US jobs are holding up well

Link

The US debt-ceiling saga has at last concluded, as expected, with an agreement. Both houses of Congress approved the bill, which became law after President Biden signed it on Saturday. There will no more talk of a debt ceiling until the start of 2025. The agreement includes two-year spending caps and other symbolic measures for the Republicans, such as a phased extension from 49 to 54 years of the age limit for work-reporting requirements to receive certain welfare benefits. The Republicans also obtained a reduction in fraud-reduction resources allocated to the IRS and restrictions will be lifted on some energy projects. All in all, the impact estimated by the independent Congressional Budget Office (CBO) is a USD 1523 billion reduction in deficits over the next decade. The impact will be negligible this year (a USD 4.4 billion reduction in the deficit) and in 2024 (a USD 70 billion reduction). In short, the economic impact will be very small, but the removal of this albatross has provided a boost to market risk-taking, as US equities are still being driven by tech stocks.

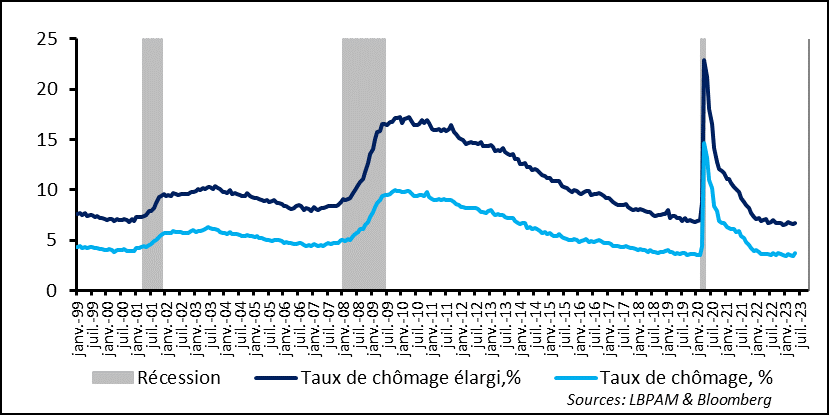

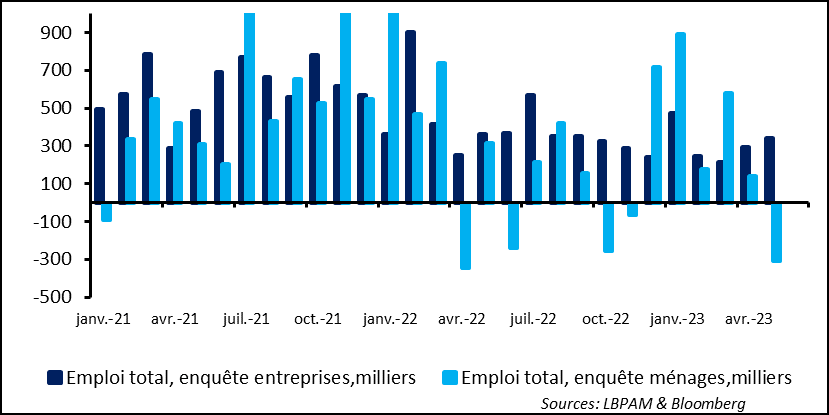

Meanwhile, investors continue to home in on the economy and how it is reacting to monetary tightening in large countries. Job figures derived from the business survey were once again surprisingly high in the United States. Almost 340,000 jobs were created in May, vs. less than 200,000 forecast. Job creations were once again rather broad-based, with the manufacturing sector showing the slowest growth. The household survey, however, painted a slightly less bright picture, pointing to heavy job destructions, which sent the employment rate to 3.7% from 3.4% the previous month. The gap between the two surveys had already shown up in recent figures and, so far, the business survey appears to have been more on the mark. Meanwhile, the still-tight job market has caused wage growth to slow only very slightly (to 4.3% year-on-year and 0.3% month-on-month). All in all, and while mixed, these statistics continue to point to a tight job market with no hope for a rapid receding in inflationary pressures. But we still don’t think they are likely to dissuade many Fed monetary policy committee members from marking a pause at their next meeting next week. The committee will also have May inflation figures available to help it make a decision. In our view, the risk in key rates is still on the upside, but we are nonetheless sticking to our scenario of unchanged rates until at least early 2024, hence a sustained restrictive monetary policy.

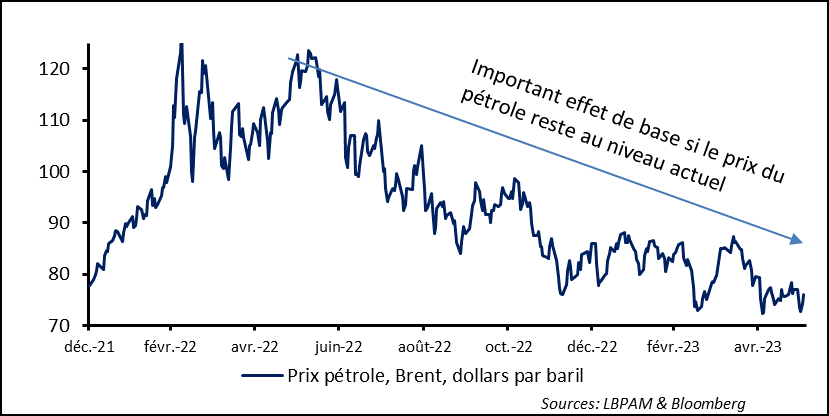

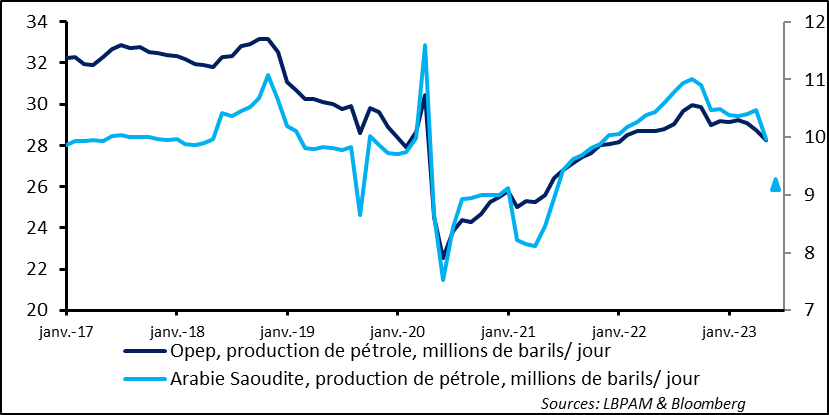

Until now, falling commodity prices, oil prices in particular, had been a big factor in receding inflation. Oil prices remain close to their one-year-plus lows despite successive output cuts by OPEC countries. This weekend, Saudi Arabia announced a surprising and unilateral 1 million bbl./d. reduction in output, effective July, in order to support prices. Other OPEC countries are reportedly keeping their output unchanged. What impact could the Saudi cut have? It will surely provide a slight short-term price boost, but the market now seems to be pricing in global demand that could remain far lower than had been expected early in the year. On top of relatively weak economic activity in major countries, the outlook for an economic recovery in China is now seen as much less of a driver than previously expected. We believe that oil prices could stabilise at a higher level than currently due to supply-side squeezes and demand that is nonetheless likely to recover, particularly from China.

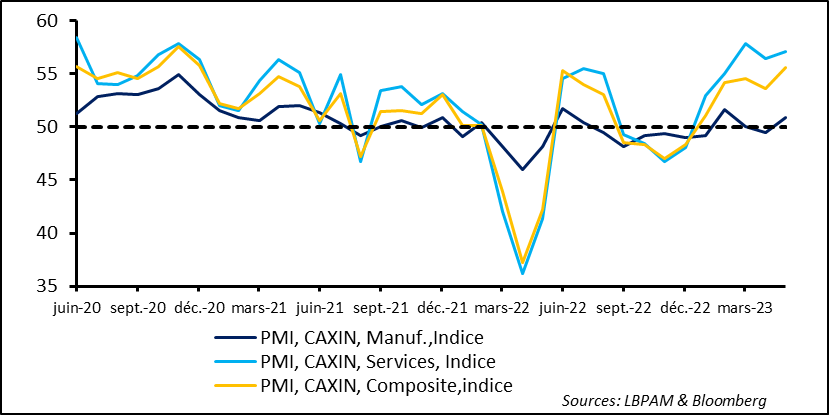

Doubts persist on the strength of the Chinese recovery. However, the latest Caixin PMI survey confirms that services continue to drive economic activity, with a slight acceleration in May. The economic reopening after the zero-Covid lockdowns remains the main driver of the recovery, although, as we saw last week, the manufacturing sector seems to be very gradually moving back towards expansion. More government economic stimulus measures are expected but the consensus still sees only a moderate boost.

Job creations remain robust in the US economy, surpassing analyst forecasts. In May, they once again exceeded forecasts rather significantly, at 339,000 jobs, of which 283,000 in the private sector, more than 100,000 higher than expected.

According to the business survey, jobs were created in all sectors of the economy, with the manufacturing sector alone showing a decline, which is consistent with the weakness in industrial activity.

The households survey painted a slightly different picture, with more than 300,000 jobs that were reportedly destroyed on the month. This sent the employment rate up to 3.7% from the previous month’s 3.4% figure, a more than 50-year low.

The gap between the messages sent out by the households survey and the business survey is nothing new. We’ve seen it several times over the past year. Even so, during the review period, the households survey has been more volatile and has often closed the gap with the business survey. The fact that jobless claims figures remain rather low, albeit higher than last year and early this year, seems to undermine the idea that many jobs were destroyed last month.

Fig. 2 – US : Contrasting signals on the job market, although the business survey seems to be more in line with other indicators

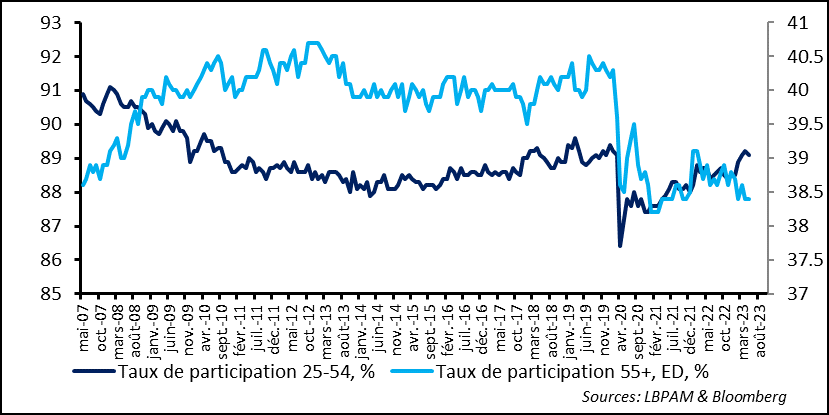

The households survey also showed that the participation rate was unchanged on the month, at 0.7 points lower than it was pre-Covid. Meanwhile, and as we have already noted, there appear to be wide disparities between age groups. While the strong economic recovery has sent the participation rate to almost its pre-Covid level in the most populous group (25-54 years), the participation “deficit” remains higher in marginal age groups. In particular, the participation rate of the oldest group appears to have receded permanently. Among the explanations for this phenomenon are stubborn health issues but, above all, the fact that strong capital gains driven by financial market performances during Covid have led a substantial number of Americans to retire earlier than expected.

Fig. 3 – US : Normalisation of the participation rate of the most populous age group, but structural decline in other age groups

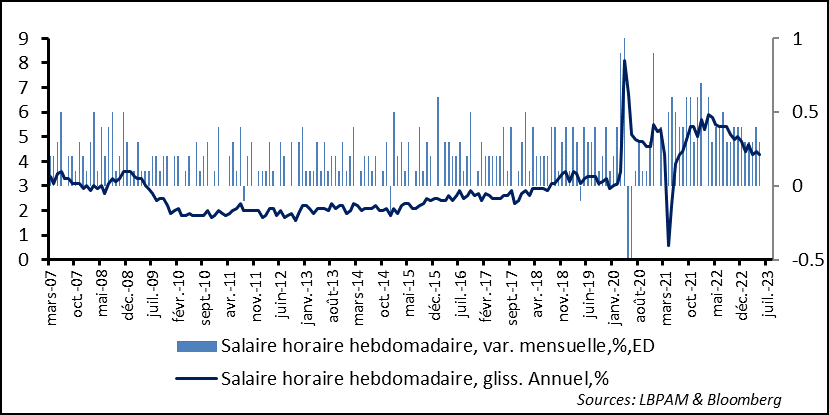

The participation deficit of some age groups may also explain, in part, the persistent wage pressures in the economy. However, the business survey found that growth in hourly wages had slowed slightly in May, to 0.3% month-on-month after last month’s acceleration. Even so, the year-on-year increase in hourly wages, which rose to 4.3%, is still inconsistent with inflation’s converging rapidly towards 2%.

Fig. 4 – US : Slightly slower wage growth but the increase (4.3%annualised[SM1] ) is still inconsistent with 2% inflation

Most importantly, we will have to await other, more reliable statistics on “actual” wage trends, because this survey is known to often be biased by skewing in the job market breakdown.

All in all, the Fed will regard a slowdown in wage growth, even a very gradual one, as a favourable factor. But the job market continues to send out robust signals of persistent excess demand in the US economy, which, in our view, could keep wage tensions – and, ultimately, pricing pressures – high.

We still expect a pause in monetary tightening, but the bias is still points to further tightening, even when factoring in demand, which remains resilient,. That being said, we feel that monetary authorities are becoming more cautious and more inclined to stick to a restrictive policy for some time to come, in our view at least until early 2024, but without continuing to raise interest rates, thus factoring into their decision-making the delays in transmitting monetary policy.

The PMI services (Caixin) in China for May confirmed that services continue to drive growth. The indicator turned up, exceeding market expectations at 57.1, or far above 50, which is the dividing line between expansion and contraction. With this gain and the return of the manufacturing sector (barely) into expansion territory, the PMI composite hit a high since 2021.

Fig. 5 – China : The PMI composite back to its high since early 2021, driven by services

Despite this favourable development, the latest economic statistics show that the recovery is not truly gaining ground evenly on all fronts, including in consumption, which remains the driver of the expansion. In particular, the important sector of construction is still in the doldrums and is not truly contributing to growth. Despite some official stimulus measures, the recovery in construction will be very slow. We still expect growth to remain strong in 1H23, albeit perhaps less so in the second half of the year, as the more immediate effects of the economic reopening fade. Without stronger support from the government, we don’t see any strong source of growth, especially as we forecast weak growth in Europe and the US.

One essential factor in receding inflation so far has been falling commodity prices, energy prices in particular. Expectations of a weakening in economic activity and, hence, in energy demand have continued to drag down prices. It was to counter this trend that at the OPEC meeting Saudi Arabia surprisingly decided to cut its output by 1 million barrels a day, effective in July.

Fig. 6 OPEC : Further cuts in output to support prices, thanks mainly to Saudi Arabia.

This steep cut in Saudi production will have a clear short-term impact on prices, but higher prices will ultimately depend on how robust demand is. Until now, demand has been rather moderate and, for the moment, it has not been boosted by the Chinese recovery as had been expected.

We expect the resurgence in Chinese demand to support global oil demand towards the end of the year, despite weak growth in the developed world. But we don’t expect any meaningful rebound in prices, despite the Saudi output cut, as supply constraints could be eased slightly by Russia, which appears to be finding markets for its oil in a number of emerging economies, thus lessening the risk that this source will suddenly vanish.

All in all, while we expect oil prices to rise from current levels, they are likely to continue feeding disinflation in the coming months through a very strong basis effect.

Fig. 7 – Oil prices : Saudi Arabia’s surprise announcement of an additional cut of 1m bbl./d., effective July, should provide some support