It looks like there will be no lull...from the US

Link

Market Update for May 26, 2025: Insights by Sebastian PARIS HORVITZ

Key Takeaways

► Investors thought that the 90-day “truce” on the trade war initiated by the new US administration would not only give visibility to this horizon, but above all that the bad news on this front was largely behind us. D.Trump's threat to the EU to raise tariffs to 50% as early as June 1 seems to cast doubt on this assumption.

► Apparently President Trump didn't like the roadmap laid out by the European authorities for negotiating new trade relations with the United States. S. Bessent even declared that the European proposals were not “in good faith” compared to the negotiations he is conducting with the countries targeted by the April 2 tariff hike in Asia. D. Trump's animosity towards Europe thus seems to be manifesting itself with brutality.

►Given the importance of Europe's trade with the USA, a 50% tariff would have a considerable impact on European growth. Indeed, even if exports to the US only account for 3% of the region's GDP. With a 50% tariff, many products could no longer be exported. For the US, this would amplify the inflationary shock, and also have a negative impact on US economic growth.

►One might think that the European strategy would be to seek appeasement. At this stage, however, this does not seem to have been the strategy best suited to President Trump's threats. China, for example, went to confrontation only to obtain a reciprocal reduction in the insane rates reached during the escalation initiated by the American president. Obviously, between allies, discussions should be calmer, but will this be the case?

► At the same time, markets have already reacted negatively to the announcement of these new tariffs. They have also reacted negatively to the new threats to American companies who fail to bring their production back to the United States, such as the one made to Appel. This is the main reason, especially in the light of recent experience, to believe that the US administration will eventually back down again. In fact, it has already done so for Europe, with D. Trump announcing that the 50% tariffs would only be applied from July 9.

►Nevertheless, once again, this latest episode should eventually force the market to increase the risk premiums associated with the uncertainty distilled by US economic policy. For the time being, this is not really the case, at least for risky assets. At the same time, the dollar remains weak and US bonds seem to be pricing in a high degree of uncertainty about the future.

►In Japan, inflation was slightly higher than expected in April. Total year-on-year inflation was 3.6%, unchanged from the previous month. At the same time, as anticipated by the market, core inflation, excluding fresh food and energy, accelerated to 3%. In part, the acceleration in inflation is due to the sharp rise in the price of rice, which is facing growing demand while supply is not keeping pace.

► This rise in inflation could accelerate the BoJ's decision to continue its gradual increase in key interest rates. But fears of a trade war with the USA are seen as constraining the monetary authorities. In addition, the BoJ is facing a strong surge in long rates, showing growing tensions on the Japanese bond market. The BoJ is likely to be more patient before acting.

To Go Further

The trade war isn't over for D. Trump. On Friday, the American president announced a 50% increase in tariffs on goods from the European Union. This seems to be due to his frustration with the progress of ongoing negotiations with European authorities.

At this stage, what is known is that the European Commission, in charge of these negotiations, has proposed a roadmap for reaching agreement on mutual tariff cuts as well as reviewing non-tariff barriers with the United States. According to several sources, the proposal would include the joint elimination of tariffs on industrial goods, as well as opening access to the common market for certain US agricultural products, while also including the joint development of “data centers” for the development of the artificial intelligence industry.

It is possible that D. Trump, given the animosity against the EU that he has shown so far, will only want to expect concessions from the Union. This will not be the case. Nevertheless, it is likely that European negotiators will try to calm the situation, given the considerable impact that a virtual halt to trade with the USA would have on the European economy.

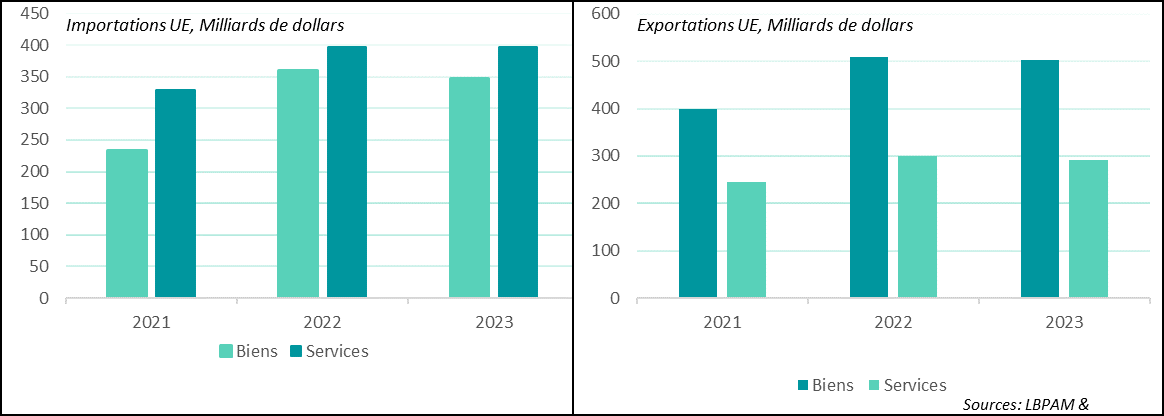

Indeed, the USA remains the EU's main trading partner, with $500 billion worth of goods exported and almost $350 billion imported. At the same time, in services, the US exports nearly $400 billion to the EU, while the region exports less than $300 billion.

It's important to keep these orders of magnitude in mind, because obviously, for both countries, if Europe were to retaliate against the US on the same scale, following a 50% increase in tariffs, trade between the two would come to a virtual standstill. For the European Union, exports of goods to the USA account for 3% of GDP. Such a shock could push the region into recession.

European Union: trade between the EU and the USA is the largest in the world

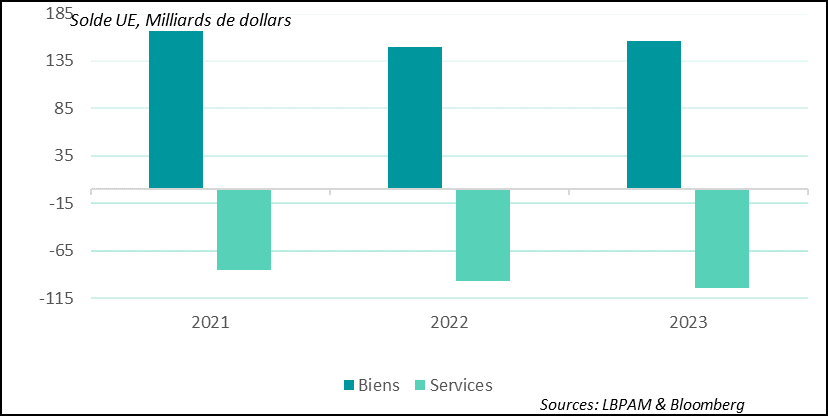

These figures clearly show that the trade deficit in goods between Europe and the United States is in Europe's favor, while the opposite is true for services.

The US government is obsessed with reducing its deficits. As we all know, such an objective makes no economic sense in isolation. Above all, to consider that the main reason behind it is unfair treatment of American exports by the rest of the world, particularly by the EU, is globally erroneous.

European Union: Europe has a trade surplus in goods with the United States and a deficit in services

The obvious question is how to break this deadlock. As mentioned, the European negotiators will obviously try to ease the situation, but it's hard to believe that Europe will appear before the US administration offering anything but concessions. Correctly, the Europeans are looking to enter into negotiations between allies and partners, in order to get a fair deal.

This does not seem to be the view of the American authorities. S. Bessent even declared that the Europeans were not negotiating in “good faith” like other trading partners. Comparing these discussions with those he has with the Asian countries for which he is also responsible.

Nonetheless, China's strategy of confrontation has forced the United States to give in, and the trade war has been de-escalated with an almost reciprocal reduction in tariffs, which had reached exorbitant levels.

The market had already reacted negatively to Friday's announcement that tariffs would be raised to 50% for the EU on June 1. Nevertheless, with D. Trump's announcement yesterday that he would allow more time for negotiations, with a tariff hike now scheduled for July 9, he is once again showing that he is retreating in the face of the negative market impact of his decisions.

At this stage, it is difficult to say with any certainty where this confrontation will end. Nevertheless, the most likely outcome is that the 50% rates will not be applied. D. Trump is likely to back down. At the same time, it is possible that rates could settle higher than the current 10%. However, we are keeping the status quo assumption in our central scenario. But, of course, this latest episode only amplifies the uncertainty already distilled by the erratic decisions of the new US administration.

The market, particularly for risky assets, seems so far to take little account of an additional risk premium on the uncertainty caused by D. Trump's policies. The assumption that persists is that of D. Trump's continued ultimate support, i.e. the persistence of the “Trump put”. This is, in our view, a reasonable hypothesis, but the succession of shocks and the accumulation of uncertainties may ultimately have an impact on corporate activity and earnings prospects.

In fact, the dollar remains weak, and has even weakened in this latest episode, while US government bonds, particularly on long maturities, seem to be holding onto significant term premiums, the highest in at least 10 years. In this respect, the fact that US fiscal policy remains very lax is contributing to this trend.

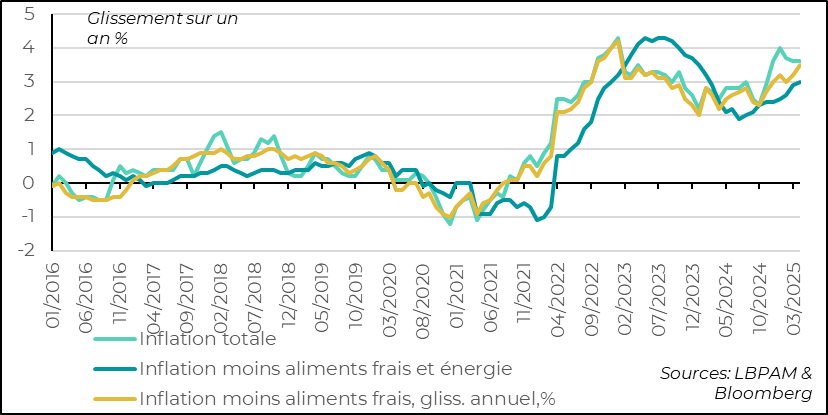

In Japan, inflation was higher than expected in April. It stagnated at 3.6% year-on-year. This still-high level reflects the effects of energy prices, but also, and above all, persistent pressure on food prices.

The main contributor to this rise in food prices is the price of rice. This has risen by 98% year-on-year. As we all know, rice is an essential commodity in the basket of goods consumed by Japanese households. This increase is due to growing demand for rice, while production is stagnating. The somewhat unexpected but persistent rise in demand seems to be linked in part to the influx of tourists to the country, particularly from Asia. In any case, at this stage, it is difficult to see a rapid correction in these tensions.

Nevertheless, while food prices do contribute to higher inflation, price trends excluding these more volatile prices (energy and fresh food) remain just as high. Core inflation, excluding energy and fresh food, rose by 3% in April, confirming the trend of accelerating inflation seen since mid-2024.

Japan: inflation remains high and on an upward trend

These higher-than-expected price rises put pressure on the BoJ to continue its exit from its still very accommodating monetary policy. Nevertheless, Governor K. Ueda continued to stress the uncertainties associated with the US trade war. This has already had a significant impact on foreign trade, weakening Japanese growth in 1Q25.

The BoJ's strategy is now also complicated by the very sharp rise in long rates over the past few months, which has even accelerated in recent weeks, particularly on the longest maturities. For example, 30-year Japanese Treasury yields have reached their highest level in 25 years.

Under these conditions, and with the uncertainties linked to foreign trade, we believe that if prices stabilize, the BoJ could remain cautious and further delay the “normalization” of its monetary policy.

Japan: long-term rates rise, with a historic increase in 30-year rates

Sebastian PARIS HORVITZ

Head of research