Global industrial activity remains mediocre

Link

Find the market analysis for April 02, 2025, signed by Sebastian PARIS HORVITZ.

Summary

► Tonight, all eyes will be on the US President's tariff announcements. After numerous rumors, it would appear that most of the USA's trading partners will be affected by bilateral tariffs. Nevertheless, in D. Trump's own words, the tariff hikes will be moderate. We'll see. It's hard to believe that this will be the end of the uncertainty over trade rules that the US administration wants to impose. But maybe we can have a short truce. What is certain is that everyone will adjust their economic and financial forecasts after these announcements.

► What is also certain is that the level of uncertainty still calls for a degree of caution in market exposure, particularly to US risky assets. This uncertainty has certainly also contributed to the fragility of the US economy at the start of the year. First of all, consumer spending seems to have come to a real standstill. Households preferred to increase their savings rather than spend. Admittedly, car sales seem to have rebounded strongly in March, no doubt due to the forthcoming price hikes on imported cars. But all in all, we're heading for a big consumer slump in 1Q25. Investment seems to be holding up better, although industrial activity seems to have deteriorated again in March.

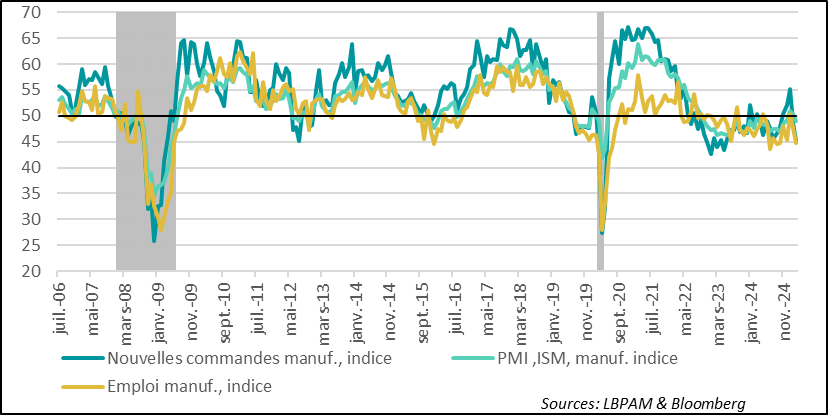

► Indeed, both S&P's PMI (manufacturing) and ISM surveys fell in March across the Atlantic. While inventories were boosted by tariffs, new orders and employment were hit hard by uncertainty. The ISM index is once again in contraction territory.

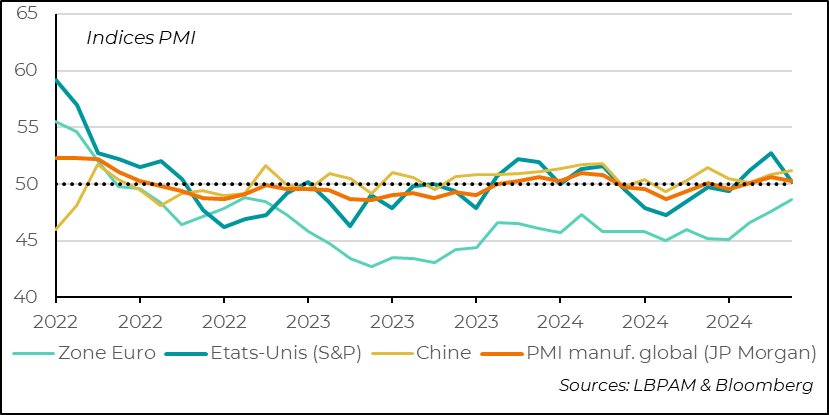

► The loss of dynamism in the United States has contributed to a slight deterioration in the situation of industry worldwide, which is struggling to take off. The climate of uncertainty created by US protectionist measures is certainly not conducive to confidence. At the same time, industrial activity in China continues to recover, still driven by foreign demand. In the eurozone, industrial activity continues to contract, but seems to be gradually coming out of its rut.

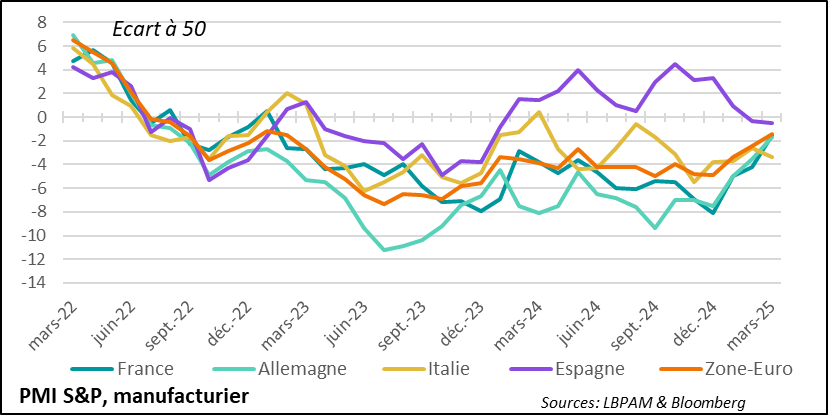

► In fact, in the eurozone, industry followed different trajectories in the major countries during March. While activity seems to be gradually heading towards stabilization in France and Germany, it took a more disappointing turn in Italy and especially Spain, where activity contracted further after a year of continuous expansion since February 2024. Obviously, the new measures against European exporters that D. Trump could take are likely to weigh further on activity. At the same time, we believe that continued monetary easing will help activity, as will new public spending, particularly in Germany. The second half of the year should therefore be more favorable.

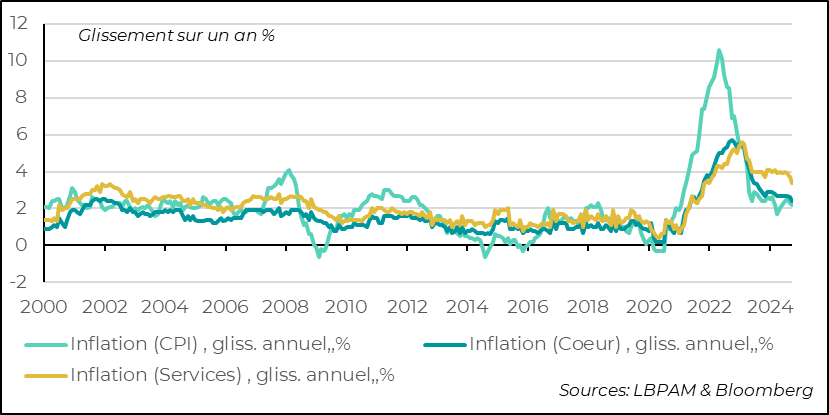

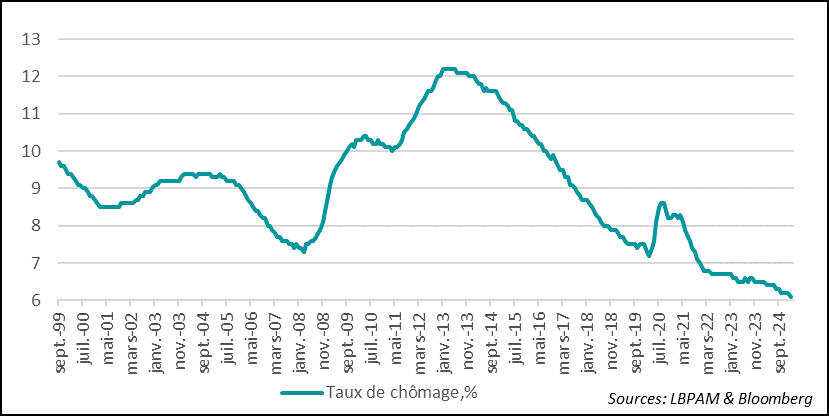

► Further ECB rate cuts are an important ingredient in our European recovery scenario. In this respect, the inflation figures for March proved fairly reassuring, with inflation decelerating to 2.2% year-on-year. Above all, underlying inflation slowed more than expected, to 2.4%, with services inflation finally dipping below 3.5%. We remain confident that the effects of indexing wages to inflation will dissipate, allowing disinflation to continue. Admittedly, the ECB remains vigilant on this point, as the unemployment rate is still historically low (6.1% in February), which could maintain more lasting wage pressures.

To do deeper

While we await D. Trump's announcement today of the list of countries to be affected by new bilateral tariffs, and above all the levels, the effects of the US protectionist policy are weighing on activity.

Thus, with the publication of S&P's monthly manufacturing PMI indicators, we can see that activity slowed in March. This trend is largely due to the downturn once again experienced by industry in the United States. In the other major regions and countries, however, business trends were slightly more favorable than in the previous month.

In China, activity rebounded again in March, but this seems to have been driven once again by external demand. Tariff hikes seem to have prompted Chinese companies to step up production in order to satisfy the rise in demand that has emerged, and to avoid, at least in the short term, some of the negative impact of the sharp increase in import taxes. Nevertheless, in the medium term, these protectionist policies are likely to weigh on Chinese industry, especially if domestic demand does not take off more rapidly.

All in all, the global industrial cycle has remained depressed for several years. US protectionism is likely to weigh further on the industry, where companies are having to adjust to a highly uncertain environment, particularly in view of trade policies that could prompt some countries to adapt their production strategies. In any case, the wait-and-see attitude is likely to persist.

Global industrial activity: S&P manufacturing PMI surveys show a slowdown in activity in March, particularly in the US

The ISM survey for the US industrial sector also showed a deterioration in activity in March. In fact, the overall index is back in contraction territory. In particular, it's clear that most manufacturers seem to have pulled on the handbrake, with pronounced declines in both the employment and new orders sub-indices. The disarray created by the Trump administration's economic policy initiatives clearly seems to be preventing companies from committing to the future.

United States: March ISM survey shows industrial activity back in contraction zone

In fact, what's most worrying is that demand could weaken more sharply than expected, pushing activity even lower and triggering a process of sharp contraction, or even recession.

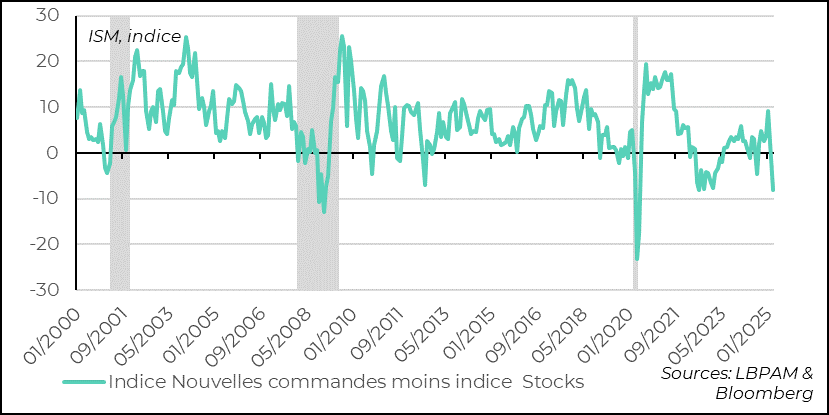

Although somewhat biased by companies' stockpiling behavior prior to the announcement of the tariff hikes, one indicator that has often been fairly reliable for tracking the industrial cycle is the gap between the new orders index and the inventory index. Over the last two months, but especially in March, there has been a very pronounced drop. An ominous message for the future.

United States: the cyclical indicator, the difference between the new orders index and the inventory index, points to a pronounced deterioration in activity

In the eurozone, industrial activity remains depressed, as corroborated by S&P's March PMIs. Nevertheless, in both France and Germany, activity is continuing to pick up, even if we're still a long way from returning to growth. Clearly, in the current climate, with the winds of uncertainty blowing in from the United States, it is difficult to envisage a rapid upturn.

Unfortunately, the lesser contraction in activity in the major countries in March contrasts with the continuing slump in activity in Italy and Spain. For the latter, the last few months have been particularly unfavorable. Indeed, for two months now, industrial activity has been contracting, after a year of continuous growth.

Eurozone: the situation in industry remains depressed, despite a slight improvement in March, with the periphery unfortunately struggling at the start of the year

The budget spending measures announced by Germany in particular should support growth over the course of the year, but their impact will only be felt very gradually in 2025. Other countries should also benefit from spending on defense activities.

Nevertheless, a key factor in Europe's recovery will remain the ECB's continued monetary easing. In this respect, inflation figures for March were very reassuring. Total inflation, as expected, decelerated to 2.2% year-on-year. Above all, core inflation fared slightly better than expected, decelerating to 2.4%, the lowest level since January 2022.

One of the most striking features of this deceleration in inflation is the downward trend in service prices. For the first time since June 2022, the index has fallen below 3.5%!

Euro zone: inflation on a favorable trend in March

This is good news for the ECB. Nevertheless, it still seems to us that the ECB should skip April and wait until June to continue its monetary easing. On the one hand, there is still a great deal of uncertainty surrounding the US tariffs, and it would be reasonable to have at least a month to see what impact they might have.

On the other hand, Mrs. Lagarde has always tried to maintain the cohesion of the Board of Governors, and she will surely seek to allay the concerns of the more conservative members, a number of whom believe that even more caution is needed in the trajectory of key rate cuts.

In particular, with substantial fiscal spending ahead, the more conservative members are likely to insist on the need to be more patient in monetary adjustment, as her policies could push the ECB's “neutral” rate higher than previously anticipated. In addition, while ECB economists still expect wage deceleration to continue, as we do, the fact that the region's unemployment rate remains historically low possibly remains a pressure factor that could make wage deceleration slower.

Euro zone: unemployment at an all-time low

Sebastian PARIS HORVITZ

Head of Research