Global industrial activity is picking up at the start of the year

Link

What are the key takeaways from the market news on January 03, 2026? Sebastian Paris Horvitz provides some insights.

Overview

► One of the uncertainties for 2026 has been lifted by Donald Trump. Indeed, the U.S. President has finally decided to nominate Kevin Warsh as a candidate to lead the Federal Reserve. Warsh has long been considered one of Donald Trump’s potential picks. He has consistently been viewed by markets—alongside C. Waller—as the most experienced candidate, having served as a Fed governor for five years, notably during the 2008–2009 financial crisis. His nomination therefore does not come as a major surprise.

►K. Warsh, having supported very conservative views on inflation in the past (including during the post‑2008–2009 crisis deflationary-risk period), may reassure markets on this issue. However, his views on the Federal Reserve have become increasingly critical. He has consistently opposed the expansion of the Fed’s balance sheet, seeing more risks than benefits, though without really grounding his argument in theoretical considerations or historical experience. More recently, during an IMF event (April 2025), he expressed strong criticism of certain positions taken by the institution, including on climate change and inclusion. With regard to the Fed, it is difficult to discern any active approach that incorporates these topics. Overall, K. Warsh remains hard to read. If he is appointed in mid-May to replace J. Powell, he will quickly be tested on his leadership and on his defense of the Fed’s independence. At this stage, we continue to believe that the Fed should remain cautious in 2026, and we see only one potential policy rate cut.

► President Trump has also announced a trade agreement with India. According to the President, the deal would involve reducing tariff rates to 18%, down from the previous 25%. Details remain limited, but again according to the President, India has committed to no longer importing Russian oil and to increasing its imports of U.S. products, particularly in the technology, agricultural, and energy sectors. Indian authorities have made no statement regarding Russian oil imports. In recent years, India had become one of the main importers of Russian oil, averaging 1.7 million barrels per month in 2025. However, imports had declined in recent months following sanctions announced by the U.S. administration. It is worth noting that this agreement comes just after the European Union signed a trade deal with India.

► France has finally adopted a budget for 2026. Indeed, S. Lecornu’s government managed to survive two no‑confidence votes and passed the budget law by invoking Article 49.3 of the Constitution. As anticipated, it was thanks to the Socialist Party that the budget was approved. This support came in exchange for multiple concessions, notably the decision to maintain the exceptional tax on large corporations, which is expected to bring in another €8 billion in 2026. However, the target for reducing the public deficit will be more modest, aiming for 5% of GDP. Overall, this has helped keep the yield spread with Germany relatively stable at 58 basis points (its lowest level in over a year) for the 10‑year maturity. Most importantly, this should bring some short‑term calm and visibility to economic agents and support economic activity.

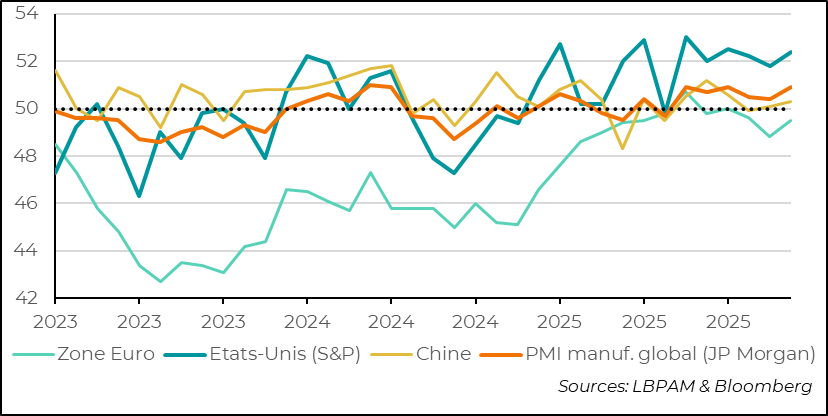

►At the start of the month, manufacturing activity indicators for January were published for a large number of countries. They brought good news. Indeed, the global index compiled by J.P. Morgan, based on S&P’s PMI surveys, rose, indicating a renewed momentum. In particular, new global orders returned to growth, reaching their highest level in one year. At the regional level, the rebound was most notable in the United States and in several Asian economies, including India. In the Eurozone, the situation also improved, even though activity remains in contraction territory.

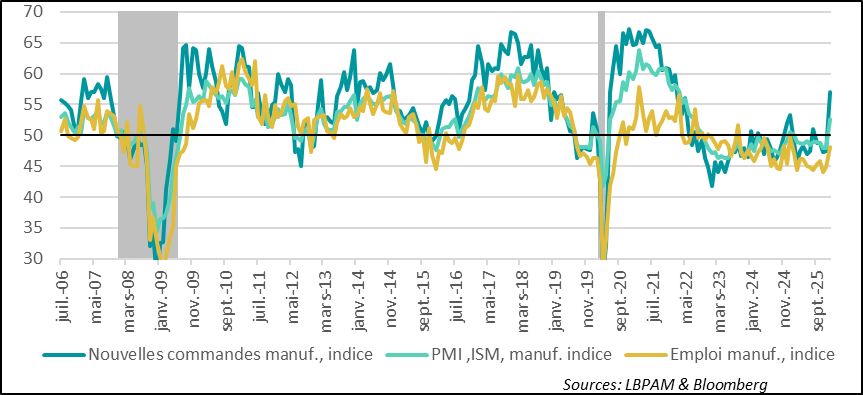

►In the United States, while the S&P indicator rebounded, the ISM survey for the manufacturing sector showed an even more pronounced surge, clearly moving back into expansion territory after having remained in contraction for a year. The ISM survey, considered the most reliable gauge for the manufacturing industry, showed that all its components improved, starting with new orders: the index climbed to 57.1, its highest level since February 2022. This is consistent with our view of an acceleration in activity during the first part of the year. However, the key factor needed to consolidate the recovery is an improvement in labour market dynamics. For now, despite a slight improvement in January, firms remain very cautious about hiring intentions, with the employment sub‑index still in contraction territory.

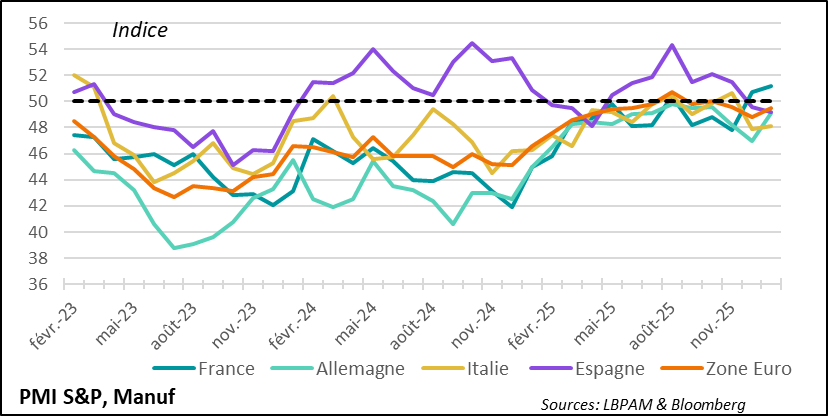

►In the Eurozone, S&P’s final PMI survey for January shows a very slight improvement in manufacturing activity, although it remains in contraction territory. The survey highlights the recovery of the manufacturing sector in France, which remains in expansion. In contrast, although activity in Germany is improving, it has not yet managed to return to expansion territory. We believe that the beginning of the year should continue to show a gradual recovery in industry thanks to the German stimulus plan.

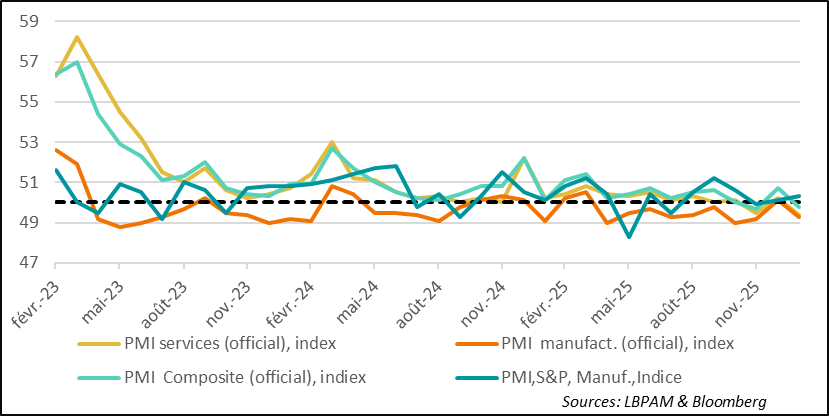

►In China, the official PMI activity surveys delivered a message of weakness across the entire economy, with the composite index (services and manufacturing) falling back into contraction territory. At the same time, the private S&P (Ratingdog) manufacturing survey painted a slightly better picture, with the index just above 50, signalling only a very modest expansion in activity. These figures support our view that the authorities will need to provide additional support to the domestic economy and will find it difficult to rely solely on the current strength of exports to achieve their growth target.

►The improvement in the industrial outlook has supported risk assets, particularly in the United States and Europe. This occurred in a market environment marked by anxiety following the sharp and sudden decline in metal prices (‑14% for gold and ‑30% for silver), particularly precious metals. This adjustment appears to have been driven by several factors, including significant speculative positions on the Chinese domestic market. However, it also seems that the correction originated from an overly rapid surge in this segment, fuelled partly by objective factors such as projections of strong structural demand for industrial metals—especially copper—and, for precious metals, by investors’ search for safe-haven assets amid elevated geopolitical risks. This excessive enthusiasm appears to have ended abruptly. For industrial metals, renewed upward pressure could return now that the market has stabilised. In contrast, for precious metals, we expect a gradual return to calmer conditions.

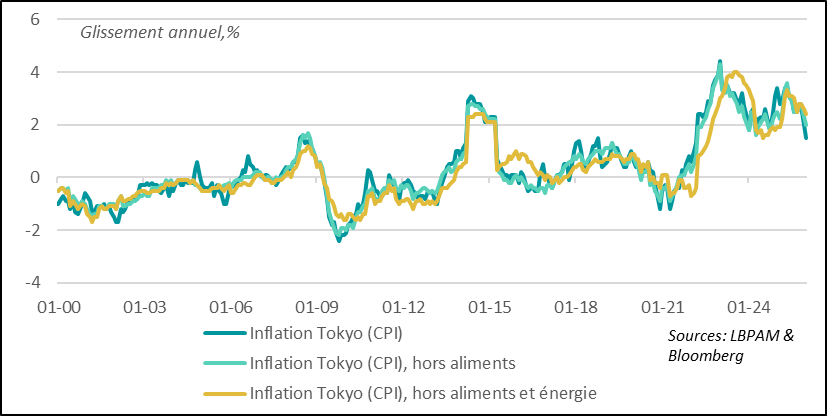

►In Japan, January inflation figures for Tokyo came in more moderate than expected. Headline inflation stood at 1.5% year‑on‑year, compared with 2.0% the previous month, while core inflation (excluding fresh food and energy) eased to 2.4% from 2.6% in December. This moderation in inflation is good news for the BoJ. We continue to expect two additional policy rate hikes over the course of the year, which would bring the rate to 1.25%.

Going Further

Global Activity: global industrial activity rebounds in January

Industrial rebound at the start of the year

The first final results on the state of the global economic cycle send a rather positive message. This rebound is fairly broad-based, even though some countries and regions continue to contribute much more strongly — notably the United States and several Asian economies.

Overall, January breaks the decelerating trend observed in recent months. India, which had experienced a soft patch after being a major growth driver in recent years, has now reversed course and continues to show very solid industrial expansion. In contrast, although the Eurozone is following the global trend, industrial activity in the region remains in contraction. The same is true in China: conditions have improved, but industrial activity remains moderate and is still largely supported by external demand.

This rebound can be explained in part by the easing of uncertainties surrounding U.S. trade policy, even though higher tariffs remain a challenge for many industrial exporters. This factor, combined with the fiscal stimulus plans announced in many countries, also appears to be supporting a renewed sense of optimism among manufacturers. Indeed, the S&P survey shows that optimism about future prospects has reached a 10‑month high.

Although it is still too early to conclude that this recovery is a lasting trend, it is in line with our scenario of a first half of the year supported by the stimulative effect of public support measures.

United States: The ISM manufacturing survey shows a marked rebound

Strong rebound in manufacturing, driven notably by new orders

According to the ISM survey, which had so far remained clearly weaker than the S&P survey, manufacturing activity experienced a very sharp rebound in January. In fact, the headline index moved back into expansion territory after a full year in contraction. One of the main contributors to this rebound came from new orders, which not only returned to growth last August but have now reached their highest level since early 2022.

All underlying components show an improvement. However, employment remains lagging behind, even though it has clearly improved compared with previous months. This still reflects a degree of caution among manufacturers. Nevertheless, we expect these better activity prospects to eventually translate into renewed momentum in employment in a sector where job growth has been contracting for several months.

It is also worth noting that input costs, as measured by the prices paid index, remain very high, suggesting that tariff effects are still present. One question for the coming months will be whether manufacturers decide to pass these higher costs through to final prices or absorb them through lower margins. In addition, import dynamics are recovering after the significant distortions caused by the large advance orders placed ahead of the early‑2025 tariff increases, which led to a contraction in imports through much of last year.

We expect this renewed momentum to continue through the first half of the year, when the stimulus effects of last year’s ‘One Big Beautiful Bill,’ particularly on investment, should be most pronounced.

Eurozone: The PMI survey shows a very slight improvement

Slight rebound in industrial activity

In the Eurozone, the rebound in industrial activity was far less pronounced than elsewhere, with activity still in contraction territory. In fact, much of the improvement can be explained by the renewed momentum in French industry. The favourable trend previously seen in the southern European countries continued to deteriorate, particularly in Spain. In contrast, conditions improved again in Germany this month, although activity there also remains in contraction territory.

The first months of the year will obviously be crucial to assess whether the German stimulus plan produces more tangible effects. We maintain our view that European industry should see a more marked pickup in activity in the first half of 2026, driven by an acceleration in infrastructure spending by the German government.

China: Activity remains weak

A mixed message for Chinese activity

According to the official PMI survey, activity in China deteriorated in January across both services and manufacturing. The composite index (services and manufacturing) fell back into contraction territory, confirming the weak momentum of domestic activity.

The private S&P manufacturing survey delivered a more favourable message, showing a very slight pickup in activity. In our view, this partly reflects differences in the samples of surveyed firms. The private survey is more sensitive to the export‑oriented sector, where activity remains more resilient.

Nevertheless, these figures show that the authorities will need to do more if they want to achieve their 2026 growth targets. We continue to expect targeted but significant measures to be introduced early this year to support domestic demand.

Japan: Inflation eases more than expected in Tokyo

Confidence remains weak but rebounds in January

Inflation in Tokyo eased more than expected in January, with headline inflation falling to 1.5% year‑on‑year from 2% the previous month. Tokyo inflation is an early indicator of nationwide inflation. This deceleration is good news for the BoJ and may provide reassurance as it continues its very gradual adjustment of monetary policy.

Nevertheless, with the stimulus plan announced by the government, we expect the BoJ to continue raising its policy rate over the course of the year, with two hikes anticipated in 2026.

Sebastian Paris Horvitz

Director of Research