Inflation continues to slow gradually

Link

- Markets jumped on the back of a further slowdown in US inflation, which fell more than expected in October after surprising on the upside in the previous two months. The US 10-year yield fell back below 4.5% for the first time in two months, and equity markets returned to their mid-September levels.

- Total inflation slowed from 3.7% to 3.2% in October in the US, mainly thanks to lower energy prices. More importantly, core inflation (excluding energy and food) slowed from 4.1% to 4.0%, its lowest level since mid-2021, thanks to a sequential slowdown in all its components in October. That said, core inflation is still twice above the Fed's target, and the further slowdown in inflation will need to be confirmed in the coming months.

- These figures reduce the risk of a further Fed rate hike, and lead the market to anticipate that the Fed could cut rates as early as Q2 2024 and for a total of 100bp by the end of next year. These expectations are back in line with our scenario. However, we believe that the Fed will wait for confirmation that inflation is slowing below 3% before being confident that it has regained control of inflation, which is unlikely to happen before next year. Above all, the market rebound is leading to an easing of financial conditions, reducing the restrictive impact of the Fed's monetary policy. All in all, we believe that the current rebound is not exaggerated, but is probably well advanced.

- Beyond the US, the latest economic data from Europe and China are reducing downside risks, supporting our scenario of weak but stable growth.

- The job market continues to outperform activity in the Eurozone, with employment up 1.4% in Q3 while GDP stagnated (+0.1%). This, combined with still buoyant wages as inflation slows, is supporting household purchasing power. In addition, the ZEW survey of German financiers indicates that, while the current economic situation remains deteriorated, confidence in the outlook is back in positive territory for the first time since April. We expect the Eurozone to continue to stagnate over the next few quarters, but to avoid entering recession despite its very restrictive monetary policy.

- In China, activity data for October point to fairly stable growth at a limited level at the start of Q4, which is reassuring given the sharp drop in PMIs and exports in October. Industrial production and retail sales accelerated slightly to 4.6% and 7.6%, helped by favorable base effects. On the other hand, investment continued to slow to just 2.9% over the first 10 months of the year, due to the ongoing contraction in real estate investment. All in all, it looks as though China will slightly exceed the 5% growth target for this year, and should slow down only gradually next year, at the cost of increasing support from the authorities.

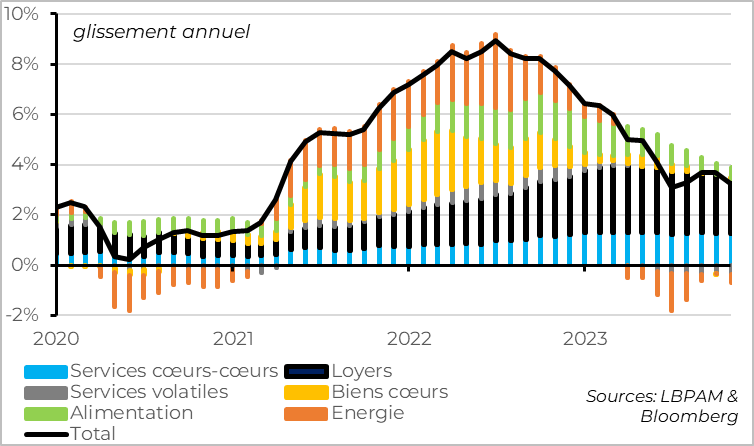

Fig.1 United States: inflation slows across the board in October

Inflation continues to slow in the USA. Prices remained stable in October, allowing total inflation to ease slightly from 3.7% to 3.2%. While this slowdown was mainly due to base effects on oil, the surprise came from core inflation (excluding energy and food), which slowed from 4.1% to 4.0%, its lowest level since mid-2021, even though it is still twice above the Fed's target.

By category, goods prices fell in October for the fifth consecutive month. This was mainly due to used car prices (-0.8% over the month), but prices of other goods have stabilized well over the past 6 months. Overall, year-on-year goods price inflation is zero for the first time since the start of the Covid. The weakness of the industrial cycle and the fall in production prices in China argue in favor of further disinflation in goods over the coming months.

Housing inflation (1/3 of the consumer basket) resumed its downward trend in October, slowing from 7.2% to 6.8% year-on-year (and 0.3% over the month after an unexpected rebound of 0.6% in September). Given the marked slowdown in new rents over the past year, this part of inflation should make a strong contribution to the slowdown in US inflation over the coming year.

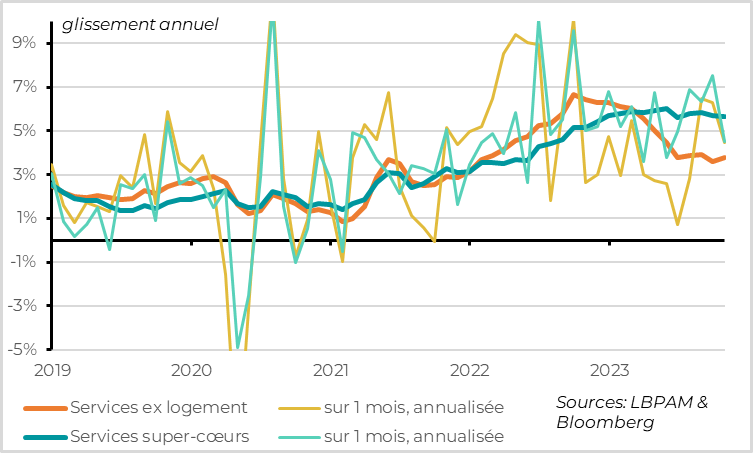

Lastly, inflation in services excluding housing, the Fed's main focus as it is linked to domestic and wage tensions, remains more persistent. It has been stable for 5 months at around 3.7% year-on-year, and slowed only slightly in October after two sharp rises (from 0.5% to 0.4% month-on-month). And if we exclude less persistent items such as the price of air transport or health insurance, inflation in super-core services (1/4 of the basket) has slowed only marginally over the past 2 months, and remains close to its all-time highs at 5.6%.

This persistence explains why we believe that the slowdown in underlying inflation to below 3% will be slow, and will probably require a clearer easing of the labor market and domestic tensions. All the more so as the latest wage figures (stable at 5.2% in October according to the Atlanta Fed) and inflation expectations (at their highest since 2008 according to the University of Michigan at 3.2%) suggest that the risks of persistent inflation above the Fed's target remain high.

All in all, the continuation of the global slowdown in inflation towards a level below 3% by early 2024 greatly reduces the risk of the Fed raising rates further. However, we will probably have to wait for confirmation of a slowdown in the most persistent components of inflation in the coming months before the Fed can be reassured that inflation will converge towards the 2% target. That's why we think the Fed will be wary of saying it's done with rate hikes before the end of the year, and can only start contemplating cuts if the economy slows more sharply by next spring.

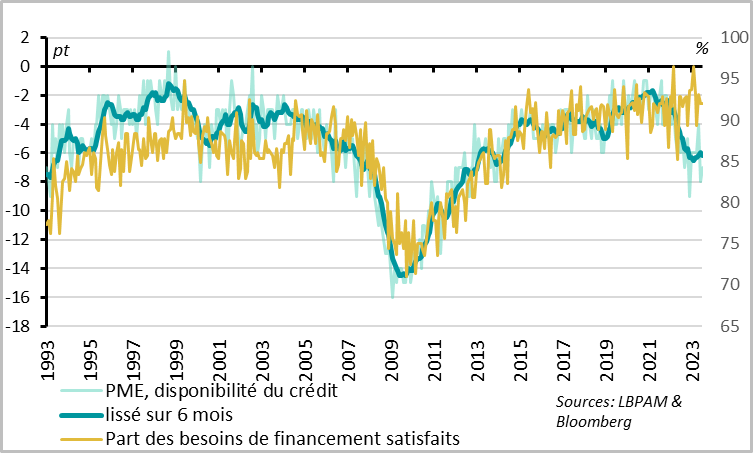

Fig.3 United States: SMEs point to orderly transmission of monetary tightening

According to SMEs, monetary tightening is working as the Fed would like. They indicate that financing conditions remain very restrictive, but that there is no shock to credit availability. This suggests that the transmission of monetary policy to the real economy is taking place, but in an orderly fashion.

On the business front, US SMEs remain pessimistic about the outlook, as their sales are slowing while their costs (energy, wages) remain high. However, hiring and investment plans remain relatively high, which still argues in favor of the soft landing the Fed is dreaming of.

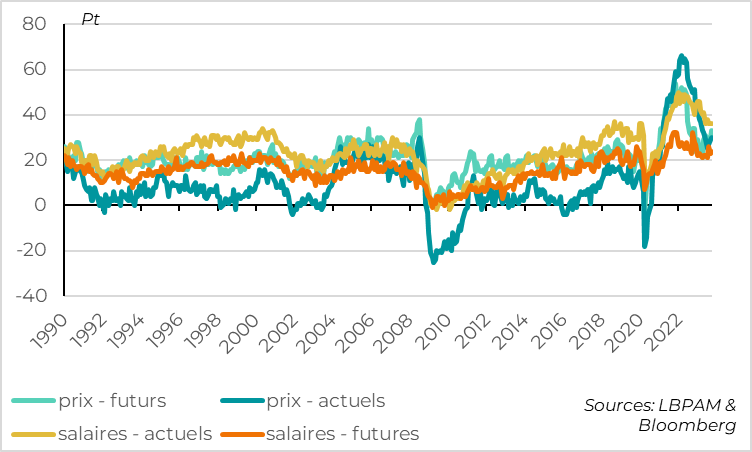

Fig.4 United States: SME price and wage increases still a little too high

But data on prices and wage pressures are less encouraging, suggesting that a more marked deterioration in economic conditions is needed to fully regain control of inflation. SMEs report that wage growth and hiring difficulties remain historically high, above their pre-Covid levels. And still 1/3 of companies say they are raising prices, which is half as much as in 2022, but up again on the first half of the year.

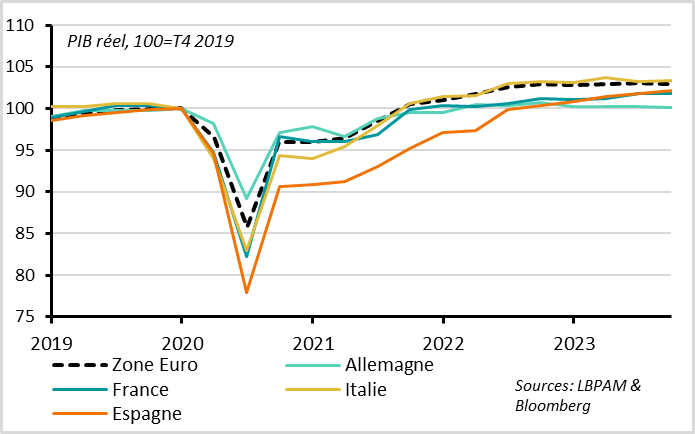

Fig.5 Eurozone: Activity stagnates again in Q3

As regards the Eurozone, the 2nd estimate of Q3 GDP confirms the weakness of activity this summer, with a decline of -0.1% over the quarter after a slight rebound of 0.2% in Q2. More fundamentally, the Eurozone has been stagnating for a year, with year-on-year growth of 0.1%. We'll have to wait for the 3rd estimate to get the details of GDP by component. But this estimate confirms France's resilience and Spain's continued recovery, while GDP is down slightly in Germany and Italy.

Fig.6 United States: SMEs point to orderly transmission of monetary tightening

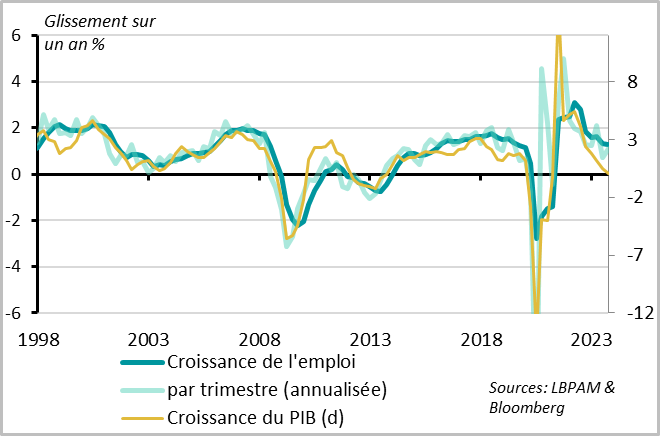

The good news for the Eurozone remains the growth in employment, which continues despite the absence of growth. Employment rose by 0.3% in Q3, following a 0.1% increase in Q2, outperforming GDP growth for the 5th consecutive quarter. Year-on-year, employment rose by 1.4%, still above its normal growth rate.

Fig.7 Eurozone: Household purchasing power back in positive territory by mid-2023

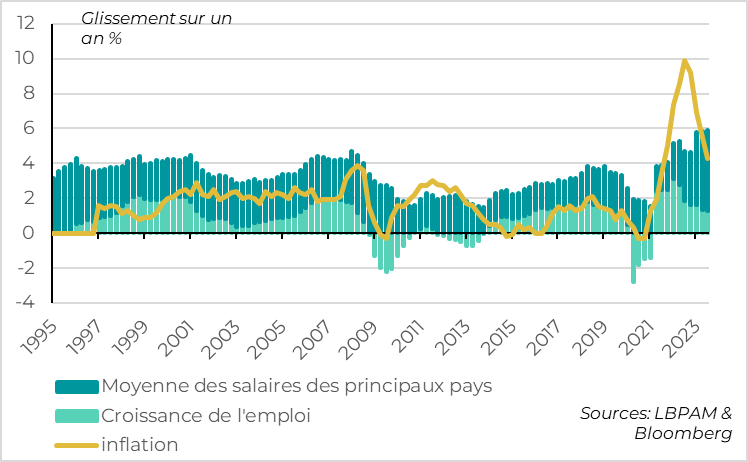

On the bright side, job growth combined with still buoyant wages in Q3 is supporting household purchasing power. Indeed, wage income will finally outpace inflation in mid-2023, for the first time since 2021. The downside is that labor productivity (i.e. output per employee) is deteriorating, boosting unit labor costs and thus inflationary pressures in the medium term.

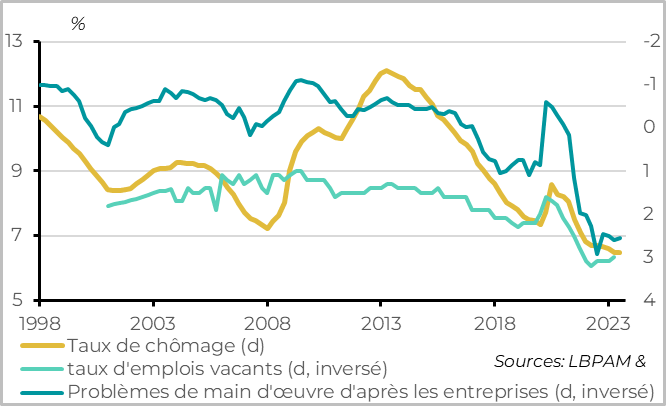

Fig.8 Eurozone: job market remains solid

The unemployment rate remained stable in Q3 at 6.5%, its lowest level since the creation of the Eurozone. It is no longer falling, and should even start to rise slightly by the end of 2024. But the labor market remains tight, according to companies, which is supporting wage growth. This is why we believe that consumption, and ultimately GDP, should not contract significantly in the Eurozone, despite the many headwinds.

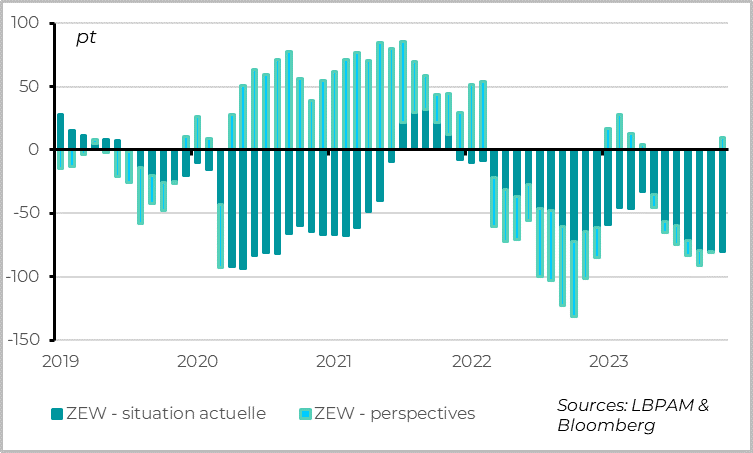

Fig.9 Eurozone: German financial confidence back in positive territory for the first time since April

The latest ZEW survey for November is also encouraging, indicating that while the current economic situation in Germany remains very poor, the outlook is stabilizing. This indicator, which is based on financial sentiment, should not be over-interpreted, but the outlook component is historically a fairly good leading indicator of 3-month cycle reversals. This suggests that the German economy could stabilize at the end of 2024, after a slight contraction in the second half of this year.

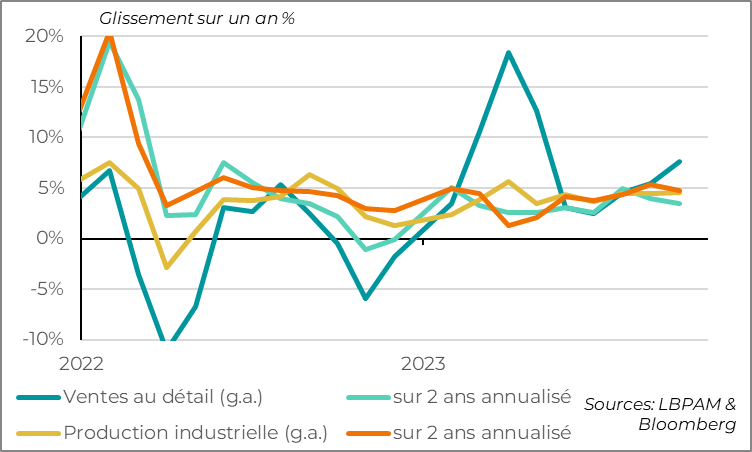

Fig.10 China: growth remains broadly stable in October

China's activity data for October point to fairly stable growth at a limited level at the start of Q4, which is reassuring given the sharp drop in PMIs and exports in October. Industrial production and retail sales accelerated slightly year-on-year, to 4.6% and 7.6% respectively. That said, this acceleration is due to favourable base effects, as activity had fallen sharply at the end of 2022 due to the Zero-Covid policy. To smooth out this effect, we can look at 2-year growth. This shows a slight slowdown in industrial production and retail sales, to 4.8% and 3.8% respectively. The 3-month growth in these indicators also points to a slight slowdown in activity in October, but no collapse.

On the other hand, investment remains very weak. It continues to slow to just 2.9% over the first 10 months of the year, its weakest growth since 2020. This is still due to the contraction in real estate investment (-9.3%), while industrial and infrastructure investment remains stable.

The adjustment in real estate is likely to remain a drag for several years, requiring strong support for the economy from the authorities to avoid an abrupt slowdown. This is what they have been doing since late summer, by increasing the central government's deficit target, reducing financial pressure on local governments and injecting more liquidity into the financial system.