Greater uncertainty

Link

-

Iran attacked Israel this weekend. More than 300 drones and missiles were reportedly launched, but almost all of them were intercepted by Israel, aided by the American, British and French armies. The US President has called for an emergency meeting of the G7 countries to avoid escalation. The prevailing feeling is that this eventuality will be avoided, but there is a great deal of uncertainty. Especially as the Israeli authorities still seem intent on entering Rafah in pursuit of Hamas, with the risk of civilian casualties. This could exacerbate tensions. In the very short term, in the event of further tensions, the premium on the price of oil could rise and the search for safe havens could increase, particularly for US government bonds and gold.

-

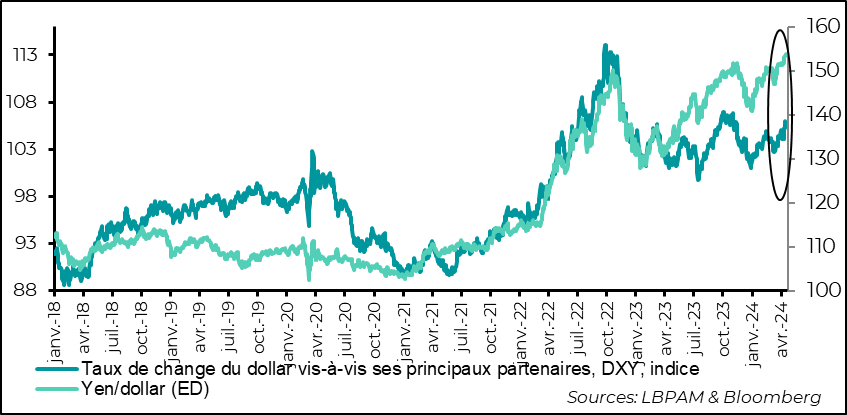

Geopolitical tensions are exacerbating the uncertainty surrounding the path of monetary policy. The bond market has already undergone a very sharp adjustment. In particular, the major change is the expectation of a delay in the start of monetary easing and fewer key rate cuts by the Fed this year. The US 10-year yield gained almost 60 basis points over 3 months, to 4.5%. This explains the strong surge in the dollar, which could also be fuelled by the new geopolitical tensions.

-

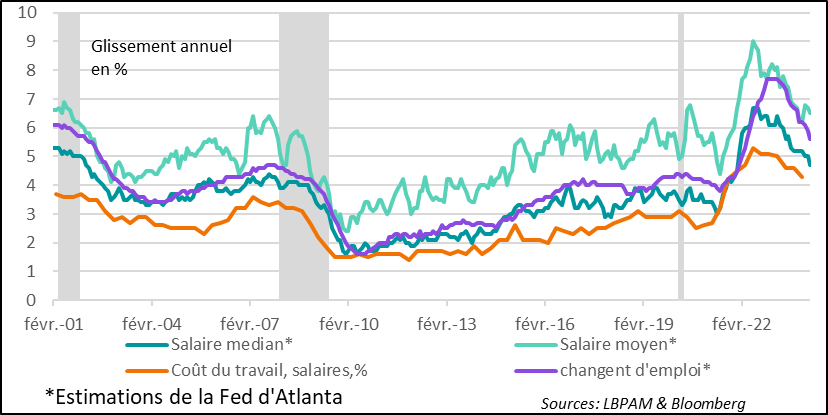

The Fed's decisions will be determined by the dynamics of growth and inflation. After three months of disappointing inflation figures, the Atlanta Fed's estimates of wage growth for March were more reassuring. The deceleration continues, with median wages rising by 4.7% year-on-year, after 5.0% the previous month. However, this is still too high to converge towards the 2% inflation target.

-

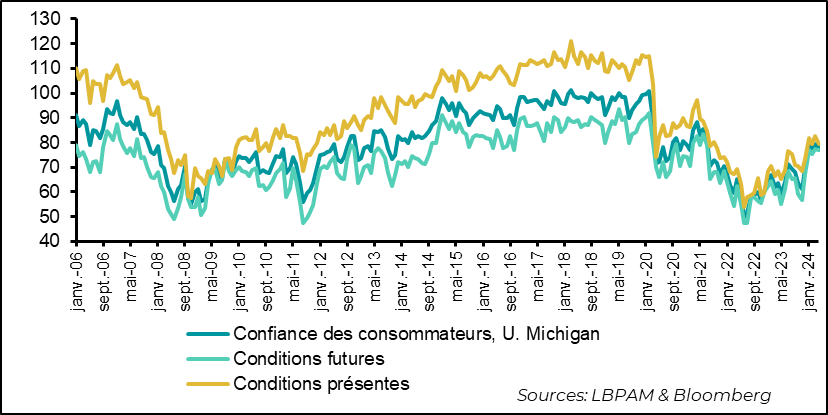

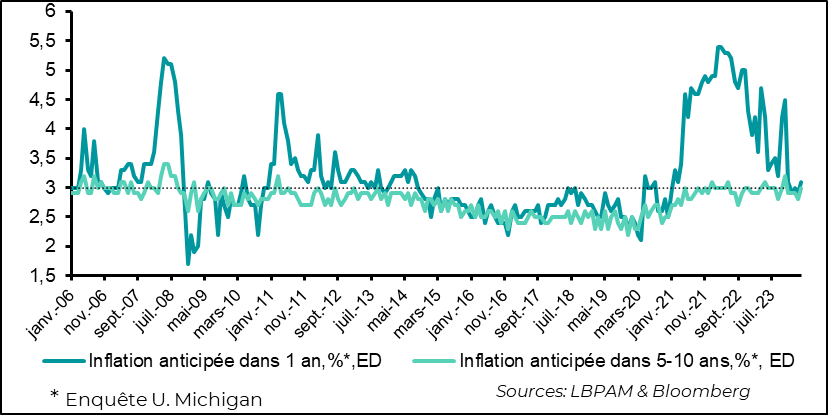

At the same time, the University of Michigan's preliminary survey of US household confidence for April showed a slight fall, but it remains at its highest level since 2021. Although still relatively weak by historical standards, consumption should hold up, with the labour market still resilient. On the other hand, short- and medium-term inflation expectations have risen slightly, to close to 3%.

-

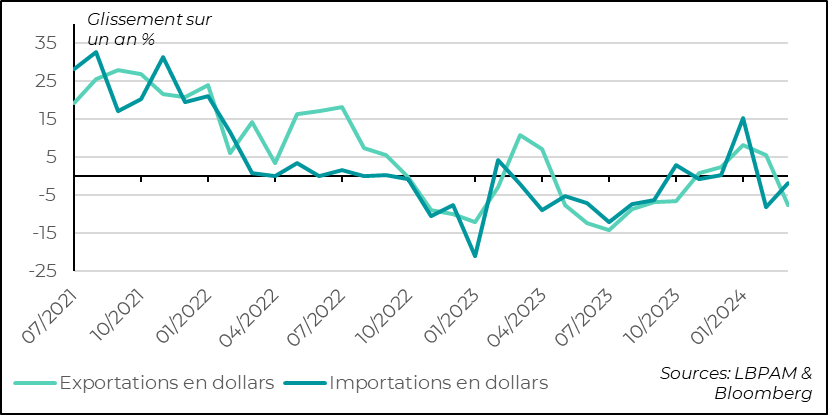

In China, foreign trade data disappointed. Exports in current dollars fell by much more than expected year-on-year. Base effects may have disrupted the statistics, but they may also indicate less solid support from foreign demand, which could weaken activity. Imports have also continued to fall, whereas a slight rise was expected. We will have to wait and see over the coming months to get a better idea of the impact of global demand on Chinese growth, and its impact on the rest of the world, particularly on demand for raw materials.

Geopolitical uncertainty has risen a notch with Iran's direct attack on Israel this weekend. Nevertheless, the country's defence capabilities and the support of its allies prevented almost all of the more than 300 drones and missiles from reaching the country and causing widespread damage or casualties.

At this stage, the diplomatic efforts of the Arab and G7 countries seem to be bearing fruit. Both Israel and Iran appear to be exercising restraint.

But obviously, given the very tense situation and Israel's possible intervention at Rafah, things could change and the escalation scenario could once again gain ground.

At this stage, it would appear that tensions are easing on the markets. The rise in the dollar seems to be stabilising, while flows into safe havens such as US government bonds and gold are fading.

Nevertheless, the backdrop of uncertainty over the path of monetary policy is likely to persist. In fact, long-term interest rates have risen sharply in recent times as a result of the sharp revision in expectations of rate cuts by central banks, particularly the Fed. Today, the market is expecting fewer than two rate cuts by the Fed, compared with six at the end of last year. We expect two. The US 10-year yield has gained almost 60 basis points in the last 3 months, to 4.5%.

Against this backdrop, geopolitical tensions have only exacerbated the appreciation of the dollar, which has benefited from expectations of a divergence in interest rates between the US and its trading partners.

The dollar thus appreciated against almost all currencies over the last period. The strongest movement has obviously been against the yen, which is now at its lowest level against the dollar since the early 1990s.

The Japanese authorities have not intervened to calm the yen's decline. The extreme weakness of the Japanese currency obviously poses a problem in terms of competitiveness for other countries. This should be corrected, but in the very short term we risk seeing a weak yen.es autorités japonaises ne sont pas intervenues pour calmer cette baisse du yen. L’extrême faiblesse de la devise nippone pose évidemment un problème du point de vue de la compétitivité pour les autres pays. Ceci devrait se corriger, mais, à très court terme, on risque de voir un yen faible.

Fig.1 Dollar: Upward pressure from expectations of a much slower easing of monetary policy, exacerbated by geopolitical tensions

The path of US monetary policy will largely be determined by inflation trends. After three months of consecutive inflation disappointments, the wage growth figures published by the Atlanta Fed were a little more reassuring. Indeed, wages continued to decelerate in March. The median wage rose to 4.7% year-on-year, compared with 5.0% the previous month.

Nevertheless, this level is still far too high. In addition, although the number of people changing jobs is falling, salaries are still rising sharply, to 5.6%. However, it is also decelerating.

These figures should reassure the Fed somewhat. But given the growth in wages, this is unlikely, at this stage, to radically change the debate on whether higher inflation will persist for longer than expected. The Fed is likely to remain cautious and ease monetary policy very gradually.

Fig.2 United States: Wages continue to decelerate according to Cleveland Fed statistics, even though their growth remains far too high to reach 2% inflation

Rising wages and a still solid job market are still reflected in household confidence. Indeed, the U. of Michigan's preliminary survey for April showed that confidence fell slightly, but remains close to the average since the start of the year, at its highest level since the summer of 2021. The rise in asset prices since the start of the year is surely a factor that has also supported confidence.

Fig.3 United States: Household confidence falls slightly according to the U. of Michigan survey, but remains close to the highest levels since the summer of 2021.

On the other hand, as in the previous month, these preliminary results show that short- and medium-term inflation expectations have risen slightly, back to the 3% level. We shall see whether the final survey confirms this diagnosis. The volatility of these figures recently is understandable, but for the Fed, lower inflation expectations would be far more reassuring.

Fig.4 United States: Upward pressure from expectations of a much slower easing of monetary policy, exacerbated by geopolitical tensions

While China is due to publish its GDP growth figures for 1Q24 this week, the foreign trade figures for March were not reassuring. Both exports and imports disappointed.

Exports fell by 7.5% year-on-year in current dollars, whereas expectations were for a decline of less than 2% to take account of unfavourable base effects. It is possible, as is often the case with March, that distortions persist in the figures. In fact, in the detailed figures, there were a few more reassuring pockets, such as exports of vehicles and semi-conductors, which rose sharply in the first quarter. The GDP figures should give us a more precise answer to the contribution of foreign demand, which has so far been a major support to growth.

The figures for imports were also disappointing. A year-on-year fall of 1.9% in dollar terms was recorded in March, much weaker than the 1% growth expected. This partly reflects the fact that domestic growth is still sluggish, despite the support given to Chinese industry.

We are still expecting GDP growth in 1Q24 to be close to the government's target of 5%.

Fig.5 China: Upward pressure from expectations of much slower monetary policy easing, exacerbated by geopolitical tensions