The Fed must reconcile financial stability with the fight against inflation

Link

- The markets appear to be stabilising after a week of extreme stress triggered by fears for the banking system. The series of measures already taken by the US authorities to reassure the market on regional banks’ viability appears to be paying off. Especially as Treasury Secretary Janet Yellen said that other measures would be taken, if necessary, in particular to dissipate any fears over the security of deposits in these banks. Today it will be the Fed’s turn to provide a new brick to the wall being built against the loss of confidence in the banking system. Ensuring financial stability is a priority, but the Fed faces the dilemma of whether it should set aside monetary tightening for a while or stick to it, albeit at a more gradual pace. We expect it to do the latter, as we now know that the problems that have emerged in a handful of regional banks at this point look rather idiosyncratic, even though they were triggered in part by the steep rise in key interest rates. As a result, we believe that the Fed has the means to deal with them through targeted liquidity injections if necessary. However, the stubborn inflationary pressures in the US economy, if left untreated, could complicate the US economy’s future landing scenario.

- A 25 basis-point hike in key rates looks like the most likely scenario for the Fed. That being said, everything will depend on central banks’ diagnosis of risks to financial stability. The most reassuring scenario would be this moderate increase, as that would mean that the Fed is reassuring the market that we are not facing a systemic risk. If that is indeed the case, it would keep the market from expecting an excessively rapid easing in monetary policy. That would, in turn, prevent an overly rapid easing in financial conditions that would maintain demand-side pressure on prices, which would require a more sudden tightening in monetary policy in the future, something that would do far greater damage to the economy.

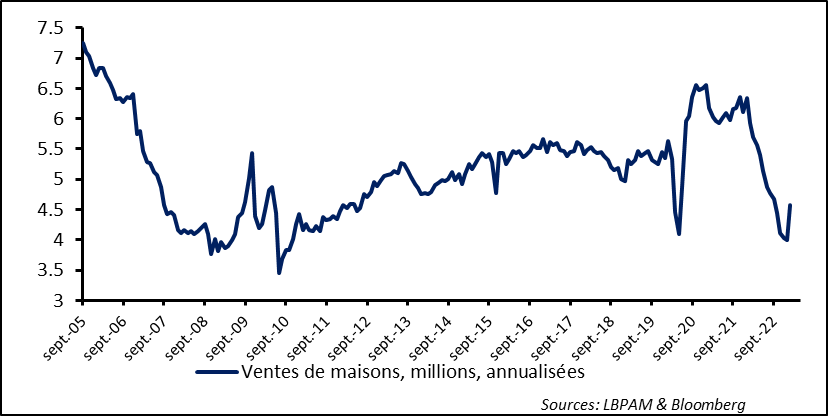

- We see it as very likely that the phase of stress in bank liquidity that we have just experienced in the United States will lead to an even tougher lending conditions, particularly at regional banks. We can therefore expect that the channels of monetary policy transmission will be not be even more restrictive, which could exacerbate the slowdown in the US economy. As a result, the spike in economic activity that we have seen so far this year could be short-lived. For example, the strong rebound in home sales in February, the first in a year, may not last long. Obviously, much will depend on the reaction of the job market.

- In Europe, fears caused by the Credit Suisse (CS) rescue seem to be receding a bit. The markets were reassured by statements by the Single Resolution Board and the ECB clarifying the treatment of AT1 debt as outranking shareholders in the event of bankruptcy or major distress. Serious concerns had arisen on these instruments after Swiss authorities, as part of UBS’s takeover of CS, decided to offer partial payment to CS shareholders, while AT1 bondholders were wiped out. This contributed in part to the market rally and came on top of the ECB’s reassurances last week on the resiliency of the European banking system.

- The planned meeting between Presidents XI and Poutine has provided further evidence of closer ties between the two countries. Although China continues, in a way, to justify the Russian aggression in Ukraine, President Xi is still insisting on a peaceful solution to the conflict. He even announced that he would meet with President Zelensky for this purpose. Perhaps as a sign of caution, President Xi did not seem to be in a hurry to sign an agreement with Russia on the building of a gas pipeline to transport Russian gas to China (which would thereby replace Europe), despite the big expansion in trade between the two countries since the invasion of Ukraine. All in all, this meeting may keep the West on high alert and could continue to feed a climate of tensions. That being said, this does not currently seem to be much of a concern for the markets.

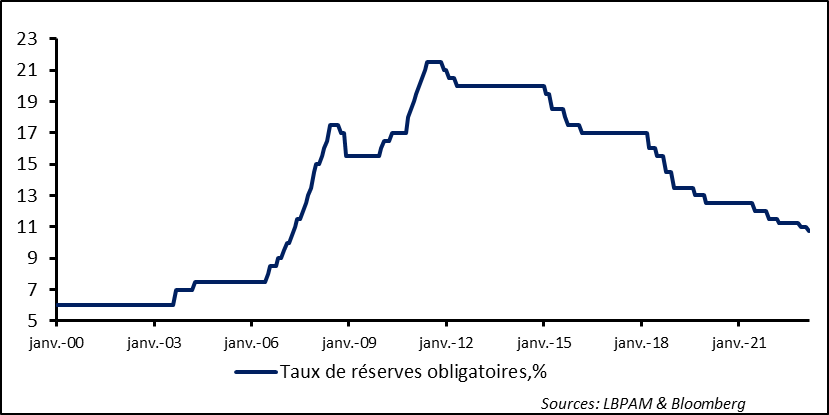

- The Chinese authorities continue to take stop-gap measures to support the reopening of the economy after setting aside the zero-Covid policy. The latest of these is a further reduction in the reserve requirement ratio, in order to free up liquidity with the goal of boosting credit. Meanwhile, key rates remain unchanged. New rate cuts are expected, however, especially given the recent slackening in the current, services-driven recovery.

Despite support provided by the US authorities, regional banks’ difficulties could very well exacerbate the constraints on economic expansion. For, while it is hard to say for sure, bank lending is likely to slow more than expected in the coming months. As a result, the good news on the economy that we have seen so far this year could begin to fade more rapidly than expected. In particular, we have seen not just good resilience in consumption, but also a rebound in some sectors that had taken a direct hit from monetary tightening. This is especially true for construction and real estate in general. In the wake of strong figures on home construction, housing sales were also expected to improve, but they actually did so even more than expected. The reduction in mortgage lending rates early this year very likely provided a boost to the sector, but this is unlikely to last long.

Fig. 1 – United States: The year began with lower interest rates, which restimulated real estate, but that is unlikely to continue

Home sales in millions, annualised

Indeed, our scenario continues to assume that the Fed will have to keep key rates high for some time to come in order to fight excessive inflation. We don’t see a significant reduction in rates happening until early 2024.

Obviously, this scenario assumes that current stress in the banking sector do not spill over into a more systemic risk that would cause the Fed to ease its monetary policy more rapidly. Once again, at this point we don’t see the failure of a few banks leading to systemic failures comparable, for example, to what we experienced in 2008-2009.

In the Eurozone, it is just as difficult to assess what impact this phase of banking stress could have on the economy. The ECB has already attempted to reassure economic agents on the resilience of the European banks by pointing out their solid capital standings and access to abundant liquidity to deal with shocks, should they occur. In addition, in order to halt the pressures that the markets continue to exert on Eurozone banks following the Swiss authorities treatment of CS’s AT1 debt, European regulators have reiterated their doctrine in this area, insisting that AT1 bondholders must bear any losses after shareholders have taken a hit. This clarification seems to have calmed down the markets somewhat

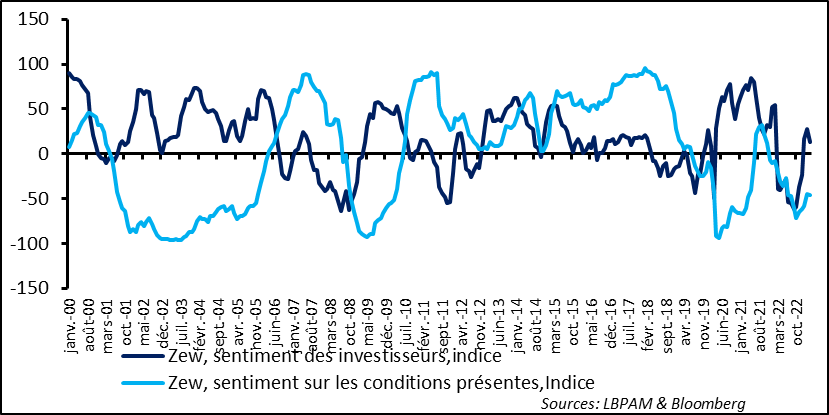

Be that as it may, it will obviously take some time for calm to be completely restored to the banking sector. The stress that this episode has triggered showed up partially in the worsening of the ZEW survey of German market participants. The apparent impact is only partial as the critical moments of the crisis are not reflected in the survey, due to the period which it was conducted. But it does show that the improvement in market participants’ view of present conditions has come to a complete halt and remains low.

Fig. 2 – Euro Zone: Unsurprisingly, investor sentiment has worsened and is likely to remain low despite the current improvement

ZEW, investor sentiment, index

ZEW, sentiment on present conditions, index

Some nervousness is likely to persist for some time to come. In the meantime, the extreme speed at which the markets rallied in certain sectors does give pause, particularly those sectors that were already trading on highly demanding multiples. We would call for greater caution, and it would seem wiser to seek out value in sectors that have been unduly hit by the recent episode of stress.

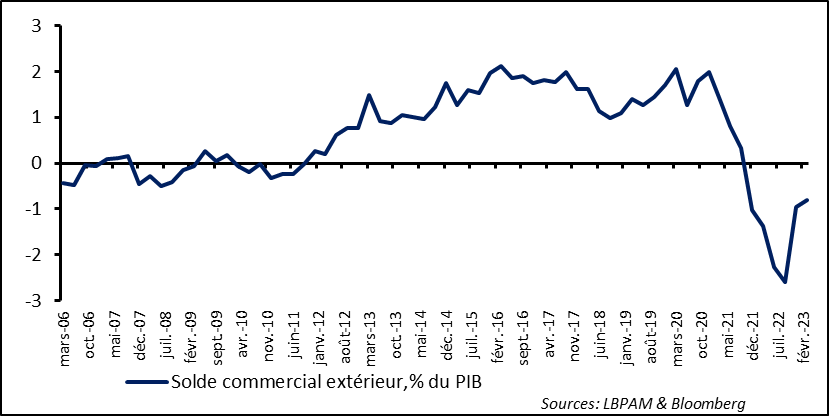

Despite the fallout from stress in the banking sector, it is important to continue focusing on the positive factors that have so far supported the European economies. While the fiscal crutch is still with us, the somewhat radical shift in the energy equation has also provided a big boost to the Eurozone economy. The massive shock caused by the spike in energy costs continues to fade, thanks to lower consumption but above all to the steep drop in prices, particularly of natural gas. The price per MWh has pulled back to its levels of early 2020, i.e., close to 40 euros. This positive “countershock” to purchasing power shows up clearly in the January trade balance and is likely to do so even more in the February and March figures.

Fig. 3 – Euro Zone: Thanks to falling energy prices, particularly of natural gas, the energy shock is easing considerably

Foreign trade balance, % of GDP

Even so, we expect economic activity to be weaker the rest of the year, due to ongoing monetary tightening and the likely greater caution of banks.

While the Chinese president remains in the international spotlight with the exacerbation of geopolitical tensions, the Chinese economy continues, little by little, to return to the path of stronger growth. The latest statistics are still showing that the recovery is indeed being driven by the halt to zero-Covid restrictions. That’s why it is in services that economic activity is recovering the fastest.

Even so, after having attempted to boost consumption through targeted measures such as subsidies for buying electric cars (which were eliminated at the start of the year), the authorities are likely to ratchet up assistance to the economy as a whole, particularly through their usual lever of credit. This is no doubt the purpose of the reduction in the reserve requirement ratio, which is likely to free up more resources for bank lending. The next step is likely to be a further cut in key rates.

Fig. 4 – China: The central bank has lowered its reserve requirement ratio to boost lending but without lowering its key rate.

Reserve requirement ratio, %

As we know, previous stimulus phases have often taken the form of a big boost in lending. This is time is likely to be a little different. In particular, despite recovering slightly, the real estate market is still on shaky ground, and it is hard to see how it can once again be a major driver of growth. Even so, the authorities will no doubt attempt to stimulate growth via more attractive credit conditions, albeit with greater restraint, if they want to maintain momentum that is in line with their objectives.

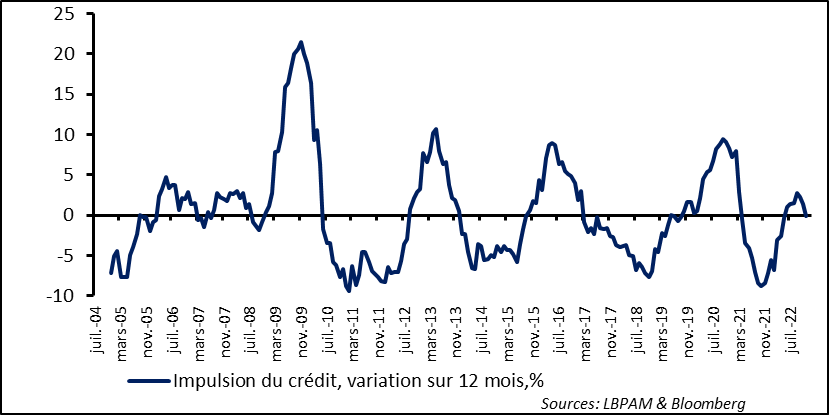

Fig. 5 – China: The boost to the economy via credit stimulation is weaker than during past phases of stimulus.

Credit stimulus, 12-month change, %