It is difficult to analyse the economic situation without US data!

Link

Key takeaways from the october 3 , 2025 market update insights from Xavier Chapard.

Overview

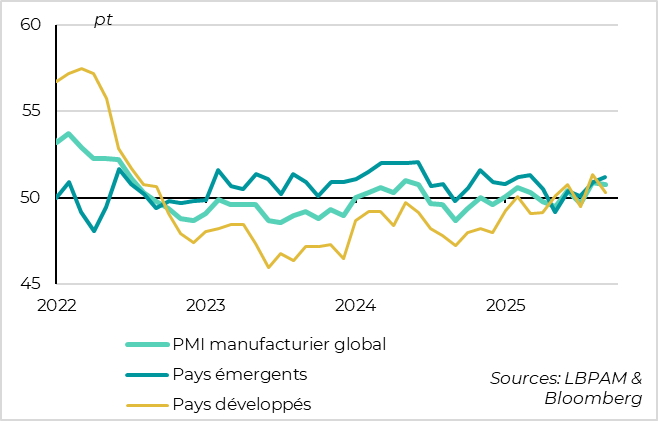

► The composite PMI for developed countries fell by 0.7 points to 52.5 points in September, reducing the upside risks it indicated this summer but remaining consistent with continued resilient global growth.

► The US government has been in shutdown since Wednesday, meaning that certain federal government services have been suspended due to a lack of funding. A compromise between Republicans and Democrats is needed to pass a bill that would release the required funds, as this bill must be approved by 60% of senators.

► This is the first shutdown since 2020 (also under the Trump presidency), but there have been many during the 2010s. Historically, these episodes have had only a minor and temporary impact on the US economy and markets. This should still be the case this time around, at least if it does not last too long and is not accompanied by large-scale permanent layoffs of civil servants (which is currently a threat being brandished by Donald Trump).

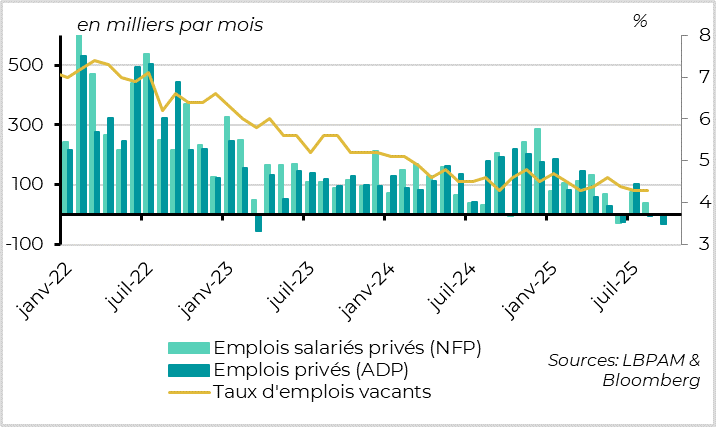

►On the other hand, one immediate effect is that the government can no longer publish economic statistics, starting with the employment data for September, which should have been released today. This leaves the markets in limbo at a time when the slowdown in US employment is one of the main risks to the economy and the reason why the Fed has resumed its rate cuts since September.

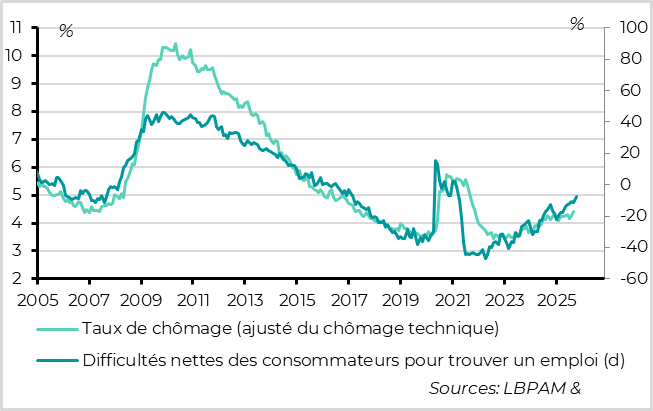

►Private data, which is still being released, suggests that the US labour market continued to slow in September, although this still does not appear to be abrupt. Private employment fell in September after stagnating in August, according to ADP, and US households consider the labour market to be the weakest since Covid, according to the Conference Board survey. This maintains the risk of a more pronounced deterioration in the US economy in the short term, although we believe this risk remains contained.

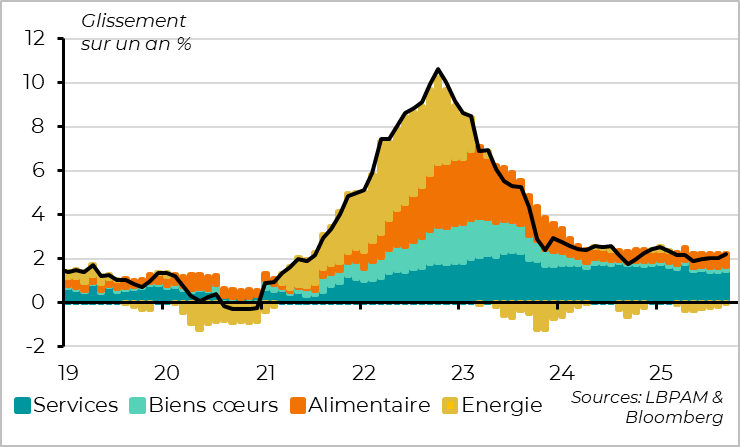

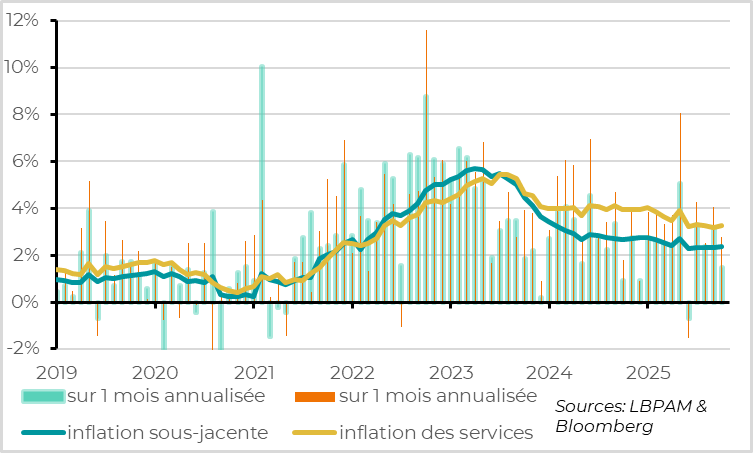

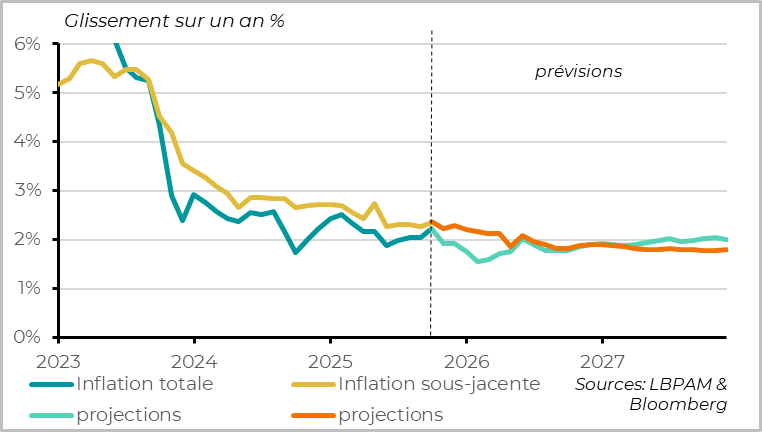

►In the eurozone, inflation rose above target again in September, to 2.2%, as expected given the unfavourable base effects on energy and service prices. While this confirms that the end of disinflation is taking time, it does not call into question the prospect of inflation falling below 2% from next spring onwards. This outlook is even reinforced by the slowdown in price rises in September after they were slightly high in August.

►The good news once again comes from the global industrial cycle, which continues to hold up well despite our expectations of a sharp slowdown due to the delayed impact of the trade war. The global manufacturing PMI remains virtually stable at 50.8 points thanks to rising PMIs in emerging Asian countries. That said, this resilience is very concentrated, with PMIs falling in almost all developed countries, and is driven by an increase in inventories that is unlikely to be sustainable.

In-Depth insights

United States: employment risks appear to persist in September

Private sector employment falls in September after stagnating in August

The first significant economic data not to be published due to the forced closure of the US government concerns employment (yesterday's unemployment benefit claims and today's official employment reports for September). This comes at a bad time, as the main short-term risk to the US economy (and to Fed rates) stems from the slowdown in employment since the beginning of the summer.

In the absence of official data, we are left with private data and surveys to estimate labour market dynamics. And these data are not reassuring, even if they are not very conclusive.

Private employment fell by 32,000 in September according to the ADP survey, after being revised to 0 for August (compared with an initial estimate of 54,000, but most of this revision was due to a technical adjustment). That said, the three-month average of employment changes according to ADP has been stable since June at around 25,000, which is close to the level of official job creation published for this summer (29,000 in August). This suggests that the labour market is weak, but not collapsing.

This is also the message from the August employment flows published earlier this week, which show a slowdown in both hiring and separations, but a stable number of job vacancies, still on a par with the number of unemployed.

Households report continued slowdown in the labour market

However, household surveys indicate a further weakening of the labour market in September, which is weighing on consumer confidence. Indeed, consumer confidence as measured by the Conference Board survey fell sharply in September due to consumers' worsening assessment of the current labour market. The job scarcity indicator, which is historically a very good indicator of the unemployment rate, reached its highest level since Covid and is consistent with a further rise in the unemployment rate in the short term, albeit not a sharp one.

Overall, the very limited indicators available for September remain consistent with our scenario of a further but limited deterioration in the US labour market between now and the beginning of next year. However, the risks of a more pronounced deterioration, while limited, remain. This should prompt the Fed to make further small downward adjustments to its rates in the coming months, even if the risk of inflation limits the extent of these cuts.

Eurozone: inflation rises temporarily in September

Inflation slightly above 2% in September due to base effects

Inflation in the eurozone accelerated from 2.0% to 2.2% in September, exceeding the target for the first time since April. However, this acceleration was expected and is solely due to less favourable base effects on energy prices. In fact, energy prices fell by 0.1% over the month, but they had fallen by 1.7% in September 2024. At the same time, food prices slowed slightly, from 3.2% to 3.0%.

More fundamentally, core inflation remained stable at 2.3% for the fifth consecutive month, which is in line with expectations but reassuring after the upside surprise in German inflation. In reality, it rose slightly in September, from 3.27% to 3.35%. But here too, this was due to an unfavourable base effect on service prices. Inflation in services accelerated from 3.1% to 3.2% this month because service prices were abnormally low in September 2024. Meanwhile, inflation in manufactured goods prices remained stable at 0.8%, which is in line with its historical average.

However, the trend remains bearish with the slowdown in price increases on a sequential basis.

La hausse séquentielle des prix ralentit en septembre, à un plus bas depuis mai. Sur le mois, les prix sous-jacents ralentissent après avoir surpris un peu à la hausse en août. Ainsi, les prix cœurs augmentent de 0,12% en septembre contre 0,26% le mois dernier, grâce à une hausse de 0,23% du prix des services après 0,33%. C’est la hausse, si elle se répétait, serait compatible avec une inflation sous la cible de 2%.

A full return to target inflation is still on track for early 2026.

Overall, September's inflation figures confirm that the convergence of core inflation towards the target is taking some time, but that a return to the target is in sight. We anticipate that headline inflation will return to the 2% target next month and be below target next year. Core inflation is expected to remain slightly above target until next spring, but to be slightly below target in the following quarters.

The latest figures and our forecasts are broadly in line with the ECB's scenario, so there is no reason for it to change its stance in the short term. It should reiterate that it is ‘well positioned to wait’ at its October meeting. That said, we still believe it could cut rates one last time in December from a risk management perspective, as the risks to inflation and growth are rather bearish for next year.

World: Industry performs even better than expected in September

Global manufacturing PMI remains stable thanks to emerging economies

S&P Global's composite manufacturing PMI remained virtually unchanged in September at 50.8 points, down from 50.9 points in August, consistent with limited but positive global industrial production growth. This is a pleasant surprise following last week's decline in preliminary PMIs for developed countries.

In fact, final PMIs did fall in developed countries in September, but slightly less sharply, so that they remained above 50 points overall. Above all, PMIs in emerging countries rose to their highest level since the announcement of reciprocal tariffs, driven by emerging Asia (especially China and South Korea).

That said, this good news should be put into perspective, as PMIs fell in 75% of the countries covered by the survey, something we haven't seen in three years, and inventories rose sharply in September.

We still believe that global industrial production will slow significantly due to the trade war, especially since it benefited in the first half of the year from increased demand in anticipation of tariff increases. However, PMIs suggest that this slowdown could be delayed and more limited than we anticipate.

Xavier CHAPARD

Strategist