Jobs markets extremely firm … and strained

Link

- After rallying sharply midway through last week following the central bank meetings, the markets consolidated slightly after extremely firm US jobs data was published on Friday, casting doubt over the Fed’s capacity to rapidly wind down its anti-inflation policy. Geopolitical concerns were also exacerbated due to heightened tensions between China and the US after the Americans shot down a Chinese balloon which had flown over its territory. The US cancelled the planned visit to Beijing by the Secretary of State and China “reserved the right to respond further”. This event has sapped the momentum towards reduced tensions between the two super powers, which began with the meeting between Xi and Biden in mid-November. It also serves as a reminder that the geopolitical landscape remains highly challenging.

-

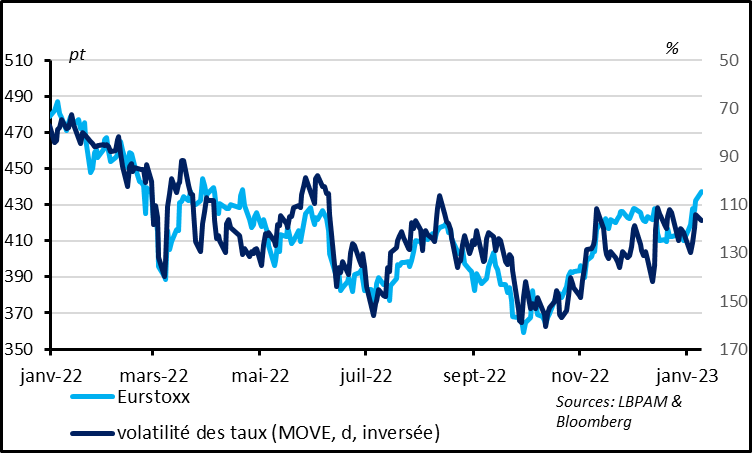

We note that risky assets benefitted strongly from lower interest-rate volatility over the past few months, although we believe that this driver is probably now behind us.

-

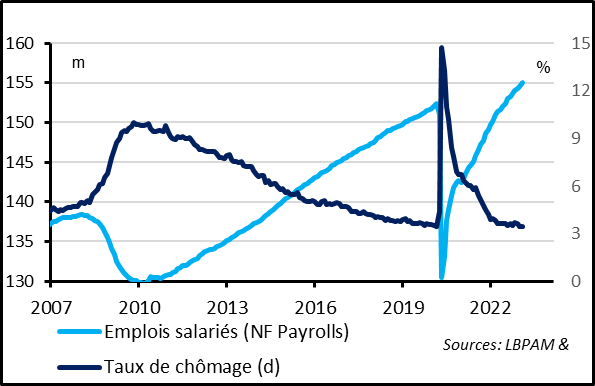

The January US jobs report was truly exceptional, reducing the risk of a sharp recession in the US in early 2023, but also diminishing the Fed’s capacity to rapidly adopt a more accommodating stance. 517,000 new jobs were created, which was double the number reported in December and almost three times higher than forecasts. The unemployment rate fell to 3.4%, its lowest level since the 1960s. The US jobs market will therefore undoubtedly remain under great strain.

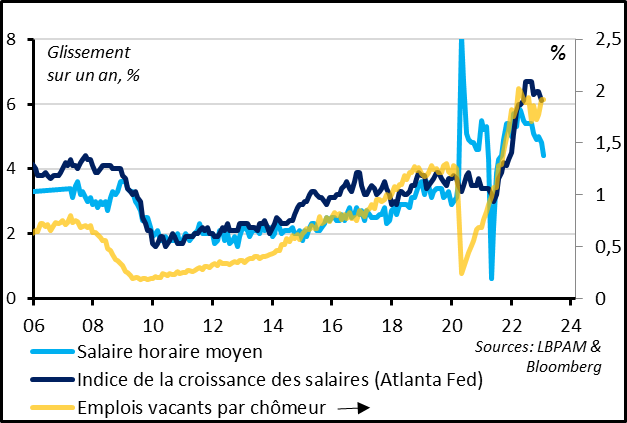

- Despite these tensions, hourly wages slowed to 4.4% year-on-year in January, their lowest level since 2021, after peaking at 5.9% in early 2022. Although part of the acceleration in salaries is probably only temporary as it has been driven by the reopening of the economy, we still believe that wage inflation will remain too high to be compatible with inflation returning sustainably towards 2%, unless the jobs market eases significantly, which will require a sharp slowdown in the US economy during 2023.

-

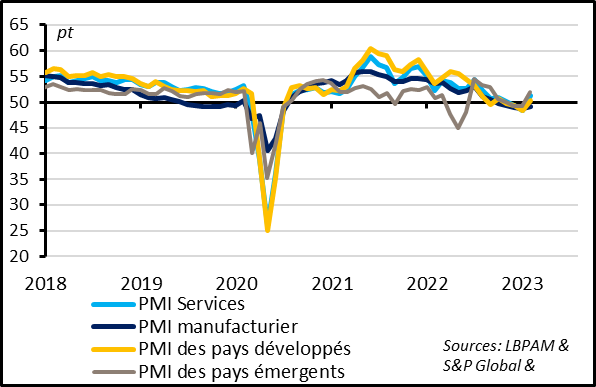

The global economic climate improved slightly in early 2023, with PMI data coming in higher across the leading economic regions and various sectors during January. In addition to the less abrupt slowdown in the US, the eurozone and China have both seen their S&P global composite PMI break upwards through the 50-point threshold in January for the first time since the summer. We believe that outlook is better than may have been feared in both regions for 2023, although the situation remains complicated.

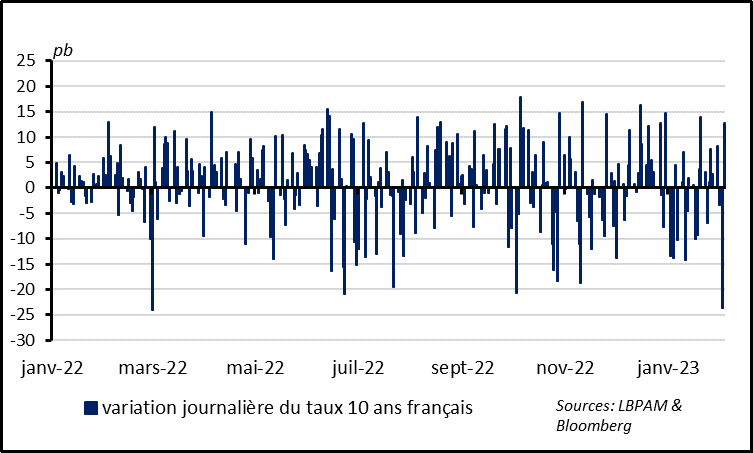

French 1-year debt yields steepened by 0.11% on Friday, following the publication of the US jobs report. This move wiped out more than half of the fall recorded the day before, which was the sharpest downturn within the past year, triggered by the ECB meeting on Thursday. German and US yields also followed the same pattern. We believe that the markets over-reacted to the forward guidance provided by the central banks last week. Investors focused on the fact that the central banks are reaching the end of their rate hike cycles and considered that inflationary risks had abated slightly, leading to anticipation of base rate cuts as early as during the second half of the year. However, both the Fed and the ECB stated that they plan to raise rates further at their next meetings and intend to maintain rates at high levels for a long period, in order to ensure that inflation returns sustainably towards the 2% target.

Fig.2 Markets: interest rate uncertainty has been a key driver for the equity markets over the past year

The risky assets markets have been fuelled since October by lower interest rate volatility, which had previously increased sharply throughout 2022. This reflects the fact that the markets are anticipating the end of the rate hike cycle, after being surprised by the pace and severity of monetary policy tightening by the central banks last year. Interest rate volatility nonetheless remains high compared to the recent past, at 50% above the 10-year average. It would therefore be reasonable to expect volatility to fall further and continue supporting risky assets. However, the current level is actually in-line with the average recorded before the financial crisis and the introduction of ultra-accommodating monetary policies. We therefore believe that volatility should remain higher than in the recent past, as uncertainty over the economy and, above all, inflation, is now greater and the central banks are likely to maintain their restrictive monetary policies in place for some time. If our assumptions are correct, rates will not be as negative for risky assets as in 2022, although they will not remain a key driver for assets across the board for much longer, as has been the case over recent months.

Fig.3 US: exceptionally strong jobs report in January.

Job creations were exceptionally strong in January, which reduces the chances of a steep recession in the US in early 2023, but also means the Fed is unlikely to adopt a less restrictive stance. Non-farm payrolls increased by 517,000, which was double the number reported in December and almost three times higher than forecasts. Although the January increase should be relativised, due to the annual revision of previous data, it is nonetheless clear that the jobs market is more dynamic than expected. Payroll figures at the end of 2022 were effectively revised upwards by 815k, which implies that the majority of employees who had disappeared from the statistics since the Covid crisis were in work. Other surveys also indicate sharp increases (+868,000 according to the household survey) and leading jobs indicators, such as temporary employment and working hours data, improved after several months of deterioration. The unemployment rate fell to 3.4%, reaching its lowest level in over 50 years. The labour force participation rate was revised upwards to above pre-Covid levels for the first time, adjusted for demographic changes. Overall, the US employment market clearly remains under strain.

Despite persistent tensions in the jobs market, the hourly wage rate slowed further in January, to 4.4% year-on-year. This is the slowest pace of growth recorded since 2021, after peaking at 5.9% in early 2022. The data corroborates the Fed president’s suggestion last week that a soft landing in the US economy is possible. This would effectively imply that wages and inflation could slow down without the jobs market or growth deteriorating significantly. However, wages over previous months have been revised sharply higher, increasing at a much faster pace than is considered compatible with inflation returning sustainably towards 2%, i.e. at 4.4% vs a reasonable level of 3-3.5%. The revised data also shows that over-reaction to a single set of either positive or negative data must be avoided, particularly in a context of major structural changes within the economy.We believe that the current slowdown in wage growth is due to the fact that the acceleration observed between mid-2021 and mid-2022 was probably chiefly only temporary, as it was triggered by the economy reopening post-Covid, and that this factor is now waning with the reopening behind us. We still believe however that wage pressure will remain too high if the jobs market does not ease significantly, which would require a sharp slowdown in the US economy. We therefore believe that unless there is a deep recession, the Fed will have to maintain high rates over the next few quarters.

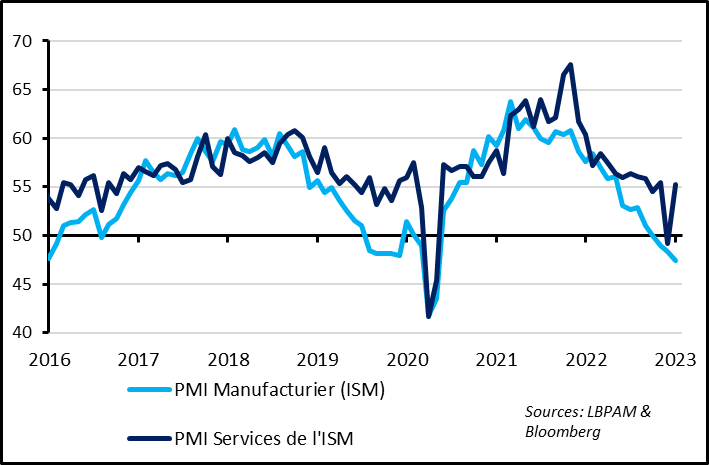

Fig.5 US : the ISM services index rallied sharply in January, wiping-out December’s downturn

In addition to the resilience of the American jobs market in January, the ISM services index rallied to 55.2 points, after collapsing to 49.2 in December. It is reassuring to see the leading US economic indicator once again indicating business expansion, despite remining on a decelerating trend since the beginning of 2022. Overall, US growth appears to be slowing further but without collapsing at the start of 2023, contrary to the trend implied by business indicators in December.

Fig.6 Worldwide: PMIs improved across the board in January for the first time in a year

Outside of the US, the global economic climate has improved slightly at the start of 2023, driven by the resilience of the eurozone economy and reopening in China. The composite global PMI improved for the second consecutive month in January, edging towards the 50-point threshold. PMI data is stronger across the board, including in both industrial and services sectors and also among emerging and developed economies. The trend is being driven chiefly by the eurozone and China, where S&P global composite PMIs have broken upwards through the 50-point threshold once again in January, for the first time since the summer. We believe that outlook for 2023 is better than may have been expected in these two regions, despite remaining complicated.

Xavier Chapard