In search of a new candidate for the US Democrats

Link

-

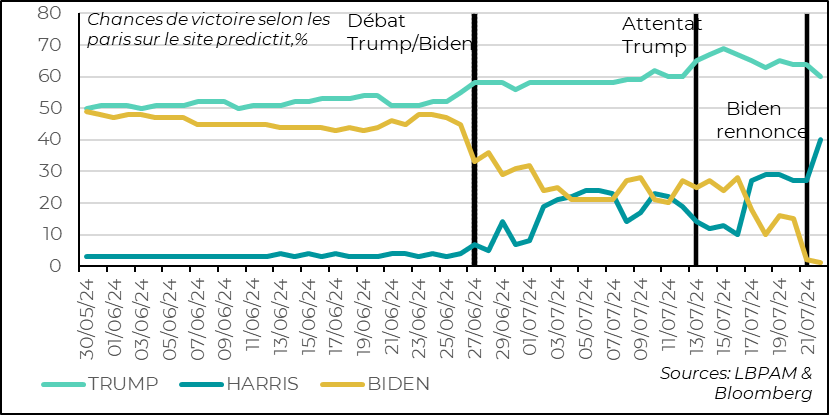

J. Biden was unable to resist the accumulating calls from his camp to withdraw from the presidential race, as well as his tumble in the polls. He has already declared his support for the candidacy of Vice President K. Harris. The new candidate will be officially named at the Democratic Party Convention (August 19-22). K. Harris seems to be the favorite, but another candidate could be chosen. As far as the markets are concerned, there's a slight change in the certainty of a D. Trump victory, even if he still has a huge lead, if the polls and betting platforms are anything to go by.

-

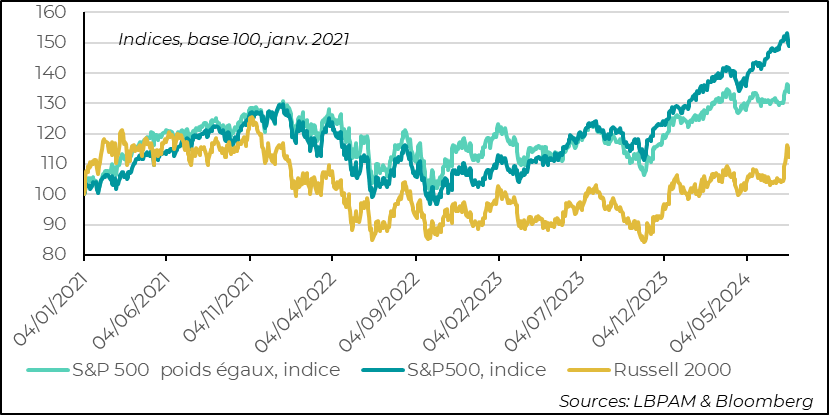

Recent market movements continue to be dominated by expectations regarding the evolution of monetary policies, and for equities, particularly in the US, by the financial results currently being published for 2Q24. As we indicated last week, a fairly strong rotation movement has begun, benefiting the most discounted stocks in particular, which could benefit from the forthcoming monetary easing. The major US tech stocks were thus abandoned. This trend seems to have lasted, even if it has moderated. Nevertheless, as the monetary straitjacket loosens, and economic growth continues, it would be normal to see small caps perform well.

-

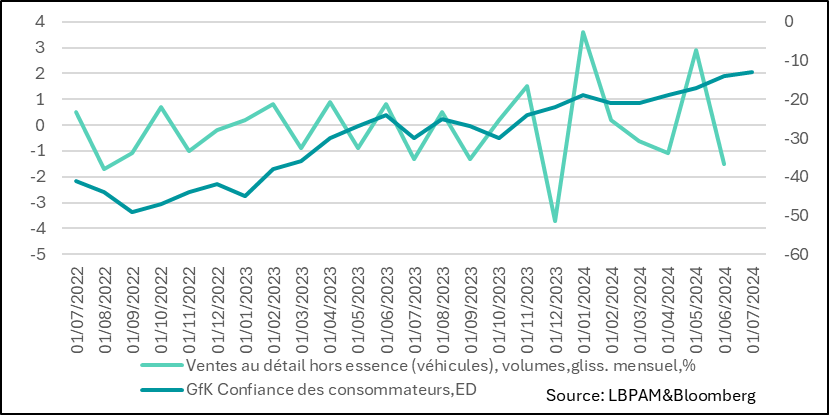

In the UK, retail sales in June came in well below expectations, falling sharply. Unfavorable weather conditions at the beginning of the month probably contributed to this decline. What is certain is that the contribution of consumption to GDP growth in 2Q24 could be much weaker than anticipated. At the same time, let's not forget that wages are rising faster than prices, which should support purchasing power. In fact, consumer confidence has continued to rise, even if the job market seems to be weakening somewhat. This consumer momentum is unlikely to change the views of central bankers. We continue to believe that, despite the resilience of service prices, the BoE should make its first rate cut by the end of September.

-

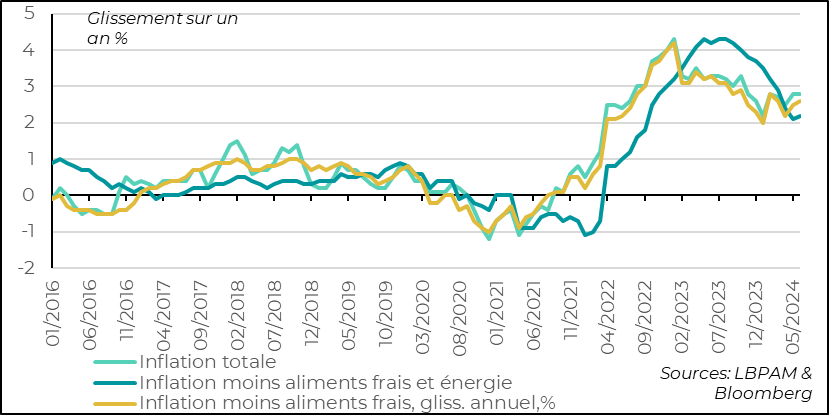

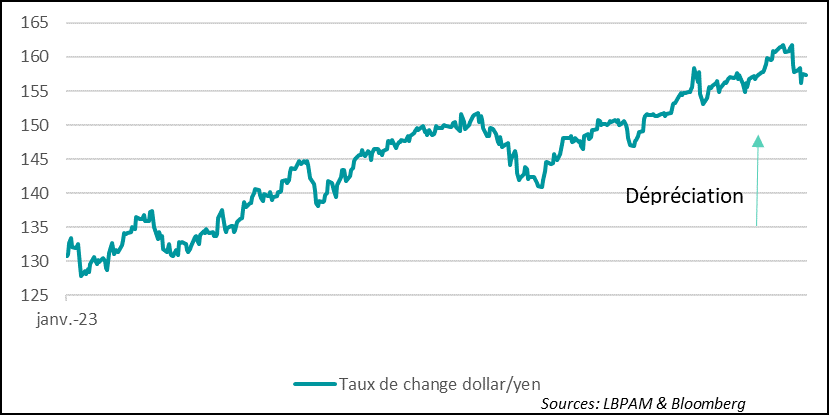

In Japan, total national inflation was stable in June (2.8% year-on-year), below the consensus forecast for acceleration. However, core inflation accelerated to 2.6%, up 0.1 percentage points on May. Even so, these figures should reassure the BoJ. In addition, as in other developed countries, service prices continued to progress well. As a result, it seems likely that we will see a further rise in key interest rates in the coming months. This has helped to keep the yen relatively stable, following its recent appreciation. This trend is set to continue, particularly in view of US monetary easing. The yen/dollar exchange rate remains at its lowest level since the early 1990s.

J. Biden has decided not to seek a second term as President of the United States. Since his poor performance in the debate with D. Trump on June 27, highlighting age-related frailties, pressure from his camp for him to leave the presidential race has only increased. Opinion polls have also reduced his chances of re-election, most recently with a significant drop after the attack on D. Trump. Finally, financial resources for campaigning were dwindling as some donors became more reluctant to provide their support.

It was in these conditions, when he was currently isolated because he had contracted Covid, that he wrote an open letter to Americans announcing his decision to withdraw. At the same time, he gave his support to K. Harris, the Vice President, to take up the torch.

A new campaign is about to begin, which will be fairly short, as we are only 3 months away from the presidential elections on November 5.

Although J. Biden has given his support to K. Harris, the final decision on who will be the nominee is in the hands of the Democratic convention which will take place on August 19-22.

It is likely that other candidates will come forward to be nominated. Speculation about the candidacy of certain governors, including those of California (G. Newson), Illinois (J.B. Pritzker) and Maryland (W. Moore), has been in the spotlight for weeks.

What is certain is that it will be necessary to move quickly to prevent D. Trump from continuing to lead the race.

K. Harris's big advantage is that she can quickly mobilize financial resources to start her campaign, as she could use the $96 million pot left by J. Biden without constraints. However, should another candidate be selected, it is likely that he or she could benefit from substantial donations, including those already given to J. Biden up to the maximum authorized by law.

At this stage, the good news for K. Harris is that she has already taken the challenger's position in opinion polls and betting platforms. For example, Bloomberg, based on figures collected on the Predictit website, already estimates K. Harris's chances at 40%. What's more, the Trump campaign has already begun attacking Ms. Harris.

Fig 1 United States: J. Biden's fall in the polls and betting was brutal, as was the rise of K. Harris's chances

For the markets, this casts doubt on the bets that almost took it for granted that D. Trump would be elected, which had given a boost to risky assets, not least because of the potential new tax cuts.

Obviously, the new situation could induce a little short-term volatility. Nonetheless, the market is currently focused on rate-cutting decisions and corporate financial results, particularly those of major technology stocks.

As a result, we have recently seen a rotation in the US indices. Tech giants, such as Nvidia, have seen their share prices fall sharply, while neglected stocks, particularly small caps, have rallied, as shown by the strong rebound of the Russell 2000 index. The cocktail of future rate cuts and relatively more attractive valuations than the Tech giants gives these stocks an advantage.

Fig.2 United States: The “rotation” moderates, even if the big tech stocks suffer from fears of overly demanding valuations

- S&P 500 equal weights, index

- S&P 500, index

-Russell 2000

However, this rotation seemed to be moderating at the end of the week, as we await the results of the Tech majors over the next few weeks. Nonetheless, it seems to us that this rotation would be good news and would rebalance the market. Above all, the ingredients are there for such a rotation to continue.

In the UK, retail sales were much weaker than expected in June. Indeed, sales fell sharply, by -1.2% over the month, compared with -0.6% expected. It seems that the bad weather at the beginning of the month had a greater impact on sales than expected. However, unless there is a very good surprise in household spending on services, the contribution of consumption to GDP growth in 2Q24 should be limited.

However, it is difficult to see this as a sign of a lasting weakening in consumption. Indeed, let's not forget that even though the labor market has been deteriorating since the start of the year, with a rise in the unemployment rate, real wages are rising, as wages are still growing faster than inflation. In fact, the household confidence survey continues to recover.

Fig.3 United Kingdom: Retail sales very weak in June, despite confidence continuing to gain ground

- Retail sales excluding gasoline (vehicles), volumes, monthly sliding, %

- GfK Consumer confidence, ED

For the BoE, whose first rate cut is expected by September, these figures are not a game-changer. Indeed, this weakness in retail sales should not alter the decision it will take. The caution shown so far is mainly due to the lack of progress in the lull in prices in services, even if the deceleration we are seeing in wages, partly attributable to the easing of the labour market, is moving in the right direction.

In Japan, national headline inflation in June rose less than expected, although core inflation accelerated slightly year-on-year to 2.6%. While there are a number of specific factors behind this slight acceleration in inflation, the important message is that price trends continue to show that inflation momentum appears well anchored around the BoJ's target. In fact, inflation has remained above 2% for over two years.

Fig.4 Japon : L’inflation cœur accélère en juin, mais moins qu’attendu: suffisamment pour rassurer la BoJ qui devrait poursuivre la normalisation lente de sa politique monétaire

- Total inflation

- Inflation less fresh food and energy

- Inflation minus fresh food, year-on-year, %

This should reassure the BoJ to continue normalizing its key rates and begin reducing the size of its balance sheet. Nevertheless, as we all know, this departure from a very accommodating policy is likely to be slow. Indeed, since his arrival at the head of the bank, K. Ueda has been extremely cautious in his management.

Like the market, we expect the BoJ to raise its key rate for the second time in the very near future, and to start reducing its asset purchases.

This expectation, combined with the interventions of the Ministry of Finance and, of course, expectations regarding the trajectory of US monetary policy, has strengthened the yen. Nevertheless, the Japanese currency remains at a historically low level against the dollar. We are at levels not seen since the early 1990s.

The strengthening of the yen is set to continue over the coming year. Nevertheless, as during the recent depreciation, the authorities will try to avoid too rapid a movement.

The yen's appreciation is likely to act as a headwind for Japanese equities, even though Japanese companies, especially exporters, still enjoy a strong competitive advantage.

Fig.5 Japan: The expected increase in Japanese key rates, while the Fed is expected to lower its own, maintains the yen's upward trend against the dollar.

- Dollar/yen exchange rate