Global economic activity still positive in May, albeit with widening sector divergence

Link

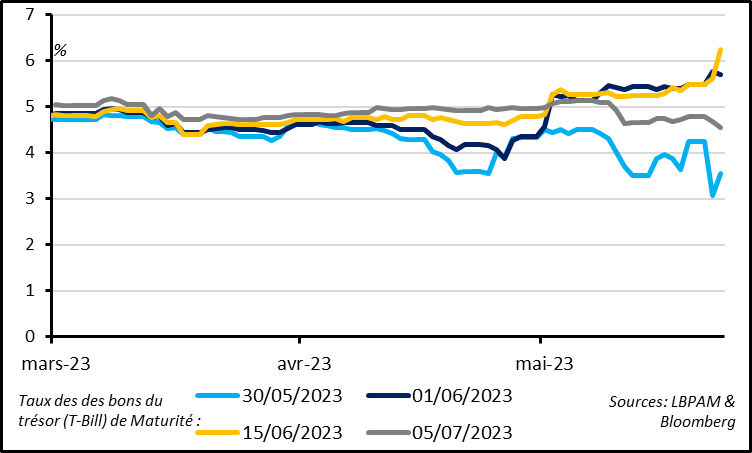

- Uncertainty over the raising of the US public debt ceiling continues to drive risk appetite in the short term. After being given hope by ongoing negotiations late last week, the markets are once again on edge. The Republicans announced yesterday that there is still no agreement on avoiding a US payment default by the start of June, and that no other meetings are planned. Tensions, which for the moment are limited to US money markets, could very well continue to worsen between now and next week, although we still expect the debt ceiling to be raised at the last minute.

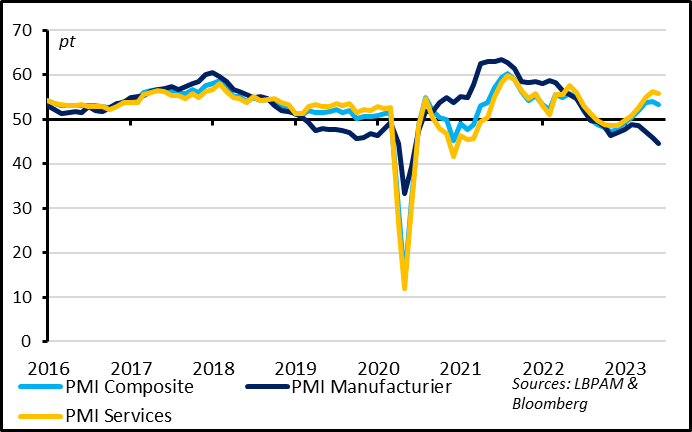

- S&P Global’s flash PMI figures are rather reassuring on the resilience of the global economy in May, although the widening gap between strong services and weak manufacturing raises questions on the sustainability of growth. The composite PMIs are slightly above their historical averages on both sides of the Atlantic, thanks to resiliency in services, which suggests that consumption remains positive. But at the same time, manufacturing PMIs fell again in May and are far into contraction territory regarding industrial activity. The gap between services PMI and manufacturing PMI is at a two-year high in the United States and at its widest since January 2009 in the Eurozone.

- On the one hand, we were expecting a wide gap between manufacturing and services this year, given the rotation from goods consumption to services as economies continue to reopen, and given the industrial cycle’s greater sensitivity to tighter monetary policies. But, on the other hand, manufacturing seems to be very weak at a time when it should be riding the receding of the energy shock, the mitigation of disruptions in supply chains, and the reopening of China. The good news if that services consumption, which is the largest component of our economies, remains solid, thanks to solid job markets and higher household purchasing power. The bad news is that this very solidity is keeping inflationary pressures heavy in services, something that central banks can hardly approve of, given that inflation services is proving to be more sustained than inflation in goods.

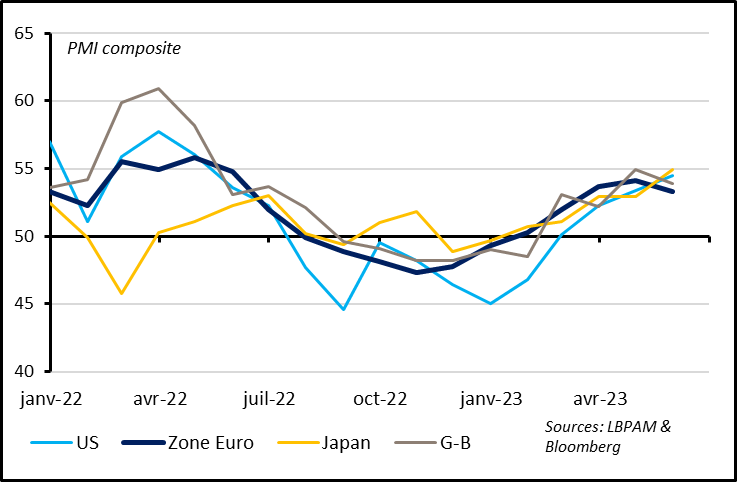

- Geographically, PMIs fell slightly in Europe while remaining rather high (at 53.3 pts for the Eurozone) after rebounding in recent months. This reinforces our view that growth is likely to take off again after stagnating during the winter but that the good news, mainly on lower energy prices, are mostly behind us. The rise in US PMI (to 54.5 pts) is reassuring, as that suggests that consumption of services continues to drive growth, although weakness in manufacturing and leading indicators continues to point to a more challenging outlook. The true good news is from Japan, where PMI figures are at a high since the start of the post-Covid recovery, at 54.9 pts. This confirms that the Japanese recovery is picking up speed after the belated reopening of its economy.

Fig. 1 – US: the debt-limit risk is driving up yields on Treasury bonds maturing in early June

T-Bill yields maturing in:

Debt-ceiling concerns have created dislocation on the US Treasury market, which is normally the most liquid and safest financial market. For example, Treasury bonds maturing in the first half of June – when, according to Treasury Secretary Janet Yellen, the Treasury could be short of cash if the debt ceiling is not changed – are yielding 200bp more than Treasury bonds maturing at the end of May and 100bp more than those maturing after the end of June. And the cost of protection against a US default one year out is still above 150bp, which is more than twice as high as its peak until this year.

However, apart from the money market, financial tensions remain limited, which shows that the markets are not panicking. The dollar has recovered slightly over the past two weeks; long-term interest rates are at highs since the mid-March banking stress; and equity markets have been stable for the past month. This makes sense, given that the risk of a US default is ultimately very low. But volatility could rise in the run-up to early June, as greater financial tensions are probably necessary to force the Republicans and Democrats into an agreement.

Fig. 2 – Eurozone: the composite PMI remains solid in May, thanks to services, while industry worsens further

PMI Composite PMI Services PMI Manufacturing

Eurozone PMI figures dipped slightly in May but remained consistent with growth that is close to potential (~0.35% per quarter) and higher than in winter. The decline in PMI figures comes after several months of steep rises since the end of last year, and the PMI is still slightly above its long-term average.

Activity continues to be driven by services, in which the PMI remains high, at 55.9 pts. This is consistent with an improvement in the consumption outlook, thanks to higher household purchasing power, which is being driven by the solidity of the job market (jobs up by 0.6% in the first quarter, with an acceleration in wage growth) and the lower energy bill (natural gas fell below EUR 30 / MWh for the first time since mid-2021). However, this improvement seems to be behind us, as business confidence in services has receded over the past three months, while consumer confidence stagnated in May after rebounding for several months and remains at a rather depressed level.

In contrast, the manufacturing cycle continues to weaken. At 44.6 pts, the manufacturing PMI hit a 10-year low when excluding the global lockdown quarter of 2020, and the gap between manufacturing and services PMIs is the widest since the Great Financial Crisis of 2008-2009. And yet, supply-side restrictions have receded, including energy costs and production chain issues. So, this is from demand-side weakness, as seen in the decrease in new orders and order backlogs.

The gap between manufacturing and services is also showing up in prices, and the ECB is likely to be more alert to stubborn tensions in prices of services than to receding tensions in the price of goods. On the one hand, manufacturers reported a decrease in their selling prices in May for the first time since September 2020. On the other hand, service providers continue to raise their prices aggressively, as demand is holding up and wage costs continue to rise.

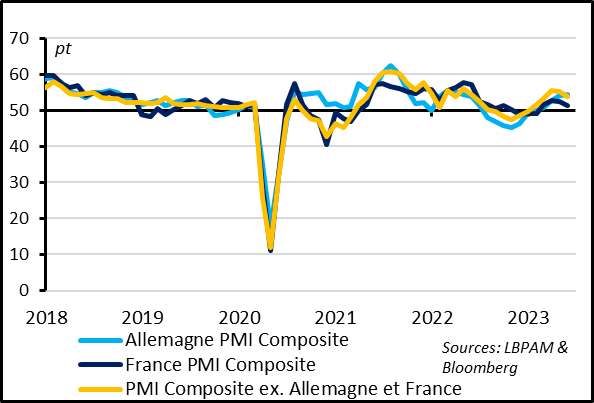

Fig. 3 – Eurozone: the recovery continues in German domestic demand, while activity slows in France and the rest of the Eurozone

Pts Germany PMI Composite France PMI Composite

PMI Composite excl. Germany and France

For once, German domestic demand drove economic activity in the Eurozone in May. The German composite PMI was stable at 54.3 pts in May and exceeded the Eurozone’s index, thanks to a new increase in German services PMI, which came close to its level of mid-2021 (57.8 pts). In contrast, the German manufacturing PMI fell steeply once again and, at 42.9 pts, is in abrupt contraction territory. When excluding Germany, PMI figures consolidated a little in May, and are still low in manufacturing and rather high in services. Note that activity looks weaker in France (PMI composite at 51.4 pts), but this may be due in part to the especially high number of legal holidays in May.

Fig. 4 – Developed countries: activity continues to pick up in developed economies outside Europe, particularly in Japan

Jan. Apr. Jul. Oct. …

US Eurozone Japan UK

As in the Eurozone, the UK’s PMI consolidated slightly in May its steep rise in April and remains slightly above its historical average, at 53.9 pts. This is consistent with slight growth after the near-stagnation of the UK economy this winter and confirms that the UK avoided a recession. While manufacturing activity continues to decline (with the manufacturing PMI at 46.9 pts), activity in services remained strong (55.1 pts). On top of higher household purchasing power and the ongoing post-Covid recovery, the hospitality sector no doubt got a temporary boost from the crowning of King Charles III. The downside of this economic resilience is stubborn inflationary pressures, particularly in services. This increases the chances of another key rate hike by the Bank of England in June or July.

Beyond Europe’s borders, PMIs rose further in May in the US and Japan.

The strength of US services is reassuring as it suggests that consumption continues to drive growth, although weakness in manufacturing and leading indicators continue to point to a challenging outlook. Indeed, the gains in S&P Global’s US PMI survey to a one-year high (at 54.5 pts) were driven solely by services, while the manufacturing PMI fell sharply and moved back into contraction territory (at 48.5 pts).

In contrast, after a later reopening of its economy, Japan seems to be recovering faster. Its PMI is at a high since the start of the post-Covid recovery, at 54.9 pts, thanks to services, but also manufacturing. Japan’s services PMI is at an all-time high, and its manufacturing PMI is back into expansion territory for the first time since the end of 2022 (at 50.8 pts). After the strong Q1 GDP numbers (including a 3.1% increase in private demand), April and May PMI figures confirm that the recovery is gaining strength this year. Note that the increase in Japanese manufacturing PMI seems to be driven more by the domestic recovery than by an improvement in the Asian industrial cycle, given that foreign orders continue to decline. This suggests that the Chinese recovery is so far not the main driver of the Japanese recovery.