Growth is currently neither too strong nor too weak

Link

Key takeaways from the september 23 , 2025 market update insights from Xavier Chapard.

Overview

► While last week was dominated by numerous central bank meetings, the focus shifts back to economic conditions this week with the release of the first surveys for September in developed economies (including S&P Global’s flash PMIs today). As markets are pricing in significant Fed rate cuts without a marked slowdown in growth, the margin for error in economic indicators is narrow. A sharper slowdown would undermine corporate earnings expectations, while a reacceleration in growth would challenge the Fed’s ability to cut rates in an environment where inflation remains above target. The good news is that current data supports this middle-ground scenario in the short term, which could allow market optimism to persist for now.

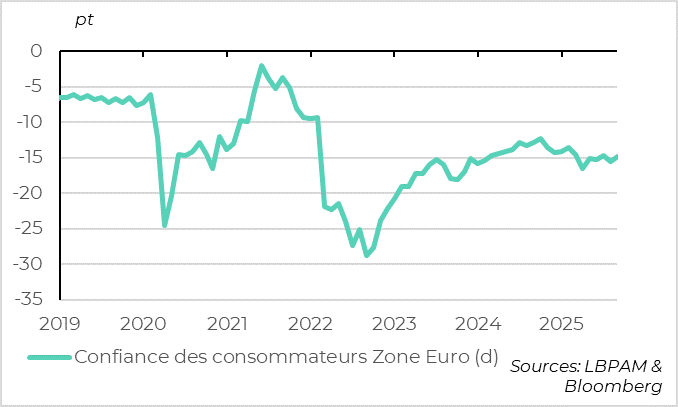

► Eurozone consumer confidence reversed its unexpected drop from August in September, but at -14.9 points, it remains subdued. This suggests that consumption is still sluggish despite falling inflation and resilient employment. We continue to expect slightly above-consensus growth for Europe next year (1.2%), supported by relatively accommodative monetary and fiscal policies and lower energy prices in euros. However, a more noticeable recovery in confidence and economic activity will likely have to wait until the end of the year.

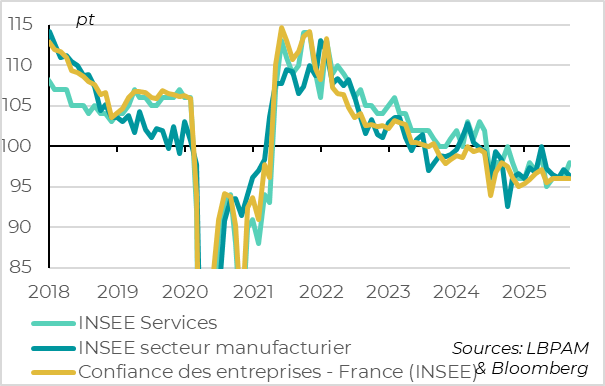

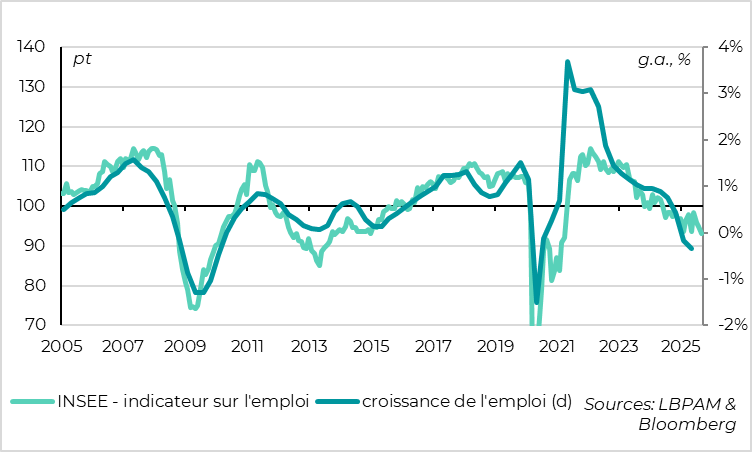

► Business confidence in France remained stable in September, at 96 points according to the INSEE survey, still below its long-term average. At least it didn’t decline, despite rising political tensions and fiscal uncertainty, and remains consistent with slightly positive growth. This aligns with our expectation that French growth will fall below the Eurozone average starting this year, while remaining positive and not jeopardizing the broader recovery. That said, the aggregate employment indicator dropped to its lowest level in ten years (excluding the COVID period), reflecting corporate caution that limits the potential for a stronger rebound.

►France’s credit rating was downgraded again this weekend, this time by DBRS (from AAh/Negative to AA/Stable). At the same time, Fitch, which had downgraded France the previous week to A+, upgraded Italy’s rating from BBB to BBB+. These changes were expected but once again highlight the diverging paths of France and Italy. This is already well reflected in the markets, as France and Italy have been paying similar yields to borrow for 10 years since last week. However, given that political and fiscal uncertainty is likely to remain high in France in the coming weeks, while Italy’s fundamentals continue to improve, we remain cautious on French debt compared to that of Southern European countries.

In-Depth insights

The European consumer remains cautious

Consumer confidence picked up slightly in September

Eurozone consumer confidence rebounded in September, rising from -15.5 to -14.9 points according to the European Commission’s initial estimate. This is reassuring, as it offsets August’s unexpected decline, which had interrupted the recovery trend seen since the lows of April (at the peak of trade uncertainty). However, the indicator remains well below its historical average and its level at the start of the year.

Households remain cautious despite solid fundamentals. The labor market is resilient (with unemployment at a historic low of 6.2% in July), real wages are rising thanks to moderating inflation, and the household savings rate remains high. With improving credit conditions following ECB rate cuts and lower energy prices in euros, one might expect a faster recovery in confidence and consumption.

Overall, the recovery in consumption is likely to remain sluggish in the short term due to external uncertainties (and domestic ones in France), but should continue and even strengthen towards the end of the year as external headwinds fade and fundamentals remain supportive.

France: companies accustomed to political risks

French business confidence remains stable at a surbdued level

According to the INSEE business survey, confidence remained stable in September for the fourth consecutive month, at 96 points. While this is still below the long-term average (100 points), there is no sign of a shock linked to increased political and fiscal risk since the end of August. Notably, confidence improved in the services sector in September—a sector focused on the domestic economy—which offset a slight deterioration in industry.

Overall, the INSEE indicator is consistent with growth below potential (i.e., below 1.0%) but still positive.

However, employment continues to slow, reaching its lowest level in ten years

French companies, however, report reducing employment in September, with the aggregate employment indicator falling to 93 points—its lowest level since 2015 (excluding the COVID period). Unlike the rest of the Eurozone, employment in France has been slightly declining since late 2024, and this survey suggests the trend continued over the summer. In contrast, employment appears to be stabilizing in Germany after a decline in the first half of the year.

This suggests that French companies remain cautious in the face of ongoing uncertainties, and that consumption prospects in France are constrained despite households maintaining a historically high savings rate in mid-2025 (19%).

Xavier CHAPARD

Strategist