Interest rate cuts approaching in Europe

Link

-

The markets are awaiting Wednesday's US inflation figures for April. This will be the first test after the Fed's reassuring meeting at the beginning of the month, when Powell indicated that the next key rate change should always be downwards, even if the first cut is likely to come later than previously thought. This led to a sharp fall in interest rates, which have fallen by almost 20bp in the US since the start of the month. We believe that uncertainty about US interest rates (and therefore about other US assets) remains high, hence our preference for European bonds and equities. Particularly as the economic recovery in Europe is confirmed.

-

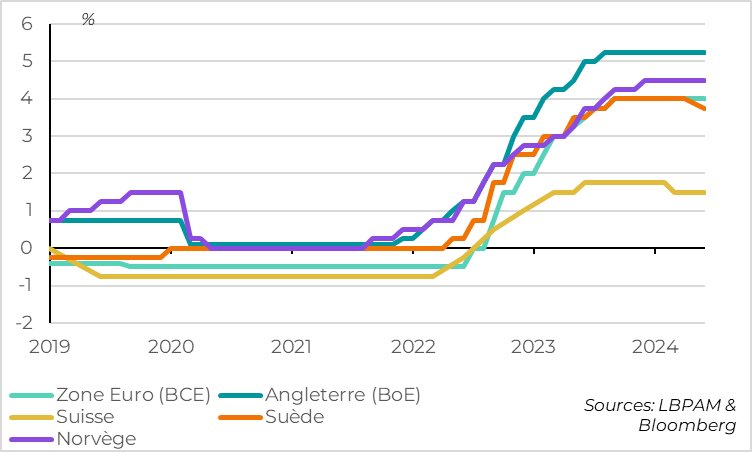

Rate cuts are more imminent in Europe, where central banks are adopting fairly accommodating tones. After the Bank of Switzerland, Sveriges Riksbank became the second G10 central bank to start cutting rates last week. Beyond that, the ECB has all but pre-announced its first rate cut in June. And the Bank of England (BoE) is also preparing to start cutting rates this summer, probably before the Fed. The BoE's accommodative tone last week reinforces our belief that UK rates could fall a little faster than the markets are expecting.

-

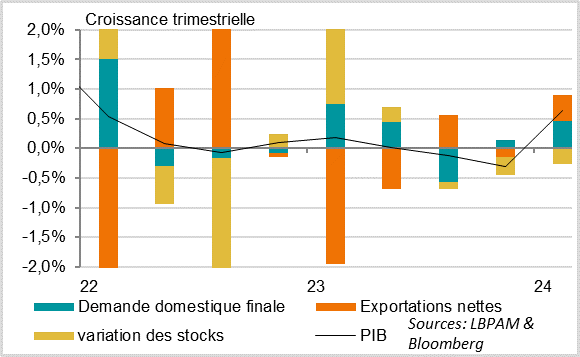

At the same time, the recovery in the UK is stronger than expected. Growth rebounded strongly in Q1 (+0.6% over the quarter) after the recession in the second half of last year, allowing GDP to climb back above its historic high and start Q2 with momentum. If the strength of the recovery is exaggerated by the fall in imports, this confirms the return of growth in Europe in 2024 after several quarters of stagnation. However, this recovery should remain gradual, which would not call into question gradual rate cuts as long as price and wage pressures continue to ease.

-

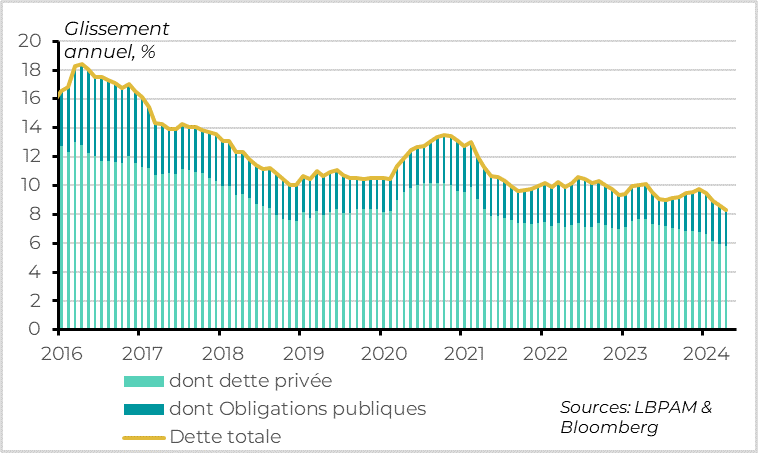

In China, however, the outlook remains complicated and we still believe that growth is likely to slow again in the second half of the year. Indeed, total credit to the economy fell in April for the first time, as the fall in government bond issuance failed to offset the continuing weakness in demand for private credit. And the lack of demand relative to supply is maintaining deflationary pressures, with inflation remaining low at 0.3% and producer prices still falling more than expected.

Fig.1 Europe: key interest rate cuts have begun

After the Bank of Switzerland, Sveriges Riksbank became the second G10 central bank to begin cutting rates last week. And while the ECB has all but pre-announced its first rate cut in June, the Bank of England (BoE) is also preparing to start cutting rates this summer, probably before the Fed.

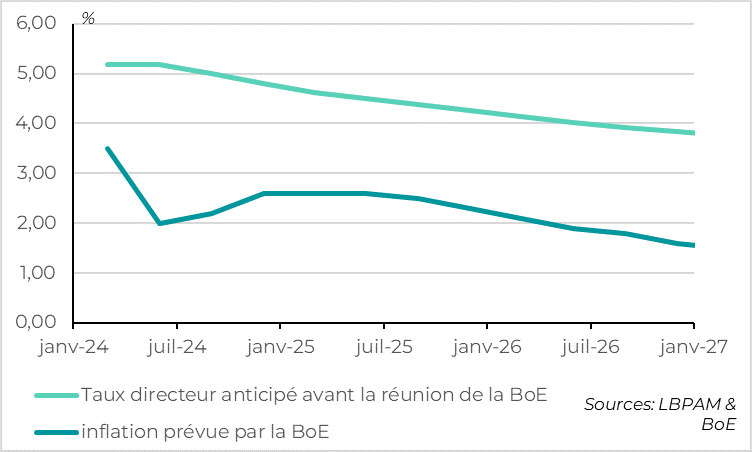

Fig.2 United Kingdom: the central bank sees inflation falling back below target if it keeps interest rates too high

The BoE was more accommodating than expected at its last meeting on Thursday. Of the nine members, two voted for a rate cut (one more than in March), although the majority preferred to leave rates unchanged, as expected. In addition, the BoE adjusted its statement to emphasise the importance of the forthcoming data in its decision on rates. Finally, the BoE has revised down its inflation forecasts, which now indicate that inflation will fall below the 2% target over the next 2 years (to 1.9% over 2 years, 1.6% over 3 years). Given that these forecasts are based on market interest rate expectations, this suggests that the BoE believes that market expectations prior to the meeting were too high. These expectations pointed to a rate cut of one and a half percentage points between now and the end of the year, centred on the fourth quarter.

All in all, it seems that the Bank of England is ready, barring any surprises, to cut rates this summer. The timing between June and August remains uncertain in our view. Governor Bailley left it open after the meeting, saying that a rate cut in June "was neither ruled out nor a fait accompli". But we think that the BoE should cut rates a little more quickly than the markets expect, in the following quarters.

Fig.3 United Kingdom: the rebound in activity was stronger than expected at the start of 2024

UK growth rebounds to 0.6% in Q1, its highest level since 2021, erasing the recession of the second half of last year. This recovery is exaggerated by the fall in imports, with net exports adding 0.4 pt to growth in Q1. But this is partly offset by the negative contribution from inventories. Overall, final domestic demand grows by 0.5% after 0.1% in Q4 2023, and is close to its mid-2023 peak. It is being driven by the slight recovery in consumption (+0.2%), which is benefiting from the increase in household purchasing power now that inflation is slowing. But it is also benefiting from a stronger-than-expected return to investment, both by companies (+0.9%) and households (+4.5% after 5 quarters of contraction). This is encouraging for the economic cycle, as it suggests a rise in confidence and a reduction in the monetary brake.

The recovery should continue in the 2nd quarter, thanks in particular to strong growth in March (+0.4% over the month). In fact, the growth rate for Q2 (i.e. if there is no growth in April, May and June) was already 0.4% in March. Although we expect a gradual recovery, these latest data suggest upside risks for growth in Europe this year.

Fig.4 China: credit slows sharply in April, which is not encouraging for future activity

Total credit to the Chinese economy fell in April for the first time, with the slowdown in public sector debt issuance no longer offsetting weak demand for private credit. Over a year, the stock of credit slowed from 8.7% to 8.3%, and M2 money supply grew by less than 8% for the first time (7.2% in April). This does not bode well for future growth, even though activity was stronger than expected at the start of 2024, and it shows the importance of public support in maintaining stable growth. We think that Chinese growth will reach the 5% target set by the authorities for this year thanks to the momentum at the start of the year, but we fear a slowdown in the second half of the year, especially if the authorities do not do more.

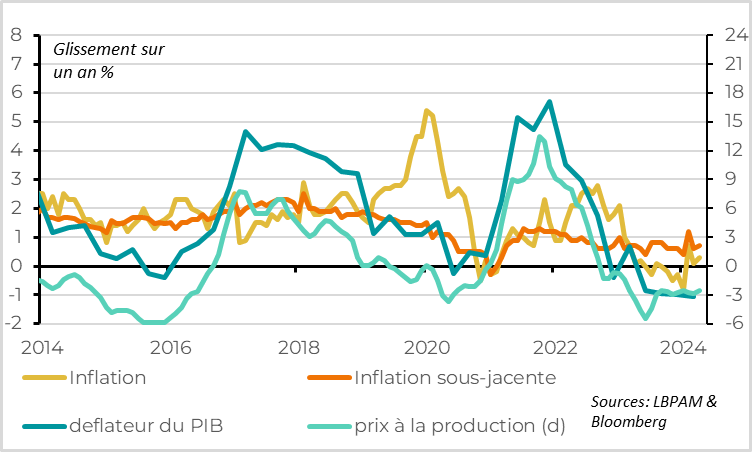

Fig.5 China: deflationary pressures remain high

Inflation in China rose slightly in April, from 0.1% to 0.3%, but it remains very low and is mainly due to the smaller negative contribution from energy. Core inflation remains stable at just 0.7%. Moreover, producer prices are continuing to fall sharply (-2.5%), raising fears of a further fall in the GDP deflator. The weakness of prices in China is both an indicator of the imbalances in the Chinese economy (lack of domestic demand in the face of rising production capacity) and a problem in itself, as it complicates the management of the high stock of debt in the economy. Against this backdrop, we believe that China's long-term economic prospects are limited.