Hopes of de-escalation still alive

Link

Read Sebastian PARIS HORVITZ's market analysis for April 23, 2025.

Summary

►Yesterday, the US stock market rebounded strongly, boosted in large part by the reassuring words of Treasury Secretary S. Bessent. He declared that an agreement with China would be reached. Nevertheless, apart from the belief in the hope of a change of course by D. Trump, little substance was provided on the type of compromise that might be found. Let's not forget that tariffs for the majority of trade flows between the two countries are now at prohibitive levels!

►For the time being, the level of trust in the US government seems to be seriously undermined in many countries. So, even if trade agreements are reached, they are likely to be obtained on a balance of power that is fairly unequal for many countries. On this basis, it is difficult to see the construction of a mutually beneficial framework for each nation in the future, and one that would provide a stable context for economic agents to make their decisions.

►In addition to the enormous uncertainty created in the short term by the trade war started by President Trump's administration, which is reflected in numerous indicators, it's even harder to find confidence in the threat posed by the US President to the Fed's independence. Igniting this other fire of uncertainty once again risks weighing on investor confidence.

►Nevertheless, since the launch of the tariff hike campaign, D. Trump has often backed down in the face of the negative impact of his decisions or comments on the market. Yesterday's conciliatory remarks on China and the fact that he had never considered firing J. Powell are further proof of this. But this creates a climate of disorder and loss of confidence.

►So it's hard to see whether all these shocks will really soften, and especially whether they will be short-lived. The longer world trade is disrupted, the greater will be the economic costs. The surge in gold, still close to its all-time highs, seems exaggerated, as does the sharp fall in the dollar, if the risks dissipate quickly. But, at this stage, we remain very cautious about this possibility. Hence our very cautious positioning in terms of asset allocation.

►As part of its spring meetings, the IMF has just published its economic forecasts for 2025-2026. The organization has revised growth for these two years sharply downwards compared with its January forecasts, partly taking into account the effects of US protectionist measures. US expansion is revised down by 1 percentage point. Of course, world trade will suffer considerably in 2025 (-1.5% downward revision). But above all, the IMF highlights the risks of much weaker global economic growth over the period.

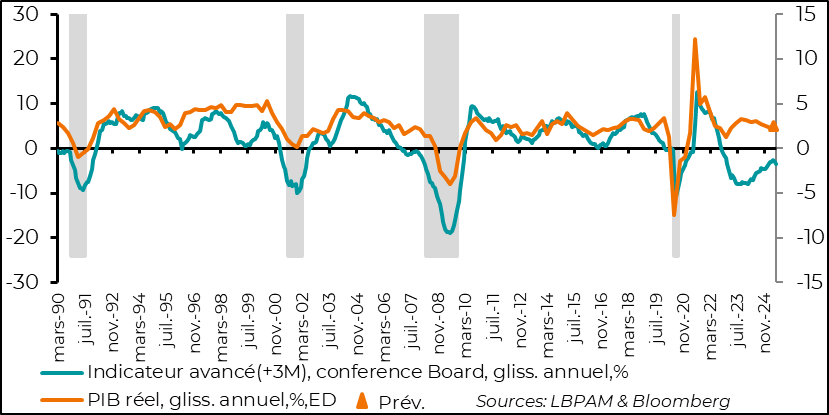

►In this sense, it came as no surprise to see the Conference Board's leading indicator fall sharply in March, halting the improvement we'd been seeing so far. Today, with the publication of S&P's advanced PMIs for April, we'll see the impact of the uncertainty caused by the decisions taken by the US government on activity.

To go deeper

It's clear that the economic decisions taken by President Trump's administration since coming to power have severely darkened the economic outlook. The trade war with the rest of the world that was initiated has created a huge mess, and to this day it's still impossible to know how we're going to get out of it.

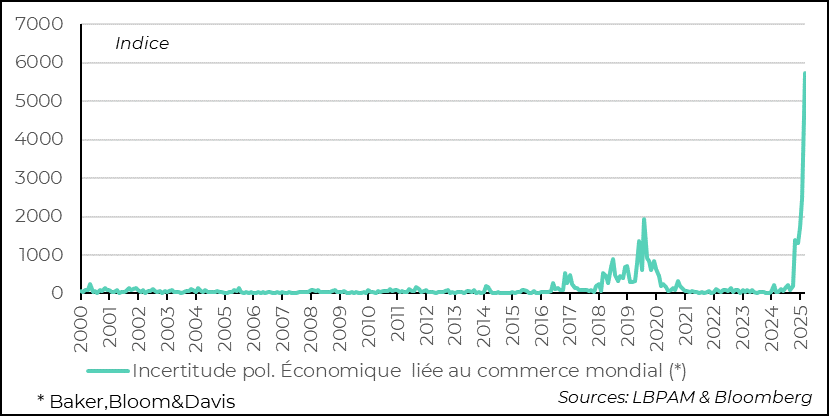

Uncertainty remains extreme, as evidenced by the few measures that exist on the subject. We must realize that these shocks to world trade are historic in their scope and scale. The entire global economic order is being turned upside down.

World: the uncertainty generated by US trade policy is historic

We can take comfort from the fact that, with the exception of China, the extreme levels of US tariffs announced on April 2 are no longer an issue, even if current levels remain the highest in almost 100 years. Above all, we can hope that the negotiations over the next three months will result in lasting compromises.

Nevertheless, it is difficult to be certain, as it is not clear what concessions the US is seeking.

At the same time, D. Trump's numerous backtracking on measures taken show that market movements are a means of changing the American president's mind fairly quickly. It may be “the art of the deal”, but when it comes to the global economy, it's a strategy that can prove very costly.

Yesterday, Treasury Secretary S. Bessent's comments on his belief that an agreement would be reached with China, backed up shortly afterwards by those of the President, came as further relief to the markets.

Indeed, for the United States, a rapid agreement with China is crucial if the prohibitive bilateral tariff levels between the two countries are to be halted. China's share of US imports is 15%. This ranges from finished goods to inputs into American production chains.

With this in mind, industry lobbies are asking D. Trump to do as he did for electronics, after the Appeal request, and exempt imported Chinese products from tariffs (in addition to the 20% due to Fentanyl retaliation), to avoid too great a shock on them.

So the longer an agreement is delayed, the greater the negative impact on certain American industries.

S. Bessent and presumably the President know this. So there is likely to be a bit of “panic” in the administration in the face of the Chinese reaction, which is opposed to any negotiation before the American authorities change their tone. Despite the very negative impact of U.S. tariffs on the Chinese economy, one gets the impression that the authorities are far better prepared to withstand the economic shock than the United States.

Then there's Europe. What kind of agreement will be reached? It's hard to say, especially as, once again, we don't really know what the Trump administration's objective is today. We can only hope that the zany idea of reducing the US external deficit to zero has already been abandoned.

Nevertheless, even after these agreements, we may well wonder what the state of future economic relations will be. How will the global production chains built up over decades stand up to American nationalism? It's hard to say.

We know that in many countries, in many so-called strategic areas - military, energy, technology, health - there is a desire to create autonomy vis-à-vis the rest of the world. This clearly reflects the shift to a less secure world. But how the new economic equilibrium will be constructed is not a simple question, and risks maintaining a high level of uncertainty.

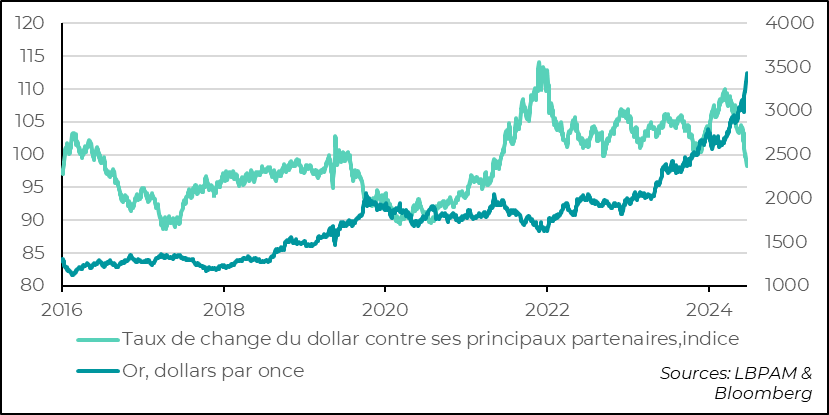

In the short term, we can see that the uncertainties created by the economic situation are translating into fairly strong movements in safe-haven assets, starting with gold. The price of gold has reached all-time highs in recent days.

At the same time, the dollar continued its slide. The DXY index, which tracks the greenback's performance against the major currencies, reached its lowest level since early 2022 on Monday. So, despite rate hikes and uncertainty, the dollar is suffering. In large part, this is due to anticipated risks to US growth, which would lead to Fed rate cuts.

The search for protection: investors continue to seek refuge in gold, while the dollar continues to suffer

For some, these movements also reflect a lack of confidence in American assets, starting with the dollar. This is possible, but it seems far too premature to think that the dollar's dominance is disappearing. The dollar remains the dominant currency in the global economic system.

At the same time, at this stage, the evolution of US assets, clearly shows that the policies pursued by the Trump administration are mainly hurting the US economy.

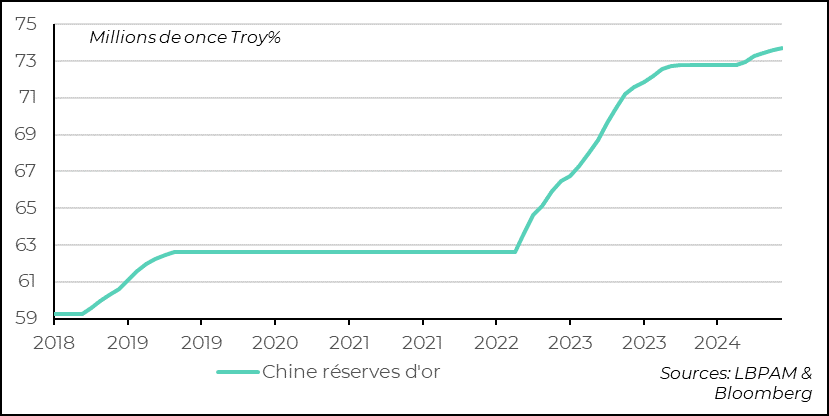

It is also true that some major countries have begun to diversify their foreign exchange reserves in recent years. This is particularly true of Russia, even before the war in Ukraine, and especially China. Recently, gold purchases by the Chinese authorities have increased once again

China: China continues to diversify its reserves by accumulating gold

The impact of the economic shock created by the protectionist trade policy initiated by the United States dominates the IMF's new economic forecasts. Global growth has been significantly revised downwards for 2025 and 2026. At the same time, not all the latest developments regarding US tariffs have been fully incorporated.

As a result, the IMF, like the vast majority of economists on the markets, has revised global growth downwards for 2025.

It is, of course, US GDP growth in 2025 that has been adjusted downwards the most, with a reduction of 0.9 points to 1.8% as an annual average. Nevertheless, the IMF remains relatively optimistic about economic expansion across the Atlantic. We expect growth to be closer to 1%.

At the same time, U.S. inflation has been sharply revised upwards, estimated at an annual average of 3% in 2025, but falling gradually towards 2% in 2026.

While the company has revised its growth forecasts downwards, with the world's growth at its lowest level for 20 years since the crisis of 2008-2009 and 2020 (Covid), its most important message is that the protectionist measures taken are harmful to growth, and that the risk of recession has risen sharply.

It remains to be seen whether any progress can be made on trade disputes between member countries during the discussions scheduled to take place at the IMF's biannual meeting. This is one of the few remaining forums for international dialogue.

IMF: growth revised downwards for 2025 and 2026, particularly in the United States, with a much higher inflation projection

Finally, on the economic data front, we had the publication of the Conference Board's leading indicator for March, which, unsurprisingly, showed a fairly clear deterioration in activity.

The very gradual recovery in this indicator over many months has now been halted, largely due to the market downturn.

Today, we'll see what S&P's preliminary PMI surveys have to say about the state of activity.

United States: further evidence of the deterioration in the US economy, with the Conference Board's leading indicator falling sharply in March

Sebastian PARIS HORVITZ

Head of research