Global growth remains robust at the start of Q2, but for how long?

Link

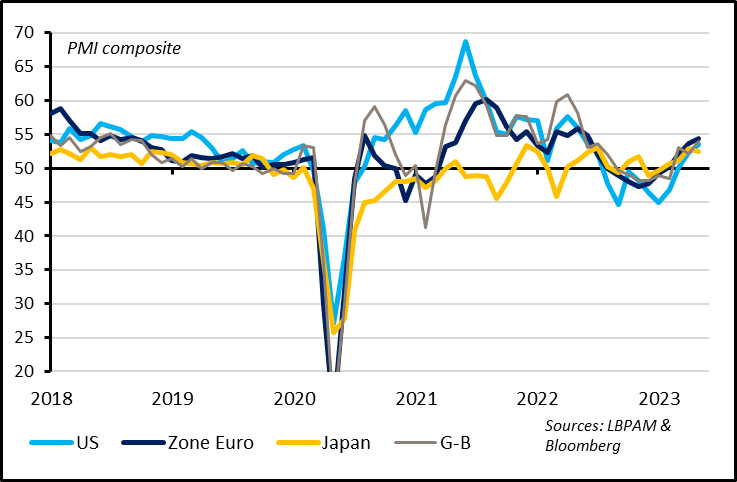

- The global economy continues to perform well in April after rebounding in the first quarter. The PMIs rallied significantly again in April and are clearly in expansionist territory in the major developed countries. This is reassuring, for it suggests that the banking stress in March did not lead to an abrupt cyclical downturn. And it follows a fairly significant rebound in global growth in Q1, driven by the Chinese recovery. This resilience in the global economic climate should be confirmed by the GDP growth figures released this week for the US and the Eurozone.

- The S&P Global PMIs reached 53.5 points for the US and 54.4 for the Eurozone -- the highest levels for nearly a year. This increase is driven by services, which suggests sound resilience in household demand. Conversely, industrial activity is contracting sharply outside the US, which is consistent with a deteriorating global industrial cycle.

- Despite the resilience of the global economy up to now, we continue to expect that global growth will be limited in the coming quarters, with only slightly positive growth in Europe and a mild recession in the US in the second half of the year. The financial conditions have tightened sharply over the past year and are expected to weigh on demand with a delay. We still think that the banking stress in March is not of such nature as to lead to an abrupt global recession but will help tighten credit conditions for businesses and households in the coming quarters.

- Moreover, contrary to current activity data, the leading indicators are rather misaligned. The Conference Board's leading indicator for the United States has been dropping for a year and has reached a level that has always preceded a recession. In the Eurozone, the ZEW [Leibniz Centre for European Economic Research], PMI and INSEE survey confidence indicators stopped rebounding in April and remain at relatively low levels (albeit considerably improved after last summer).

- The first corporate results for Q1 point to a stronger-than-expected start to the year but with an uncertain outlook. The season of corporate earnings is still at an early stage, so it is difficult to draw conclusions yet. Less than 20% of the S&P500 companies in the US have reported. But results so far are better than expected, with three-quarters of companies surprisingly on the rise. Nevertheless, this reflects the limited expectations of analysts for the start of the year (profits are down year-on-year) and companies are cautious about the outlook for the coming quarters.

Global growth remains robust at the start of the second quarter after rebounding slightly in Q1, according to the April PMI surveys.

Figure 1 World: The PMIs are up in April to near one-year highs in developed countries

Composite PMI

Eurozone

The S&P Global composite PMI for the US stands at 53.5 points, up from 52.3 in March, a near one-year high. It benefited from the rise in the indicator for the services sector but also for industry. In point of fact, the manufacturing PMI is back above the 50pt limit (i.e. the limit between contraction and growth) for the first time in 6 months. This is consistent with the rise in the manufacturing indicators of several regional Federal Reserve Banks in April and suggests that demand for goods is resilient after it declined in 2022. On the downside, the resilience of demand is keeping prices under pressure, as evidenced by the further rise in the final price indicator to the highest level since September.

This survey is ultimately reassuring for it suggests that the American economy is still resilient, contrary to the latest data which would suggest a sharper slowdown in Q2. Applications for unemployment benefits have actually been rising quite sharply since March, the PMI published by the ISM fell precipitously in February, etc. For the time being, the data remain compatible with our scenario which foresees a slowdown in the American economy closer to the summer, and even a slight recession in the second half of the year. The American economy could persevere longer than we expect, but in that case inflationary pressures are likely to remain more persistent and force a later but more significant slowdown.

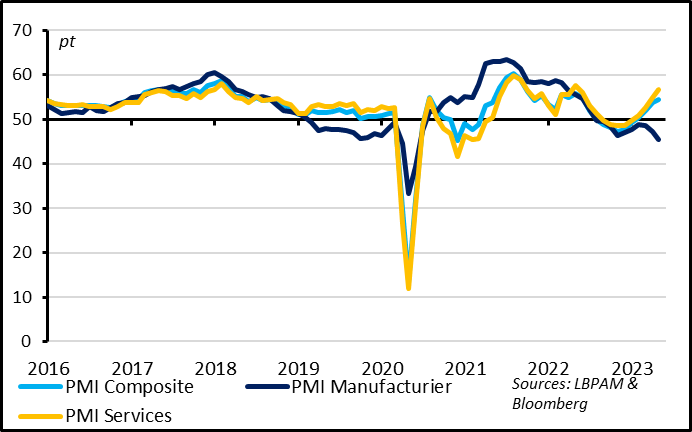

Figure 2 Eurozone: the PMIs are up again in April, driven by services

Composite PMI Manufacturing PMI

Services PMI

The composite PMI for the Eurozone suggests that growth is recovering after the stagnation of GDP this winter. It is up to 54.4pt from 53.7pt, the highest level since mid-2022, which is consistent with growth exceeding 1.5% if the historical relationship between the PMI and GDP remains valid, i.e. growth above its trend rate.

In sectoral terms, growth is being driven exclusively by services, which are benefiting from lower energy prices, a resilient labour market and wage acceleration. The services PMI accordingly reached 56.6pt in March, the highest level since last spring. Conversely, the manufacturing PMI falls again to just 45.5pt, a low since the start of the post-lockdown recovery that suggests a sharp contraction in industrial activity. This is consistent with the signs of a slowdown in the global industrial cycle seen in the Asian figures (declining production and exports from Taiwan and Korea).

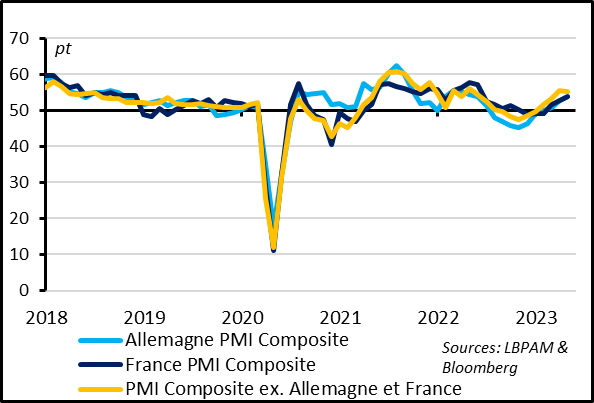

Figure 3 Eurozone: the improvement in the economic climate is generalized in terms of countries

Germany Composite PMI

France Composite PMI

Germany and France Composite PMI

In geographical terms, the business momentum seems to be picking up steam in April with French and German PMIs (at 53.8pt 53.9pt respectively) catching up with those of the rest of the Eurozone which had rebounded more strongly in Q1. This is encouraging because it suggests that the recovery in services goes beyond tourism, a sector that is particularly supportive of services in Italy and Spain.

In contrast to the United States, companies in the Eurozone continue to indicate a slowdown in price increases despite the recovery in demand, which is probably due to lower energy prices and the appreciation of the Euro since the end of last year. The price indicators remain much higher than has been historically the case however, especially for services, which suggests that inflation is still far from returning to normal. We ultimately continue to expect the Eurozone to avoid recession in 2023 but to suffer from relatively weak growth after the stagnation this past winter. Lower energy prices than last year and a strong labour market should actually support demand, but tighter financial conditions and the gradual withdrawal of fiscal support should limit the recovery.

Beyond this, the UK PMI is also recovering in April, up from 52.2 to 53.9 points, the highest level for over a year. As in the Eurozone, this rise came from services, whereas industrial activity contracted sharply. Contrary to our expectations, the UK could also avoid recession this year, but we still think that growth should be weaker than in the Eurozone, as the two zones share common constraints, plus a more pronounced fiscal adjustment and greater structural problems.

The Japanese PMI is finally the only one not to advance in April but, at 52.5 points, it continues to indicate a gradual recovery of the economy.

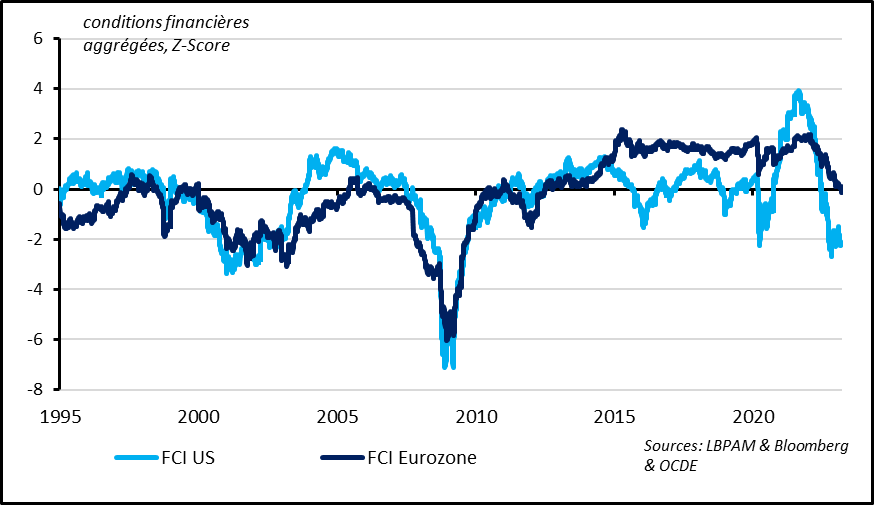

Whereas it is reassuring that the economy is resilient just after the banking stress of March, we still think that the tightening of financial conditions necessitated by persistent inflationary pressures limits the growth potential for the coming quarters.

Figure 4 Global: The financial conditions have tightened considerably over the past year and will eventually weigh on growth

Aggregate financial conditions, Z-Score US FCI Eurozone FCI

The monetary tightening over the past year has already led to a significant hardening of financial conditions, even before the banking stress. The latter is likely to reinforce the hardening of credit conditions for companies and households, even though we have often said that we do not think this is a systemic stress. And the persistence of inflationary pressures should force central banks to maintain tight monetary conditions even if the economy slows down considerably, in contrast to recent economic cycles. While the end of policy rate hikes is drawing near, it is not yet here and, more importantly, it should not mark a pivot to rapid rate cuts.

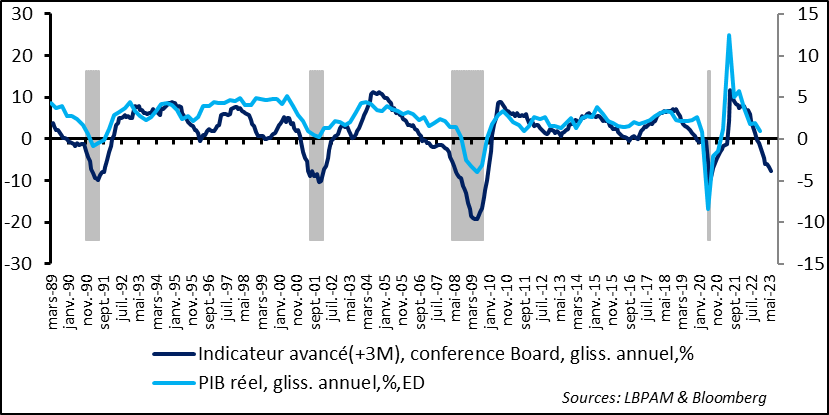

Figure 5 United States: The leading indicator is at a level that has always preceded a recession

Conference Board Leading indicator (+3M), year-on-year,

% Real GDP, year-on-year, %, Right Scale

Contrary to the resilience of coincident activity indicators such as the PMIs, leading indicators are also less well oriented.

For example, the Conference Board's leading indicator for the US fell again in March for the 12th consecutive month and now stands at a level that has always preceded a recession (-7.8% year-on-year).

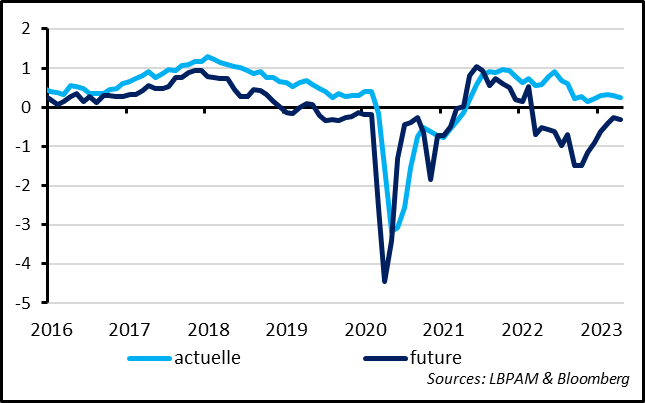

Figure 6 Eurozone: Corporate expectations stopped rebounding in April and now stand at fairly low levels

Current Future

Similarly in the Eurozone, the expectation indicators in the ZEW, PMI or INSEE surveys fell in April for the first time since they started to rebound after last summer and remain at fairly low levels. This suggests that companies remain cautious about the outlook despite the resilience of current activity and the decline in the energy shock.