Is the US back ?

Link

- The black swan of the US debt ceiling is expected to be resolved in the coming days, allowing the markets to refocus on the economy. Biden and McCarty ultimately reached an agreement to raise the US debt ceiling this weekend. This agreement was the best that could be reasonably expected, as it postpones the risk of a US default by at least two years, while triggering cuts in public spending that are far less stringent than the Republicans had hoped for. The agreement must still be approved by Congress by the 5 June deadline, and that is not completely assured, given the extreme positions of certain Democrats and Republicans in the House. On the markets, implementing the agreement could push US short-term rates up slightly and real rates down slightly. Most importantly, it will allow the markets to focus on the economic outlook.

- The latest figures from the United States suggest that demand continues to hold up well and that inflationary pressures remain too high, but that the job market is beginning to ease a bit. Against that backdrop, we continue to expect the Fed to pause its rate hikes until the end of summer, but the risk is that it will have to raise its key rate again if the economy and inflation do not begin to show clearer signs of slowing between now and then. The markets’ expectations have at last become more reasonable, as they now price in an additional Fed rate hike by July and fewer rate cuts between now and yearend.

-

Unlike early in the year, economic indicators are becoming less encouraging outside the US.

-

Chinese PMI figures fell once again rather sharply in May, especially in manufacturing, where the PMI is at a low since the December halt to the zero-Covid policy (at 48.8 pts). We continue to believe that the upturn in consumption and services will be enough to push Chinese growth above its official 5% target, the lack of a stronger upturn in other sectors (real estate, manufacturing, infrastructure, etc.) raises questions on the sustainability of this recovery. The authorities will probably have to do more to support confidence.

- In the Eurozone, the Commission’s Economic Sentiment Indicator fell sharply in May and points to stagnation in growth after the rebound of these recent months. And it confirms that economic momentum is modest outside of the services sector. While we expect growth to remain positive, we also expect it to remain limited in the coming quarters

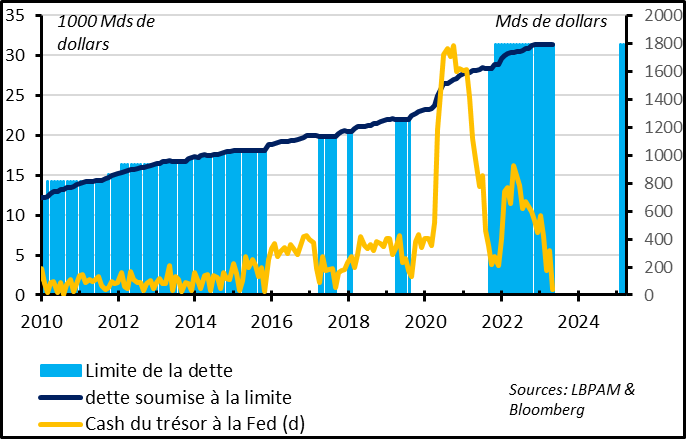

Fig. 1 – US : The debt ceiling is expected to be suspended until 2025

Biden and McCarthy at last reached an agreement to raise the US debt ceiling by 5 June, thus heading off a historic default. It was high time, as the US Treasury held just 40bn dollars on its account at the end of last week.

This agreement is very good news. First of all, it suspends the debt ceiling until 2025, hence after the presidential elections of late 2024. This means that the risk of default will not re-emerge in the next two years and that the new administration will be in place when it could re-emerge. Second, the agreement includes far less massive fiscal cuts than the Republicans were initially calling for, which means that there will be no great change in the economic outlook. The agreement is not precise but seems to point to budget cuts of about 0.3 pt of GDP for 2024 and 0.5 pt for 2025. This is likely to reduce growth by about 0.1/0.2 pts next year, more than three times less than would have happened under the Republicans’ initial plan. Note that a slight fiscal consolidation should meet with the Fed’s approval amidst an overheating economy and stubborn inflationary pressures.

That being said, the agreement must be passed by Congress. As this is a bipartisan agreement, such might have been a formality. But given the extreme stances taken by some members of Congress in both parties, the deal will have to be approved by the House before it is certain to apply (it should clear the Senate more easily). The other point of attention is the flood of Treasury bonds that will have to be issued in the weeks after the debt ceiling is suspended. The Treasury is expected to have to issue almost 1000bn dollars in Treasury bonds to build its reserves back up. This could exert a little pressure on short-term rates and make financing more expensive for banks who are in competing to attract deposits.

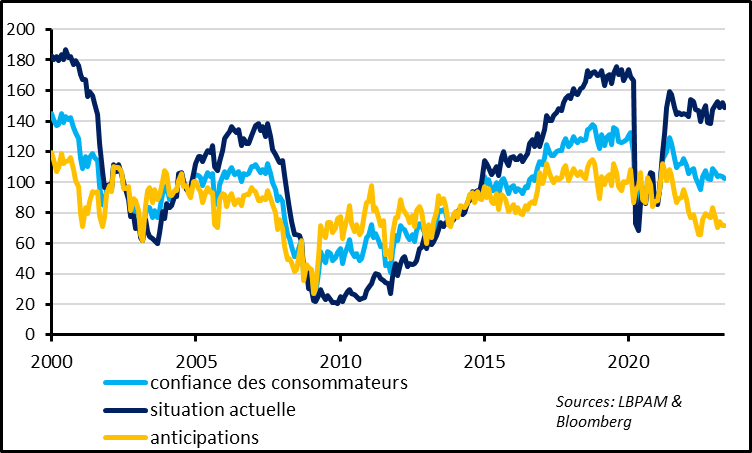

Fig. 2 – US : Consumers report solid current conditions but have little confidence in the future

If this agreement is indeed passed in the coming days, it will allow the markets to refocus on the economic outlook. Data released last Friday confirmed that demand rose further in April, with a 0.8% increase in consumption and an unexpected rebound in core durable goods orders (+1.4%). This is consistent with stable growth of 2% in the economy in Q2. But these figures also suggested that inflationary pressures remained far too high. Indeed, the personal consumption price deflator, which is the Fed’s favourite price indicator, rose from 4.6 to 4.7% in April, confirming that inflation ex energy had ceased slowing since the end of last year. This led the markets to doubt that the Fed had completed its rate hikes and that it could lower its key rate in the second half of the year.

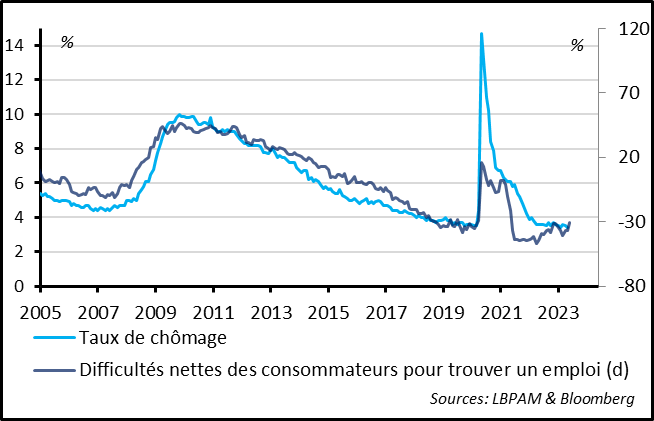

Fig. 3 – US : Most importantly, consumers report that the job market is starting to slow a bit

Consumer confidence in May declined less than expected and is still in line with its historical average. And while households have rather little confidence in the outlook, they continue to report that their current conditions are solid. This suggests that consumption should remain positive in the short term. That said, households reported in May that the job situation is worsening and that, while it remains very favourable, is the least well off since the Covid shock. This could be the first sign that job growth is beginning to slow to a greater degree and that the unemployment rate will rise slightly in the coming months. This would be bad news for growth in the second half of the year but good news for the Fed, as the Fed wants the job market to ease in order to slow wage growth and lessen inflationary pressures.

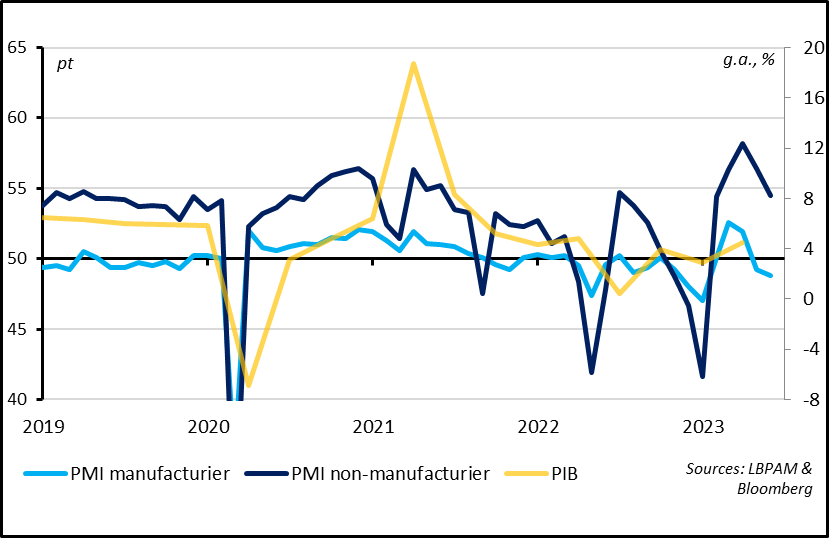

Fig. 4 – China : Another steep drop in PMIs in May, raising doubts on the sustainability of the recovery

Official Chinese PMIs declined steeply in May for the second consecutive month after their sharp rebound early this year, leading to heightened uncertainties on the sustainability of the post-Covid recovery. The PMI manufacturing index fell further into contraction territory, at 48.8 pt, a low since reopening began in December. While weakness in industrial activity reflects in part the weakness of the global industrial cycle, it also shows that the domestic recovery is not enough to support this sector. The PMI non-manufacturing index also fell sharply in May, by 2 points to 54.5 pts, while remaining relatively high. On the one hand, this shows that services continue to recover, driven by the rebound in consumption. But this also suggests that this rebound is slackening rapidly. And with no other sources of Chinese growth, consumption should lead to strong growth in the first half of 2023 but will probably not be enough to support strong growth beyond that.

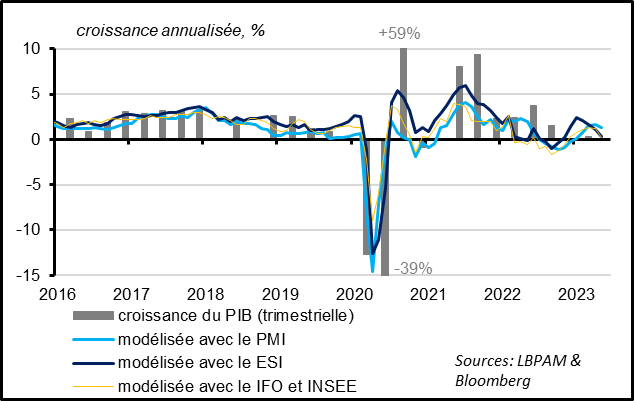

Fig. 5 – Eurozone : confidence indicators fell in May, suggesting positive, but modest growth in mid-2023

The European Commission’s Economic Sentiment Indicator (ESI) fell for the fourth consecutive month in May, from 99 to 96.5 pts, a low since November. The ESI points to almost zero growth in May. This is less encouraging that the PMI composite, which remains at a level consistent with growth close to potential, although the first decrease in the PMI since September in May also suggests that the economy is worsening. Most of all, the ESI confirms that activity remains solid in services, which is very heavily weighted in the PMI, while activity is slowing considerably in manufacturing, retail sales and even a little in construction.

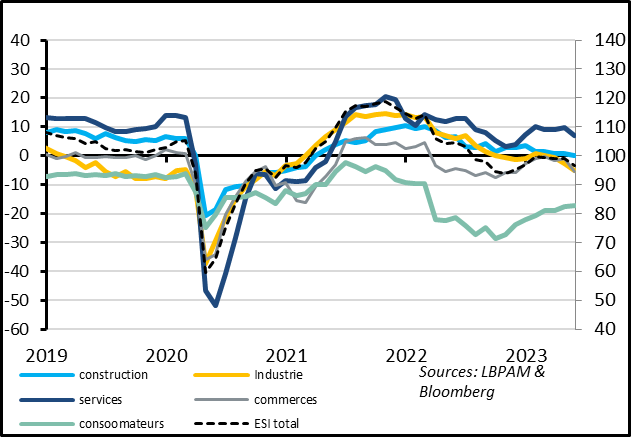

Fig. 6 – Eurozone : Confidence still high in services but down in all other economic sectors

Geographically, the indicator has declined in core countries, while southern European countries continue to outperform, as seen in Q1 GDP figures. Business confidence is down in all sectors, while remaining positive in services and construction. It has moved slightly into negative territory in manufacturing and retail trade. The only ESI component that did not decline in May was consumer confidence, which levelled off at a moderate level after several months of rebounding steeply.

This suggests that households have already adjusted to the impact of the energy countershock after last year’s energy shock hit consumption massively this winter. Consumption is expected to rebound a bit in mid-2023 but any momentum in consumption beyond that will depend more on the job market. On this point, the ongoing improvement in employment and the acceleration in wage growth in early 2023 (from 3% to 4.3% in Q1) are good signs. That said, monetary tightening and the slow receding of inflationary pressures are likely to slow momentum in consumption, hence our forecast of positive but weak growth in the Eurozone in the coming quarters.