Increasingly complacent markets

Link

-

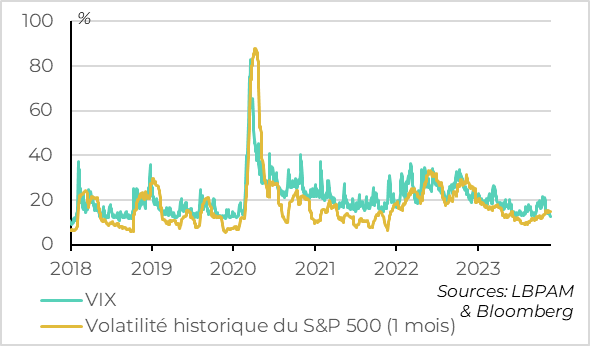

Markets are becoming increasingly complacent as we approach the end of the year. Equity markets have rebounded by over 10% in the last month, and are now within 2% of their July highs. And this rebound continued last week despite the slight rise in interest rates. Above all, the VIX equity fear index ended last week at its lowest level since before Covid, at 12.5%.

-

TThe market consensus is for a perfect scenario, in which slowing inflation allows key rates to be cut before mid-2024 without growth slowing sharply. These expectations may persist for a few more weeks, as the latest macroeconomic data point in this direction. But the risk of a sharper slowdown (our scenario) or more persistent inflation could quickly weigh on risky assets. With valuations having risen since the beginning of the month, the margin for error is limited.

-

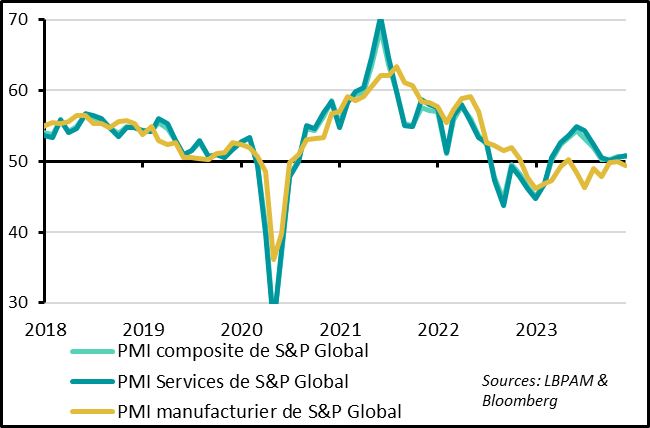

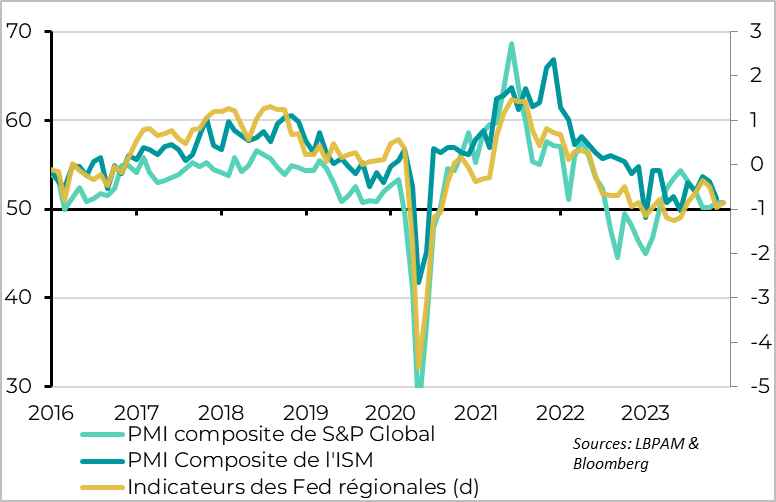

The US PMI published by S&P Global remained stable in November at 50.7pt, with a further contraction in industry offset by a slight improvement in services. Regional Fed indicators also point to a stabilization of economic conditions at a slightly positive level. We'll have to wait for the publication of the ISM (in the next two weeks) to get a clear idea of US momentum at the end of the year. But it seems that growth is stabilizing in November at a limited level after its sharp slowdown in October. Such a gradual slowdown at the end of 2023 leaves the debate open between a soft landing or a steeper one in the coming quarters.

-

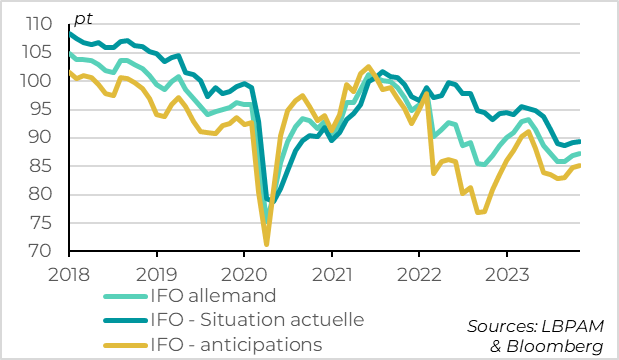

The German IFO continued its slow recovery in November, driven by a stabilization of expectations, although it remains at a very low level. This supports our scenario of stagnation but not recession for the Eurozone in the coming quarters.

-

At global level, the stability of the US PMI and the slight rise in European PMIs suggest a slight increase in November, despite the fall in Asian PMIs. This would be the first rise in 6 months, even though the global PMI would remain close to the stagnation zone for global activity. This suggests that global activity is not slowing further, but remains sluggish, with the beginning of convergence between Europe and the United States.

-

The truce in the Gaza Strip and the release of hostages held by Hamas (58 so far) continued over the weekend and may continue into the early part of the week. Israel's intervention in Gaza will resume thereafter and is far from over, but it would appear that the risks of escalation are diminishing.

-

This week, the market will be keeping a close eye on inflation figures in the Eurozone and the United States, which should confirm the fairly rapid slowdown in underlying inflation at the end of 2023. The OPEC+ meeting, postponed until Thursday, will also be important, as producer countries could announce further significant production cuts for early next year.

Fig.1 Market: implied volatility on equity markets is at its lowest since the Covid

-VIX

-S&P 500 historical volatility (1 month)

The VIX, the implied volatility on the US market often referred to in the markets as the fear indicator, fell to its lowest level since the Covid shock in early 2022, to 13.5%. This indicates that the cost of protection against high market volatility is low, and that investors are not anticipating sharp falls in equity markets.

However, realized market volatility over the past month has been in line with its historical average, and higher than the VIX, which is historically quite rare. But this can be explained, as current volatility reflects the rebound in equities, which have risen by over 10% in the past month and are now within 2% of their July high.

Still, the VIX is a contrarian indicator, as it tends to revert to its mean, around 19%. This suggests that investors are rather complacent, and that the risk of a technical correction is increasing.

-S&P Global composite PMI

-PMI Services from S&P Global

-S&P Global Manufacturing PMI

OS&P Global's PMI for the United States remained stable in November at 50.7pt, slightly above expectations even though it remains at a level consistent with fairly limited growth.

This stability reflects a marginal improvement in services activity (+0.2pt to 50.8), while industrial activity fell back into contraction (-0.6pt to 49.6pt).

Fig.3 United States: regional surveys also point to stable activity

-S&P Global composite PMI

-ISM Composite PMI

-Regional Fed indicators (d)

The stability of US growth in November was confirmed by the regional Fed confidence indicators, which rose slightly overall in November after falling sharply in November. Overall, they remain just above the boundary between expansion and contraction in activity.

This is reassuring, as regional Fed indicators have been a better indicator of US growth recently than the overall S&P PMI. We'll have to wait for the release of the ISM (in the next two weeks), the best economic indicator of late, to get a clearer idea of US momentum at the end of the year.

As things stand, however, growth looks set to stabilize in November at a limited but still positive level, following its sharp slowdown in October. This is consistent with our scenario of a fairly marked slowdown in the US economy at the end of 2023, before a slight contraction at the beginning of 2024. But it's also consistent with the market's scenario of a temporary and limited slowdown at the turn of the year. The debate between a soft and a hard landing for the US economy therefore remains open.

Fig.4 Eurozone: German IFO confirms signs of stabilization in economic outlook, which still remains weak

-German IFO

-IFO - Current situation

-IFO - expectations

Like last week's German and Eurozone PMIs (+0.6pt to 47.1pt), the German IFO indicator edged up in November, but remained at a deteriorated level.

The IFO rose for the third consecutive month in November, to 87.3pt. This reflects a stabilization in the current conditions indicator and a sharper rebound in the expectations indicator. But these indicators remain at the deteriorated levels historically associated with a fall in German GDP. Given that German GDP has already fallen by 0.1% in Q3, we believe that a mild technical recession (i.e. two consecutive quarters of falling GDP) remains likely.

However, the fact that both this indicator and the Eurozone PMI are beginning to recover from very depressed levels reassures us of our scenario of stagnation rather than recession for the Eurozone in the coming quarters.

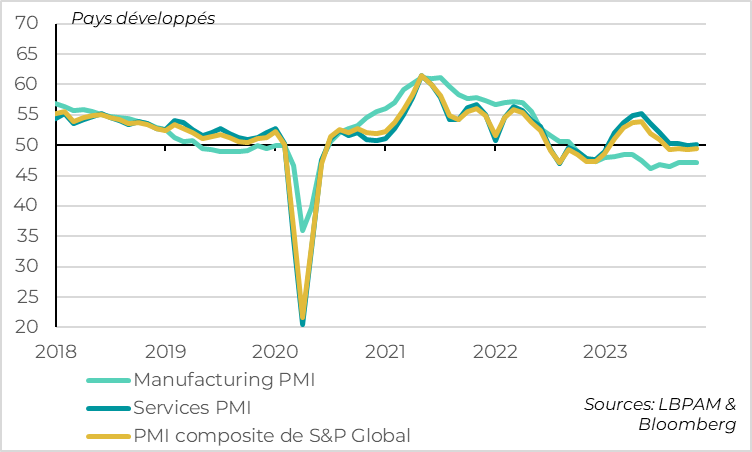

Fig.5 World: economic conditions in major countries remain stable but mediocre

-PMI manufacturier

-PMI Services

-S&P Global composite PMI

All in all, the advanced PMIs for developed countries published last week suggest that the global PMI should rise marginally in November, after 6 consecutive declines which had brought it down to the 50pt mark in October. For developed countries, the PMI is expected to return to its summer levels after its sharp decline in October, while remaining in the contraction zone.

In terms of sectors, this reflects a stabilization of activity in services after several months of sharp slowdown, while activity in industry remains deteriorated. In geographical terms, the latest data suggest a gradual convergence between Europe, which is beginning to stabilize after its summer contraction, and the United States, which is gradually slowing after its summer acceleration.