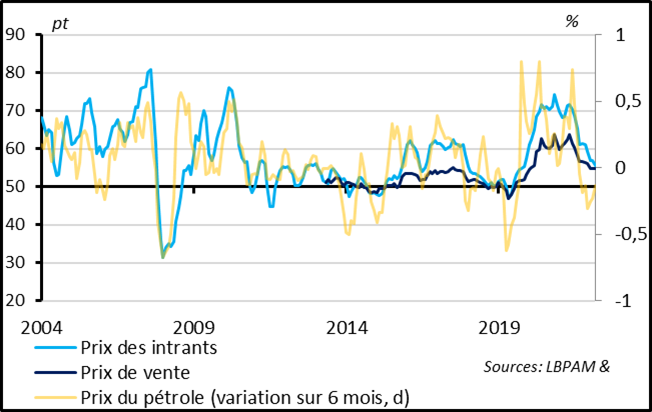

Fig. 2 – Global PMI : price indicators remain high, even in manufacturing

Despite the normalisation of commodity prices and production chain tensions, companies continue to report steep price rises. The PMI input indicator slowed only slightly in February and is historically high at 59.8 point, whereas the sales price indicator rose slightly to 55.3 points.

Prices continue to rise strongly in services, which is consistent with our view that domestic inflationary pressures will ease materially only if economic activity slows, given the very tight labour market. But prices also continue to rise in manufacturing at a fast pace, which is more surprising, given the downturn in commodity prices and the normalisation of delivery times.

On the one hand, that suggests that companies are holding onto greater pricing power than had been feared, and that could limit the shrinking in margins that we expected. But, on the other hand, this also suggests that inflationary pressures could remain more stubborn, including in goods, which would limit the slowdown in inflation this year. In that case, the slowdown in inflation would be due solely to energy prices, and core inflation would still be above central banks’ targets at yearend.

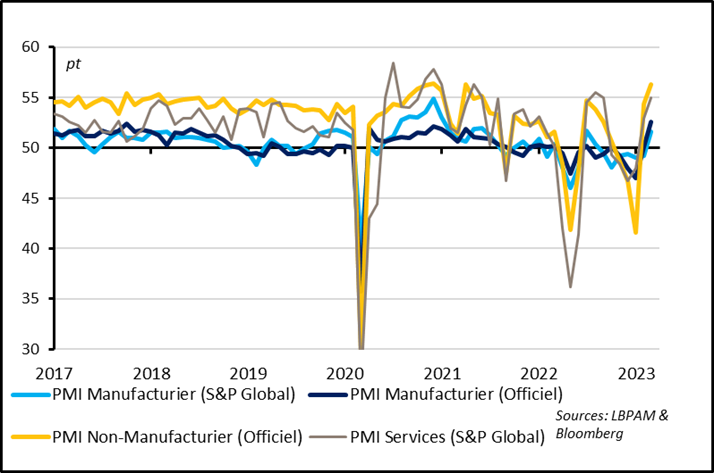

Fig. 3 – China: The manufacturing sector has rebounded, but it is services that are driving the economy, thanks to the upturn in consumption.

In China it is clearly the consumer awakening that is driving stronger economic activity. The strongest rebound in activity is in the services sector, with PMIs at about a 10-year high. PMIs have moved back into the expansionary zone in manufacturing but remain lower than in services. While this Chinese recovery was predictable, it looks more robust and rapid than expected. This suggests that risks are on the upside in our 5.5% growth forecast for this year.

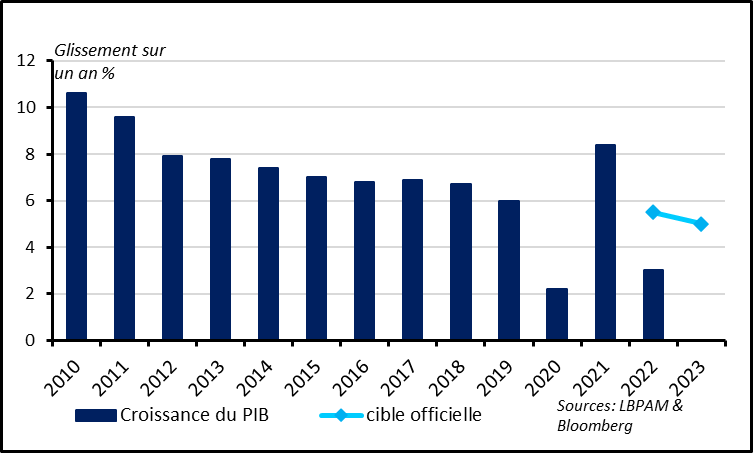

Fig. 4 – China : A conservative 5% growth target for this year

However, the Chinese authorities have announced conservative economic targets for this year. The have set their growth target at “about 5%”, which is below their target of last year (5.5%) and economists’ forecasts (above 5%). This doesn’t look very ambitious after the weak growth of 2022 (3%) and in light of the impact of the post-Zero Covid rebound. The other targets (on unemployment, local government debt-issuance quotas, etc.) are also a little lower than last year.

The Chinese government is focusing on economic and financial stability and national security, rather than growth. In a speech this weekend, the prime minister called for policies that balance “growth and security”. At the same time, while fiscal targets are conservative, the defence budget has been expanded by 7.2% for 2023, the biggest increase since 2019.

All in all, we believe that China will easily reach its growth target this year after having missed it by far last year, and without any major new fiscal or monetary stimulus. This will leave manoeuvring room for the new leadership to focus on improving the quality of growth as well as more geostrategic goals, such as technological autonomy, national security, etc.

For the rest of the world, the Chinese recovery should help economically, but less so than in the past, as the recovery is being driven by private domestic demand rather than by major infrastructure projects. On the bright side, this Chinese recovery is unlikely to generate strong pricing pressures, with the possible exception of energy. But the risk of an escalation in Sino-US tensions is once again higher, as seen in the new bans on technology exports imposed by Washington late last week.

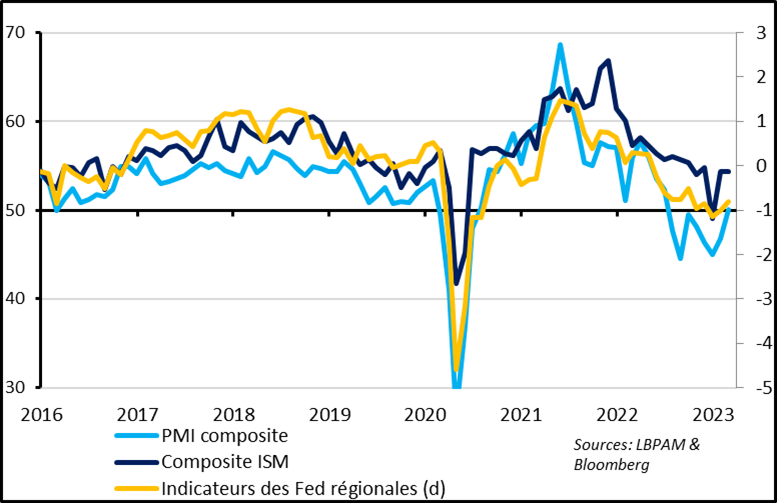

Fig. 5 – United States: The ISM indicator remained high in February

In the US, the ISM services indicator remained stable in February after rebounding in January, to 55.1 points. This is encouraging, as this indicator had been the weakest since Covid in pointing out the direction of the US economy, in particular vs. the S&P Global PMIs and the regional Fed indicators, which remain lower. All in all, the ISM composite for services and manufacturing was stable in February at its historical average. This confirms that the US economy is growing at a reasonable pace so far in 2023 and that the positive signs in January were not due merely to seasonal effects.

Nevertheless, the steep rise in euro zone inflation expectations are good news as that would suggest that we have overcome deflationary risks for some time to come, those deflationary risks that dragged down the euro zone over the past decade and would also be a sign of vigilance for the ECB. However, the ECB must keep these expectations under control.