The Fed absolutely must bring inflation and banking stress under control

Link

- The authorities continue to try to resolve the crisis of confidence in the banking system. After the measures taken by US authorities one week ago (guaranteeing the deposits of failed banks and injecting Fed liquidities), Swiss authorities orchestrated UBS’s takeover of Credit Suisse and guaranteed it CHF 100 billion in liquidities this weekend. The prompt and forceful responses of the authorities reassure us, although it is still too early to say for sure that a systemic crisis has been avoided. The markets remain on edge this morning, which suggests that confidence, which is essential to banking, is still very fragile.

- The Fed faces a tough dilemma in the run-up to its Thursday meeting. If it continues to raise its rates, it will strength its anti-inflation credentials but at the risk of exacerbating financing tensions. In retrospect, this could end up being a historical error, as experience has taught us that a serious malfunction in our banking system is, in a way, the biggest risk of all. If the Fed foregoes a rate hike, it can limit the pressure on financial markets but would then risk de-anchoring inflation expectations and could even ratchet up fears on the banking system (is the situation of the banks, which the Fed supervises, even worse than we thought?). All in all, we believe that the Fed will, like the ECB last week, raise its rates (by 25bp) while issuing assurances that it will provide banks with all the liquidity they need. This is what it has done since the banking crisis began, by lending massively to US banks (by easing refinancing conditions) and, since this week-end, to international banks (by lending dollars to other major central banks).

-

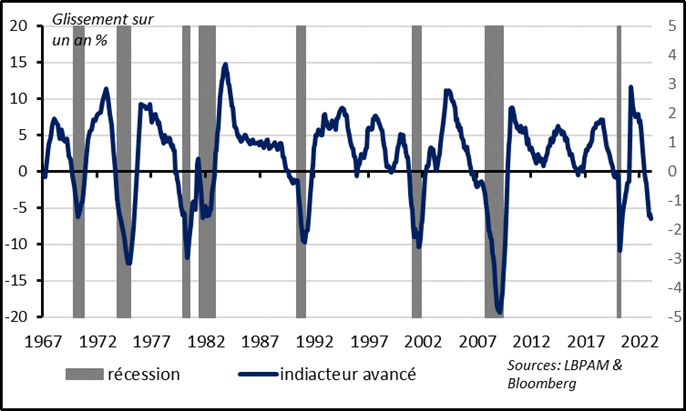

The latest figures confirm that the US economy has remained strong in early 2023 but that its outlook was in jeopardy, even prior to the recent financial stress. Manufacturing output and retail sales held up in February after their steep rise of January, which suggests that US growth is still close 3% in Q1. However, the Conference Board leading indicator fell for the 11th consecutive month in February and is now at a level that has always flagged a coming recession. And household confidence fell in early March for the first time in four months and remains low, despite the ongoing normalisation of inflation expectations. We forecast a slight recession in the United States by yearend, but there is a risk that the recession will come sooner and will be more severe if financing conditions remain worse and for longer.

-

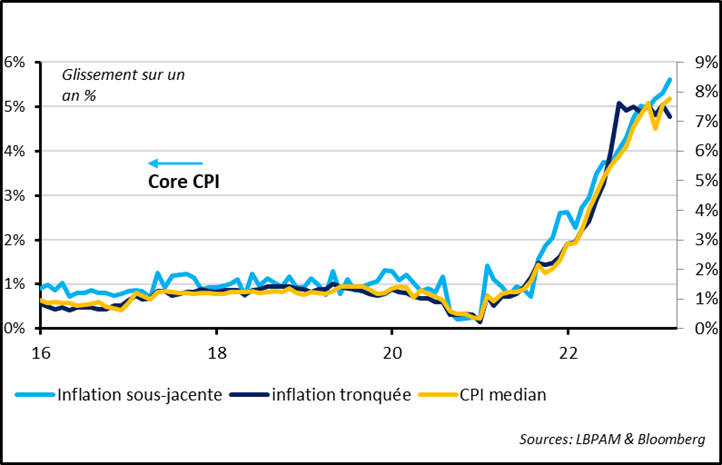

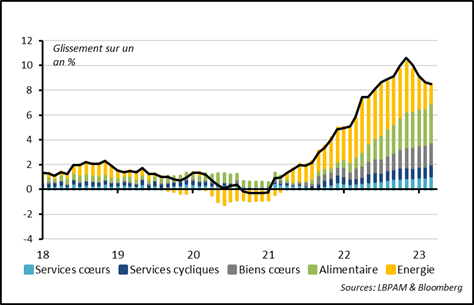

In the Euro Zone, final inflation figures for February confirm that it rose further in all categories other than energy and that medium-term inflationary pressures remain very high. This is why the ECB raised its rates by 50 bp last week. The ECB reiterated that it was prepared to provide all liquidity that banks might need, but at a higher price, in order to cool off demand and inflation.

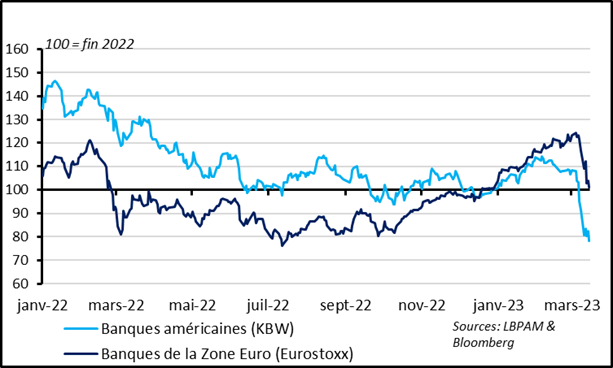

Fig.1 – Banks : bank shares are still under pressure…

Banking shares remain under selling pressure this morning after wiping out all their gains on the year in the Euro Zone and falling back to where they were at the start of the Covid crisis in the US. They are now more than 30% off their highs of early March in the US and almost 20% in the Euro Zone. Credit Suisse shares are down by one third on the month to date and UBS’s takeover bid is 60% under its Friday closing price.

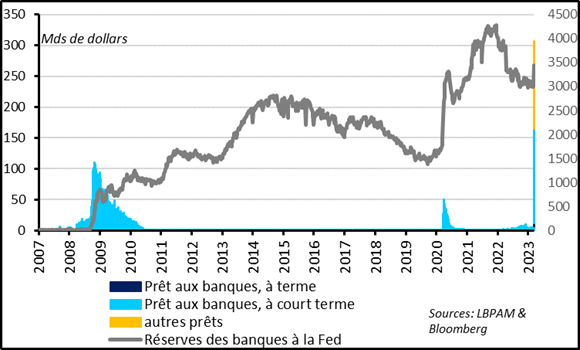

Fig. 2 – Banks : … despite official action, in particular by the Fed

The authorities continue to increase their support for banks. As of Wednesday evening, the Fed had already provided more than USD 160bn in liquidity to US banks via emergency lending operations, which is more than at the worst of the 2008 financial crisis. This led to a rebound of USD 440bn in bank reserves at the Fed, cancelling out in one week the reduction that had occurred during one year of quantitative tightening. The Swiss central bank pledged to supply UBS with up to CHF 100bn in liquidity after the announcement of its takeover of Credit Suisse, or twice as much as it had pledged to Credit Suisse last week. And the Fed and other major central banks agreed this weekend on daily provision of dollar liquidity to banks instead of conventional weekly operations, via currency swap lines between central banks.

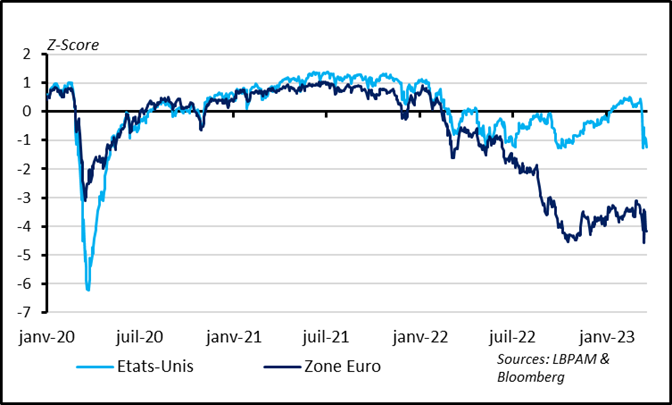

Fig. 3 – Financing conditions: a severe tightening that could alter prospects if it lasts or if it is increased further

Banking stress will have a negative impact on the economic outlook, but how much of one will depend on how deep and how long tensions on financing conditions are. Banking stress has caused financing conditions to become far tighter over the past two weeks (by about one standard-deviation). But for the moment, the impact has been far less severe than during the Covid crisis, the Euro Zone debt crisis or the 2008 financial crisis. In absolute terms, financing conditions have returned to their lows of last October, prior to the rally in risky assets. This level is restrictive but probably not much more than what it takes to lower inflationary pressures.

If banking stress is absorbed relatively quickly and financing conditions do not worsen any further, we believe that our baseline scenario remains valid. Our scenario had already been conservative. We were already forecasting weak growth in the Euro Zone for some time to come and a recession in the US by yearend caused by the need to cool over overheating economies and, hence, inflationary pressures. And we already felt that monetary tightening was going to hit the economy enough to keep central banks from having to raise their key rates any further (just above 5% for the Fed and about 3.5% for the ECB).

Fig. 4 – United States : the leading indicator was already falling before the recent bout of banking stress and was in recessionary territory

But if banking stress persists and financing conditions worsen sustainably, we will have to revise our scenario to factor into a risk of a more severe recession on both sides of the Atlantic, a faster pullback of inflation and key rates that would no longer be rising or that might even begin to fall by yearend. But we don’t think we’re there yet.

Fig. 5 – Euro zone: Inflation continues to accelerate in all categories other than energy

Fig. 6 – Euro zone : medium-term inflationary pressures remain high