Inflationary pressures fall more sharply in Europe than in the United States

Link

-

The markets consolidated slightly at the start of the week, continuing to normalise after their strong rebound at the end of 2023. Cautious statements by central bankers on the timing and speed of rate cuts called into question the aggressive rate cuts that the markets were anticipating. For the first time since mid-December, 10-year yields have risen above 4% in the United States and above 2.75% in France. This is weighing on equities, which are holding up reasonably well against a backdrop of continuing high political uncertainty (following Trump's clear victory in Iowa) and geopolitical uncertainty (with the growing number of "incidents" in the Middle East).

-

Activity in the Eurozone remains depressed at the end of 2023, particularly in Germany. Industrial production and retail sales contracted by 0.3% in November, suggesting a further fall in Eurozone GDP in Q4 after the -0.1% fall in Q3 2023. That said, leading indicators such as the ZEW point to a slight improvement in the outlook at the start of 2024. We continue to forecast that the Eurozone will continue to stagnate until mid-2024, but should avoid a full-blown recession.

-

The good news for the Eurozone again comes from inflation. After the sharper-than-expected slowdown in inflation at the end of 2023, the ECB survey shows that household inflation expectations are calming down and returning to their lowest level since the start of the war in Ukraine. Although most ECB members are arguing against imminent rate cuts, sluggish growth and the clear decline in inflationary risks justify cutting rates fairly quickly, as early as April in our view.

-

In the UK, the latest data is more reassuring, despite the fact that the risk of recession and persistent inflation was higher there than in the Eurozone and the US. Economic activity seems to be stabilising at the end of 2023 and the labour market is slowing only gradually. At the same time, wage growth is finally slowing markedly, falling below 6% by the end of 2023, whereas it was still almost 8% last summer. While this is still well above the 3-4% that the Bank of England considers reasonable, the progress should enable the central bank to announce the end of its rate hike cycle at the end of January.

-

Chinese growth was somewhat disappointing at the end of 2023, still weighed down by the property sector. GDP grew by 5.2% in Q4 and over 2023. This is slightly above the authorities' target for the year (5%), but a disappointing level for a post-Covid reopening year. We believe that the authorities' increasing support for the economy will help to stabilise growth at just below 5% this year, but the property sector continues to pose negative risks to our scenario.

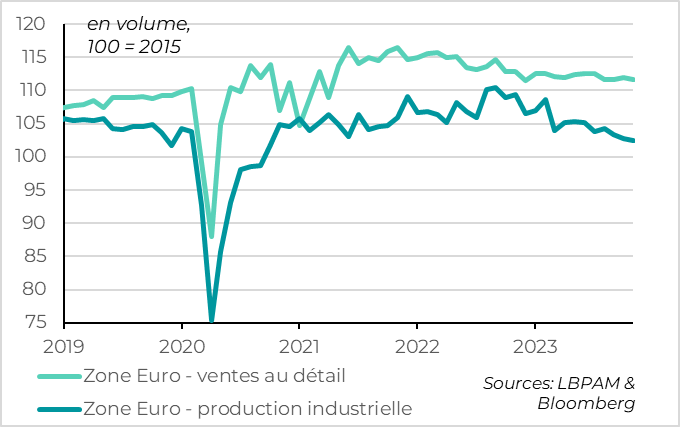

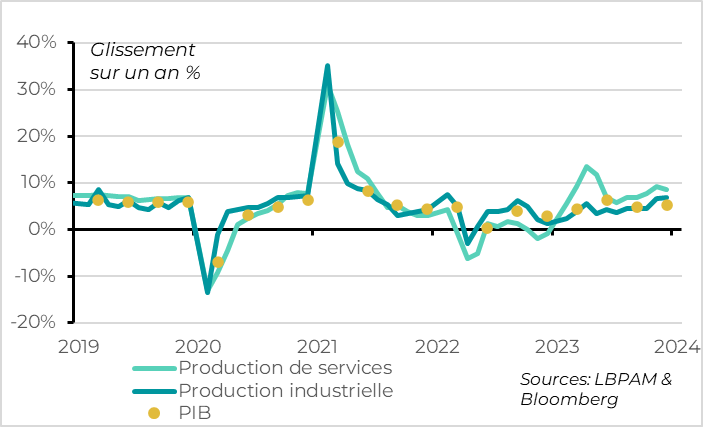

Fig.1 Eurozone: very weak monthly activity data at the end of 2023

Activity in the Eurozone remains weak at the end of 2023, particularly in Germany.

For the Eurozone, retail sales cancel out their October rebound in November (-0.3%), while industrial production falls again (-0.3% after -0.7%) and car sales remain below their summer level.

These monthly activity data and the fact that the services PMI remained below 50pt suggest that GDP fell again in Q4, perhaps a little more than in Q3 (-0.1% quarter-on-quarter). The Eurozone would therefore be in technical recession in the second half of 2023 (i.e. two consecutive quarters of falling GDP). That said, the fall in GDP remains very limited and employment has held up well, so that in our view this is more a case of stagnation than a real recession.

In country terms, activity at the end of 2023 was particularly weak in Germany. According to the German statistical agency's first estimate, GDP fell by 0.3% in Q4 after rising by 0.1% in Q3. If Germany avoids a technical recession, GDP would have fallen by 0.3% over 2023 as a whole.

In contrast, activity held up better in France, thanks mainly to services. Last week, the Banque de France revised its growth forecast for Q4 2023 from 0.1% to 0.2%, following a 0.1% fall in Q3.

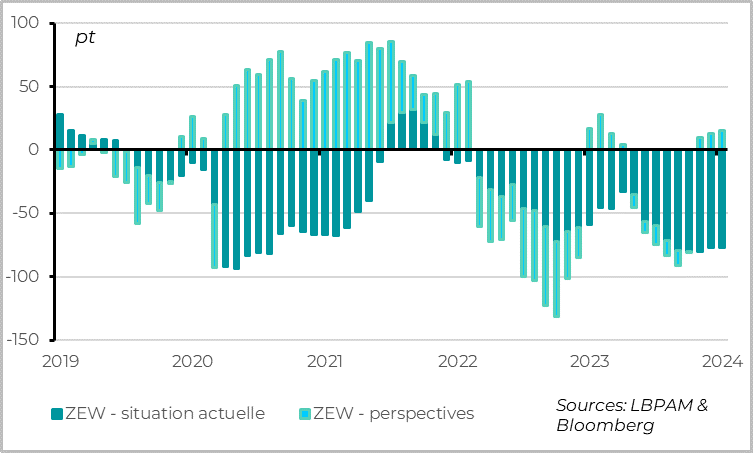

Fig.2 Eurozone: But confidence in the outlook continues to recover in early 2024

That said, the outlook for Europe is improving slightly for 2024, even if activity is still weak in early 2024.

According to the ZEW survey, the outlook continues to improve in January, even though the current situation of the German economy is stagnating at a very low level. This survey of investors (not businesses or households) should be taken with a grain of salt, but it has historically been a fairly good leading indicator of cyclical downturns. And it goes in the same direction as the PMIs and consumer confidence indications at the end of 2023, which were starting to improve but remained at deteriorated levels. This suggests that activity remains weak but is not deteriorating any further, and could start to improve a little in the coming months.

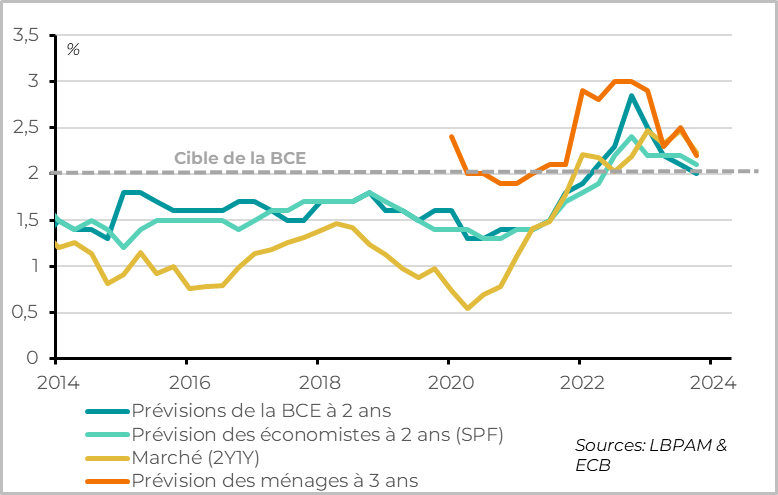

Fig.3 Zone-Euro : la baisse de l’inflation et du pétrole permet aux anticipations d’inflation

As in recent months, the good news for the Eurozone comes from inflation, and this time from inflation expectations. In addition to the sharper slowdown in inflation achieved by the end of 2023, inflation expectations are falling back into line with the ECB's target for the next 1-2 years. Well-anchored inflation expectations are vital if inflation is to return gradually to its target and if the ECB is to start cutting rates.

According to the ECB, household inflation expectations will fall sharply by the end of 2023, from 4% to 3.2% over 1 year and from 2.5% to 2.2% over 3 years. In both cases, this is their lowest level since the start of the war in Ukraine. Economists' inflation expectations have also returned to close to the 2% target at the end of 2023, and in December the ECB forecast that inflation would return to its target during 2025.

The latest speeches by ECB members, while not calling into question the fact that rates should fall in 2024, continue to indicate that they do not wish to start cutting key rates too quickly. This is why we believe that the ECB will wait until the 2nd quarter. But, unlike in the US, sluggish growth and the clear decline in inflationary risks justify cutting rates fairly quickly, as early as April in our view.

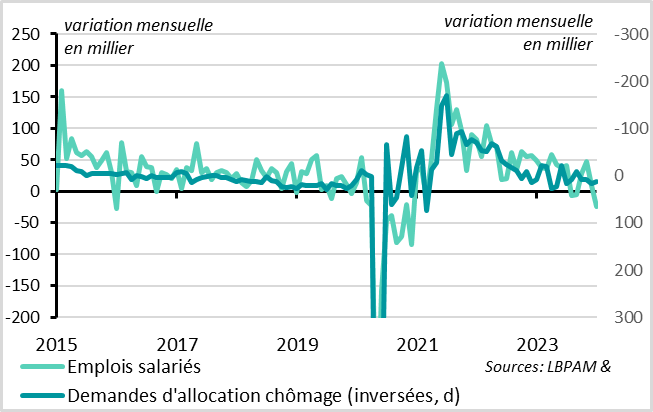

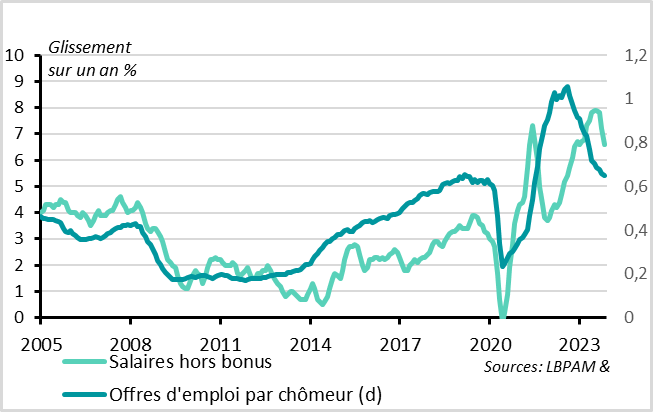

Fig.4 United Kingdom: employment slows but does not collapse

In the UK, the latest data are rather encouraging for the Bank of England.

Activity remains weak at the turn of the year, but is not contracting sharply. GDP rebounded by 0.3% in November after a fall of 0.3% in October. If we add the rebound in the services PMI, which has been in the expansion zone since November, it would appear that GDP stagnated in Q4 2023 after its slight fall of 0.1% in Q3. Contrary to what might have been feared, the UK therefore seems to have avoided a technical recession in 2023.

The labour market is slowing but not deteriorating sharply. Payroll employment fell in December by 24 thousand according to the ONS's first estimate, but continues to be revised upwards for previous months. Overall, employment rose by 30 thousand in Q4 after 18 thousand in Q3, a limited level but far from a collapse. The number of unemployed also rose, but only slightly. Overall, the unemployment rate has stabilised since the summer at 4.2%, after rising gradually from 3.5% in mid-2022. It remains slightly below the equilibrium level estimated by the Bank of England (~4.5%).

Fig.5 United Kingdom: Wages and employment pressures begin to ease fairly quickly

Above all, wage pressures are slowing rapidly. This reduces the risk of a wage-price loop, which was higher in the UK than in other developed countries.

Weekly wages slowed from 7.2% to 6.6% over 3 months in November, and fell below 6% for the first time in 1 and a half years. This is a marked slowdown from the 8% reached last summer, although it is still well above the 3-4% that the Bank of England considers reasonable.

And the leading indicators suggest that wage pressures will continue to slow over the coming months. Job vacancies continue to normalise. They remain at a high absolute level, but have finally returned to their pre-Covid level in relation to the number of unemployed.

With core inflation falling more sharply than expected at the end of 2023, the Bank of England is likely to withdraw the upward bias in rates that it has maintained until now in the coming weeks. We expect it to start cutting rates in the spring, like the ECB, and potentially a little more aggressively in subsequent quarters.

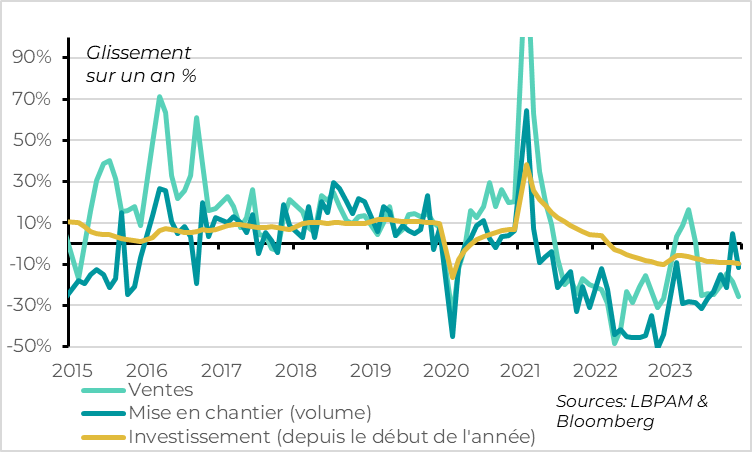

Fig.6 China: growth remains stable but limited at the end of 2023

Chinese growth came out at 5.2% in Q4 2023, which is also the growth rate for 2023 as a whole. This is slightly above the authorities' target (5%), but remains limited after the weak growth of 2022 (3%) and for a year that is supposed to mark the post-Covid reopening of the Chinese economy. This is all the more true given that growth is slowing sequentially at the end of the year, after rebounding slightly in mid-2023.

The monthly data show that industrial activity accelerates slightly towards the end of the year, driven by public investment and the tech cycle in Asia, but that domestic demand slows again due to the ongoing property adjustment.

Fig.7 China: Property prices still a long way from stabilising

In fact, the fall in property investment accelerated in December to reach 9.6% over 2023, sales and housing starts remain very weak and property prices fell the most sharply since 2015 in December.

While we expect growth in China to stabilise at just below 5% this year thanks to the authorities' increasing support for the economy, our scenario assumes that the property adjustment remains under control and weighs less negatively on confidence. As things stand, the risks therefore still appear to be on the downside.