It's all about confidence

Link

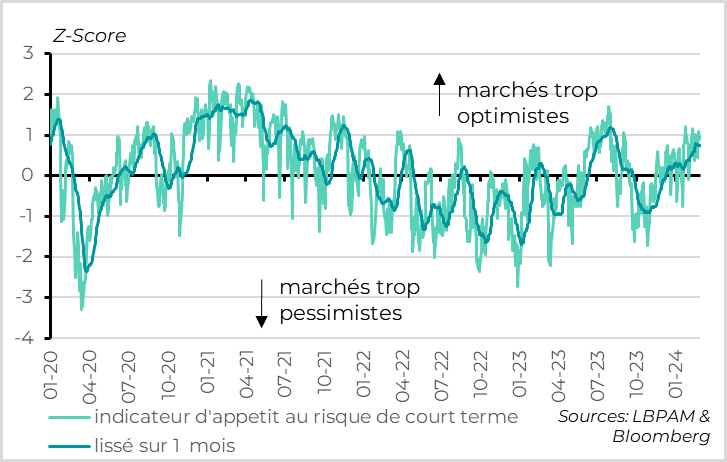

- Risk appetite on the markets is reaching high levels, even if it is not yet in the zone of extreme optimism according to our indicators. Equity markets are stable at the start of the week after several weeks of strong gains. This is despite a further reduction in expectations of rate cuts by central banks in 2024, which have halved for the ECB and the Fed since the start of the year. This does not yet suggest a strong risk of market consolidation in the short term, but probably a need to breathe given the already high level of market confidence.

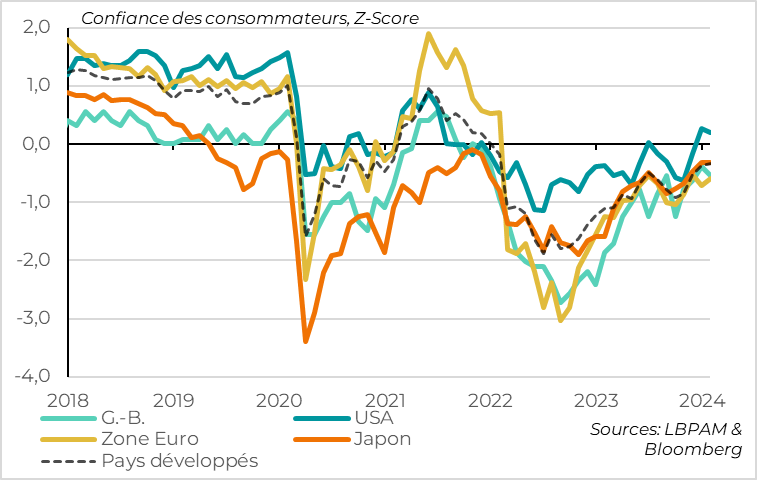

- On the other hand, the household surveys for February were a little disappointing. They show that household confidence in the developed countries has stopped rebounding this month, after rising to its highest level since the start of the invasion of Ukraine two years ago at the beginning of the year, and that it remains limited overall.

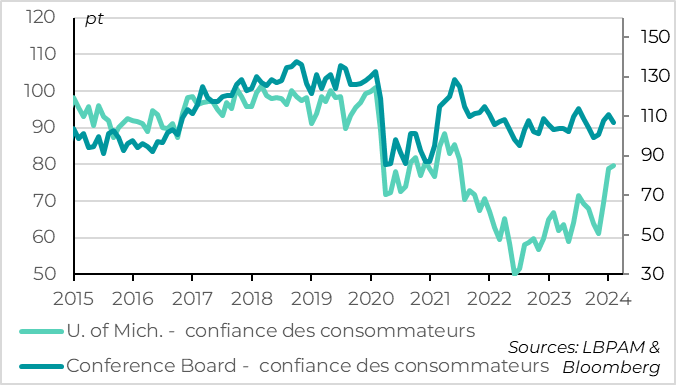

- In the United States, the Conference Board survey indicates that household confidence unexpectedly fell in February for the first time in 4 months. It remains relatively high, but households are indicating a slight deterioration in the labour market and their outlook. This does not suggest a reversal of growth in the US, but probably a weaker dynamic than in the second half of 2023.

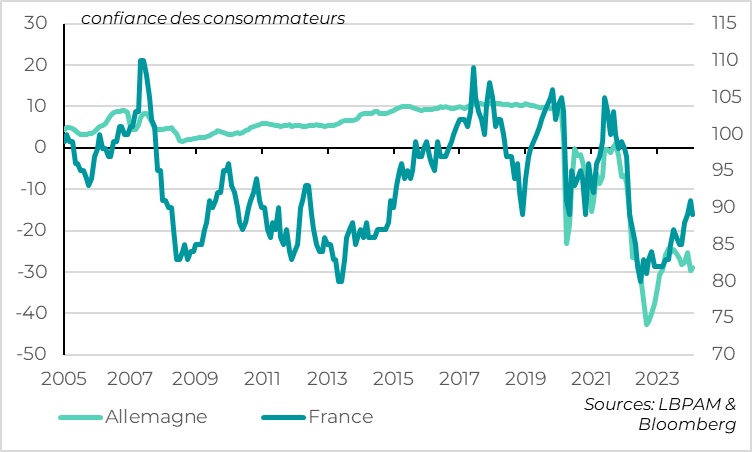

- In the eurozone, household confidence has stagnated at a limited level since the end of 2023, whereas it had been rebounding sharply since mid-2023. This reinforces our conviction that the recovery in the Eurozone will be only gradual in 2024, and less marked than anticipated by the authorities (including the ECB). This is all the more true given that business credit fell in January, whereas it was improving slightly at the end of 2023. As with the PMIs, household confidence remains very weak in Germany, is recovering slowly in France and is improving more markedly in the rest of the zone. This is another sign that the momentum in Italy and Spain remains solid at the start of 2024.

- Japanese inflation remained higher than expected in January and above the 2% target, rising from 2.6% to 2.2%. This reinforced expectations that the central bank could exit negative rates as early as April, and pushed Japanese 2-year yields to a 12-year high (at 0.17%). But the surprise on inflation comes solely from highly volatile elements, notably the price of foreign travel. And activity has been weaker than expected since the end of 2023. Against this backdrop, we believe that the central bank could wait until the summer to exit negative rates.

Fig.1 Markets: risk appetite approaching excessive levels

-Short-term risk appetite indicator

-Smoothed over 1 month

The equity markets are fairly stable at the start of this week, after hitting new all-time highs last week following 7 consecutive weeks of gains. And while US tech has outperformed in recent months, the vast majority of equity markets have risen, driven by the AI theme and lower economic risks.

At the same time, however, long yields have risen by 30bp since the start of the year, due to reduced expectations of rate cuts by central banks. The market is now anticipating 3 rate cuts by the Fed this year (75bp), compared with more than 6 expected at the start of the year. For the ECB too, expectations of a rate cut in 2024 have been halved since the start of the year, to less than 100bp. For the first time in a long time, these expectations are at least as conservative as our forecasts.

Overall, the performance of risky assets despite the rise in risk-free rates is squeezing risk premia, which fell back below their long-term average last week. This indicates that risk appetite is fairly high, even if it does not yet appear to be very extreme according to our indicators. Historically, this context increases the risk of the markets breathing heavily in the medium term, even if a sharp consolidation in the short term is not the most likely outcome.

Fig.2 Developed countries: Consumer confidence stabilises at a limited level

-G.-B

-USA

-Euro zone

-Japan

-Developed countries

After 3 months of rebound, consumer confidence in the developed countries stabilised in February at a still limited level.

On average in the developed countries, household confidence is at its highest level since the start of the invasion of Ukraine in March 2022. But it did not rise any further in February and remains below its long-term average. And this is true for all developed regions outside the United States.

This may reflect the slight rise in petrol prices in February, due to the rise in oil prices and refining margins, which is having a major impact on household confidence in the short term. But in a scenario where inflation slows faster than wages and labour markets remain solid, we are counting on a recovery in consumption (and its resilience in the US) to allow a gradual recovery in the global economy. If consumer confidence does not return to normal in the coming months, there is a downside risk to our scenario of a gradual recovery in global growth this year.

Fig.3 United States: consumer confidence consolidates slightly in February

-U. of Mich consumers confidence

In contrast to the University of Michigan survey, the Conference Board survey shows that household confidence fell in February for the first time in 4 months. And this drop comes after a lower level of confidence than initially estimated in January (from 110.9 to 106.7pt). According to the survey, confidence remains at a relatively high level, as the current situation of American households is fairly solid. But confidence remains below its pre-Covid levels, as household confidence in the outlook is fairly limited.

This does not suggest that consumption has collapsed, but that it is likely to be weaker than in the second half of 2023, when consumption was growing at a rate of 3%. If this is the case, US growth could normalise after accelerating to over 4% in H2 2023.

Fig.4 United States: Households report a slightly weaker job market

-Unemployment rate

-Consumers' net difficulty in finding a job (d)

According to US households, the job market remains solid, but a little weaker in February than in the previous two months. The most important indicator in the Conference Board survey, the number of households who think it is difficult or easy to find a job, deteriorated slightly in February after a clear improvement in December and January. This suggests that job creation could slow after 2 months of more than 300,000 net new jobs, and that the unemployment rate could rise slightly in the coming months. This would suggest that the US economy is still solid, but a little less exceptional than in 2023, which is our central scenario.

Fig.5 Euro-Zone: Germans want to save and the French remain cautious

-Germany

-France

In the Eurozone, household confidence barely stabilised in Germany in February after falling in January, and remains at a very low level. The details of the survey show that the outlook for household purchasing power is improving after the fears linked to the budget crisis at the turn of the year, which is consistent with the rise in real wages. But this is offset by a fall in the outlook for household spending. This suggests that German households prefer to save because of the uncertainties, which is not encouraging for domestic demand.

In France, household confidence reversed its sharp rise in January in February. This movement is probably exaggerated by the rise in regulated energy prices this month. On trend, French household confidence has picked up fairly sharply since mid-2023, thanks to the fall in inflationary fears. But it remains at fairly low levels.

As with the PMIs, consumer confidence seems to be improving more markedly in the southern countries, as consumer confidence for the Zone as a whole rose slightly in February, from -16.1 to -15.5pt. This is yet another sign that the momentum in Italy and Spain remains solid at the start of 2024.