Harris vs Trump, less than 2 months to go before the outcome

11.09.2024

Link

Sebastian PARIS HORVITZ provides an in-depth analysis of the US presidential elections in his September 09, 2024 market review.

In summary

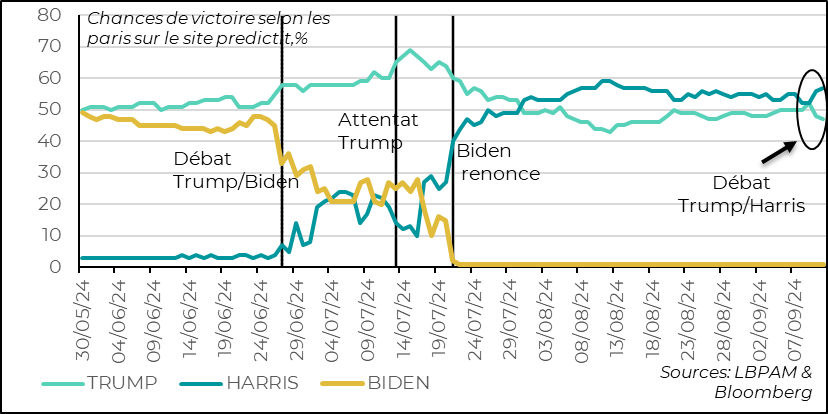

►The American presidential election is fast approaching. Last night's debate seems to have gone in K. Harris's favor, if most of the pundits' comments and online betting are to be believed. We'll see if K. Harris maintains this lead. After the debate, K. Harris, in a sign of her good performance, received the support of mega-star Taylor Swift.

►The road to the election is not over, and is likely to add volatility to the markets. But the Fed's monetary policy decision next week will be the most decisive for the markets in the short term. The CPI inflation figures due today, in the event of a much steeper than expected fall, could push the Fed to a sharp 50bp rate cut. This is not our scenario. Although energy prices are likely to contribute to disinflation, core inflation is likely to show a further moderate decline. This, together with a labor market that is not collapsing, is in our view in line with an initial moderate cut of 25 bp.

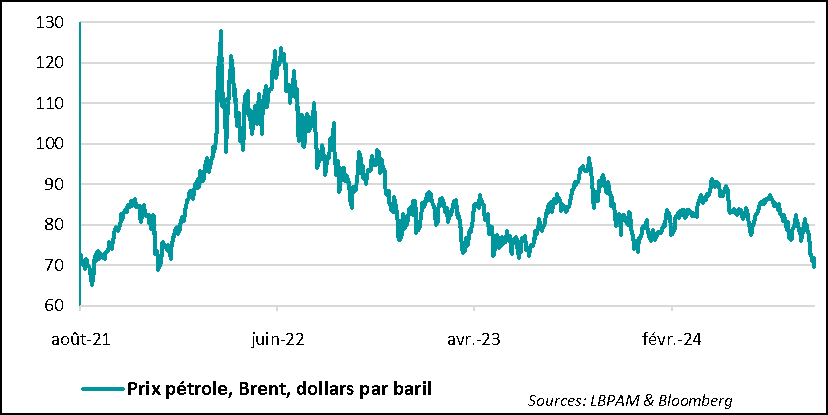

►Energy's contribution to disinflation is obviously a positive factor. This supports household purchasing power in the US and Europe, and therefore growth. This fall in energy prices is due to the sharp drop in the price of oil ($69.7 a barrel). Weak global demand, particularly in China, is weighing on prices. Nevertheless, while OPEC countries were expected to reduce their production cuts in October, they, and Saudi Arabia in particular, could further reduce supply in order to support prices.

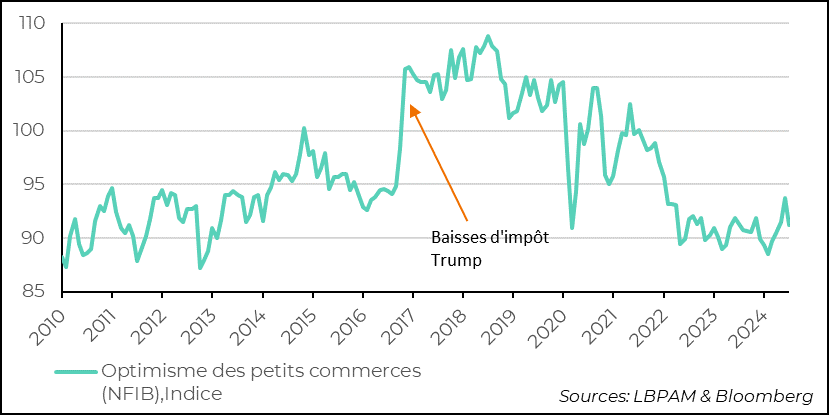

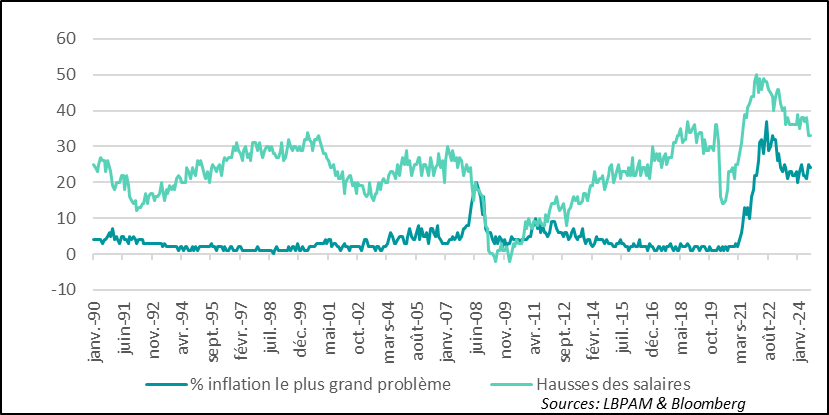

►Today, any variable that gives a signal on the evolution of the American economic cycle is important to follow, in view of the concerns that have spread to the markets about the risk of recession. The August NFIB survey shows that small business confidence is slipping, but not collapsing. Inflation remains a problem, but on the labour market, wage increases are easing.

►As mentioned earlier, China's weak economic performance continues to give cause for concern. Domestic demand is unable to take off in the face of a deflationary deleveraging strategy. Strong support for production, rather than consumption, is reflected in falling prices, but is nonetheless finding an outlet on world markets, with exports continuing to grow quite strongly (8.7% year-on-year in dollars, in August). Imports are stagnating.

The televised debate between K. Harris and D. Trump last night seems to have given an advantage to the current Vice-President of the United States. Obviously, the debate presented a huge contrast with the one between D. Trump and J. Biden. On both economic and social issues, K. Harris put D. Trump in a defensive position, prompting him to launch numerous attacks on the Vice President that seem to have been rather detrimental to the former president.

All in all, the first imperfect measures of the outcome of this debate were seen in online betting, which turned, markedly, in Ms. Harris's favor. In addition, anecdotally, Mrs. Harris, after the debate, had the pleasant surprise of receiving the support of mega-star Taylor Swift, who declared that, in view of the debate, she would vote for K. Harris and T. Walz, her running mate.

For more information

United States: the debate between K. Harris and D. Trump seems to have turned in favor of the vice-president, if online betting is to be believed

Following the debate, some called for a new debate between the two candidates. It would appear that, in view of D. Trump's performance, there is some hesitation in his camp to organize another. We'll know in the coming days.

Obviously, the economic programs of the two candidates have many differences, with D. Trump in particular advocating major tax cuts and a highly protectionist trade strategy. Nevertheless, both could still significantly increase the US public deficit, although by most calculations, D. Trump's would be far more costly. On the markets, it's the promises of further tax cuts that are translating into greater support.

The race for the presidency is not over, and is likely to bring further volatility to the markets. Also, we must not overlook the elections for both chambers, especially the Senate. At this stage, most estimates point to a Republican majority, with the gain of two seats, i.e. their 51 out of 100. Nevertheless, some elections remain highly undecided. In the event of a Harris victory, it is clear that control of the Senate by the Republican party would severely limit the new president's room for manoeuvre in implementing her policies.

One piece of good news for the global economy in recent weeks has been the fall in oil prices. The price of oil has fallen to its lowest level since the end of 2021, reaching $69.5 a barrel for Brent crude.

This should restore purchasing power to households on both sides of the Atlantic and support growth, while contributing to ongoing disinflation.

At the same time, this fall in oil prices also reflects the lack of momentum in the global economy. Growth is still there, but expansion is slow, with the economy struggling to regain momentum.

Against this backdrop, OPEC's latest forecasts for future demand have been revised downwards for 2024, to 2.11 million barrels/day, compared with 2.25 million barrels/day previously. This also weighed on prices.

Global: oil prices continued to fall, reaching their lowest level since the end of 2021

As a result, the market seems to be in a situation of slight oversupply, despite the OPEC+ countries' reduction in supply by almost 2 million barrels/day. It's hard to say today what OPEC's final decision will be on the production cuts initially envisaged last year. Indeed, the organization had announced that it might open the floodgates again in October. This now seems unlikely, given current price levels. In fact, we could possibly see further cuts. Added to this uncertainty could be a premium that seems to have disappeared concerning tensions in the Middle East. It is against this backdrop that we continue to believe that oil prices could recover somewhat between now and the end of the year.

Economic growth still seems resilient, even if there are signs of a gradual slowdown, as last week's labour market figures showed. In a similar vein, the NFIB survey in the US also showed a slowdown in activity, if we refer to the drop in confidence in August. This has broken the upward momentum in this indicator seen since March. Nevertheless, this indicator is also highly sensitive to the political context, and it is likely that the change in the dynamics of the presidential election has had an impact on business sentiment.

United States: NFIB survey shows a drop in confidence in August

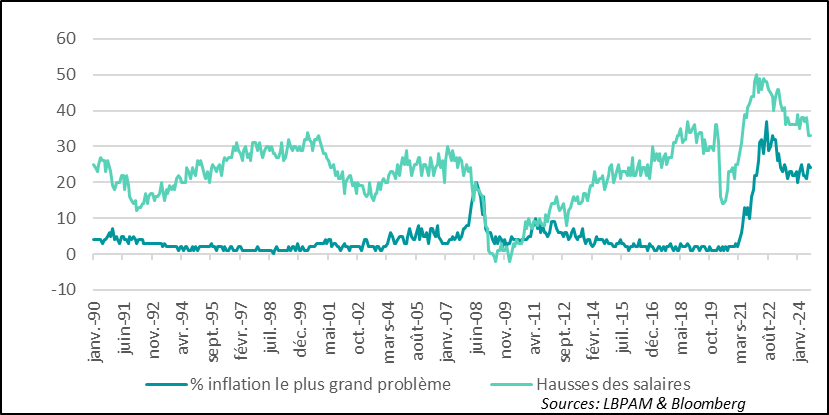

In the details of the survey, we can emphasize that for small retailers, even if disinflation is progressing, inflation remains a cause for concern: this indicates that normalization on price progression has not yet really taken hold.

At the same time, one of the contributors to rising costs has been the rise in labor costs. However, according to the survey, wage increases in this segment of the economy continue to ease, which would be a step in the right direction for the Fed. It should be noted, however, that the survey reveals that these businesses are still finding it difficult to hire qualified staff.

USA: NFiB survey continues to indicate that inflation remains a problem, even as wage increases ease

The PMIs showed that Chinese growth continues to be hampered by lacklustre domestic demand. Foreign trade data confirmed this situation, with dollar-denominated imports declining in August to just 0.5% year-on-year. At the same time, exports remained robust, rising by 8.7% year-on-year.

China: foreign trade figures confirm weak domestic demand and support growth from foreign demand

Sebastian Paris Horvitz

Head of Research