Japanese policy adds to uncertainty

Link

Market Analysis for October 21, 2024 by Sebastian PARIS HORVITZ.

In summary

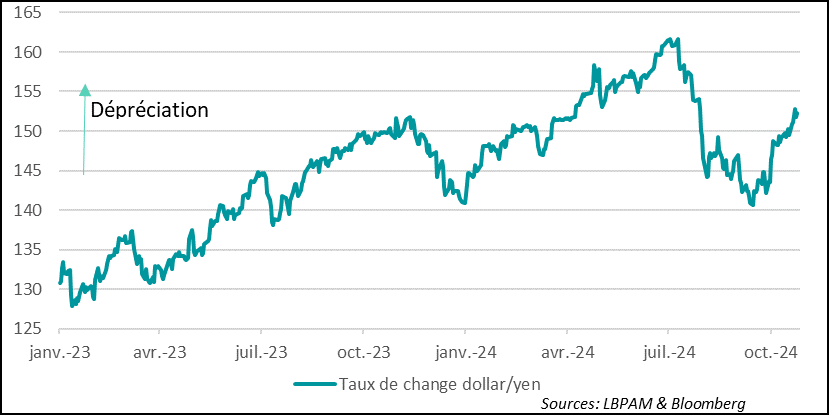

►The recent volatility on the markets is understandable, given the geopolitical and political framework that lies before us. Uncertainty over the outcome of the US elections obviously dominates the behavior of many investors. In this context, the surprise defeat of the Liberal Democratic Party (LDP) in Japan's early parliamentary elections has added a new level of uncertainty. It raises questions about future economic policies, with potential impacts on monetary policy. The yen, which was once again on a downward trend, could continue to suffer, at least in the short term.

►In an uncertain global geopolitical context, Israel's expected retaliation against Iran has heightened anxiety about the situation in the region. Nevertheless, statements by Israeli and Iranian leaders seem to indicate their desire to avoid further escalation. As a result, after a surge in the price of a barrel of Brent crude oil above $75, a sharp fall seems to be taking hold, reflecting relief among market operators. Maintaining a low oil price continues to support the global economic recovery.

►In Europe, as feared, Moody's followed Fitch in changing the outlook on French public debt from stable to negative. The considerations are the same. In other words, political instability and the consequent lack of clarity about the French government's ability to put public finances back on a more sustainable trajectory. At the same time, France's rating has been maintained at Aa2, one notch higher than the current comparable ratings from Fitch and S&P (AA-). This should not have a marked impact on interest rates. The market is likely to await the budget vote.

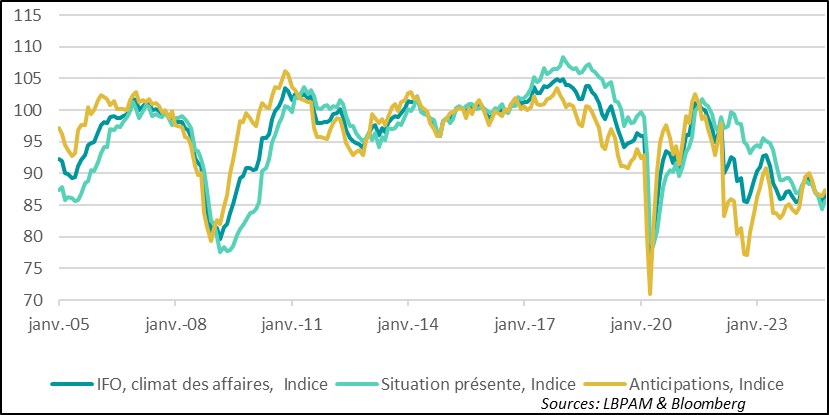

►On the economic front, in line with the PMI survey, the IFO's October survey confirmed the stabilization of activity, albeit at a low level. The overall index rebounded by one point, but remains well below the historical average. It's already good news to see that the index's downward trend is coming to a halt and recovering somewhat. Nevertheless, the fragility of the German economy will obviously be an important consideration in the ECB's decision in December. We still think that the ECB should continue its gradual cuts.

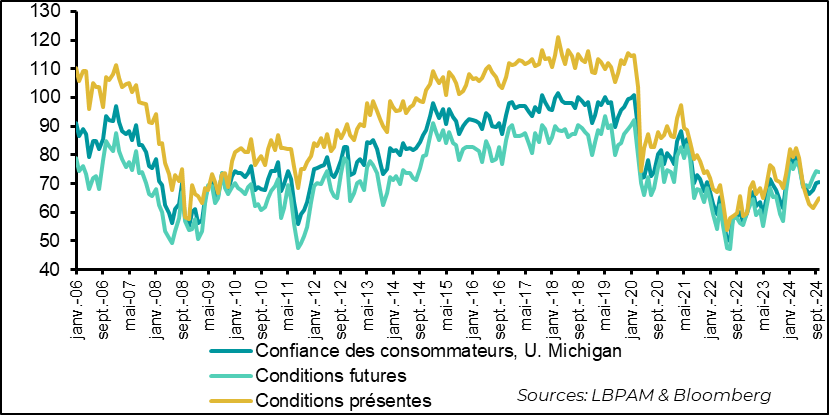

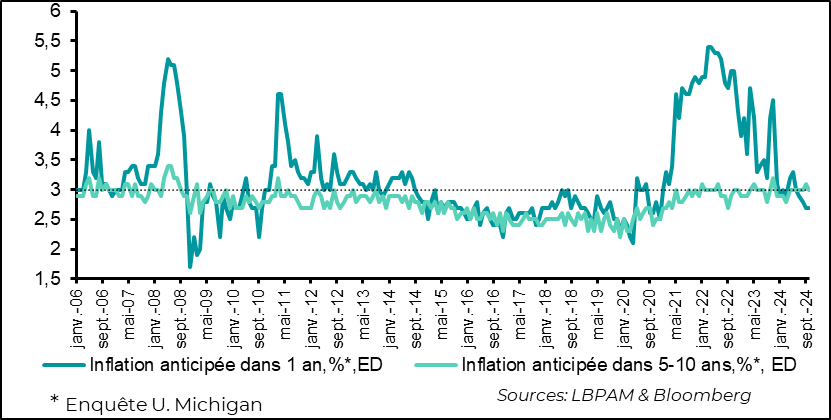

►Across the Atlantic, the University of Michigan's final household confidence survey for October was more reassuring than the preliminary results. The overall index continued to rise, reaching its highest level since the spring. Lower interest rates appear to have had a positive impact on consumer appetite. Lower short-term inflation expectations may also have helped improve sentiment. Nonetheless, a real trend is unlikely to emerge until after the election results.

To go deeper

The early parliamentary election called by Shigeru Ishiba, the new Prime Minister, was a surprise defeat for the Liberal Democratic Party (LDP), which lost its majority. Of the 465 seats in the Assembly, the LDP and its partner (Komeito) would have won just 214. This defeat seems to have severely punished the PLD, following the discovery last year of embezzlement by members of the party.

No other party achieved a majority, but it was the center-left opposition party, the Constitutional Democratic Party (PDC), which was the main beneficiary of the elections with 148 seats, over 50 more than in the previous Assembly.

This result was not anticipated, and we could be entering a period of political instability. Indeed, at this stage it is difficult to see whether the LDP can find a new majority. Negotiations are about to begin. PDC leaders have also declared that they will try to find alliances with other opposition parties in order to change government.

In the short term, this instability is likely to weigh on the Japanese economy. The yen should reflect this situation and is likely to remain under pressure, maintaining its recent downward trend.

Japan: The yen could continue to come under downward pressure following the elections

On the other hand, it's harder to see whether this situation will create a great deal of mistrust in Japanese assets, primarily equities. A fall in the yen could once again support the Japanese stock market in the very short term.

What is certain is that political uncertainty is likely to complicate the Central Bank's (BoJ) task. At this stage, we still expect the normalization of monetary policy to continue gradually, with a further increase in key rates towards the end of the year or early next year. However, the BoJ could be more patient, depending on the direction fiscal policy might take in the event of a change of course.

In the Eurozone, the IFO survey for October confirmed the stabilization of the German economy, following the better results of the preliminary PMI surveys. Indeed, the business climate indicator rebounded, breaking the downward trend of recent months. Both sentiment on current conditions and outlook improved in October.

Nevertheless, the level of the indices remains well below historical averages, underlining the continuing weakness of the German economy. In particular, the very poor state of industry - a worldwide phenomenon - is weighing heavily on Germany's economic momentum.

Euro zone: IFO business climate survey in Germany shows slight improvement at last, although activity remains depressed

Most likely, German GDP contracted again in 3Q24, but the survey figures are reassuring and point to a slight recovery in the final quarter of the year. This should be supported by continued monetary easing by the ECB.

In the United States, despite the uncertainty surrounding the presidential election, consumer confidence, as measured by the University of Michigan survey, rose slightly in October compared with the previous month. Thus, the decline in the survey's preliminary result has been erased.

Above all, consumers' opinion of current conditions continued to improve. Expectations were slightly down on September.

This overall improvement can be attributed to two factors. Firstly, the Fed's sharp rate cut in September, and especially the prospect of further rate cuts, seems to have translated into a more favorable view of households' future purchasing prospects. On the other hand, the fall in short-term inflation expectations also seems to have reassured households.

Nevertheless, given the still depressed level of confidence compared to its historical average, we'll surely have to wait for the outcome of the elections to see a clearer trend emerge. It's worth pointing out that the divide between households more inclined to vote Democrat or Republican remains very strong, with the latter retaining a far more negative perception of the economy.

United States: Household confidence according to U. of Michigan survey continues to recover in October, but remains historically low

As mentioned, one of the factors contributing to the continued improvement in confidence has been short-term (1-year) inflation expectations, which remain low. This is largely due to the persistent fall in gasoline prices, which have been declining since the end of April. On the other hand, the medium-term outlook remains within the high range of the last 10 years.

United States: Short-term inflation expectations remain very contained, while medium-term expectations are still in the high range of recent years

Sebastian PARIS HORVITZ

Head of Research