Inflation is slowing in the United States, but its convergence toward 2% will be slow

Link

Find the market analysis of February 17, 2026, by Sebastian Paris Horvitz.

Overview

► U.S. Secretary of State Mr. Rubio spoke at the annual Munich Security Conference. Unlike J. D. Vance, the U.S. Vice President last year, his speech was noticeably more friendly toward European allies, while stressing the need for them to evolve. According to him, this evolution would align with the themes promoted by President Trump. To underline the U.S. government’s stance, Mr. Rubio visited only two countries after Munich: Slovakia and Hungary, both considered pro‑Russian and aligned with D. Trump. Mr. Rubio also expressed full support for Hungarian Prime Minister V. Orban ahead of the upcoming legislative elections on April 12.

►Thus, in a context of ongoing tensions with the United States, European Union member states met to discuss industrial policy, and more specifically competitiveness. Given the urgency, heads of state emphasized the importance of accelerating European integration. In this spirit, the Commission is expected to present at the next European Council meeting a plan entitled “One Europe, One Market.” In addition, during a Eurogroup meeting, all Finance Ministers agreed on the need to strengthen the international role of the euro to better protect European economies. It remains to be seen how Europe will act to reinforce its security and growth beyond the stimulus plans currently in place, particularly in Germany.

►Nevertheless, despite a politically fragmented world and unprecedented tensions between the U.S. and its allies, markets remain primarily focused on economic trends and on the impacts of the development of artificial intelligence (AI). On this topic, after a phase driven by heavy infrastructure investment for AI applications (the search for winners), investors’ attention has recently shifted toward the potentially disruptive effects of AI on existing industries (the search for losers).

► In particular, last week software companies were heavily hit, leading to massive corrections in their stock prices. It is well known that markets often exaggerate trends. While fully aware of AI’s profoundly disruptive and transformative nature, and while maintaining a relatively pro‑risk stance in portfolio allocations, we nonetheless favor strong diversification over abrupt bets based on limited tangible evidence.

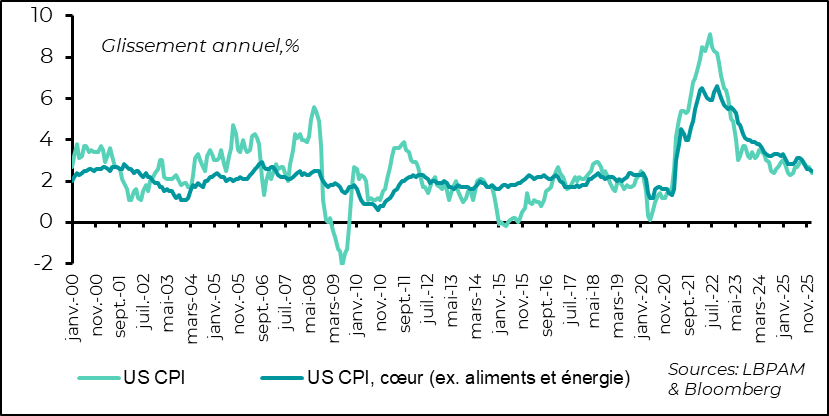

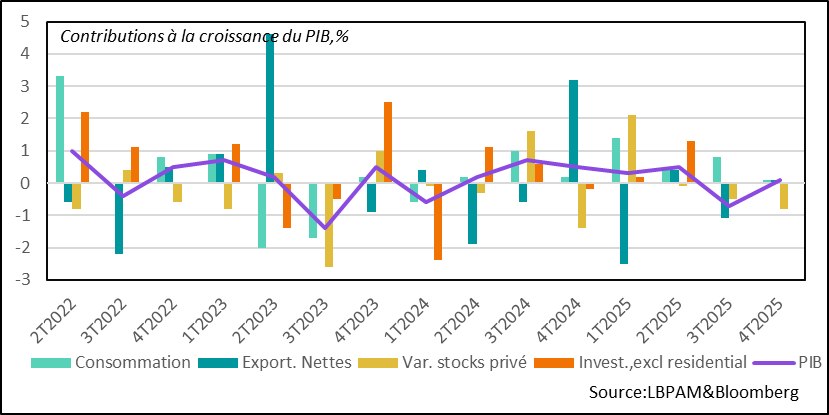

►From a cyclical standpoint, U.S. data—whose publication schedule remains disrupted—has recently been rather favorable. Following labor market statistics indicating that unemployment remained low in January (4.3%), inflation figures came in lower than expected. Headline CPI slowed to 2.4% year‑on‑year, while core inflation fell to 2.5%, its lowest level since early 2021. A positive trend shift seems to be emerging since the government “shutdown.” However, it is still difficult to affirm that a clear movement toward 2% inflation is underway. Those who believe so now expect three or even four Fed rate cuts. For our part, we believe the disinflationary trend will remain slow, especially as demand is likely to stay relatively strong in the first half of the year. Hence our expectation of just one policy rate cut in 2026.

►In Japan, GDP growth data for Q4 2025 disappointed, with an increase of only 0.1%. While this does represent a rebound after the ‑0.6% drop in the previous quarter, it points to rather modest expansion at year‑end. However, this disappointment is partly explained by a strongly negative contribution from inventories to GDP and by the still‑negative contribution of public investment. We believe the coming months should show improvement, already visible in cyclical indicators such as PMI surveys. This upturn is mainly driven by the fiscal stimulus introduced by Prime Minister S. Takaichi, which should further support growth. In this context, we believe that although GDP figures are weak, they should not prevent the BoJ from continuing to tighten monetary policy. This factor should continue to strengthen the yen, which may weigh somewhat on Japanese export‑exposed equities..

Going Further

United States: Inflation is slowing more than expected at the start of the year, but...

...on a year‑over‑year basis, inflation is decelerating

Despite delays in the release of economic data caused by the new government “shutdown,” U.S. CPI inflation for January 2026 came in lower than expected. Headline inflation fell to 2.4% year‑on‑year, mainly due to a decline in gasoline prices. Core inflation, excluding energy and food, dropped to 2.5%, its lowest level since early 2021, largely thanks to the slowdown in rental prices, which carry significant weight in the index. These developments are reassuring and positive news. Nevertheless, the abrupt break in trend observed since the government paralysis (“shutdown”) is somewhat surprising.

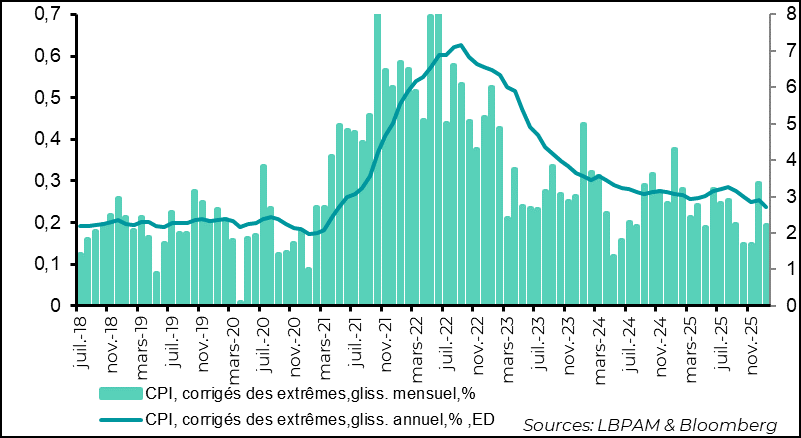

Inflation measures adjusted for extreme variations are also declining

Although certain goods and services contributed particularly strongly to the recent slowdown in inflation, measures designed to filter out extreme movements confirm that the deceleration is indeed real. For instance, statistics from the Cleveland Fed also show a clear slowdown, both year‑on‑year and month‑on‑month. This trend may have been influenced by data‑collection challenges during the shutdown period. However, it is also possible that it reflects weakening demand at the end of the year, which may have limited price increases despite persistent cost pressures, notably linked to tariff hikes.

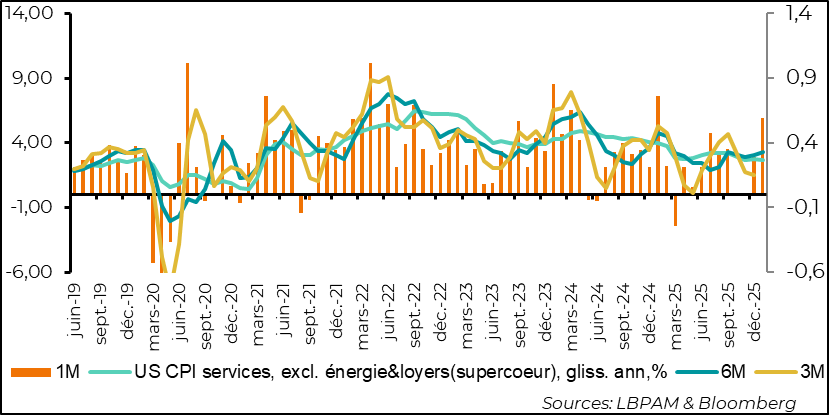

Prices for non‑housing services are also slowing, even though there was a temporary acceleration in January

At the same time, despite a broad year‑on‑year deceleration, data from the most recent month show that some pockets of price tension persist. For prices of services excluding rents and energy (the “super‑core”), a measure closely monitored by Fed Chair J. Powell, monthly growth was very strong, exceeding 0.5%. This movement may reverse, but it remains a point to watch in the coming months.

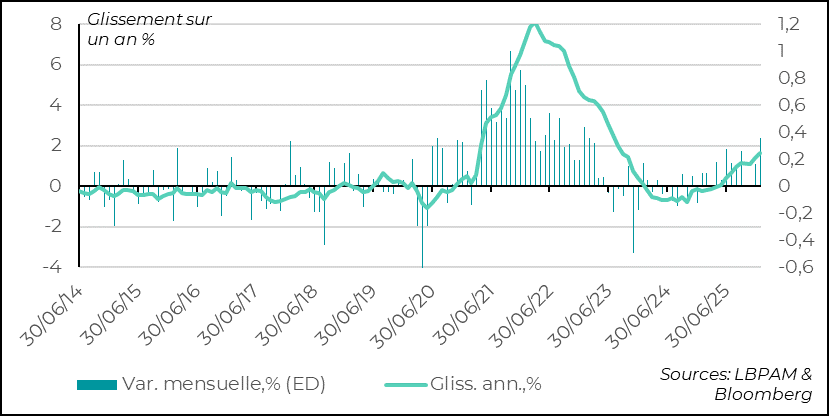

Goods inflation persists

Furthermore, the idea that the pass‑through of tariff increases on goods is now complete does not seem fully supported by the data. In fact, goods prices continue to rise. Aside from the Covid period, goods prices in the U.S. had generally tended to stagnate. Today, they continue to increase. Even if these rises appear modest relative to the scale of tariff hikes, the data suggests that the process may not yet be over. Prices for goods excluding food, energy, and used cars rose again in January by 1.6% year‑on‑year and 0.4% month‑on‑month.

We continue to believe that the impact of tariffs should fade over the course of the year, particularly if President Trump pursues the tariff reductions already initiated, such as those recently applied to certain metals. However, if—as we anticipate—demand accelerates in the first half of 2026 due to ongoing fiscal stimulus, inflation is likely to decelerate much more slowly than currently expected. This is why we believe the Fed should remain cautious in the coming months and proceed with only one additional rate cut, likely in the spring or summer.

Japan: growth slows in the fourth quarter of 2025, but is expected to accelerate in the first half of 2026

Japan’s GDP growth disappointed in Q4 2025, with an increase of only 0.1%

Japan’s GDP grew by just 0.1% in the fourth quarter of 2025, a result well below expectations. Two main factors contributed to this slowdown: a sharp decline in inventories and, to a lesser extent, the continued contraction of public investment.

The data also show that domestic demand remained weak at the end of the year—particularly household consumption, but also private investment.

This trend could raise concerns about the future trajectory of the economy. However, recent business surveys, notably the PMIs, paint a more positive picture. This improvement is partly driven by the stimulus plan that Prime Minister S. Takaichi is preparing to implement. The program is expected to be even more ambitious following the LDP’s historic victory in the latest elections, which granted the party a supermajority in the House of Representatives.

In this context, we expect stronger growth in the coming quarters. This should reinforce the Bank of Japan’s determination to continue tightening its monetary policy. Despite the weak growth in Q4 2025, the yen has continued its appreciation trend. However, this trend may put pressure on Japanese export‑oriented companies, potentially weighing on their valuations after the significant gains recently observed. Conversely, sectors more exposed to the domestic economy should, in our view, benefit from a more favorable environment in the months ahead.

Sebastian Paris Horvitz

Head of Research