It looks like Trump and the Republicans won this election

Link

Check out our market analysis from November 06, 2024, by Xavier Chapard.

In summary

► At the time of writing, the outcome of the US election is not official, but it seems very likely that Donald Trump has won the presidential election. Indeed, he won Georgia and has a solid lead in many swing states. On the Congressional front, Republicans have regained control of the Senate, while it's too early to tell about the House of Representatives, although Republican momentum looks strong. The scenario of a red wave is therefore likely, even if that of a divided government presided over by Trump is still possible. And the risk of political instability is receding.

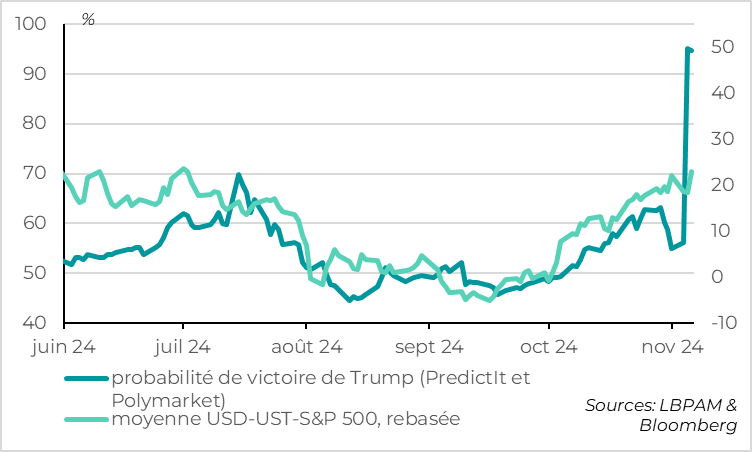

►Online betting has settled with over 95% chance of Trump winning, compared with 60% before the election. The markets are also reacting strongly this morning, but without exaggeration in our view. US long yields are up 14pt to 4.4%, the euro-dollar is down 2% and approaching 1.07, and US equities are clearly outperforming. Indeed, US equity futures are up over 1% this morning after yesterday's sharp rise, and are approaching their October highs, while European equities are consolidating slightly.

►Trump-related bets could continue to perform well in the coming days, especially if the red wave is confirmed, even if they already largely incorporate the election. That said, we'll need to be more cautious about exaggerating the rise in long rates or the rise in US equities in the coming weeks, as the next administration's economic policies are unclear and will take time to implement. In the medium term, a clear election result is favorable in a rather buoyant macro-economic context.

►It's almost easy to forget that the Fed and the Bank of England will be deciding on their monetary policy tomorrow. Both are expected to cut rates again, by 25bp, but to be cautious about the pace of rate cuts thereafter. In the US, unemployment is lower (4.1% vs. 4.4%) and core inflation more persistent than the Fed expected in September, which does not justify another big 50bp rate cut. At the same time, the net slowdown in employment in October and, above all, in wages in Q3, allow the Fed to gradually lower its rates, which remain high, by 25bp per meeting. On the BoE side, the pace of rate cuts is likely to remain at 25bp per meeting, as the budget is less restrictive than the central bank anticipated for next year.

►Beyond that, while political and geopolitical risks remain high, risks to the economic cycle are clearly receding. This is positive for the markets in the medium term, once electoral volatility has subsided, at least as long as the risks do not cause a major shock to the economy or markets.

►U.S. growth remains solid at the start of Q4, according to the U.S. ISM services index, which rose again in October to reach a 2-year high of 56pt. This is reassuring given the political uncertainties. But the good news goes beyond the USA, as shown by (1) economic surprises in the Eurozone and China, which returned to positive territory in early November for the first time since the spring, and (2) the rise in global manufacturing PMI for the first time in 5 months in October. This is in line with our scenario of a slow but lasting recovery in the Eurozone and stabilization of Chinese growth in the short term.

To go deeper

United States: Markets reasonably factor in Trump's likely victory

USA: ISM services at 2-year high in October

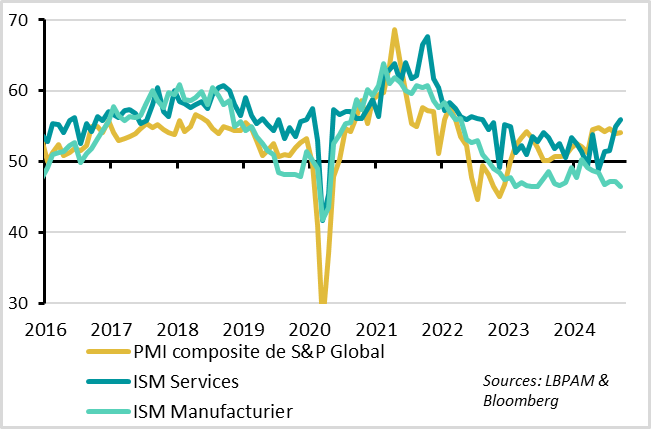

The ISM service index, probably the most important coincidental economic indicator for the US economy, rose again strongly in October to 56pt, its highest level in over 2 years. This survey is very reassuring at a time when political uncertainty was very high and economic data is distorted by temporary factors (hurricanes and strikes). The U.S. economy thus appears to remain buoyant, driven by consumption and services.

The details of the survey show that activity and orders slowed marginally in October, but remain above their historical average, at over 57.5 points. Above all, the employment component rebounded strongly to 53.0pt, suggesting that the employment trend is holding even if official job creation slowed markedly over the month.

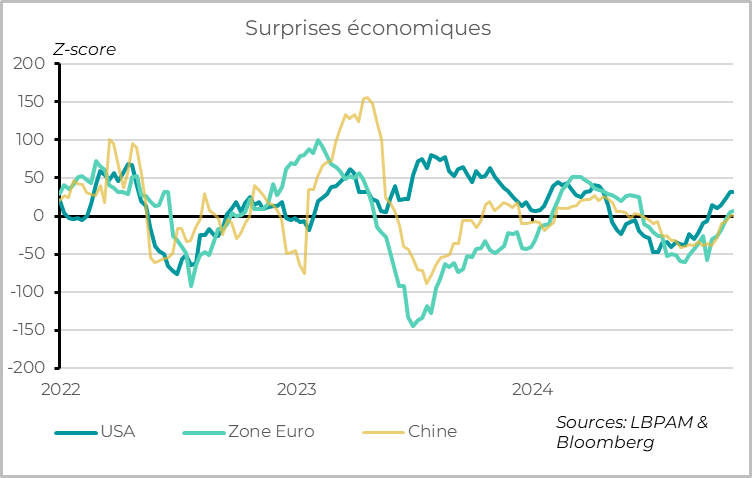

World: economic surprises return to positive territory, even outside the USA

Economic surprises were fairly negative in the Eurozone and China this summer, while they had already turned positive in the United States, indicating a risk of disappointment for growth in these two major zones. But economic surprises turned positive again for both the Eurozone and China in early November. This partly reflects economists' more limited expectations, but also a reduction in downside risks for the cycle in these zones.

In Europe, following stronger-than-expected growth in Q3 (+0.4% over the quarter) and the stabilization of the PMI in October, investor confidence improved slightly in early November. The Sentix indicator rose for the second month in a row, while remaining fairly low at -12.8pt. While investor confidence in the economy is always to be taken with a pinch of salt, it did indicate the IFO's trend reversal last month, and is therefore another reassuring sign that the Eurozone's slow recovery is continuing.

China: PMIs rebound across the board in October

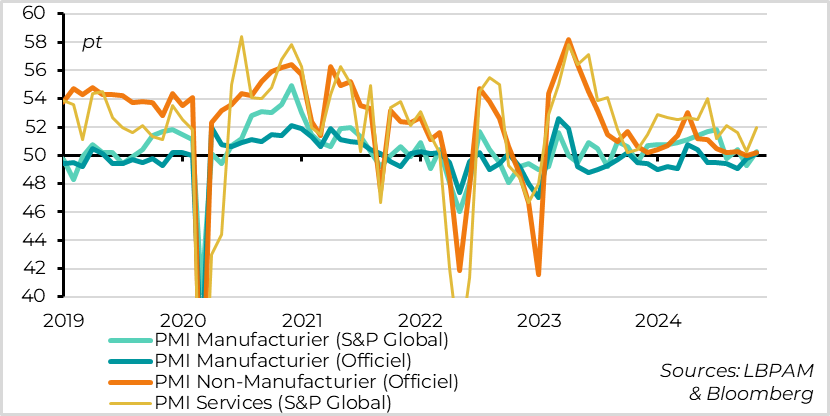

In China, October's PMIs confirm the slight improvement in economic conditions already suggested by September's activity data, following a sharp slowdown this summer. This suggests that the economic support measures announced by the authorities over the past two months do indeed reduce the risk of a further slowdown in growth, even if we await the announcement of more substantial fiscal measures on Friday to stabilize real estate and enable a slightly sharper and more lasting rebound.

Indeed, official PMI surveys, such as S&P Global's for both manufacturing and services, rose in October, a month in which they are usually weaker due to the reduced number of working days. Manufacturing PMIs returned to just above the 50pt mark in October, while services PMIs improved after flirting with the contraction zone last month. Overall, Chinese PMIs are consistent with growth above Q3's 4.6% in October, albeit still a little below the 5% target.

World: Global manufacturing PMI recovers slightly in October

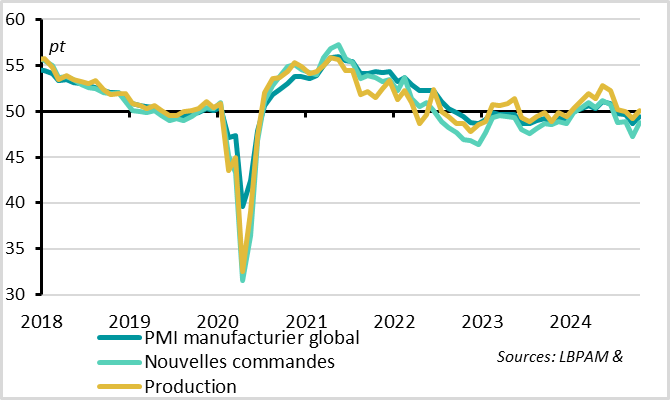

Improved economic indicators in the Eurozone and China go hand in hand with slightly less negative signs for the global industrial cycle. The global manufacturing PMI rose in October for the first time in 5 months, which is reassuring after last month's sharp drop. That said, this only cancels out September's sharp fall, so that the manufacturing PMI remains below the 50pt limit, at 49.4pt, and the detail of the survey does not indicate that a strong rebound in global industrial activity is imminent.

The details are rather reassuring. The current production indicator is back slightly above 50 points after falling into contraction in September for the first time this year. And leading indicators such as new orders and production expectations are improving slightly, albeit still at low levels.

That said, companies are continuing to reduce industrial employment, in the most marked way since the Covid shock, and the manufacturing PMI is still falling in 1/3 of the countries covered by the survey.

Xavier Chapard

Strategist