It's hard to celebrate these first 100 days

Link

Read Sebastian PARIS HORVITZ's market analysis for April 28, 2025.

Summary

►This week, President Trump will celebrate his first 100 days in office. The period can certainly be characterized by an incredible avalanche of shocks, unleashed with disconcerting speed. For the global economy, it was obviously the shock of the tariffs that created the chaos. Today, we're waiting for the rest, after the shock has been softened a little...at least for 90 days.

►In fact, trade policy, aggressive rhetoric towards Canada (stirring up the idea of the 51st U.S. state) or Denmark (acquisition of Greenland), or highly critical stances towards Europe, including the EU's exclusion from peace talks in Ukraine, have all been highlights, indicating a change in the world.

►Despite this, the US government continues to proclaim that “America first” does not mean America alone. Of course, most countries have a duty to maintain a dialogue with the world's leading power. Nevertheless, the new American policy has already brought about some notable changes, with consequences that could prove highly significant for the future.

►The most trivial observation concerns Europe. Suddenly, it has decided to strengthen its defense. In a historic move, Germany has decided to boost its military spending, while embarking on a massive infrastructure expenditure plan. The EU as a whole will also be arming itself. However, we still need to think about other areas of security, including technological and energy security, in order to truly defend our role as a more autonomous power in the world of tomorrow.

►Against this backdrop, the markets have had a chaotic start to the year. Nevertheless, if avoiding US risky assets has been the right strategy since the beginning of the year, we haven't really had a catastrophe. In part, this is due to the resilience of the global economy so far. Then, by the almost commonly accepted view that the global economy will withstand negative tariff shocks. Nevertheless, like us, many believe that the future trajectory is fragile.

►But, perhaps, the key factor in this resistance is the strong belief that, on the one hand, D. Trump will come to support the market if it is too weakened (the Trump “put”) and that central banks, particularly the Fed, will be another bulwark for the market (the Fed “put”). These supports are likely to be there, but too much complacency, particularly in the US, could be confronted with a much more difficult reality. For our part, like many others, it's hard to celebrate these first 100 days, which have been so destabilizing. As a result, we continue to maintain a cautious stance in our asset allocations.

►President Trump can congratulate himself on his blitzkrieg policy in all areas, but this already seems to be having a marked negative impact in the American population. The latest opinion polls show a very significant drop in the president's popularity. This could create stronger resistance in his own camp, while the budget is still not approved.

►This loss of confidence is reflected in views on the economic situation. This can be seen in the final U. Michigan survey for April, with a sharp drop in confidence. But it remains difficult to predict what impact this will have on consumer behavior. We expect a marked slowdown in consumption, especially in the middle of the year.

►During these first 100 days of D. Trump in power, despite the surges for the future, the eurozone continued to show very weak growth in its activity. This was confirmed by the April PMIs. In particular, France continues to be the country where the malaise is most marked. This was again shown by the INSEE business climate survey. The construction and retail sectors are suffering the most. The only good news is an improvement in the business climate in industry.

To go deeper

After 100 days of his presidency, the speed and scale of the shocks imposed by D. Trump on the United States and the rest of the world is simply extraordinary. Obviously, it's the tariff shock that has been the dominant factor in market behavior. While the increase in tariffs was expected, the first announcements surprised by their scale and dealt a heavy blow to confidence.

Since then, Trump has made several adjustments to soften the blow. For most of the United States' trading partners, a single rate of 10% is now in place, except for China, which continues to have a rate of 145% imposed on it!

We await the outcome of ongoing bilateral negotiations to see what level of tax the US will finally impose. Nonetheless, there is a great deal of uncertainty, and the most likely outcome is that the damage already done to confidence will weigh on future global growth.

We, like many economists, believe that the probability of recession is high for the second half of the year in the United States. But, we risk having to adapt quickly to the erratic changes that D. Trump's government may decide, for better or worse.

At the same time, the all-out policy blitzkrieg pursued by the new US administration has not only destabilized world trade and international relations, but also opinion at home.

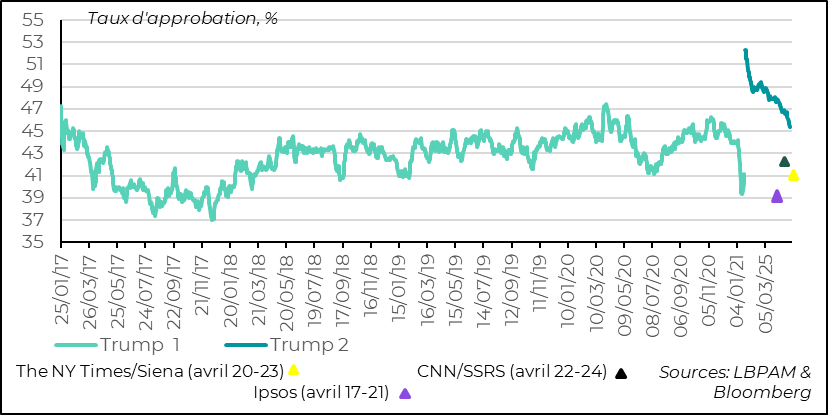

In fact, according to the latest polls, D. Trump's popularity is plummeting rapidly. While he was elected with a robust majority, and a popularity he had never achieved, his advantage is melting like snow in the sun, and has already dropped to less than 50% according to the average of polls listed by Raelclearpoltics.com, the lowest level of any other president at this stage of their term (except himself in his first term).

The last three polls, considered the most reliable by the New York Times, conducted at the end of April, even show a level of popularity already close to the lows of his first term.

At the same time, in detail, the President still retains strong support among Republican voters, but his popularity is plummeting among independents and certain minorities who helped get him elected.

United States: President Trump is fast becoming less popular (average of polls from Realclearpolitics.com)

It's hard to say whether this rapid decline in popularity will end up changing the game within the Republican Party, which for the moment, like one man, seems completely aligned behind the relatively brutal line followed by D. Trump.

In particular, we shall see whether the vote on the forthcoming budget, which for the moment, according to the envelope already voted on, reflects a policy very close to the President's wishes, will be amended in its final version, particularly with regard to the new tax cuts envisaged.

At this stage, the proposed budget, in the absence of additional savings, would considerably increase the public deficit and keep public debt on an unsustainable trajectory.

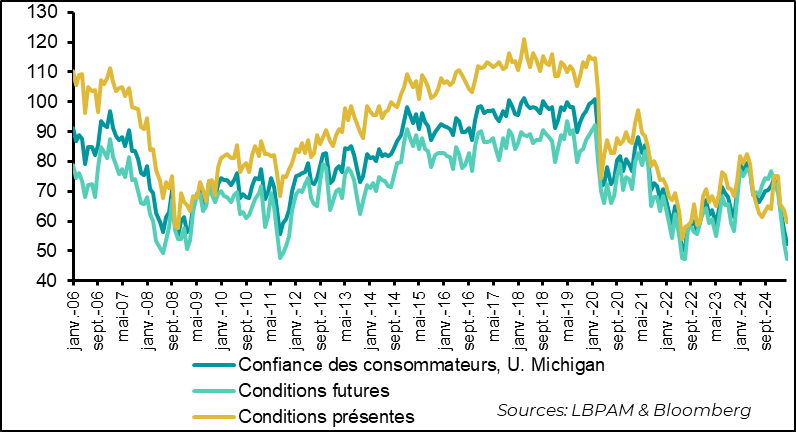

This deterioration in voters' political support for the President is also reflected in household surveys concerning their views on the state of the economy. The U. of Michigan's final survey of American consumers for April, while not as bad as the preliminary survey, clearly shows the collapse of confidence in a very short space of time.

United States: U. of Michigan's April survey shows a collapse in confidence, particularly concerning the outlook

This drop in confidence is difficult to translate directly into consumer behavior. Nonetheless, two important variables can only give cause for concern.

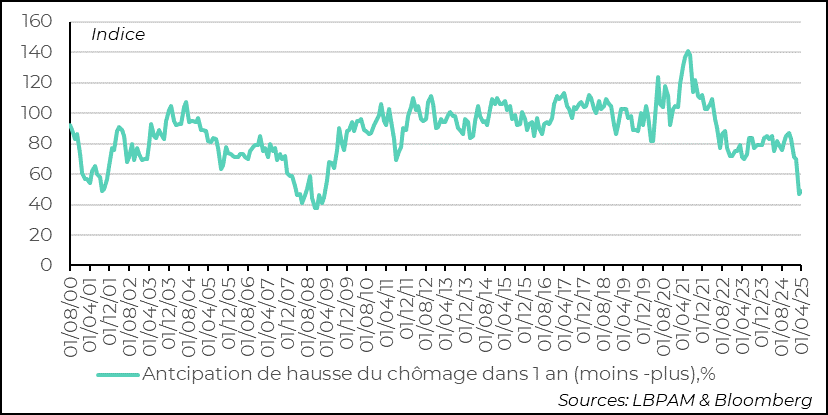

While employment has continued to hold up since the start of the year, households seem increasingly worried about the outlook. Fears of rising unemployment are at their highest since the 2008-2009 crisis. Again, as with everything since D. Trump took office, the most striking thing is the speed of the deterioration.

This dynamic could translate into greater caution in household spending in the months ahead.

United States: households very concerned about unemployment trends

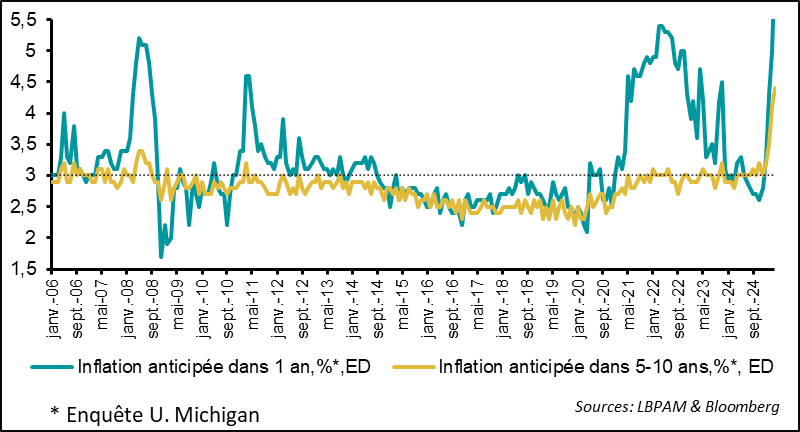

Another important variable is, of course, inflation. As we all know, the surge in inflation in the Covid period was one of the factors that cost J. Biden dearly politically, despite the enormity of the budgetary gifts made by his administration.

All in all, inflation expectations are at extreme levels, according to the U. Michigan survey. Households are very apprehensive about the effects of tariff hikes on prices, especially as the dollar has depreciated sharply in recent months.

United States: expectations of price rises at extreme levels

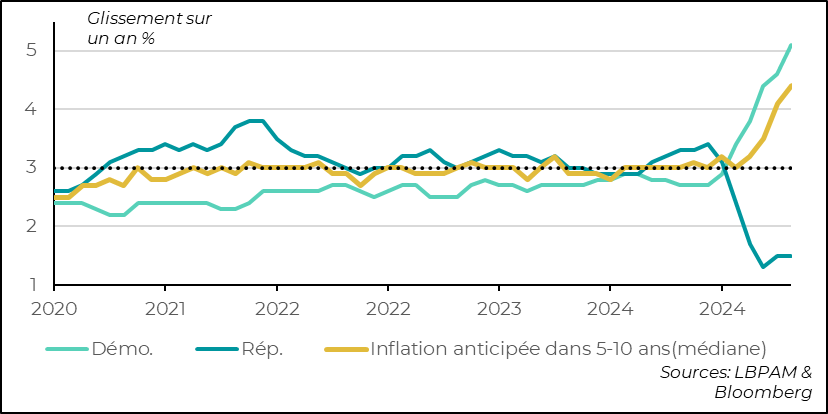

Still, it's remarkable to note the incredible dichotomy between the views of households who call themselves Republicans and those who are more affiliated with the Democratic party.

The expectations of Democratic households are perhaps a little exaggerated on the upside, given that the Fed is unlikely to let inflation get out of hand. But those of Republican households are just as, if not more, surprising, with expectations of a collapse in inflation.

United States: a deep divide on economic views due to political affiliation

The coming months should reveal the first impacts of tariff hikes on inflation, as well as the effects of disrupted trade flows. Any significant rise in prices will surely be a major political negative for the President.

We continue to expect economic momentum in the US to deteriorate over the course of the year, unless there is a reversal - unlikely at this stage - of the economic policy pursued by D. Trump's administration.

We therefore remain cautious on US risky assets.

As for Europe, we know that the trade war will have a negative impact on growth. The extent of this will depend on the agreements reached with the United States over the coming months. Nevertheless, the sharp rise in uncertainty about the future could already be weighing on investment decisions for the coming quarters in many sectors.

S&P's preliminary PMI surveys underlined the decline in confidence about the future.

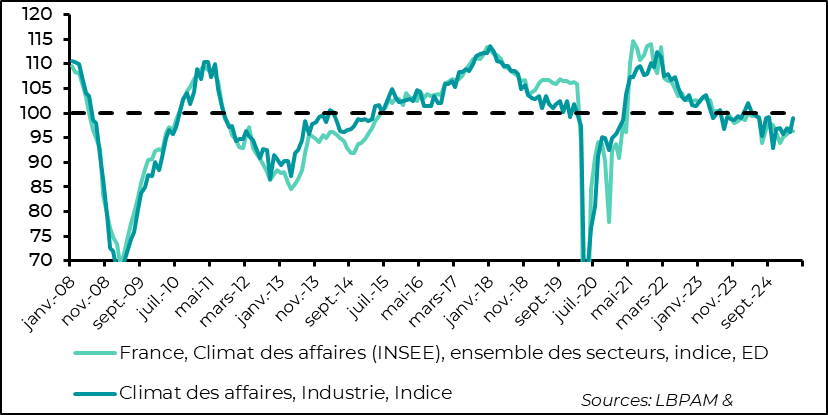

INSEE's April business climate survey for France confirms this situation, with the overall index declining again. It remains well below its long-term average. The decline is largely due to a deterioration in the retail and construction sectors.

As with the manufacturing PMI, the good news was that activity in the industrial sector rebounded sharply, approaching its long-term level. However, in view of trade tensions, a rapid upturn in activity may not be imminent.

France: business climate remains relatively gloomy for companies, although industrial activity is picking up

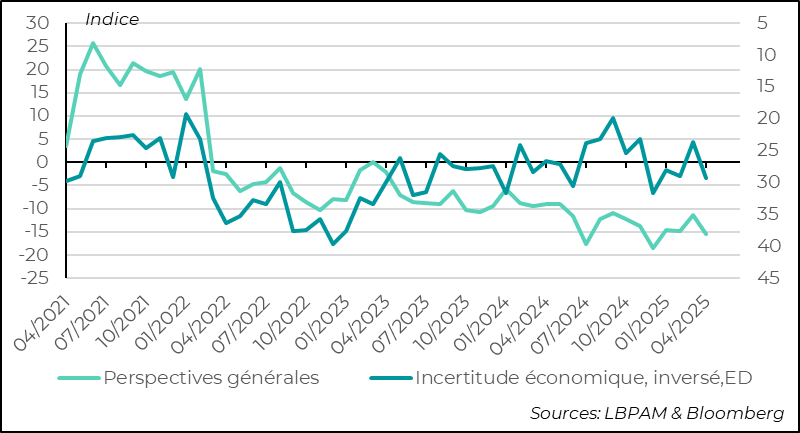

In fact, the outlook remains poorly oriented, in part because of a highly uncertain political environment.

France: outlook remains poor amid political uncertainty

The only reassuring factor for the months ahead is the ECB's now more accommodating stance, which appears to be moving towards a faster-than-anticipated monetary easing of its policy. This should also help to alleviate the negative impact on corporate competitiveness of the euro's recent sharp appreciation.

Sebastian PARIS HORVITZ

Head of research