The unbearable lightness of interest rates

Link

- While some equity indices, such as the CAC 40, are hitting all-time highs, the bond markets continue to be subject to severe volatility, with historic daily swings in yields. This has raised concerns at the Securities and Exchange Commission (SEC), which has decided to look into the actions of certain market participants, hedge funds in particular. At this point, it is hard to say whether shifts in bond yields are due to heavy and exaggerated speculative flows, which could be mitigated or even prevented by better regulation. One thing that is certain is that such volatility in yields is unlikely to provide economic actors with a normal decision-making framework. Moreover, it continues to stoke a toxic dialogue between the markets and central banks, especially the Fed. In particular, the markets continue to doubt the need to keep monetary policy on a tightening bias for some time to come.

- In addition to the firm resilience of economies so far this year, on top of the Chinese recovery, the markets appear to have been driven by the belief that monetary policies will rapidly become more accommodative – in spite of the episode of banking stress a few weeks ago. We continue to expect that growth will slacken further, due mainly to the impact of monetary tightening. Growth will remain very weak in Europe, and the United States is likely to slip into a moderate recession in 2H23. With this in mind, we still expect equity valuations to adjust under the impact of weaker profitability. However, the markets are clearly more optimistic. True, China will drive some stocks, as we have just seen in the luxury sector, but weak growth and rising interest rates are likely to remain a powerful headwind. We reiterate our cautious stance in our asset allocation, while remaining invested, but also while overweighting reasonably priced stocks, solid balance sheets and supportive long-term thematics.

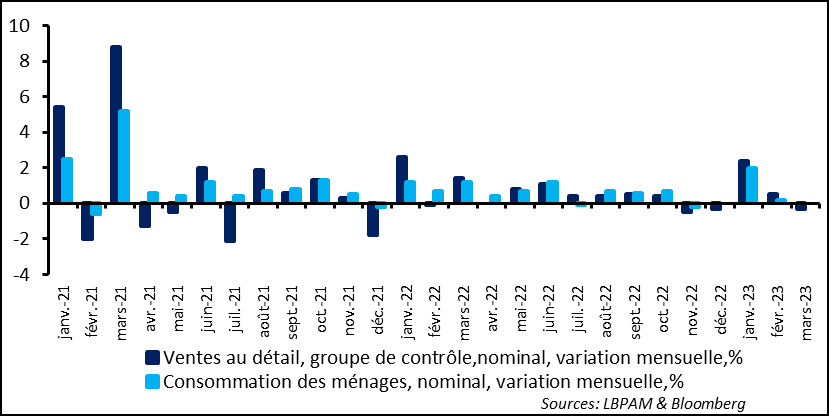

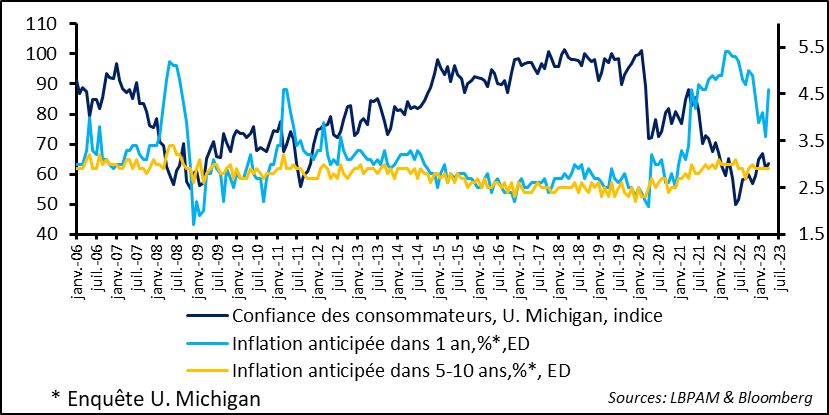

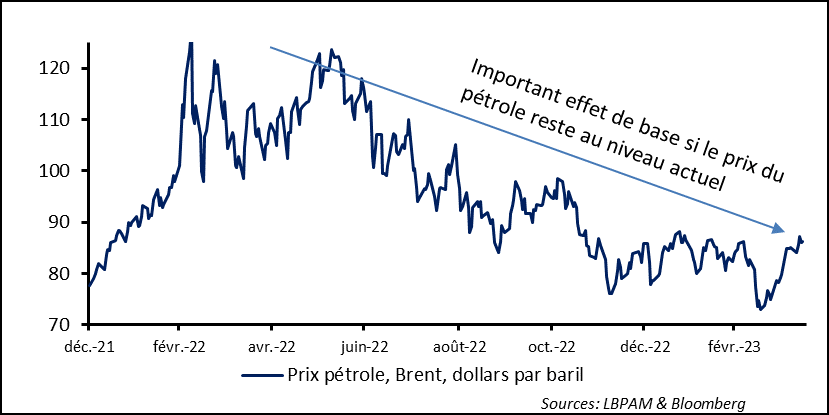

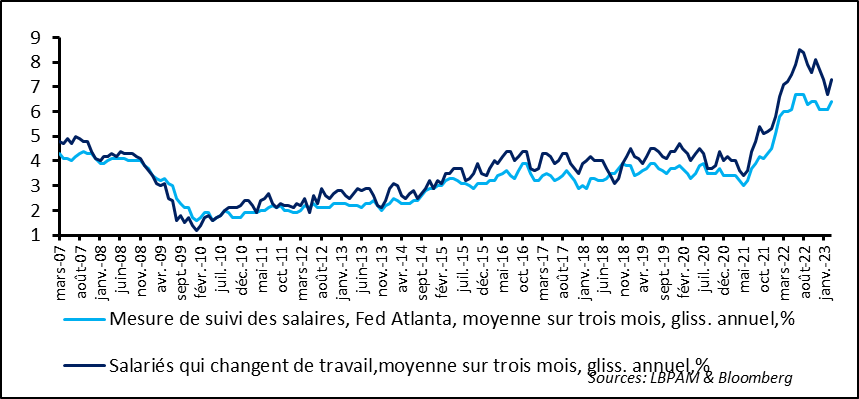

- In the midst of this debate on growth momentum, a rather negative signal emerged from the US – retail sales figures, which failed to maintain their rather upward momentum of the two previous months. The closest measure of end consumption (called the control group) declined by 0.3% on the month, and far more in real terms deflated for inflation in goods ex energy, which rose on the month. Consumption will nonetheless have made a positive contribution to GDP growth in 1Q23, but the trend appears to be weakening. Meanwhile, household confidence, as measured by the University of Michigan survey, turned up slightly but remains very low. The survey highlights in negative fashion that households’ inflation expectations for next year have risen drastically, no doubt due to higher oil prices. On top of this, wage increases reaccelerated in March, as measured by the rather reliable Atlanta Fed figures. These figures are likely to give the Fed a further argument to make one last, 25bp key rate hike in May.

- The Chinese recovery is still on track and appears to be spreading in particular to the real-estate market. True, activity in the sector is still depressed, but there are increasing signs of an upturn. For example, new home prices in the 70 main cities rose in the past two months, reversing their steady slide over the past almost one year. Even so, the road to a real recovery in the sector will be long.

- The Japan meeting of G7 ministers of energy and the environment reiterated the goal of accelerating the energy transition, in order to reduce greenhouse gas emissions. However, the impact of the war in Ukraine has undermined some of these objectives, as some countries are having a hard time altering their energy mix. In particular, and once again, no date was approved for an exit from coal. 2030, a date put forth by the United Kingdom and Canada and supported by France, was not adopted. Meanwhile, even more ambitious objectives were put forth on offshore wind power and photovoltaic solar power. However, the goal remains to implement the means necessary for achieving these goals in terms of financing, including accelerating the transition in developing countries. The USD 100 billion in transfers provided under the Paris Agreement have still not been achieved. Obviously, whether in terms of incentives or direct spending, considerable public outlays will be necessary to meet these objectives, with potentially additional inflationary pressures.

In the United States, March figures confirmed that retail sales are slowing after rebounding steeply in January. Sales excluding cars and gasoline fell by 0.3% on the month in nominal terms, albeit a little less than expected. The control group, which is used as a proxy of total goods consumption, fell in similar proportion, i.e., by about -0.5% in real terms when using the March goods consumer price index (+0.2%) as a deflater.

Fig. 1 – United States: Consumption shrank in March after rebounding strongly early in theyear

Retail sales, control group, nominal, month-on-month, %

Household consumption, nominal, month-on-month, %

Jan. Feb. Mar. Apr., Jun. Jul. Aug. Sep. Oct. Nov. Dec.

Despite this decline, consumption is still likely to make a positive contribution to GDP growth in 1Q23. We expect GDP growth so far this year to have been far more solid than previously expected, with an annualised expansion estimated at almost 2%. Even so, we still see a further slowing in activity for 2Q23, and a possible contraction in 3Q23 with signs of a downturn in the job market.

For the moment, the job market remains strong and continues to support US consumer confidence. For example, the University of Michigan flash results for April suggest that confidence has recovered a little, but while remaining at historically low levels.

Inflation in particular remains a concern. Inflation expectations for next year have risen by 1 point (to 4.6% year-on-year from 3.6% previously), no doubt due to the upturn in gasoline prices. Longer-term expectations remain stable at 2.9%.

Fig. 2 – United States: Consumer confidence is turning up but is still very low

University of Michigan consumer confidence index

1-year inflation expectations, %, ED

1-year inflation expectations, %, ED

Jan. Jul……

We’ll see what impact this new energy “tax” will have on consumption in the coming months. That impact will probably be negative.

One thing that is certain is that production cuts decided by Russia (600k bbl./d.) and, even more so, OPEC countries (1 million bbl./d.) have broken the downward momentum in oil prices. The acceleration in Chinese economic activity could also push up energy prices between now and yearend.

This increase is likely to subtract from the positive basis effects that energy prices had had on inflation in most countries so far this year. As a result, not only could we see core inflation decline only very gradually but also total inflation recede less than had been expected.

Fig. 3 – Oil: prices have begun to rise again in reaction to production cuts by Russia and OPEC and to anticipations of a recovery in the Chinese economy

Considerable basis effect if oil prices stay at their current levels

Dec. Feb. Apr. Jun. Aug. Oct. Dec. Feb.

This increase in energy prices is unlikely to make central banks overreact, given that it will be viewed as a factor slowing down the economy by weighing directly on household purchasing power.

Even so, it could continue to boost prices throughout the economy, as companies pass on higher costs into their sales prices.

Speaking of business costs, in the US, the Dallas Fed released figures on March wage increases in the economy. Wages are reaccelerating on a year-on-year basis. This therefore contradicts the hourly wage figures that emerged from the jobs survey of companies released a little more than one week ago, which pointed towards a deceleration. We know that the business surveys are subject to some biases, particularly as regards the skewing that can occur in the job market. The Atlanta Fed survey is more reliable.

Fig. 4 – United States: Wages reaccelerated in March, based on the Dallas Fed statistic.

Wage monitoring, Atlanta Fed, 3-month average, year-on-year, %

Workers who change jobs, 3-month average, year-on-year, %

Mar. Aug. Jan. Jun. Nov. Sep. Feb. Jul. Dec. May Oct…..

Without worrying too much about cost trends, it is nonetheless certain that, for the Fed, recent inflation signals continue to move in the direction of maintaining a tightening policy for more time to come, in order to move inflation back to its 2% target.

The Fed is well aware that, at this point, maintaining this goal is essential to holding onto its credibility and keeping inflation expectations anchored. This is one of the main reasons why we expect the Fed to stick to its tightening bias (i.e., no rate cuts) until early 2024, unless, of course, the US economy suffers a far greater slowdown than the one we are currently forecasting.

The bond markets and the markets in general are having a hard time pricing in this scenario. Their belief that the Fed would rush to the markets’ rescue if they showed too much weakness, remains firmly anchored. The coming months will surely be decisive on how this gap in views between market participants and central bankers will play out.

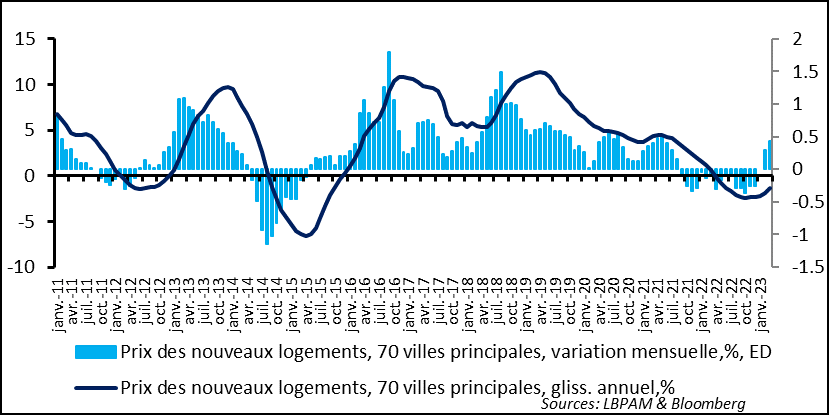

Meanwhile, the Chinese economy continues to recover, and the recovery seems to be spreading throughout the economy. The real-estate market in particular seems to be improving, but this will be a very slow process, given the extent of last year’s slump.

New housing prices rose again in March, based on figures in China’s top 70 cities. This may not be the trend nationwide, but this recovery is nonetheless a positive sign. Measures to assist property developers, particularly to finish construction jobs that had been left in limbo, appear to have restored some confidence.

Fig. 5 China: The real-estate sector is recovering very slowly from its slump, driven by measures to assist property developers

New housing prices, 70 top cities, month-on-month chg., %, ED

New housing prices, 70 top cities, year-on-year chg., %, ED

Jan. Apr. Jul. Oct. Jan. Apr. ….

The road to recovery to a robust real-estate sector will no doubt be long, but the recovery in activity does look real.