Hope beyond the current uncertainties

Link

What should we take away from market news on October 17, 2025? Answers with the analysis of Xavier Chapard.

Overview

► Risk appetite remains volatile this week, oscillating between limited hopes linked to the Trump-Putin meeting and renewed concerns about US regional banks. At the same time, the US federal government shutdown, i.e. the interruption of many public services due to a lack of funding, is entering its third week, with no significant progress in political negotiations. If it continues until Sunday (which seems likely), it will lead to a temporary rise in the unemployment rate in October (up to +0.4 points due to the temporary layoff of civil servants), but will not affect monthly job creation, as salaries will be paid retroactively. This deadlock also risks undermining the quality of other economic indicators for October, particularly the consumer price index (CPI), due to disruptions in data collection. We continue to believe that the economic impact of the shutdown will remain marginal, but it complicates the already delicate reading of the US economic situation.

► The Fed's Beige Book, a collection of economic observations compiled by the central bank's regional branches, has gained importance due to the lack of official data. It paints a mixed picture of the US economy. Economic activity has ‘changed little’ in recent weeks, supported by consumption among the wealthiest households (tourism, luxury goods), but held back by the deterioration in the situation of other households (decline in retail sales). The labour market remains ‘broadly stable’, although labour demand is slowing, particularly due to a decline in immigration. Furthermore, the transmission of tariff increases to consumer prices is continuing gradually. Overall, these factors are unlikely to change the Fed's short-term analysis, and it is highly likely that it will lower its rates again by the end of October.

► In France, the new government survived the motions of no confidence tabled by the RN and LFI thanks to the abstention of the PS, which in return secured the suspension of the pension reform. This temporary respite from political instability led to a slight decline in the risk premium on French debt, which fell below 80 basis points compared to Germany for the first time in a month. However, the European Commission is maintaining pressure on the executive, stating that it expects France to take concrete measures to meet its commitments to reduce the public deficit and is following the budget debate ‘closely’. A downgrade of France's sovereign rating by Moody's or S&P by the end of the year remains likely, which would see France drop from AA to A in the eyes of international investors. In this context, we remain cautious about French debt, even though we believe the risk of a market crisis is limited, and continue to favour the debt of southern eurozone countries in our bond allocation.

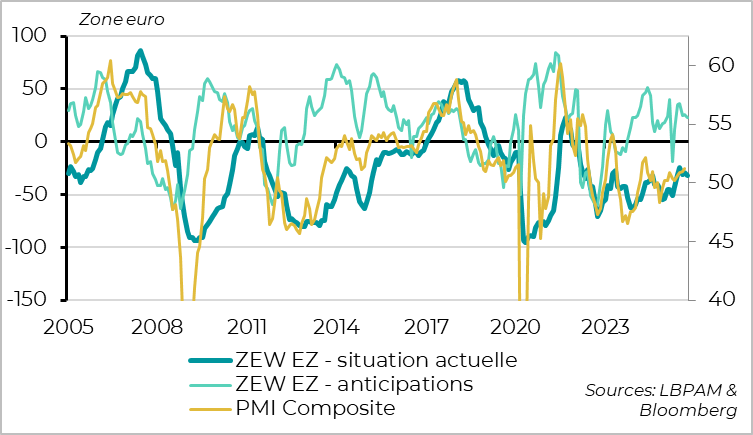

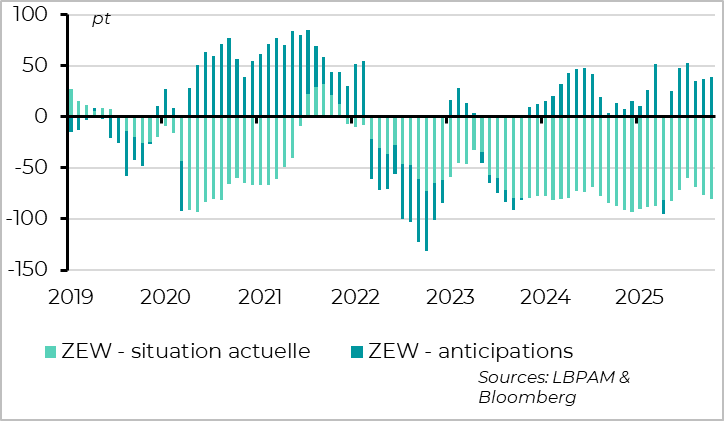

► In terms of data, macroeconomic surprises in the euro area have turned negative again in October, for the first time in eight months. The German ZEW index indicates that activity remains very weak this month, although expectations remain positive. This development is consistent with our scenario of sluggish growth mid-year, linked to trade tensions, followed by a rebound expected at the end of the year, driven by increased public spending in Germany.

► Growth is also slowing in the UK this summer, while the labour market shows more pronounced signs of deterioration. In a context where the economy is operating below potential and wage pressures are easing more significantly, we maintain our expectation of a rate cut by the Bank of England likely larger than what markets are currently pricing in.

► In China, deflationary pressures remain strong and credit growth slowed again in September, which does not bode well for short-term growth. This trend is likely to prompt authorities to announce new support measures in the coming weeks.

Going Further

Euro Area: a rough patch before year-end improvement

The German economy is weak, but the outlook remains positive

Real activity data in the euro area indicate that growth slowed over the summer and is now close to stagnation after a positive first half of the year. Industrial production fell by 1.2% in August after rising by 0.5% in July, resulting in a decline over Q3, whereas it had supported growth in Q1 and Q2. The August drop is exaggerated by a temporary 20% fall in car production in Germany, offset by an equally temporary 10% rise in production in Ireland.

Retail sales in the Euro Area also stabilized over the summer, with a 0.1% increase in August following a 0.4% decline in July. Overall, these figures are consistent with barely positive GDP growth in Q3.

According to the ZEW survey of German financial experts, the current economic situation in Germany deteriorated for the third consecutive month in October, reaching its lowest level since May. While this confidence indicator should be interpreted with caution, it does point to continued weak growth after the summer.

That said, expectations for the coming months remain positive in the ZEW survey, close to the levels seen just after the announcement of Germany’s fiscal shift toward public investment. This aligns with the increase in German public spending that begins in October following the budget vote, and which is expected to represent nearly 2 percentage points of GDP by the end of next year.

The ZEW is consistent with a Euro Area PMI stabilizing just above the 50-point mark in the short term

For the Euro Area, the ZEW survey also declined in October and is consistent with a PMI just above the 50-point threshold, although expectations remain positive.

This aligns with our scenario, which anticipates that Euro Area growth will be hurt mid-year by the trade war and remain barely positive in the short term, due to slowing U.S. demand, the payback from frontloaded purchases ahead of tariff hikes, and the delayed impact of uncertainty. However, once these shocks are absorbed—and with support from Germany’s fiscal stimulus, limited energy prices, and favorable financial conditions—we expect growth to rebound significantly by the end of the year and into next year.

United Kingdom: labour market weakness paves the way for rate cuts

The labour market slowed more noticeably this summer

As in the Euro Area, UK GDP growth slowed significantly over the summer after a very strong start to the year, while remaining slightly positive. GDP rose by 0.1% in August but was revised down for July (-0.1%). This leaves a carry-over growth rate for Q3 of around 0.2%, three times slower than in the first half of the year. A rebound in activity in September seems unlikely, as the UK PMI approached stagnation for the first time in six months (50.1 points).

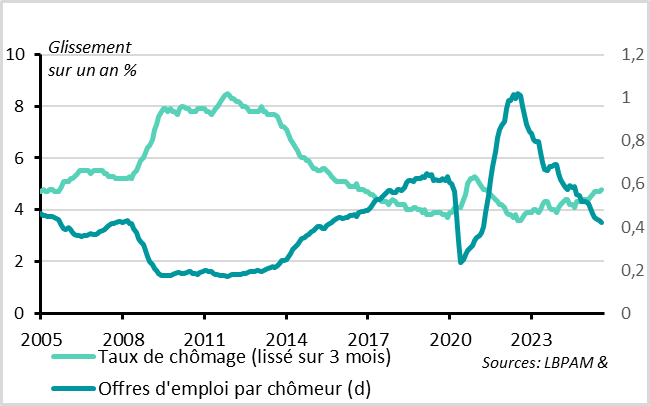

However, unlike the Euro Area, the UK’s summer slowdown is accompanied by a more pronounced deterioration in the labour market. Total employment fell by 35,000 in July/August compared to Q2—its first decline since early 2024. Payroll employment dropped by 10,000 in September, resulting in a slight decline over Q3 for the fourth consecutive quarter.

The unemployment rate rose to 4.8% in August, its highest level since the COVID period. Leading indicators suggest it could rise further in the coming months: jobless claims rebounded in September after three months of decline, and job vacancies continue to trend downward.

With the unemployment rate now 1 percentage point above its pre- and post-COVID lows, and the job vacancy-to-unemployed ratio back to its level of ten years ago (excluding lockdowns), the UK economy has very likely fallen below its potential.

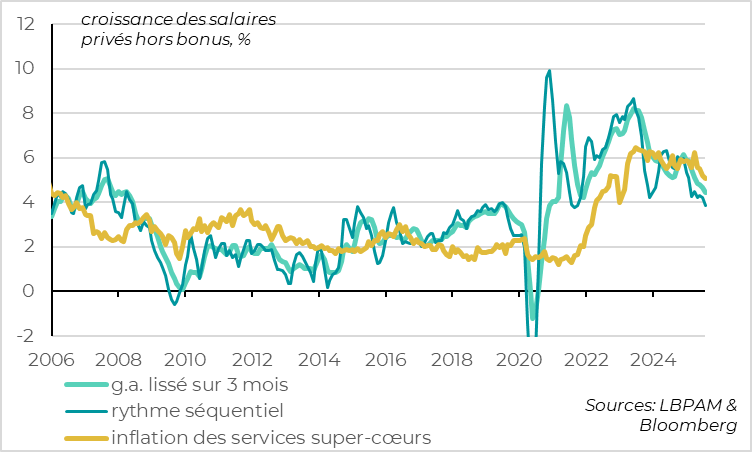

Wages are slowing significantly, easing inflationary pressures

This is consistent with the more pronounced slowdown in wage pressures. Indeed, private wages excluding bonuses—the measure tracked by the Bank of England (BoE)—slowed from 4.7% to 4.4% year-on-year in August. While this remains 0.5 to 1 percentage point above the level consistent with the inflation target, it is still the lowest reading since late 2021. The wage slowdown is even more evident on a sequential basis, with wages rising at an annualized pace of 4.2% over the last three months.

With the economy operating below potential and wage pressures normalizing, inflation should decelerate more decisively once the impact of regulated price hikes and tax increases fades in the spring. In our view, this should lead the BoE to continue cutting rates at a pace of -25 basis points per quarter over the coming quarters. BoE Governor Andrew Bailey delivered a more dovish message this week, focusing on labour market weakness rather than still-elevated inflation.

Market expectations remain conservative, with only a one-in-three chance of another rate cut this year and just two cuts priced in before the end of the cycle. This is why we remain constructive on short-term UK bonds, despite fiscal uncertainties.

China: awaiting further government support

Credit slowed again in September

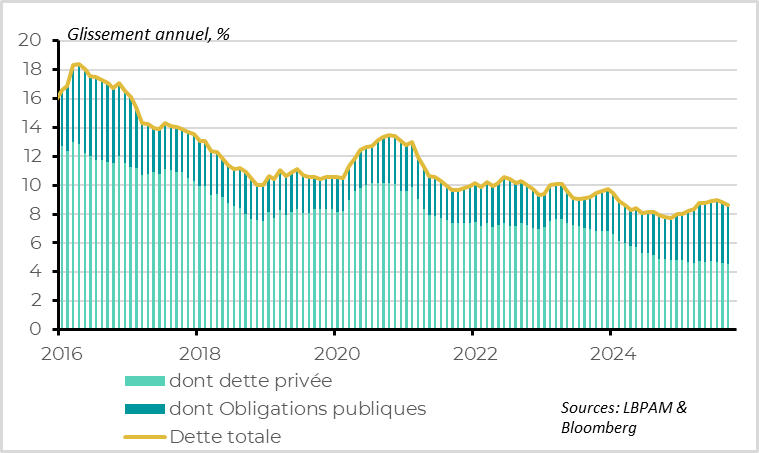

Chinese credit slowed again in September, which is not encouraging for short-term growth following the summer slowdown. The total stock of financing in the economy decelerated for the second consecutive month, after a slight recovery earlier this year—from 8.8% to 8.7%. This reflects a continued slowdown in bank lending, still weighed down by weak household and business confidence, as well as a decline in public bond issuance now that local governments are nearing their annual quotas.

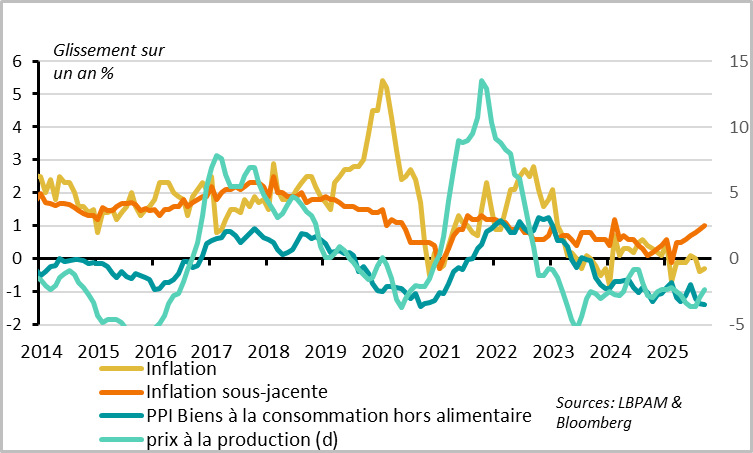

Mild deflation continued in Q3

Headline inflation remained negative in September, at -0.3% after -0.4% in August. This continues to reflect the sharp decline in food prices, while core inflation is gradually recovering, reaching 1% in September. At the same time, producer prices fell less sharply, down 2.3% after -2.9% in August. However, this is mainly due to base effects on commodity prices, as industrial goods producer prices remain negative at -1.4%.

Overall, these figures are consistent with a tenth consecutive quarter of GDP price deflation in Q3, reflecting weak private demand and persistent excess capacity.

In this context, and even though exports remain resilient, authorities are expected to announce new targeted stimulus measures in the coming weeks to support growth. While this won’t prevent a continued slowdown through year-end, it could help bring growth closer to the 5% annual target and revive activity somewhat at the beginning of next year.

Xavier Chapard

Strategist