Growth Disappoints in Europe

Link

How is global growth doing? Find out in the market analysis of September 9, 2024, by Sebastian PARIS HORVITZ.

In summary

►The global industrial cycle remains depressed according to preliminary PMI data from S&P. This weighs on global growth. Thus, it is primarily the services sector that remains dynamic and allows for the continued expansion of economies. In this context, rate cuts by major central banks are an appropriate response to ensure that activity consolidates in the coming quarters.

►However, the contrast in dynamism across different regions of the world remains significant. India remains one of the most dynamic countries in the world, although growth seems to be moderating. The United States, thanks to activity in the services sector, maintains solid growth, although a slight deceleration is also observed. Indeed, the weakening of the labor market should contribute to the continued slowdown in activity across the Atlantic, in our view. An early indicator is the decline in consumer confidence, as measured by the Conference Board, which fell sharply in September.

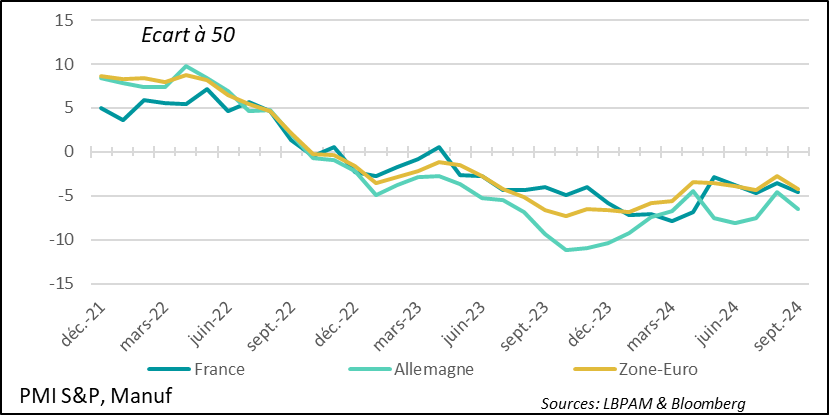

►The eurozone is lagging, with PMIs declining in both industry and services. The aftermath of the strong increase in services activity due to the Olympics in France is very marked in September. The activity indicator has entered contraction territory, significantly contributing to Europe’s poor performance. We will see if activity normalizes in France next month.

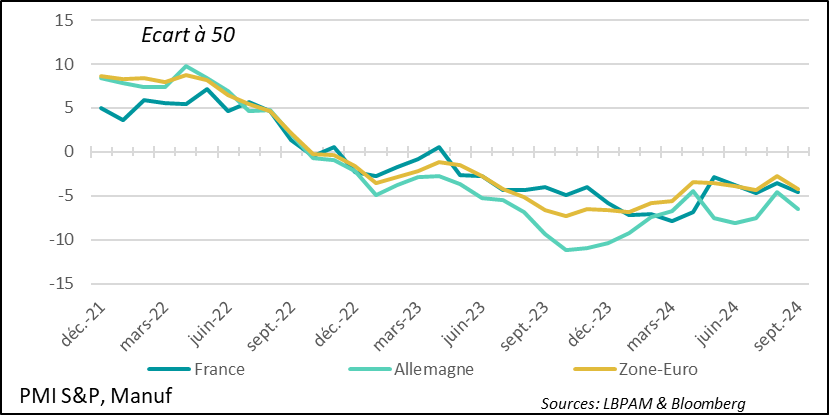

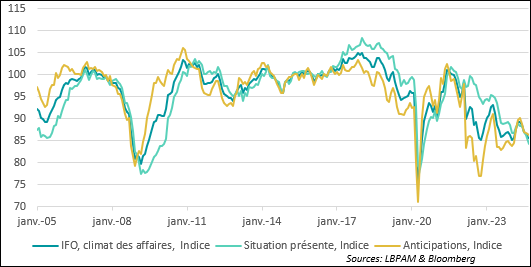

►Germany, the main economy of the eurozone, remains mired in mediocre economic dynamics, particularly in industry. The loss of confidence in Germany is also confirmed by the IFO survey, which continues to decline. The gradual easing of monetary policy should play an important role in supporting activity in the zone in the coming quarter.

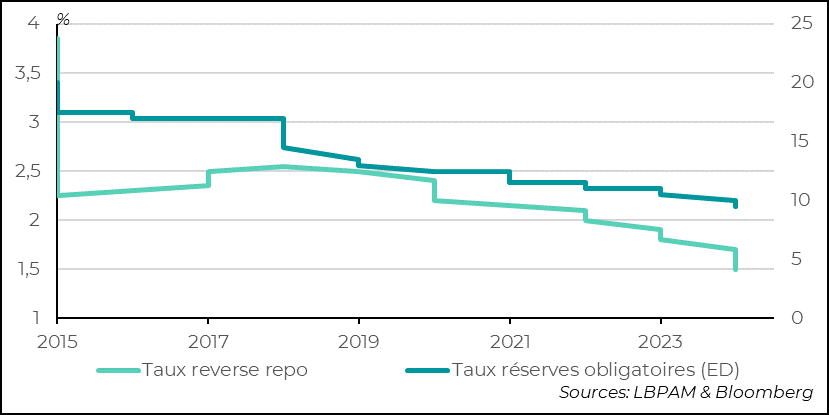

►Chinese authorities have shown increased concern about the deterioration of growth dynamics. Indeed, the central bank (PBOC) has again, and significantly, lowered its key rate and reduced the reserve requirement ratio to stimulate credit. Additionally, the authorities have reduced the down payment rate for home purchases from 25% to 15% to send a new signal of support to the still-struggling real estate sector. Similarly, the PBOC has made more than $70 billion available to institutional investors to invest in the stock market.

►The direct assistance from the PBOC to finance stock purchases resulted in a strong rebound in Chinese stock markets. However, it remains to be seen whether the measures taken will have a lasting effect on growth. It is uncertain whether they will be sufficient to restore confidence and stimulate domestic demand in the medium term.

►The decision by Chinese authorities to stimulate the economy somewhat offset the disappointment in global activity indicators. Thus, in the stock market, the most China-exposed stocks, particularly luxury goods in the eurozone, have benefited significantly from these decisions. At the same time, the entry into a more generalized cycle of rate cuts by central banks also fuels risk-taking. These forces could maintain, at least in the short term, the appetite for risk.

To go deeper

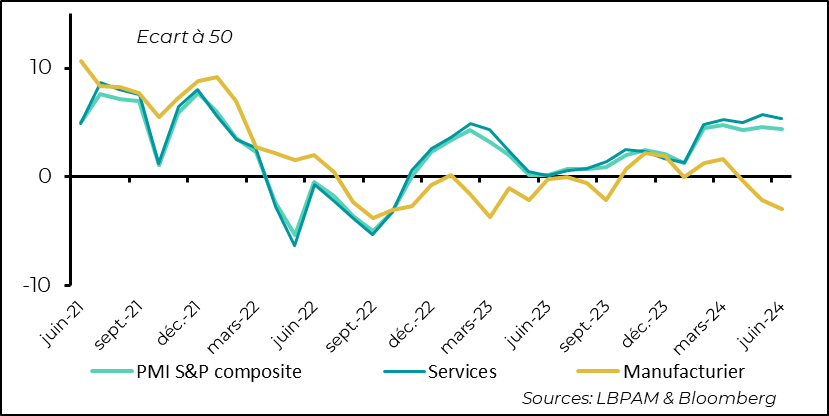

Preliminary S&P PMIs for September showed a deceleration in global economic activity, at least when referring to major economies. Two key points stand out. On one hand, the global industrial cycle remains stalled. On the other hand, the differences in dynamism around the world remain quite pronounced.

It is notable that industrial activity continues to contract globally and even more markedly. Thus, the early-year rebound seems to have vanished. It appears that the restart in the industry is struggling in this post-Covid phase. Demand seems to lack dynamism, while Chinese overproduction in certain sectors could also weigh on the industry in some economies. Nonetheless, the consolidation of growth that we expect, particularly for 2025, depends on a strengthening of the global industrial cycle, which is currently absent.

The cycle of central bank rate cuts should help support the return of demand.

At the same time, services continue to be the main driver of global expansion.

This contrast is particularly visible in the United States, where the services sector remains very dynamic, according to the S&P survey (note that the ISM survey has given a more mixed message in recent months). Even with a slight decline in September, the index remains close to the highs seen over the past two years.

Meanwhile, industrial activity has again declined across the Atlantic, with the index falling to its lowest level since June 2023. At this stage, a quick rebound is hard to foresee. Nevertheless, we believe that the easing of monetary policy should help a recovery in the coming quarters.

United States: The expansion of the American economy continues at a good pace according to the S&P PMI survey for September, with services still being the main driver.

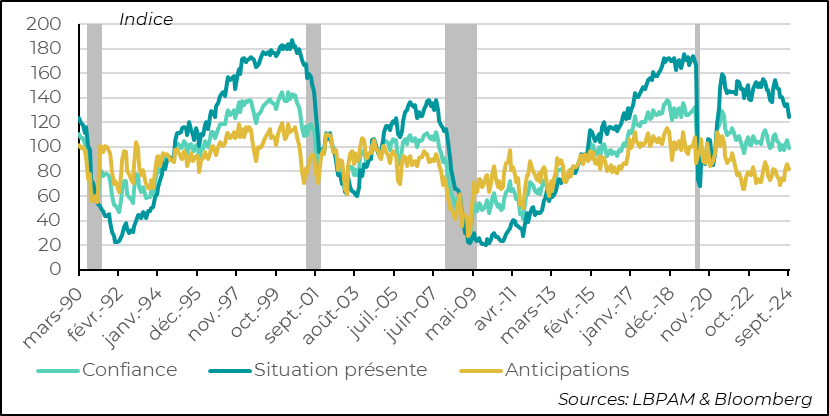

Despite the optimism reflected in the services PMI, it seems that the growth momentum across the Atlantic could well slow down after the strong performance at the beginning of the year. Indeed, the Conference Board’s consumer confidence survey for September showed a sharp decline. This is largely driven by households’ perception of current conditions, with the index dropping significantly.

United States: Consumer confidence measured by the Conference Board drops sharply in September…

Admittedly, there may be effects related to the upcoming elections, but it seems that the normalization of the labor market has once again affected confidence.

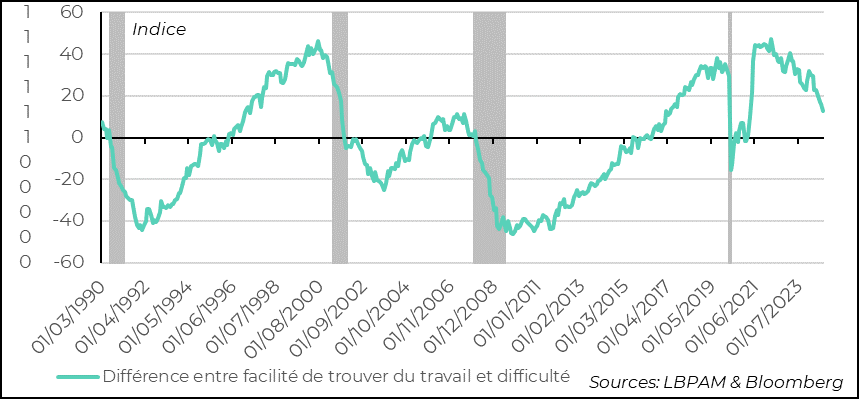

The reduction in job openings by companies and significant entries into the labor market, which have resulted in a rise in the participation rate, have gradually created a less favorable employment environment.

Thus, the measure often used to gauge households’ perception of the labor market is the difference between those who find it easy to get a job and those who find it difficult.

This measure has been declining for several months. It remains positive but seems to indicate that we are no longer in an overheated labor market regime as we clearly were a few quarters ago.

This should both reassure and concern the Fed. It reassures because it should confirm the trend towards wage moderation and contribute to the continued decline in inflation. It concerns because it could also reflect a faster deterioration of the labor market than anticipated, which the Fed wants to avoid today.

At this stage, we have a rather reassuring message about the state of the labor market from certain indicators, such as unemployment claims, which remain relatively low and thus show that there is no significant layoff dynamic taking place. Thus, we are likely in a phase of labor market normalization rather than a period of rapid deterioration, with the obvious risk of a possible recession.

United States: …this drop in confidence seems to be primarily related to a less favorable labor market

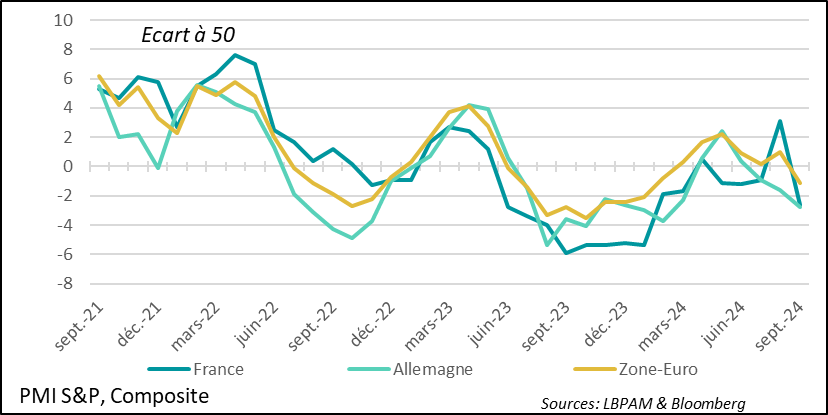

In the eurozone, the preliminary S&P PMI survey for September clearly disappointed and indicates a marked deterioration in activity within the zone. The drop in the composite indicator is notably explained by the considerable decline in the French index.

Indeed, in France, the composite indicator has fallen sharply. This is largely due to the abrupt correction of the favorable effect of the Olympics, which had led to a significant rebound in services activity in France.

However, the contraction in activity indicated by the index for September extends beyond France. The German economy remains struggling, and it appears that activity in the rest of the zone also weakened over the month

Eurozone: The S&P PMI survey indicates a sharp drop in activity in September, placing it back in contraction territory

The mediocrity of the global industrial cycle remains very present in the eurozone, with further deterioration. Germany remains the most affected economy.

Services are still holding up, remaining in expansion territory. This is despite the sharp drop in the services index in France, which is a form of correction from its strong rise the previous month due to the Olympics effect.

We will see next month if activity normalizes in France and if services activity regains ground. The ECB’s rate cuts are more than welcome to stimulate a credit cycle, which should benefit growth.

Eurozone: Services continue to support growth, with the PMI index still in expansion territory… but growth is fragile

The poor economic situation in Germany, coupled with a deteriorating political context, is reflected in the IFO survey for September. The overall index has fallen again. This decline affects not only sentiment about current conditions but also future expectations. The latter is obviously a bad omen for the future.

It seems to us that without more support from the German government, the economic recovery risks remaining slow and dragging down the eurozone, despite the positive effect of the monetary easing initiated by the ECB.

Germany: The IFO survey unfortunately confirms the negative message of the PMIs, with another decline

With disappointing economic data, it seems that the authorities have decided to act to provide more stimulus to the economy. Thus, the central bank (PBoC) has launched a series of measures to further ease credit conditions. The key rate has been lowered again, while banks’ reserve requirements have also been reduced to encourage lending.

China: Authorities mobilize through the Central Bank to stimulate the economy via credit

Additionally, the authorities have taken new measures to stimulate the real estate sector, particularly demand, by lowering the down payment rate for purchasing a home from 25% to 15%. We will see if this measure truly stimulates demand, as similar measures have so far failed to revitalize the struggling real estate sector.

Furthermore, the authorities have decided to do more and differently to support the stock prices of Chinese companies. Over $70 billion has been made available to institutional investors to buy stocks. This has had the immediate effect of strongly supporting prices and causing Chinese stock markets to soar. In the short term, we believe these measures should provide a boost to Chinese equities.

It remains to be seen if more direct measures to support demand will be taken, as this is largely how confidence can be restored.

Sebastian PARIS HORVITZ

Head of Research