Inflationary risks do not disappear quickly

Link

- As for the war between Israel and Hamas, tensions and uncertainties remain high, with the imminent invasion of Gaza and increased friction on the border with Lebanon threatening to open a second front to the north of Israel. The risk for the global economy in the short term remains, in our view, an extension of the conflict involving Iran. The markets still seem to be keeping calm, with rates stable and markets up slightly this morning in Asia. This seems reasonable as long as the central scenario is not significantly altered by events.

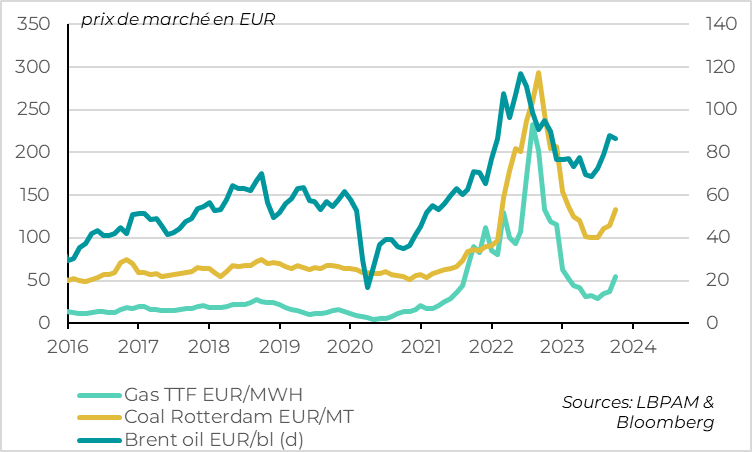

- The price of oil remains under a little pressure, rising back above $90 a barrel over the weekend. But it is "only" 5 dollars per barrel above its pre-event level, and is still below the levels reached in September. Gas prices in Europe, on the other hand, continued their upward trend, fuelled as ever by fears of supply risks as temperatures finally ease in Europe. The spot price of gas in the Netherlands, Europe's benchmark, has risen by almost 50% since its low point at the beginning of October and, at 55 EUR/MWh, is at its highest level since February.

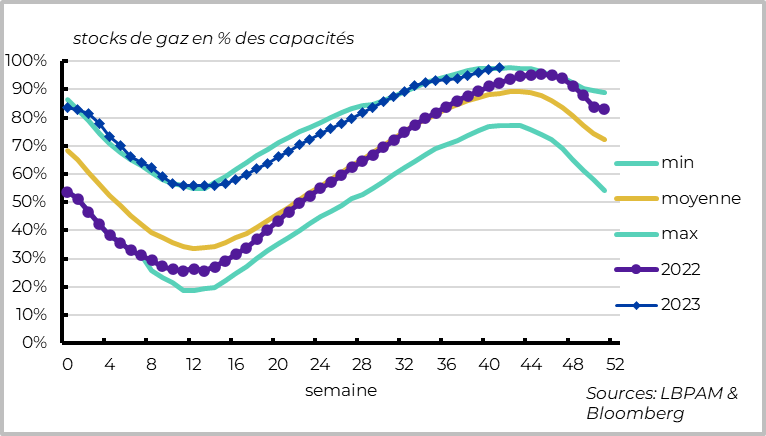

- That said, the level reached by the price of gas remains in line with our scenario (and that of the ECB), and we believe that this rise should be contained, given that gas stocks in the EU are very ample (97% full). Of course, a further rise would lead us to revise our scenario, and a recession in the Eurozone this winter would quickly become likely.

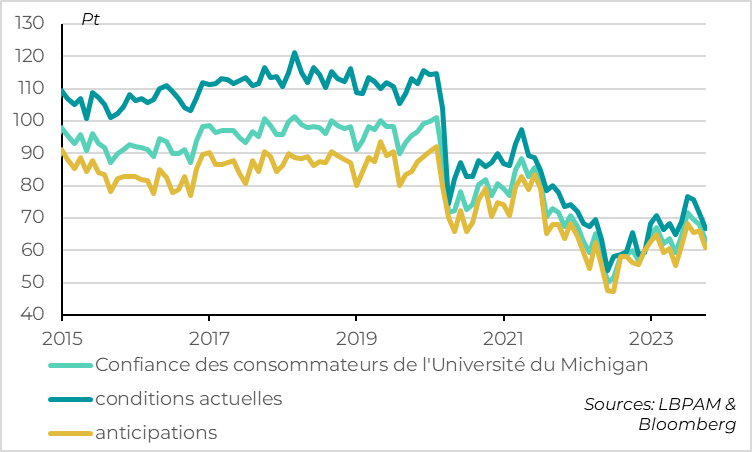

- US consumer confidence fell again at the beginning of October according to the University of Michigan survey, due to the deterioration in their financial condition following the market downturn over the past 2 months, but also to renewed fears of inflation. After three consecutive declines, household confidence is back to pre-summer levels at 63pt, supporting our forecast of a fairly sharp slowdown in consumption at the end of 2024 after its rebound in Q3.

- Above all, household inflation expectations are rebounding, both in the short and long term. They are at the top end of their historical range, suggesting that they remain anchored but that the risk of de-anchoring remains present, especially after September's slightly stronger-than-expected inflation figures. All in all, we still believe that the Fed will not raise rates further in early November, but will maintain an upward bias, indicating that a December rate hike remains a possibility.

- In China, the first data available for September (foreign trade, credit growth) are rather reassuring, supporting the idea that growth is stabilizing close to the authorities' 5% target. The authorities' fairly targeted support measures seem to be bearing fruit, helped by the stabilization of foreign demand for goods. That said, private domestic demand remains weak, reducing the chances of a sustainable rebound in growth.

Fig.1 Market: energy prices recover slightly, especially gas prices in Europe

IThe price of oil remains under a little pressure, rising back above $90 a barrel over the weekend. But it is "only" 5 dollars per barrel above its pre-event level, and is still below the levels reached in September.

By contrast, gas prices in Europe have continued their upward thrust, still fuelled by fears over supply risks at a time when temperatures are finally dropping in Europe. In addition to uncertainty in the Middle East (which produces 20% of the world's gas), a pipeline rupture in Finland and the threat of another strike in Australia have led to fears of a reduction in liquefied gas supplies. All in all, the spot price of Gas in the Netherlands, Europe's benchmark, has risen by almost 50% since its low point at the beginning of October and, at 55 EUR/MWh, is at its highest level since February.

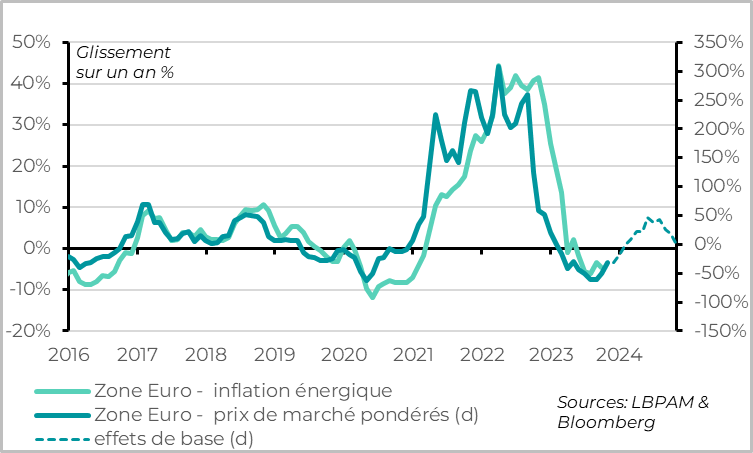

Of course, rising gas prices are not good news for growth, inflation or European currencies. If it persists, it will weigh on household purchasing power, increase business costs and push energy inflation into positive territory early next year. Given the weakness of activity in the Eurozone, a further negative energy shock could quickly trigger a recession. And given the still-high level of inflation, such a shock would limit the ECB's ability to cushion the slowdown.

For the time being, however, this increase remains limited, and in our view should remain contained given the very ample inventory levels in Europe.

Indeed, gas prices remain well below their end-2021-2022 levels and, in fact, at the level incorporated in our scenario, as in that of the ECB. The ECB's September forecasts are based on an average gas price of 54 EUR/MWh in 2024. So, until then, the recent rise in gas prices reduces the positive risks to the scenario rather than generating a downside risk. Of course, a continuation of the recent rise would change all that.

Fig.3 European Union: gas stocks are full at the start of winter, limiting risks

HIn fact, European Union gas stocks are 98% full in mid-October, just before the start of the winter season. This is the highest storage level in the last 10 years. By way of comparison, storage was only 77% at the same time in 2021, just before the start of the war in Ukraine. If winter is not too harsh, and gas sources outside Russia do not fall sharply, gas prices should not rise further in our central scenario.

Fig.4 United States: Household confidence falls sharply in early October

US consumer confidence falls again at the beginning of October, according to the University of Michigan survey, due to renewed inflation fears.

After three consecutive declines, household confidence returned to pre-summer levels in early October, at 63pt. In terms of levels, the weakness of household confidence should not be taken too seriously. Indeed, the level of household confidence according to this survey has been very low since 2022, much lower than according to other surveys such as the Conference Board's. This has not translated into weak consumption, quite the contrary. However, the downward momentum of confidence after its summer rebound does suggest that households' financial situation is worsening, which is consistent with the rise in defaults since Q2, the rise in energy prices in Q3 and the end of the suspension of student loan repayments in Q4. All in all, this figure is in line with our scenario, which predicts a fairly sharp slowdown in consumption in Q4 after its Q3 rebound, although the strength of employment could limit the extent of this slowdown.

The driving forces behind the fall in household confidence seem to be the weakening of their financial situation, which was expected with the depletion of accumulated savings and the downturn in the markets since August, but also the return of inflation fears.

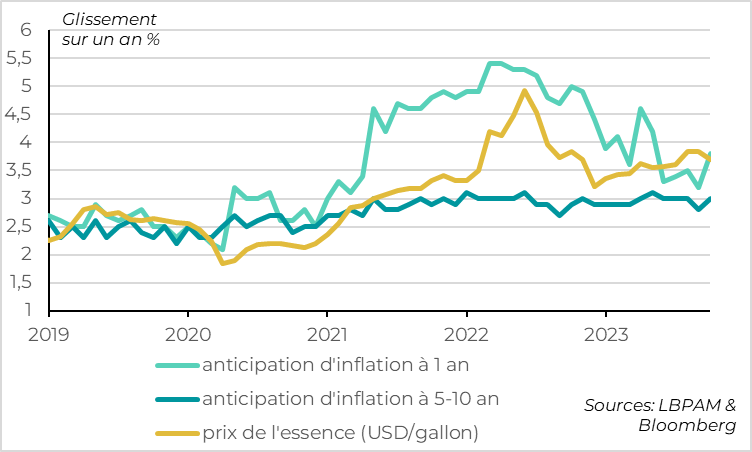

Fig.5 United States: Partly reflecting a rise in inflation fears

Households' one-year inflation expectations rebounded from 3.2% to 3.8% at the beginning of October, their highest level for 6 months, although still well below 2021-2022 levels. This may be explained in part by the rise in gasoline prices in August and September. If this is indeed the case, these short-term inflation expectations should calm down, given that gasoline prices have been falling sharply since early October.

But what's more important is that household long-term inflation expectations, which are less volatile, also rose in early October, from 2.8% to 3.0%. They remain within the range observed since 2021 (2.8-3.1%). But they are at the top end of the range observed since the early 2000s, and well above the level just before the Covid (~2.5%).

All in all, inflation expectations remain anchored, but at the upper end of their historical range. This should keep the Fed alert to the risk of inflation persisting above its target, especially after September's slightly higher-than-expected inflation and much stronger-than-expected employment figures.

After last week's speeches by Fed members, virtually all of whom emphasized the tightening of financial conditions associated with higher long-term rates, we still believe that the Fed will not raise rates further in early November. But if our scenario remains that the Fed will not raise rates further in this cycle, the risk of a final rate hike in December is likely to persist.