Heading towards a pause

Link

- US inflation figures for May have made a pause in Fed monetary tightening more likely. The figures confirmed that inflation continues to slow. Lower energy prices are a big part of this, as core inflation is receding only slowly. But, even there, May figures sent out a more reassuring message, with a more marked trend towards moderation in the past three months than we had seen until now. Even so, we remain cautious in light of resilient demand in the US, which is still reflected in a very tight labour market and, hence, in rapidly rising wages. Risks remain asymmetric, and if the current trend does not continue, the possibility of an additional tightening in monetary conditions cannot be ruled out this summer. Even so, the Fed does have arguments for being patient and making this widely expected pause and announcing it today, still consistent with the idea that it is important to consider the lagging impact of monetary adjustment, in order to keep from overdoing it.

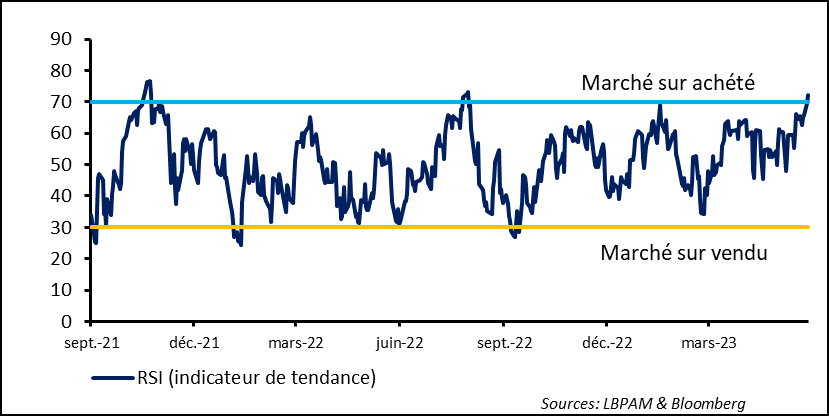

- Although this pause has been clearly flagged and is very widely expected, risk appetite has been ratcheted up further. Strong gains in the US markets in recent weeks have very clearly placed it in overbought territory. Whereas the Fed merely wants to wait to see whether weaker demand will last, the equities markets seem to be interpreting this pause as a way to support the economy, whereas the bond markets, in contrast, are bidding interest rates even higher. The coming weeks and months will tell us whether the economy is showing signs of slowing or, on the contrary, becoming more solid. For our part, we remain moderately cautious, very slightly underweighting equities in our asset allocation.

- Just how hard it is to fight inflation is quite evident in the United Kingdom, which is suffering from the same post-Covid surge in prices but a surge that is being exacerbated by structural problems, due in part to Brexit. For example, the latest figures showed that the UK job market remains tight, as seen in wages that continue to rise at a quick pace. The weekly average wage once again accelerated to 6.5% year-on-year over the past three months. This has pushed the market to once again price in higher key rate hikes by the Bank of England (BoE), and that has spilled over into the entire yield curve. Yields on UK government bonds have risen by almost 100 basis points (bps) over the past three months! The BoE governor even stated that inflation is likely to pull back more slowly and, hence, over a longer period, than expected.

- In reaction to recent signs of weakness in the Chinese recovery, all markets were expecting a move from the government in support of this recovery, which is still being driven by households and services. In reaction, the Chinese central bank (PBoC) announced a 10-bps reduction in its key rate. This was a rather token cut but is the first sign that the authorities want to keep the recovery going and even to boost it. In particular, there are rumours of a new stimulus plan for the real-estate sector, which remains bogged down in a major crisis. It remains to be seen whether pragmatism will carry the day over the authorities’ hitherto prevailing approach – which had been to rein in this key sector – and, hence, to put in measures in support of demand. We expect this to be the case. How much so remains to be seen. We remain exposed to China, betting on consumption, particularly via Internet platforms, which are trading at extremely low multiples. Even so, geopolitical risks remain a major obstacle to stronger momentum. Any easing on that end would be likely to support Chinese stocks.

US indices have soared in recent weeks. This trend has been driven by technology, and artificial intelligence in particular, but it has spilled over into other market segments. The pause expected from the Fed appears to have provided new impetus to risk appetite, moving equity prices up even faster and into a vulnerable spot, at least in the short term. Many, so-called technical yardsticks are calling for caution in the very short term. These yardsticks express either excessive market exuberance or an excessive pace of gains. In fact, one of these indicators, which is always rather reliable on market dynamics, has entered into overbought territory on the main indices, particularly the S&P and Nasdaq. A consolidation or correction could therefore take place, particularly in reaction to any statistic that would counter the highly idyllic scenario that the US equity markets seem to have adopted currently. Despite the rise in European indices, which have underperformed recently, there are far fewer signs of exuberance.

Fig. 1 – US equities: S&P 500 is trending in overbought territory, pointing to the need for a consolidation or correction.

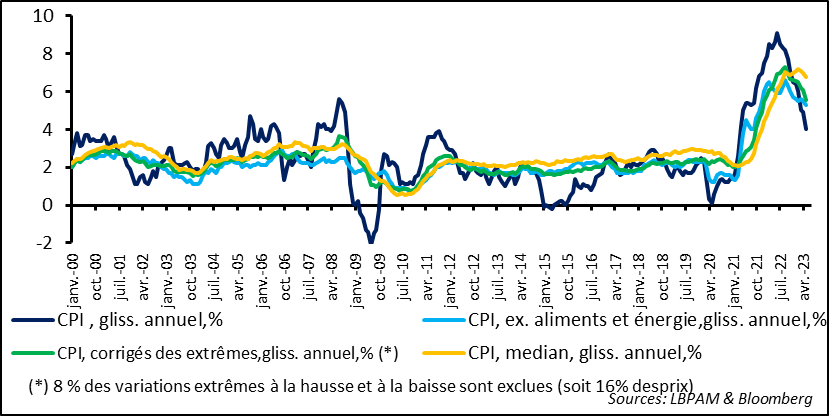

US inflation figures for May confirmed the downward trend, with total inflation falling to 4% year-on-year from 4.9% the previous month. As expected, the major downward driver was energy, with oil prices remaining low, particularly compared with one year ago.

Meanwhile, core inflation, i.e., excluding the most volatile segments of energy and food, came in as expected, slowing to 5.3% year-on-year from 5.5% in April. This far slower pace of deceleration continues to reflect in particular this very gradual decline in rental costs, which remain one of the main contributors to inflation, with a weighting in the index of more than 30%.

More encouragingly, the trimmed-mean inflation index calculated by the Cleveland Fed, which excludes goods whose prices have fallen or risen the most, has showed a rather clear deceleration, although it remains at more than 5.5% year-on-year, or more than twice as high as the Fed’s 2% inflation target.

Fig. 2 – US: Inflation is being driven down mainly by energy prices, but core inflation is receding more slowly, due to rent costs.

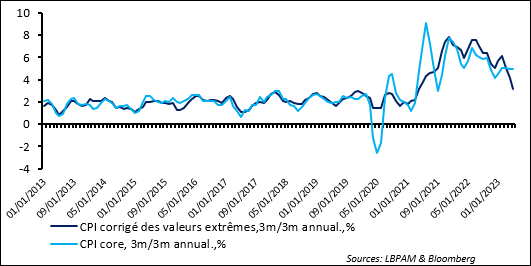

In fact, short-term momentum in core inflation has been more favourable in recent months, especially in May. For example, based on the deceleration in trimmed-mean inflation over the past three months, there has been a very clear deceleration compared with the pace over the past year

Fig. 3 – US: Far more favourable momentum in May, with one of the most marked slowdowns of the past year.

This statistic will no doubt reassure the Fed and support arguments that the expected pause in the monetary tightening cycle will indeed occur today.

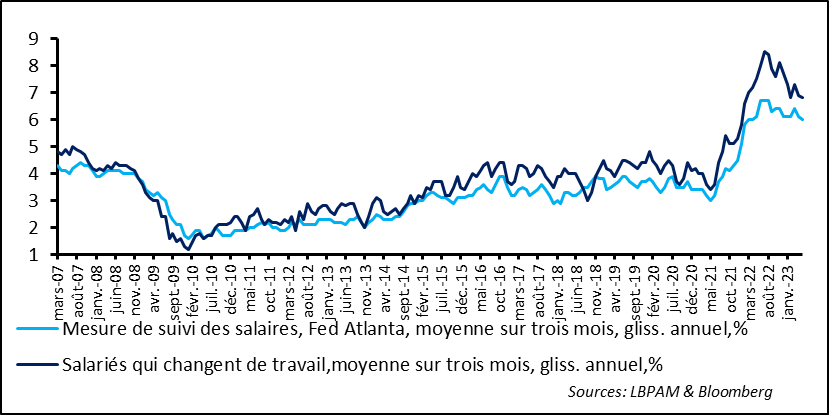

However, that does not mean that the necessary adjustment of demand to supply is already in place. For, the job market remains very tight, driving wage hikes that are still incompatible with a convergence of inflation towards 2%.

The Atlanta Fed Wage Growth Tracker, which is far more reliable than the one from the jobs report, shows that while the pace of wage hikes is slowing a bit, it is still at 6% over the entire range of wages and, in some wage categories, well above that.

Fig. 4 – US: Wages are still rising too fast for inflation to converge to 2%.

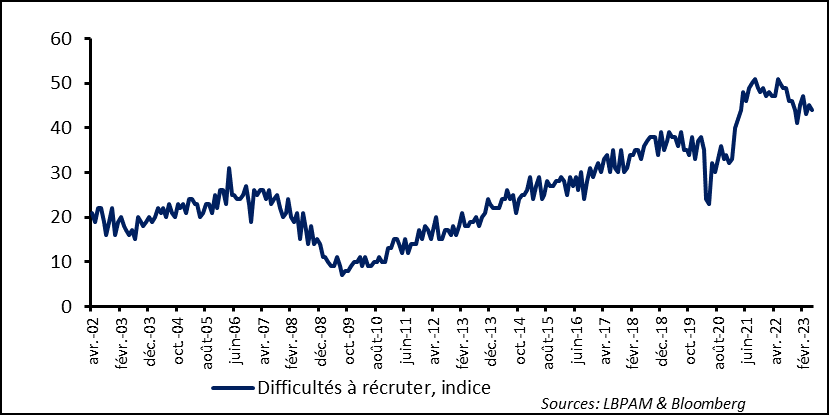

As evidence of this stubborn job market tightness, the NFIB small business survey for May shows that there are still very clear labour shortages.

Fig. 5 – US: The NFIB small business survey shows persistent labour shortages.

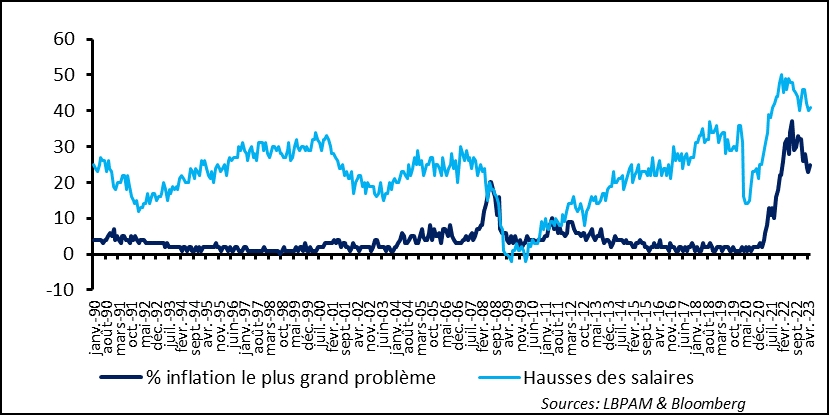

Moreover, while small business confidence has improved, inflation remains a big concern, especially the wage hikes, which are still occurring.

Fig. 6 – US: Small businesses still see inflation as one of their biggest problems, as wages continue to rise

This situation is likely to push the Fed towards keeping the door open to resuming monetary tightening if the current disinflationary trend were to reverse itself in the coming months. So, in our view, while our baseline scenario is that we are at the peak of key rates in this cycle, the risks remain on the upside. Everything will depend on momentum in jobs and inflation in the coming months.

Just how hard it is to fight inflation can be seen in the surprise changes by the central banks of Canada and Australia, which once again had to raise their key rates, in reaction to inflation that was more stubborn than expected. The UK seems to be in an even tougher spot, with persistent tensions, due mainly to a job market that remains very tight. In fact, in addition to the specific factors related to the particular cycle that we are in right now and that has pushed inflation upward, there are also structural forces, related mostly to Brexit.

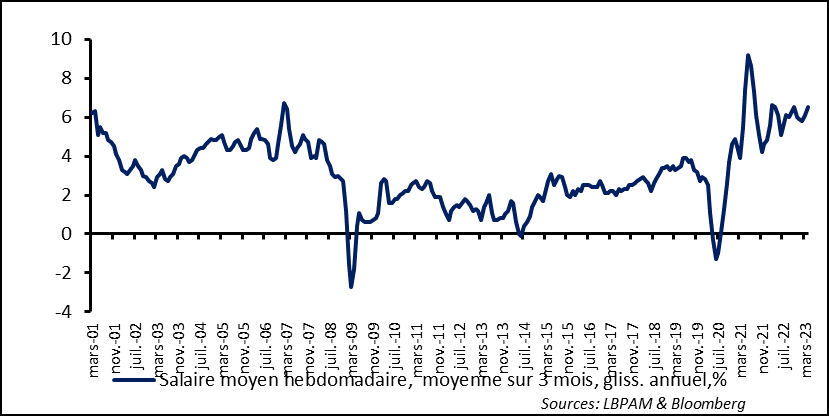

One of these is the labour shortages that are keeping the job market very tight. This has resulted in wage growth that remains very robust and that has accelerated in recent months. For example, in the latest monthly jobs report, hourly wages rose by 6.5% year-on-year (over a three-month period).

Fig. 7 – UK: The job market is still very tight, pushing wages upward

This is obviously not good news for the BoE. The markets are already pricing in additional key rate hikes that could take them to almost 6% by the start of 2024. We are more conservative, but the risks exist that the BoE will be forced to strike a tougher blow. This has hit the bond market hard, raising long-term rates to levels higher than those seen during the crisis triggered by the budget defended by former prime minister Liz Truss. All in all, yields on 10-year UK sovereign bonds have risen by almost 100 bps over the past three months.