Industrial activity remains weak

Link

Find the first market analysis of the year 2025, signed by Sebastian Paris Horvitz.

Summary

►The coming year will likely be dominated by the decisions of D. Trump and the economic policies implemented by his administration and the Republican-controlled Congress. Despite the president's proposals for key government positions, there is still much uncertainty. Firstly, not all candidates may be confirmed by the Senate. Secondly, despite the announcements of potential measures, the policies that will be followed could still surprise. As we have already communicated, we have adopted a moderate scenario. In particular, we consider that tariff increases will be much more limited than announced, as will the reduction in migration flows. Thus, the negative impact on inflation and growth would be moderate but not negligible. Nevertheless, the risk of a more significant impact seems slightly higher today than the opposite.

► For the rest of the world, the main impact will be on growth. For Europe, more expensive access to the American market, even if moderate, will slow down the economic recovery we still anticipate. China remains a target for D. Trump. Tariff measures or continued restrictions on access to American technologies will weigh on its growth. However, the implementation of retaliatory measures against American protectionist measures, depending on their extent, could have an even more negative impact on global trade and growth than anticipated.

►Central banks are likely to have more divergent trajectories in 2025 compared to 2024. In the United States, D. Trump's pro-business policies are likely to exacerbate the caution already displayed by the Fed at the end of the year. We expect two rate cuts during the year. The market has already become even more cautious. The ECB should continue a rapid reduction in key interest rates. This will be a crucial element in supporting the economic recovery. This reduction will be fueled by marked disinflation towards the 2% target. This would contrast with the United States, where the decline in inflation will be slower.

►For the markets, the approach of D. Trump's inauguration (January 20) could continue to support American risk assets in the very short term against the rest of the world, even though December showed the limit of excessive euphoria. We may enter a more cautious phase at the beginning of the year, especially since long-term interest rates have tightened significantly in the last part of 2024. The 10-year American rate at 4.6% is already close to the highest level of 2024. There is still a risk that long-term rates will tighten, but current levels seem more attractive. We believe that 2025 will require a lot of agility in portfolio management.

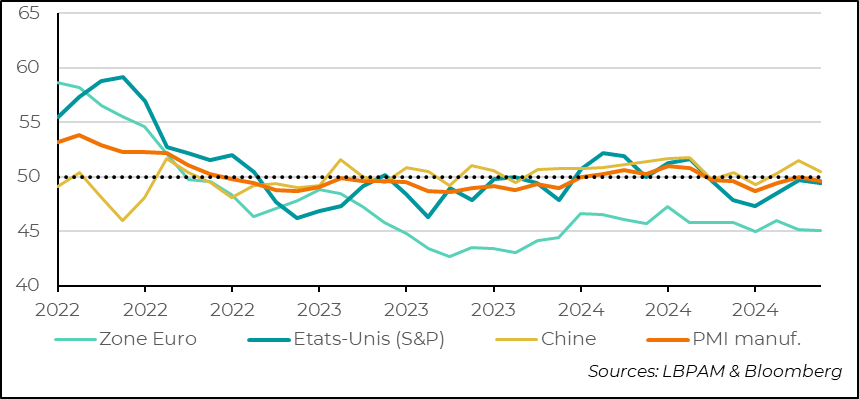

► We already have the first important economic statistics of the year. They concern the state of the industry worldwide. Unfortunately, the S&P PMI survey on the situation of global manufacturing activity showed that the last month of the year was not favorable. Indeed, the global index fell below 50 again. The slight decline in activity in the United States and a more marked decline in China were the main contributors to the overall decline. In the eurozone, the situation remained almost unchanged, with activity still in sharp contraction.

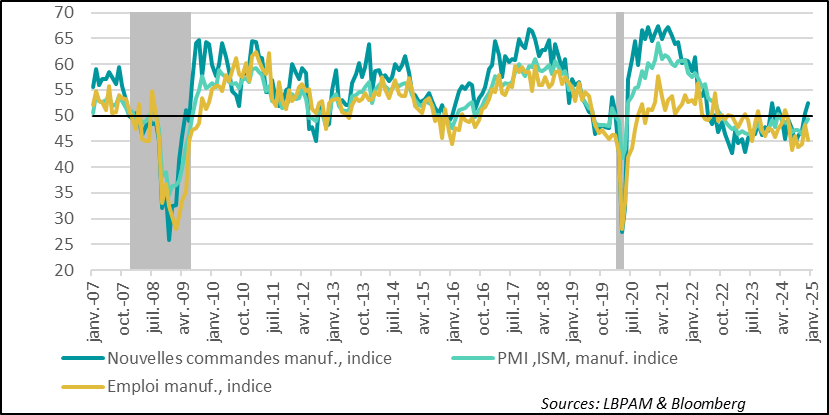

►In the United States, the ISM survey for the manufacturing sector in December was more reassuring than that of S&P. Indeed, the index continued to rise, approaching 50, the level that separates expansion from contraction. Partly, the difference is due to the new increase in new orders, while the S&P survey indicated a contraction. However, both surveys coincide on hiring, with a marked decline in the employment indicator.

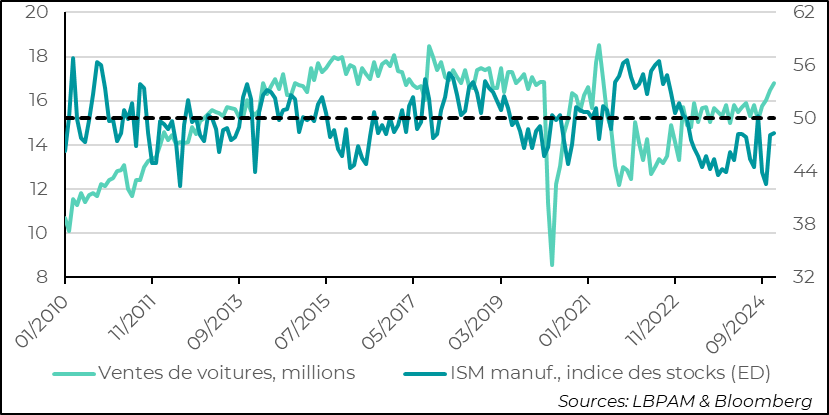

► It is interesting to note that the ISM inventory indicator remained low. This is surprising because one might have expected a strong push in inventories to anticipate potential D. Trump protectionist measures on foreign trade. In fact, partly responding to this concern, car sales surged in December. These also responded to D. Trump's announcement to eliminate subsidies for electric car purchases.

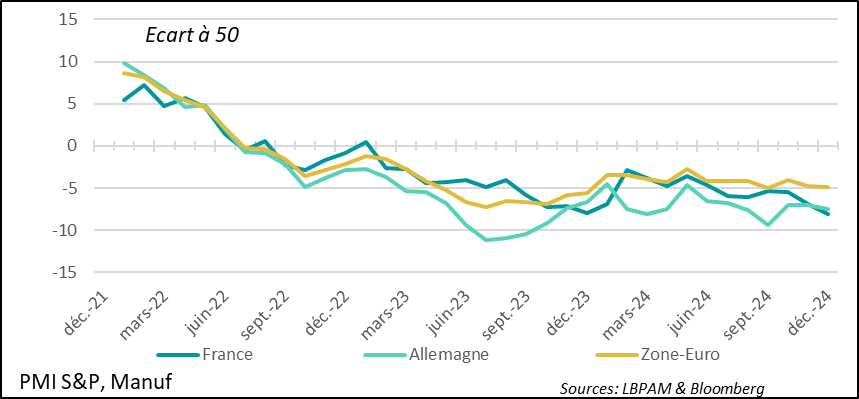

► In the eurozone, the contraction in industrial activity continues, with Germany and France contributing to this decline. In fact, France still shows the most degraded situation in the zone, while the periphery is more resilient.

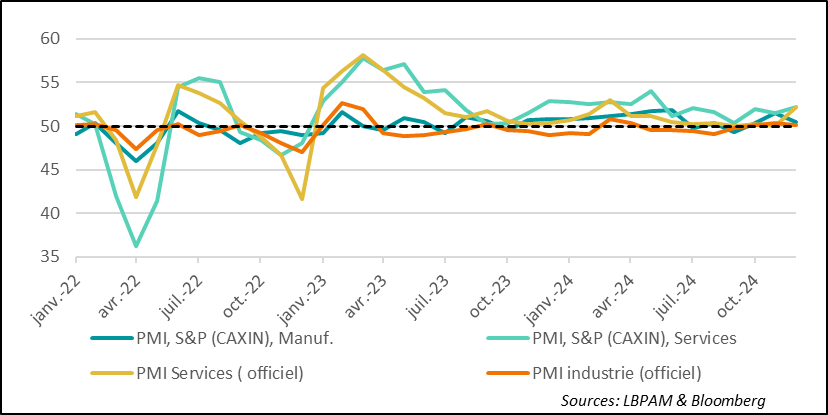

►In China, official PMIs confirmed the deterioration in industrial activity indicated by the private S&P (CAXIN) indicator. This is nevertheless surprising because one might have thought that here too, the anticipation of American tariffs could have stimulated production. However, and this is good news, the official PMI survey and the S&P survey for services saw a strong gain in December. This could indicate that some of the recent financial measures have had a positive impact on domestic demand.

► A final word on European politics. In Austria, President A. Van der Bellen is supposed to have a discussion today with H. Kickl, the leader of the far-right Freedom Party, which won the most seats in the Assembly. This comes after the conservative People's Party gave up forming a coalition with the Social Democrats. The conservative party has said it is ready to discuss with the far-right party, which it had always refused to do. Thus, for the first time since the end of World War II, a far-right chancellor may lead the country. This party is notably pro-Russian and climate-skeptical. If these positions are defended by Austria, it will be a new thorn for Europe, particularly concerning its position on Ukraine.

To go deeper

The first important macroeconomic indicators of the year do not provide a reassuring message about the state of the industrial sector worldwide. Indeed, the global indicator, calculated by JP Morgan based on S&P's PMI surveys, has again fallen into contraction territory in December, albeit marginally. The slowdown was mainly due to the decline in activity in the United States and more markedly in China, even though it remains in expansion territory. In contrast, the situation in the eurozone industry remains very precarious.

Global S&P Industrial PMI: In December, the global industrial situation deteriorated, with the global index slightly falling back into contraction territory

Today, we will have the indicators for the services sector for most of the major countries in the world. In principle, the surveys should show that activity in services remains the main driver of global economic expansion. However, the most important thing will be to see the dynamics of this activity in each country or region.

In the United States, we also had the competing ISM survey for manufacturing activity for December, often considered more reliable. This survey was more reassuring about overall industrial activity, indicating that it continued to improve, even though it remains marginally in contraction territory.

New orders were the main driver of the improvement in activity. Indeed, the index increased by more than 2 points.

However, corroborating the indications given by the S&P survey, the employment situation in the manufacturing sector deteriorated over the month, remaining in contraction territory.

United States: The ISM survey for the manufacturing sector in December improved again thanks to new orders

At the same time, the underlying index concerning companies' inventory behavior, although it has risen, remained in contraction territory. This goes against our forecast and that of many observers. Indeed, one might have expected a strong rise in inventories in anticipation of potential tariff increases by President D. Trump once he is installed in the White House on January 20.

However, on the demand side, it seems that this effect was reflected in car purchases in December, which saw a significant increase. Nevertheless, part of the sales increase can also be attributed to the abandonment of tax credits offered for electric car purchases, which are close to $6,000. D. Trump, supported by E. Musk, has declared his intention to eliminate these subsidies.

United States: Indicators give contradictory messages about expectations regarding the potential impact of tariff increases

In the eurozone, the industrial situation remained very degraded in December. Since July 2022, this indicator for the entire zone has remained in contraction territory. The trend towards improvement from the summer of 2023 gradually deteriorated in 2024.

While the peripheral countries are holding up, except for Italy, which still saw a lesser deterioration in industrial activity in December, the two main economies of the zone are suffering.

Germany and France continue to drag down industrial activity in the zone, with activity in the sector in deep contraction territory. France is the country where the situation is most degraded. This can be explained by the high uncertainty surrounding the country's economic policy.

Eurozone: In December, industrial activity remained very degraded, particularly due to the severe weakness in Germany and France

We will see today if the S&P PMI surveys for services confirm the improvement that seemed to be emerging in the preliminary surveys.

In any case, European growth remains very weak. This is one of the major factors that should push the ECB to maintain the course of rapid key rate cuts in the coming months, while inflation, in our opinion, should resume a more favorable trend to converge towards the 2% target.

In China, the industrial situation deteriorated in both available PMI surveys, the official one and the S&P (CAXIN) one. Nevertheless, the good news is the improvement in the services sector.

For the industry, this deterioration is partly due to a slowdown in orders from abroad. This seems surprising but is consistent with the American ISM surveys. Indeed, one might have expected that American orders, particularly from China, would increase significantly in anticipation of the potential implementation of higher tariffs on Chinese products by D. Trump when he takes office on January 20. We will see in the next statistics if this movement starts or not. It could be that industrialists are counting on weak or very gradual measures.

Regarding services, the rise in PMI indices is good news. This could be explained by a positive impact of the financial easing measures implemented by the authorities in the last months of 2024. Indeed, according to the surveys, it is domestic demand that has been the driving force behind this improvement in activity. This development could relieve some pressure on the authorities in the short term, even though all observers expect more to be done on the fiscal side to support consumption in the coming months to achieve growth targets.

China: While PMI surveys indicate a deterioration in industrial activity, there is a significant improvement in services, driven by a rebound in domestic demand

Sebastian PARIS HORVITZ

Head of Research